Re-globalization and Greenization: Green sectors for China’s quality growth -Q&A Part 1

Q1) What is greenization and what are green sectors?

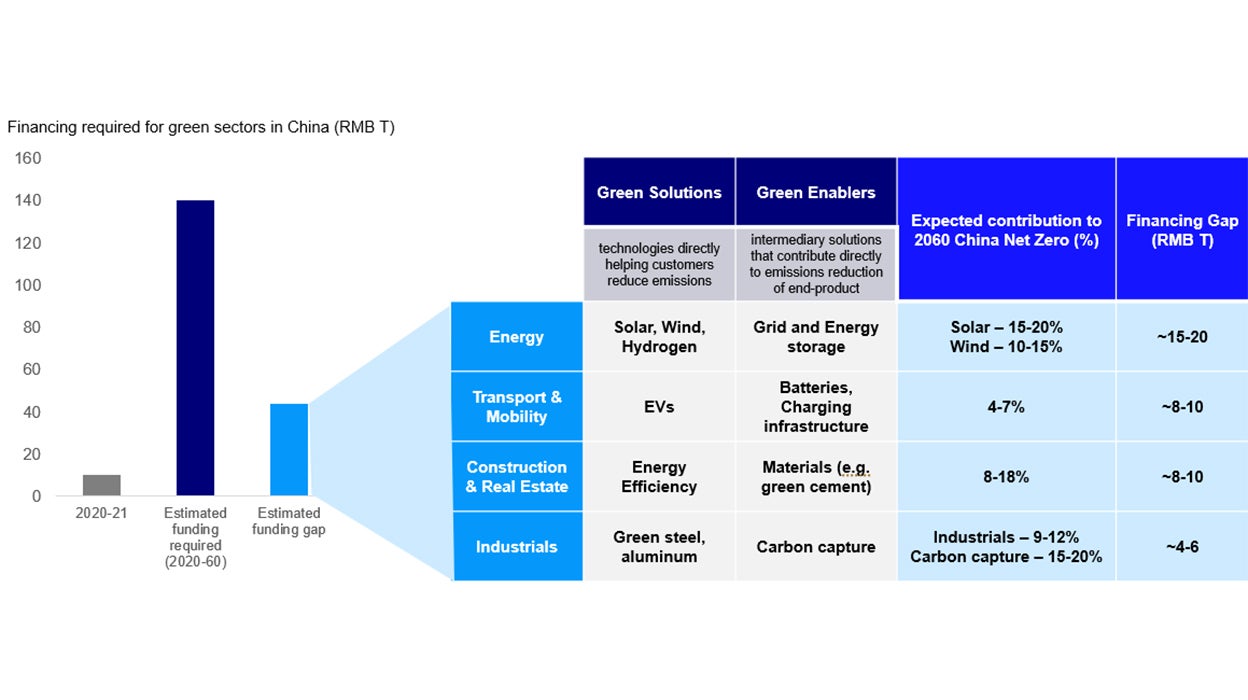

Global energy transition creates demand for green technologies, products and services. These enable other sectors to decarbonize and includes technologies and segments of (chart 1)

- Transport: Electrification of transportation through EVs supported by underlying battery technologies.

- Energy: Generating electricity and power through alternative renewable energy like solar (PV), wind, hydrogen supported by underlying grid and energy storage technologies.

- Construction and real estate: Improving energy efficiency through building energy management and use of renewable energy. Also supported by underlying materials in construction such as green cement and materials.

- Industrials: Greener production processes for materials like aluminum, steel such as through electric furnaces or using scrap materials. Further complemented by use of carbon capture, utilization and storage technologies.

Q2) Is Greenization a priority for China?

