Navigating the Risks of Fallen Angels, Zombies, and Glamours in Small Cap Investing

While Australian smaller companies offer investors the potential for higher returns, investing in this asset class can be a minefield. In our previous blog, "The Pitfalls of the Small Cap Index ," we explored how companies that exhibit negative momentum, poor quality, and overvaluation often dominate capitalisation-weighted Small Cap indices.

We refer to these companies as Fallen Angels, Zombies, and Glamours. Understanding these concepts and knowing how to avoid them is essential for maintaining a healthy and profitable investment portfolio.

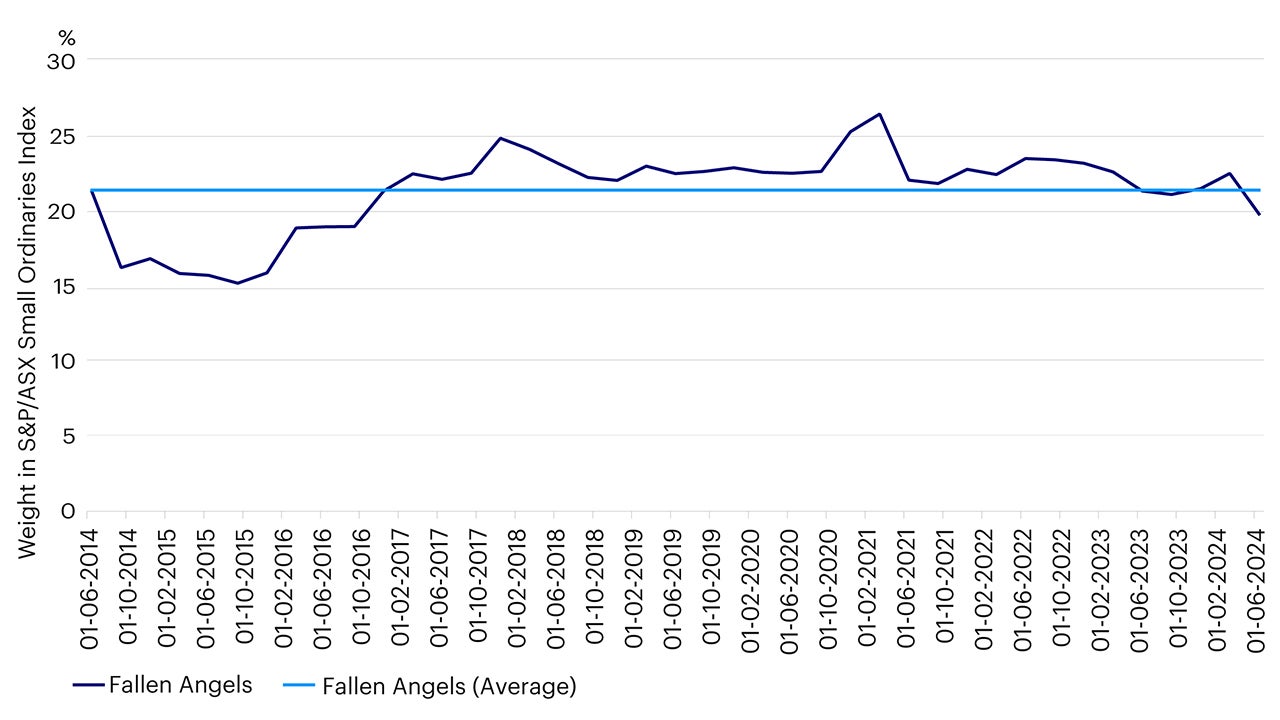

Fallen Angels are companies that have dropped from large cap to small cap indices due to declining performance. These companies often exhibit poor momentum and deteriorating business fundamentals, making them risky investments.

Exposure to Fallen Angels

Over the past decade, Fallen Angels have consistently represented a significant portion of the S&P/ASX Small Ordinaries Index. This high exposure to companies with poor momentum can negatively impact overall returns.

