The Digitalisation of Everything

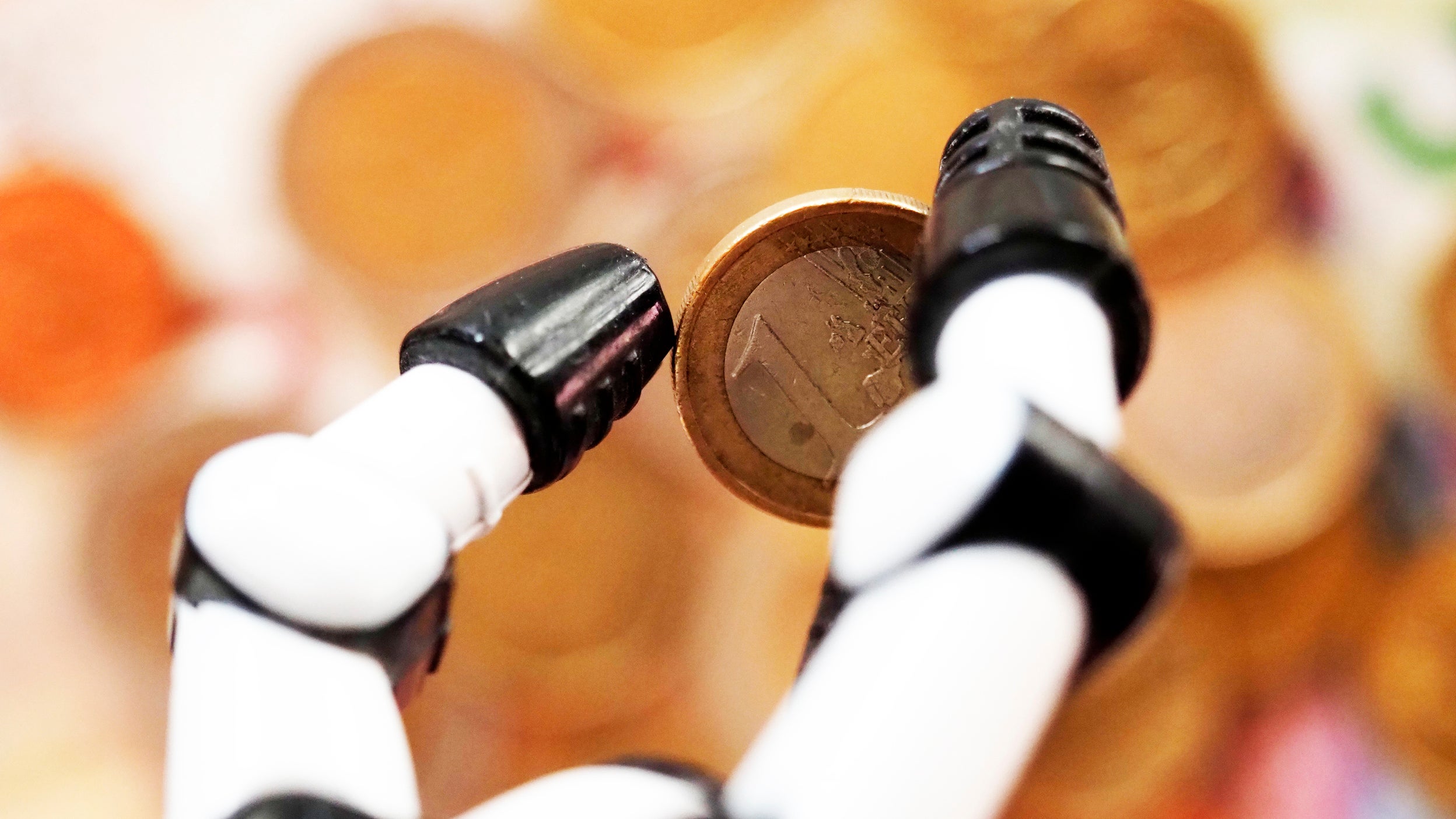

When investors think about Technology and Digitalisation as investment themes, most tend to focus on the US tech giants or some of the tech mega caps in the Far East. We think that, quietly, European policy makers have come to the realisation that they no longer want to rely on third parties for a crucial ingredient of their long-term future.

Digitalisation in Europe is not only providing investors opportunities in European technology companies, but also in industrial and consumer facing companies that are transforming their businesses rapidly into digital powerhouses.

Central to the EU’s thinking is the conviction that Europe’s future is determined by the successful achievement of the twin digital and green transitions. The COVID-19 pandemic and its impact on economy and society have underlined the crucial role of digital technologies for people and businesses. Digital technologies are critical to recover from the crisis, and to foster EU’s resilience and address the risks and dependencies on third countries, as well as to influence EU’s positioning on the global stage. Digital technologies are also essential to achieve sustainability goals. This thinking has led to the creation of a 2030 Digital strategy with significant funding and ambitious targets as part of the overall EU Recovery Fund.

