In the 20 odd years that I have been in the financial markets, inflation has rarely ignited as much debate as it is doing right now. I see that in meetings across the Henley investment floor and in numerous blogs and research pieces written by Invesco colleagues worldwide.

With seasoned veterans of disinflationary and - dare I say it - inflationary environments within the Henley Fixed Income team, the discourse on inflation on daily calls and in strategy meetings can also get quite lively. What we all agree on is that the pandemic, in addition to its human toll, will likely have a profound impact on the economic and policy landscape for years to come which could end up being inflationary. It's not a prediction but it is a clear risk given the unprecedented amounts of past, present and likely future levels of fiscal and monetary support in the system.

Our desk economist Mark McDonnell wrote an introductory piece framing the academic debate. In summary, he puts forward three arguments that 'lean' towards suggesting that this time may be different and that it could be wrong to assume that future inflation will be anchored by past disinflationary experience. I say 'lean' because nothing is definitive and it is easy to have sympathy with both sides of the inflation debate.

Bringing it back to markets, as fund managers we must make judgments and investment decisions in the context of valuations. Our collective view, as implied above, is that the unprecedented policy response to Covid-19 raises medium to longer term inflation risks. Before outlining what we have been doing in some of our funds related to this theme, it is worth recapping on recent performance of inflation-linked bonds.

Recent Performance

To get slightly technical, the expected return on an inflation-linked bond can in simple terms be thought of as a real yield (coupon) and an inflation adjusted element of both coupon and principal. For valuation purposes, we tend to look at the 'real' yield and the breakeven inflation spread which is the difference between the nominal yield on, for example, a 10-year US Treasury security, and the yield on a 10-year Treasury Inflation-Protected Security (TIPS). While not perfect, that breakeven spread gives us some idea of what the market is expecting on average for inflation over the remaining maturity of the bond.

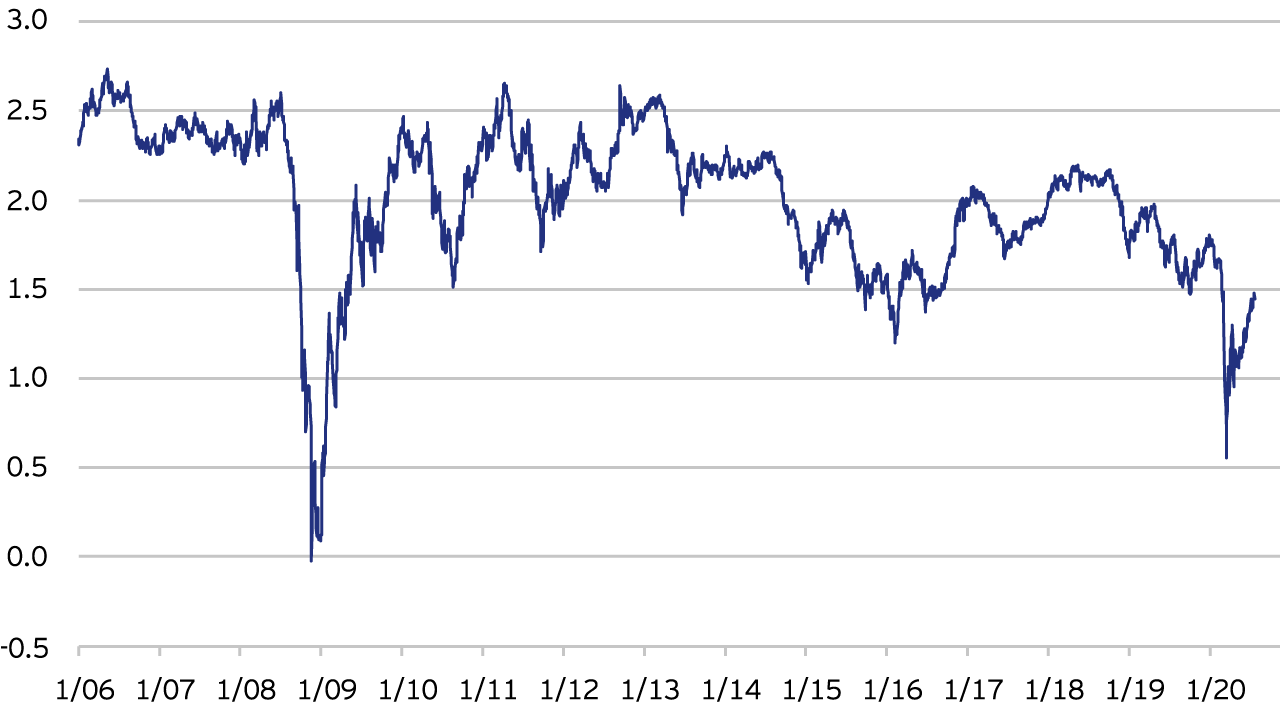

The long-term chart below shows that 10-year inflation expectations (the breakeven rate) cratered in March, much as it did during the great financial crisis. In both cases there was a genuine collapse in inflation expectations owing to sharp falls in economic output, but there are also ‘market technicals’ at play too such as diminished market liquidity. Generally, risk-off environments are not good for inflation-linked bond markets. This time around the collapse in breakeven rates back in March was exacerbated by a sharp fall in the oil price as global oil demand collapsed and OPEC talks broke up without agreement on mitigating supply constraints.

Fund Strategy

As mentioned above, the inflation debate is right up there in the list of topics discussed by the wider Henley Fixed income team. Hence it should be no surprise that several fund managers have made some allocation to inflation-linked securities.

In summary, even after the recent outperformance of inflation linked markets, while we may get a period of consolidation or even a slight reversal in performance, we still see value on a longer-term structural view. In these exceptional times, we think it is prudent to have some inflation protection.

Click here to read more about Inflation and the anchoring bias.