Episode 6 - Understanding public and private markets

Investing Made Easy

Investment opportunities span a wide spectrum, but one of the most fundamental distinctions lies between public and private markets. For investors, understanding this difference is essential. Each market type presents distinct advantages and risks, playing a critical role in shaping a well-informed and resilient investment strategy. Watch the videos to learn more.

Part 2: Building a balanced portfolio

Making a choice between public and private markets

- Investment opportunities come in many forms, but one of the most fundamental distinctions is between public and private markets.

- For investors, understanding the difference is important. Each type offers unique benefits and risks, helping to shape your investment strategy.

Public markets – publicly accessible assets

- Public markets comprises assets that are listed and traded on stock exchanges, such as stocks, bonds, exchange-traded funds (ETFs), and publicly traded real estate investment trusts (REITs).

- Examples include shares of listed companies on the Hang Sang Index, US Treasury Bonds, and ETFs that track indices like the S&P 500.

- These assets are known for their liquidity, meaning they can be easily bought and sold, in some cases within seconds. They also offer transparency, with pricing and company information readily available to the public. Because of these features, public assets are generally accessible to a wide range of investors, from individuals to institutions.

- They are also subject to regulatory oversight by financial authorities. They must disclose key information publicly to regulators, their exchanges, and shareholders. However, they are also subject to market volatility and can be heavily influenced by investor sentiment and macroeconomic events.

Key characteristics of public markets:

Higher liquidity

Transparent

Higher volatility

More diverse

Private markets – reaching beyond public markets

- Private capital markets, refer to debt and equity investments in privately owned companies, as opposed to assets traded publicly. They are typically illiquid, meaning they cannot be easily bought or sold, and often require longer investment horizons. They also tend to have less frequent pricing updates and fewer public disclosures.

- Examples include private equity and venture capital, private real estate funds, infrastructure projects, and private debt.

- Private markets are usually reserved for high-net-worth individuals, professional investors, institutional investors or accredited investors due to the complex due diligence involved.

- Specifically, lock-up period refers to the timespan when capital cannot be withdrawn, aligning with the asset class's long-term, value-building strategy. For example, a long/short fund invested mostly in liquid stocks may have a one-month lock-up period. This ensures the manager has time to unwind or adjust positions in an orderly manner if fund redemptions occur. Meanwhile, some private market traditional, closed-end funds usually have 8-12 years of lock-up periods. This may allow fund managers to execute long-term strategies, such as business transformation, asset development, or value realization through exits.

- However, private markets may offer potential advantages such as higher returns—often referred to as the illiquidity premium, as these assets tend to be less correlated with traditional public stocks and bonds.

- As such, private markets may also enhance diversification^. As a result, they can help smooth out returns and reduce the overall volatility of your portfolio, especially during periods of market stress.

Key characteristics of private markets:

Diversification

Higher complexity

Less regulated

Higher growth potential

| Public markets | Private markets | |

|---|---|---|

| Investor type |

|

|

| Investment duration |

|

|

| Performance |

|

|

Building a balanced portfolio

- We believe a diversified investment portfolio often includes a mix of public and private assets, each playing a distinct role in achieving long-term financial goals. The right balance depends on several factors, including your investment objectives, risk tolerance, time horizon, and access to capital.

- Public assets offer liquidity and transparency, making them ideal for investors who may need to access their funds more readily. They could also provide broad market exposure and are easier to monitor and adjust over time.

- Private assets, on the other hand, are typically suited for long-term investors who can commit capital for extended periods. While they come with higher barriers to entry and less frequent pricing, they may offer the potential for enhanced returns and diversification^ benefits—especially during periods of public market volatility.