The Digitalisation of Everything for European corporates is about much more than just having a website or adopting a cloud strategy, it’s about sustainability and long-term value creation. It is best compared to the top performers in sports, they possess two essential qualities: speed and agility. Speed is about repetition and efficiency. Agility is about scalability, creativity and reactivity. Combined, they allow businesses to scale in a superior way, whilst testing new ideas and improving outcomes. Businesses that are digitally transformed are experiencing greater productivity and operating efficiencies. In Europe, given that these changes are still in their infancy for many industries, the implications and opportunities will be dramatic.

Standing still is not an option for Corporate Europe

We see a bifurcation between those companies that are willing to embrace digital change versus those that are not. Businesses with visionary leadership and strong cultures can better navigate this complex terrain. We identify these businesses through the hundreds of company meetings we do each year provide us with valuable insights into the inner workings of the company and the mindset of the management teams.

Through this engagement we have identified underappreciated companies such as Bankinter in Spain which is leading the charge in digitally transforming itself in a traditional industry. This transformation has improved the banking experience for its clients, increased its market share consistently and at the same time lower its operating costs and the cost of risk by lending based on better data. Needless to say, that over time shareholders will benefit too from Bankinters digital transformation.

But bigger doesn’t always mean better in the digital world

The internet has lowered barriers to entry, creating more competition in many industries. Starting up a business has never been easier: you can find manufacturers to make your product all over the world at the click of a button, you can advertise and find your customers easily via Instagram, and DHL will deliver. Digitalisation is allowing small companies to take on even the very biggest players, creating significant disruption. Consumers want a seamless e-commerce and omnichannel experience. Whilst e-commerce brings additional complexity, a successful omnichannel approach allows businesses to connect with their customers across different touch points, learn more about their customers, build new revenue streams and create a more resilient business model.

SkiStar, a Nordic ski resort operator is an example of a business that has taken their business to the next level based on a smart digital strategy. Its ski resorts, websites and apps are providing digital win-wins for customers, property owners and the company itself. Via its app, customers can buy digital ski passes, rent accommodation, their ski’s and book classes all in advance of the trip, saving the customer money, time during their holiday, as well as reducing their carbon footprint (less plastic). This is also good for SkiStar, as it gives it a larger share of costumer wallets, a more predictable business, cash up-front and lower costumer acquisition costs.

What about investing in European Tech Companies directly, I hear you say…

Europe has a rich history of innovation in Semiconductors and behind the likes ASML, NXP, Nokia, Infineon and ST Microelectronics lies a fertile hunting ground of smaller leading-edge niche tech companies. These companies are surfing the next wave of innovation by using new semiconductor materials or by creating new packaging methods, helping the Semiconductor industry continue to lower the cost of computation, driving the data revolution.

Besides the Semiconductor industry we are continued to be impressed by Europe’s network of Universities and innovation hubs as a breeding ground for new technology, innovations and emerging companies. Post financial crisis the EU helped to create innovation hubs in Berlin, Paris and Amsterdam to create a start-up culture, a lot of these companies are now coming to age and making the step to the public markets. Especially in our Small Cap strategies we are benefitting from a rich hunting ground in Software, Internet, AI and IOT companies offering niche products and applications sold worldwide.

Finnish QT (pronounce Cute) started its life as a department inside Nokia, having created software to design digital user interfaces. It has a great business model charging its clients a small subscription fee and when a client designs a user interface with its software QT collects a royalty on a per product sold basis. Given the strong growth in developer subscription licences that QT has seen in 2020 we expect to see many years royalty income growth as the products designed with QT software are being mass produced and sold.

Sustainability through Digitalisation

As we eventually emerge from the clutches of the global pandemic, we see the issue of Sustainability receiving a boost from Digitalisation. From an environmental viewpoint, the pandemic has strengthened Europe’s resolve when it comes to the fight against climate change. To reach the EU’s ambitious goals, society will need to stick to many digital experiments that were successfully tested during the pandemic. In order to create Smart Cities and Smart Grids, e-Mobility, Industry 4.0 and eventually decarbonise Europe’s economy the role of technology cannot be overstated.

At the cross-roads of Technology and the Green Economy we see amazing innovation creating leaps forward that were unimaginable only a few years ago. This innovation manifests itself in many investment opportunities for European investors, in the Technology sector itself but also in adjacent sectors like Industrials, Utilities and Automotive. The need for digital and green transformation are interlinked and absolutely crucial for businesses in every sector and industry. It is in these traditional sectors like Healthcare, Financials and Retail we see further opportunity to pick tomorrows global winners.

In conclusion, we understand that for most investors, Europe is not the first place to start looking for new technology stocks, but backed by EU commitment, a highly educated work force, a rich industrial and university infrastructure we think there are ‘European tech acorns’ to be found.

Secondly, when it comes to the fusion of Technology and the Green Economy, Europe is world leading in our view. Lastly, we see large numbers of companies in other sectors of the market making very promising digital and green transformations that will ensure their long-term sustainability, while being valued by the market for a less favourable outcome.

This misperception is what is giving investors that are willing to look deeper into Europe a real valuation opportunity.