Accessing emerging markets with ETFs

Emerging market (“EM”) economies by their nature are some of the fastest growing in the world and could offer a long-term growth opportunity for a global investor’s portfolio. While EM countries account for 40% of the global GDP1, they currently represent about 12% of the global market capitalisation2. Ongoing transformative impacts of technology, changing demographics, and improving health care in EM countries could spur further growth in the long run.

Exchange-traded funds (“ETFs”) can offer investors an easy way to capture opportunities in emerging markets. In this article, we will explore the benefits of using ETFs to access emerging markets.

Benefit #1: Efficient exposure

Emerging market ETFs can give broad and diversified exposure across local economies and businesses that may not be as easily accessible for many investors. For example, many equity EM ETFs track the key MSCI Emerging Market Index, capturing the performance of large and mid-cap companies across 27 countries with 1,293 constituents3.

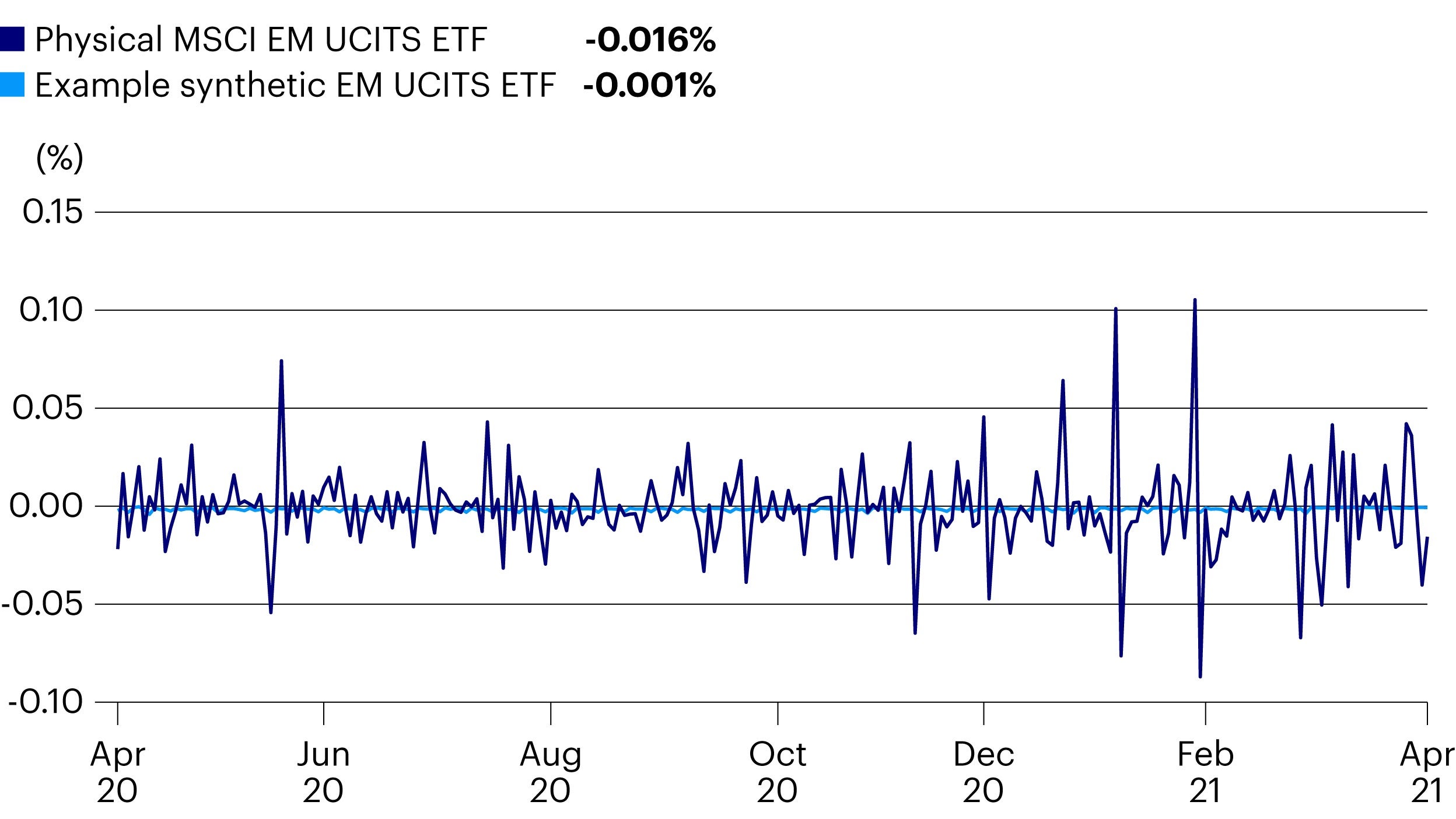

Synthetic replication for ETFs is particularly useful in tracking emerging market equities. Unlike physical replication, where an ETF holds all or a sample of the securities in the index, synthetic ETFs overlay swap contracts on top of a basket of equities in order to deliver the performance of the index. This gives precise and reliable passive exposure to the performance of an index.

Physical ETFs tracking the MSCI EM Index typically exhibit higher and more variable tracking, whereas synthetic ETFs can offer consistently low tracking error. For physical MSCI EM ETFs, trading in local economies can be very complicated. Managing various regulatory requirements and trading nuances can result in higher tracking error and deviation from the MSCI EM Index. Swap-based replication removes most of the “noise” of local market trading, and benefits from accurate tracking of the MSCI EM Index.

