Battery Boom, REIT Revival & Consumer Confidence - August 2025 Reporting Season in Review

With most ASX-listed companies releasing their preliminary FY25 results last month, this reporting season delivered a mix of surprises, sector rotations, and factor shifts.

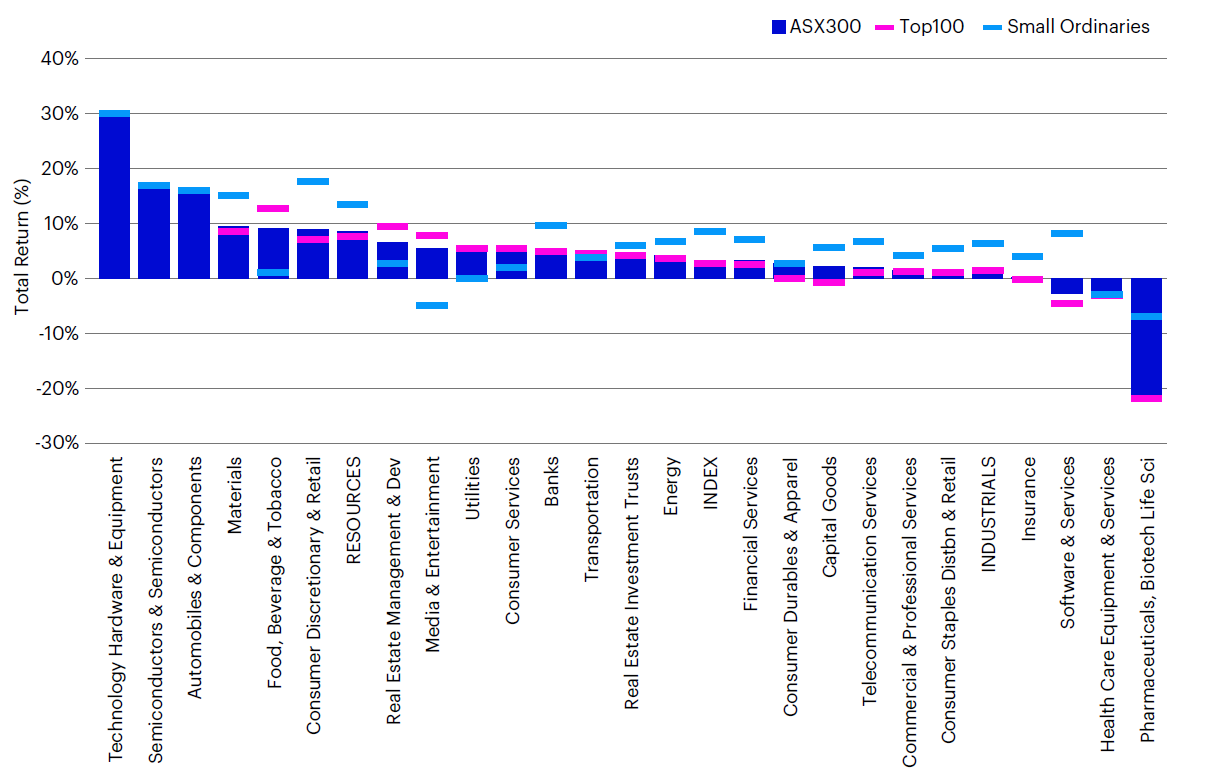

The S&P/ASX 300 returned 3.3%, with strong outperformance by S&P/ASX Small Ordinaries Small Caps (8.5%) over S&P/ASX 100 Large Caps (2.7%). The Resources super-sector (8.5%) outperformed Industrials (1.9%), with Small Caps dominating across both.

Volatility was high, with a 50% return spread between best and worst performing industries.

Source: Bloomberg, Invesco. Total returns over August 2025. Past returns are not a reliable indicator of future returns.

Looking at the month of August 2025 in review, the standout themes across sectors:

- Consumer Confidence Returns: Retailers like Adairs (+33%) and Nick Scali (+26%) rallied on upbeat trading updates.

- Global Expansion Woes: CSL (-21%), James Hardie (-24%) and Reece (-18%) struggled with offshore headwinds.

- Defence Stocks in Demand: Codan (+47%) and Austal (+18%) benefited from geopolitical tailwinds.

- Battery Materials Bounce Back: Pilbara Minerals (+53%) and Lynas (+33%) rallied despite weak earnings.

- REITs Rebound: Lendlease (+9%) and Stockland (+12%) found support amid rate cut hopes.

Our Australian Equities team further breaks down these trends, themes, and standout results in our August 2025 Reporting Season in Review.