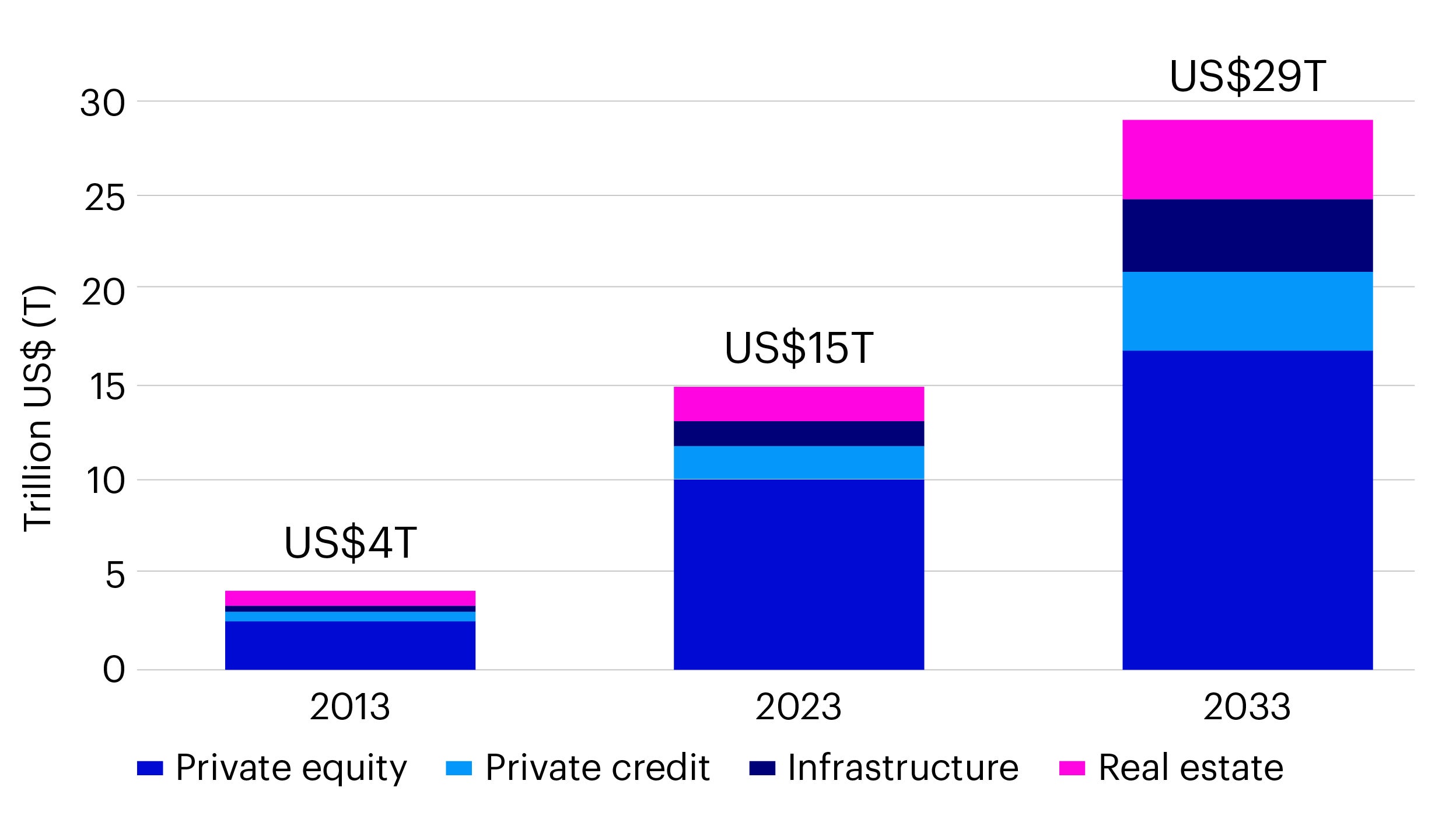

- Investors’ interest in private assets has been growing in recent years. One of the key drivers behind the growth of private assets was the global financial crisis of 2008–2009. As traditional banks pulled back from lending, companies began seeking alternative sources of funding. Many discovered that private markets could provide the necessary capital without the costs and regulatory burdens associated with going public.

Source: : Partners Group and Blackrock, as of March 2023. For illustrative purposes only.

- Historically, institutional investors focused primarily on publicly traded stocks and bonds. Today, however, many have expanded into private markets, with some, for example, allocating up to 20% of their portfolios to these investments.

- By combining both asset types, investors could create a more resilient and diversified portfolio. A blended approach may help smooth out performance across market cycles and can reduce overall portfolio risk while enhancing return potential.

- Below example showcases how different asset classes can complement one other with its own strengths:

Public equities and bonds could provide liquidity and market exposure.

Private equity or real estate could offer growth potential and diversification.

Private credit may add income stability with lower correlation to public markets.

A comparison of performance

According to Bloomberg, global private credit, a type of private asset, has been outperforming US investment grade bonds and US high-yield corporate bonds since 2013. However, unlike public indices (e.g., S&P 500), private asset indices often rely on self-reported data from fund managers. These indices may exclude underperforming or smaller funds, leading to survivorship bias (i.e. performances might be overstated).

Source: Bloomberg, as of May 2025. For illustrative purposes only. Indexes cannot be purchased directly by investors. Past performance does not predict future returns.

- The Indxx Private Credit Index tracks the performance of the Business Development Corporations (BDCs) and Closed-End Funds (CEFs), trading in the US, with significant exposure to private credit, as defined by Indxx.

- The Bloomberg US Aggregate Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

- The Bloomberg US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody's, Fitch and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on Bloomberg EM country definition, are excluded.

^ Diversification does not guarantee a profit or eliminate the risk of loss.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.