On the fixed income side, EM debt ETFs commonly track broad indices, giving more diversified access across the maturity, rating, and credit spectrum in emerging economies compared to directly investing in individual EM bonds. Fixed income ETFs also have additional sources of liquidity from the secondary market, which can be especially beneficial in emerging economies where bond markets could be less liquid.

Benefit #2: Ease of access

Ease of market access with ETFs is another compelling reason when determining emerging market investments. Not only can ETFs give broad exposure across many EM countries, ETFs can also provide targeted country access to emerging economies that may be typically difficult to invest in.

For example, China is the world’s second largest and the fastest growing major economy, but direct investment for global investors has been challenging for many years. This is mainly due to foreign ownership restrictions, complexities around the China equity share types, and strict trading regulations. Investors can avoid these trading issues and gain access to the China market by simply investing in one ETF.

China ETFs can offer a greater exposure to China’s rapidly changing domestic market than broader EM indices. Although the MSCI EM Index has a large weight in China at just under 40%3, the index does not account for the full weight in A-shares, leaving out an important part of China’s rapidly changing domestic market. A China All-Shares ETF, for instance, provides full exposure to all share types (including A-shares) at full free float market cap weight, better reflecting China’s domestic and international opportunities.

Furthermore, ETFs provide additional accessibility benefits because of how they trade. ETF investors can respond to news quickly and are able to buy and sell ETFs on exchange throughout the day, with the same degree of control as trading common equities.