Policy tailwinds drive the development of green sectors. (chart 2)

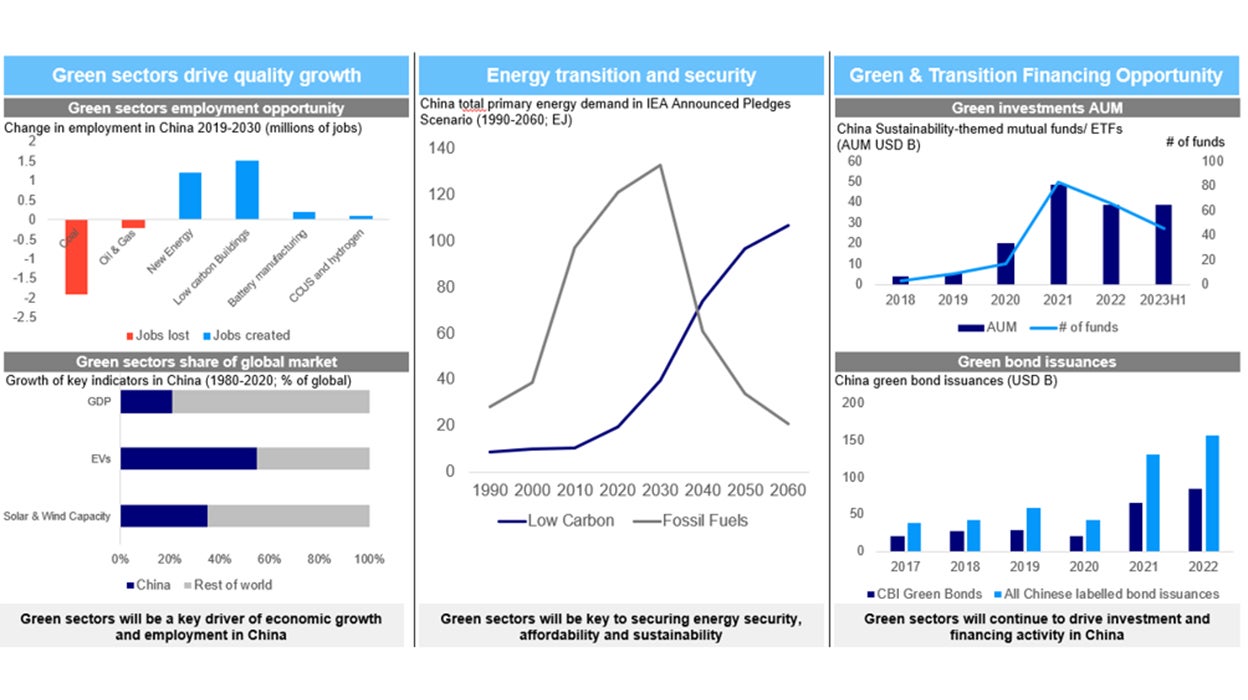

Green sectors to drive quality economic growth in China

- Increasing emphasis on “quality of growth” where green sectors have higher degree of technology and innovation, export potential and delivering on sustainability outcomes.

- “1+N” policy framework has helped to set national targets alongside supporting policies to drive domestic growth and penetration of green sectors.

- E.g., this includes targets for EV share of new auto sales to be 45% by 20271 alongside purchase tax exemption of up to 30K RMB per unit for purchases of new EVs in 2024 and 2025.2

- Exports to drive economic growth as these green sectors are backed by cost advantages, economies of scale and transition demands.

- China’s share of EVs sold in Europe has grown significantly to 8% in 2023 and could reach 15% by 2025.3

Source: WEF Financing transition to net zero (WEF_Finance_the_Transition_NewZero_Future_China_2022.pdf (weforum.org) ) ; Mckinsey Financing the net zero transition (financing-the-net-zero-transition-from-planning-to-practice.pdf (mckinsey.com) )

Energy transition and security (ETS)

- China remains the largest emitter globally4 and 3060 goals will drive transition from coal-based economy to green economy. This is to address goals relating to energy security, affordability and sustainability.

- China’s ETS is expected to be a critical policy driver where carbon prices reached a record 70RMB/ton in 20235.

Green and transition financing

- The World Economic Forum previously estimated that 140T RMB6 is required in China for green and transition financing across 2020-2060.

- Green sectors provide the financial sector with broader financing and investment opportunities, serving as a good diversification against traditional consumption, infrastructure or property related financings.

- This is supported by PBOC’s monetary tools for carbon reduction projects as well as clarity in standards through publication of Green Bond Project Catalogue and Green Bond Principles that defines green activities for the market.

Source: IEA Energy Sector Roadmap to carbon neutrality in China (Executive summary – An energy sector roadmap to carbon neutrality in China – Analysis – IEA ); CBI China Green Bond Market Report 2022 (cbi_china_sotm_22_en.pdf (climatebonds.net) ); Cerulli ESG Investing in Asia 2023