MQV vs. Anti-MQV: Achieving Superior Returns in Small Caps Without High Fees

Active managers in Australian smaller companies have historically outperformed the S&P/ASX Small Ordinaries Index, justifying the typically high management and performance fees they charge.

However, are these exceptional returns solely attributable to manager skill? Or could a process that simply avoids stocks characterised as Fallen Angels (Anti-Momentum), Zombies (Anti-Quality), and Glamours (Anti-Value) deliver an equally compelling result?

We explored this further in Australian Smaller Companies: Fallen Angels, and Zombies and Glamours....oh my!

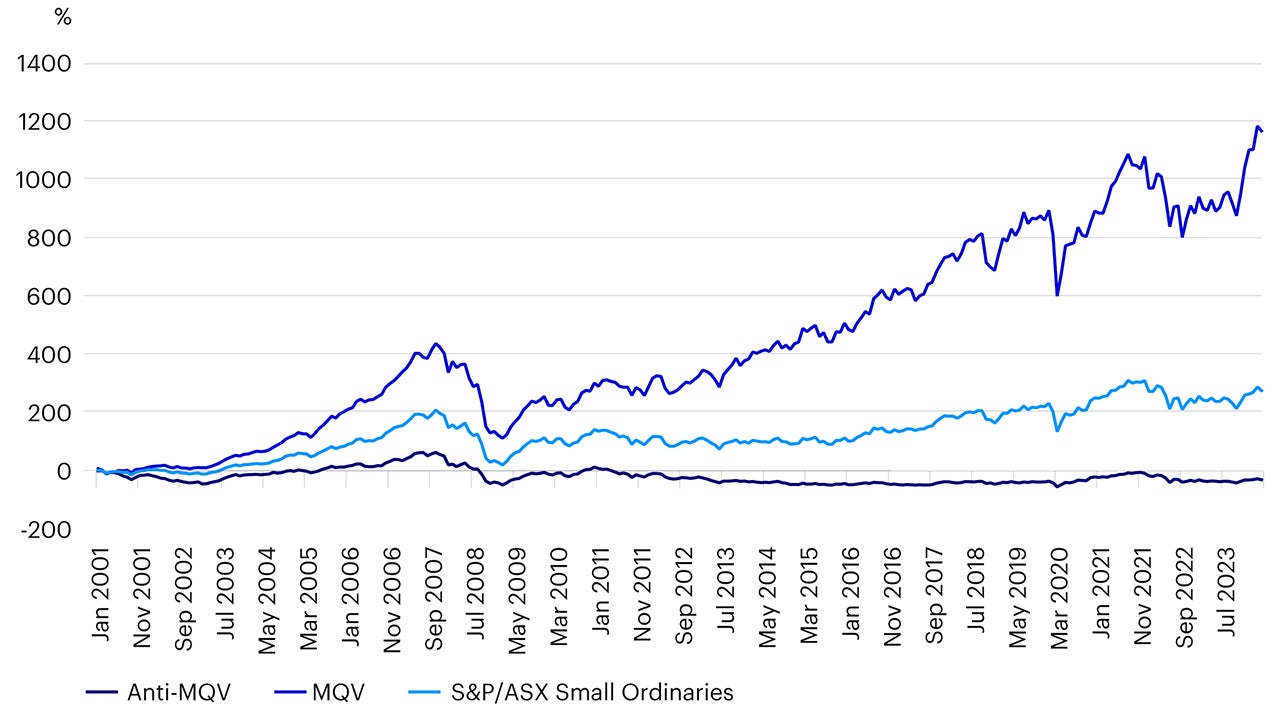

Looking at a hypothetical scenario (Figure 1), by combining the three factors of Momentum, Quality, and Value into an aggregate alpha score, a portfolio can be built of the top 20% of companies based on those aggregate alpha scores (MQV portfolio). Comparing this to a portfolio of the lowest 20% of companies based on an aggregate score of the underlying Momentum, Quality and Value exposures (Anti-MQV Portfolio).

- Momentum refers to the tendency of stocks that have performed well in the past to continue performing well in the future.

- Quality focuses on companies with strong financial health and stable earnings.

- Value emphasizes investing in stocks that are undervalued relative to their intrinsic worth.

MQV vs. Anti-MQV: To illustrate the effectiveness of the MQV strategy, we compare the performance of the MQV portfolio with the Anti-MQV portfolio. The MQV portfolio, significantly outperforms the broader S&P/ASX Small Ordinaries Index. On the other hand, the Anti-MQV portfolio, clearly underperforms the index.

Source: Invesco Quantitative Strategies, Standard and Poors’.

MQV represents the top 20% of companies based on Invesco Quantitative Strategies (IQS) proprietary MQV factor. Anti-MQV represents the bottom 20% of companies based on Invesco Quantitative Strategies (IQS) proprietary MQV factor.

Benefits of the MQV Strategy: Our simple MQV example illustrates several benefits. By focusing on Momentum, investors can capitalise on trends and avoid underperforming stocks. Quality ensures that investments are made in financially sound companies, reducing the risk of significant losses. Value helps investors identify undervalued stocks with the potential for growth, enhancing overall returns. Additionally, our MQV example illustrates that by employing a systematic approach, the returns of active Australian Small Cap managers can be near replicated by simply avoiding exposure to Fallen Angels, Zombies and Glamours.