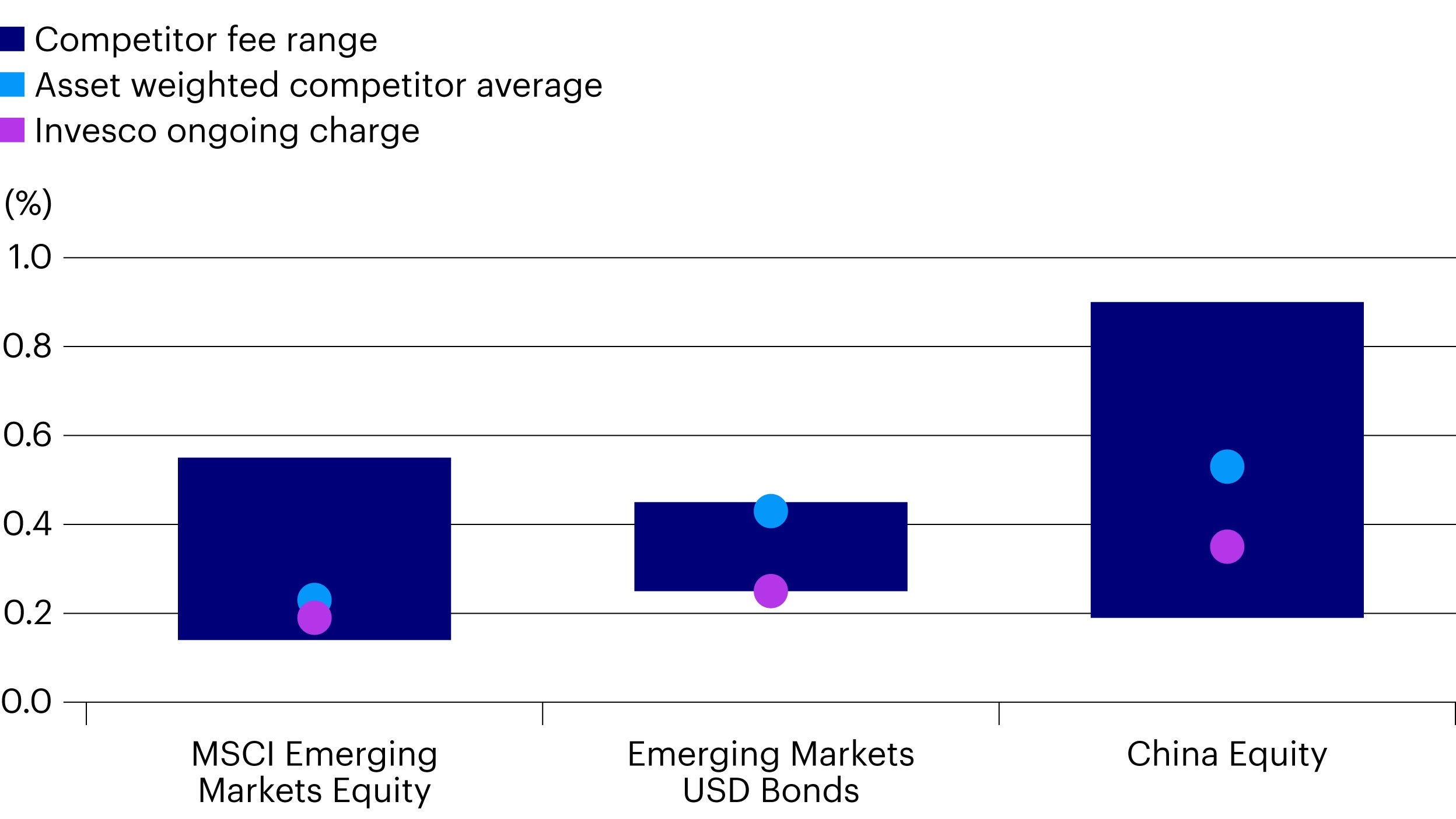

Benefit #3: Low cost

Lastly, cost is an important factor to consider. ETFs tend to have lower and more transparent cost structures compared to most other types of investments, and lower fees often result in more returns in an investor’s investment. As ETFs became more popular and competitive, fees for ETFs tracking emerging market indices have fallen drastically over the last few years. The asset weighted average fee for ETFs tracking the MSCI Emerging Markets Index is now sitting at just over 0.20%, compared to 0.45% in 2018. For cost-conscious investors, ETFs could be an attractive vehicle to access emerging markets.

Conclusion

ETFs are effective investment tools to gain exposure to growing emerging market opportunities. The efficiency, ease of access, and cost-effective characteristics of ETFs allow investors to target in emerging markets that can be typically challenging to access.

Footnotes

-

1 Source: IMF, World Economic Outlook, Apr 2021.

2 Source: MSCI Emerging Market countries, 31 Mar 2021.

3 Source: MSCI, 31 Mar 2021.

Risk warnings

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

When investing in emerging and developing markets there is potential for a decrease in market liquidity, which may mean that it is not easy to buy or sell securities. There may also be difficulties in dealing and settlement, and custody problems could arise.

Important information

-

This article is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.By accepting this material, you consent to communicate with us in English, unless you inform us otherwise.