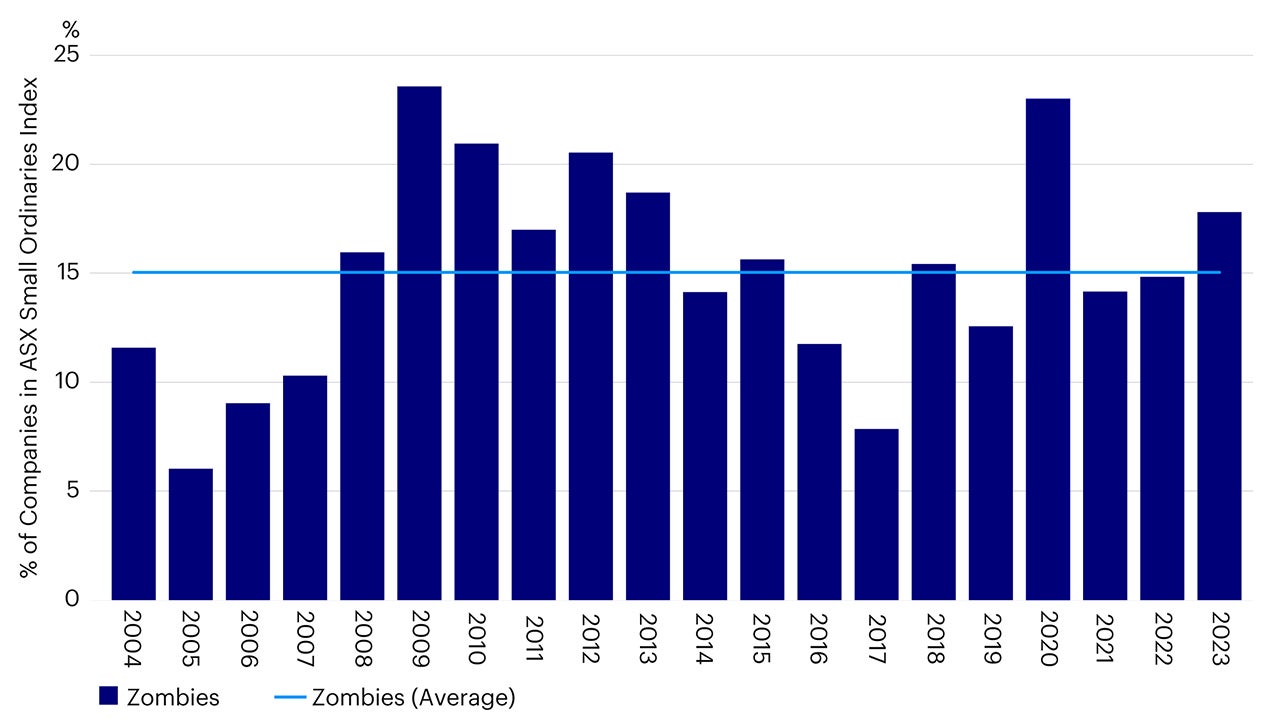

Zombies are companies that struggle to generate enough revenue to cover their operating and interest expenses. These companies typically have weak financials, low growth potential, and a high risk of insolvency. Investing in Zombies can lead to significant losses, as these companies are unlikely to recover and thrive.

Prevalence of Zombies

Zombie companies are much more prevalent within Small Cap indices than they are in Large Cap indices. On average, one out of every seven companies in the S&P/ASX Small Ordinaries index is a Zombie, with this number increasing during periods of economic stress.

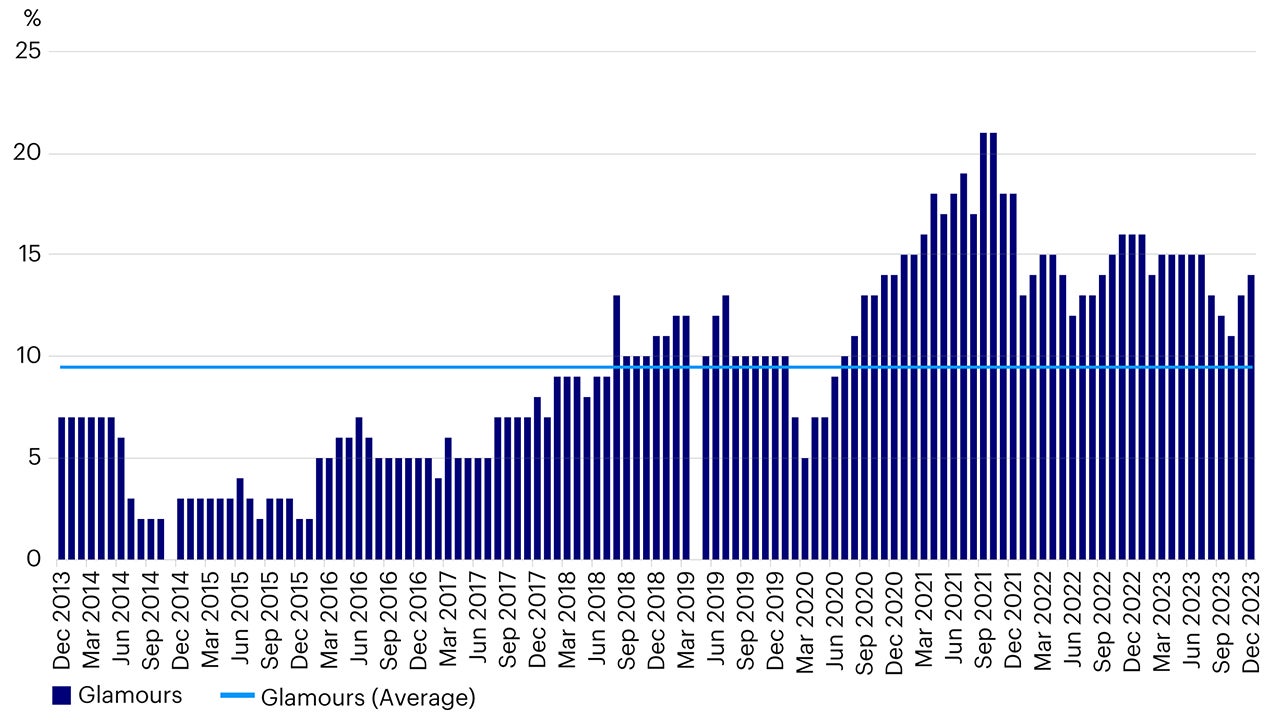

Glamours are companies with high valuations and growth expectations. While they may seem attractive, their overvaluation makes them vulnerable to market corrections and underperformance.

High Valuations of Glamours

Historically, companies with high forecasted growth that is yet to materialize are often overpriced. Figure 3 below shows the number of companies in the S&P/ASX Small Ordinaries index trading on extremely high valuation multiples.

Source: Invesco Quantitative Strategies, Standard and Poors’. Glamours refers to constituents of the S&P/ASX Small Ordinaries Index that are trading on a Price/Sales ratio greater than 30. To provide some context, it would take at least 30 years of current revenue of these companies to recover the initial investment. Data is from December 2013 to December 2023.

In conclusion, Fallen Angels, Zombies, and Glamours represent significant risks in small cap investing. By understanding their characteristics and implementing strategies to avoid them (as we explored in detail in Australian Smaller Companies: Fallen Angels, and Zombies and Glamours....oh my! investors can protect their portfolios and achieve better returns.

Stay vigilant and prioritise quality, financial health, and realistic valuations to navigate the complexities of small cap investing successfully.