"This fund takes a very active approach to stock picking and security selection. We are seeking to finance companies that can make a difference."

Alexandra Ivanova, Fund manager

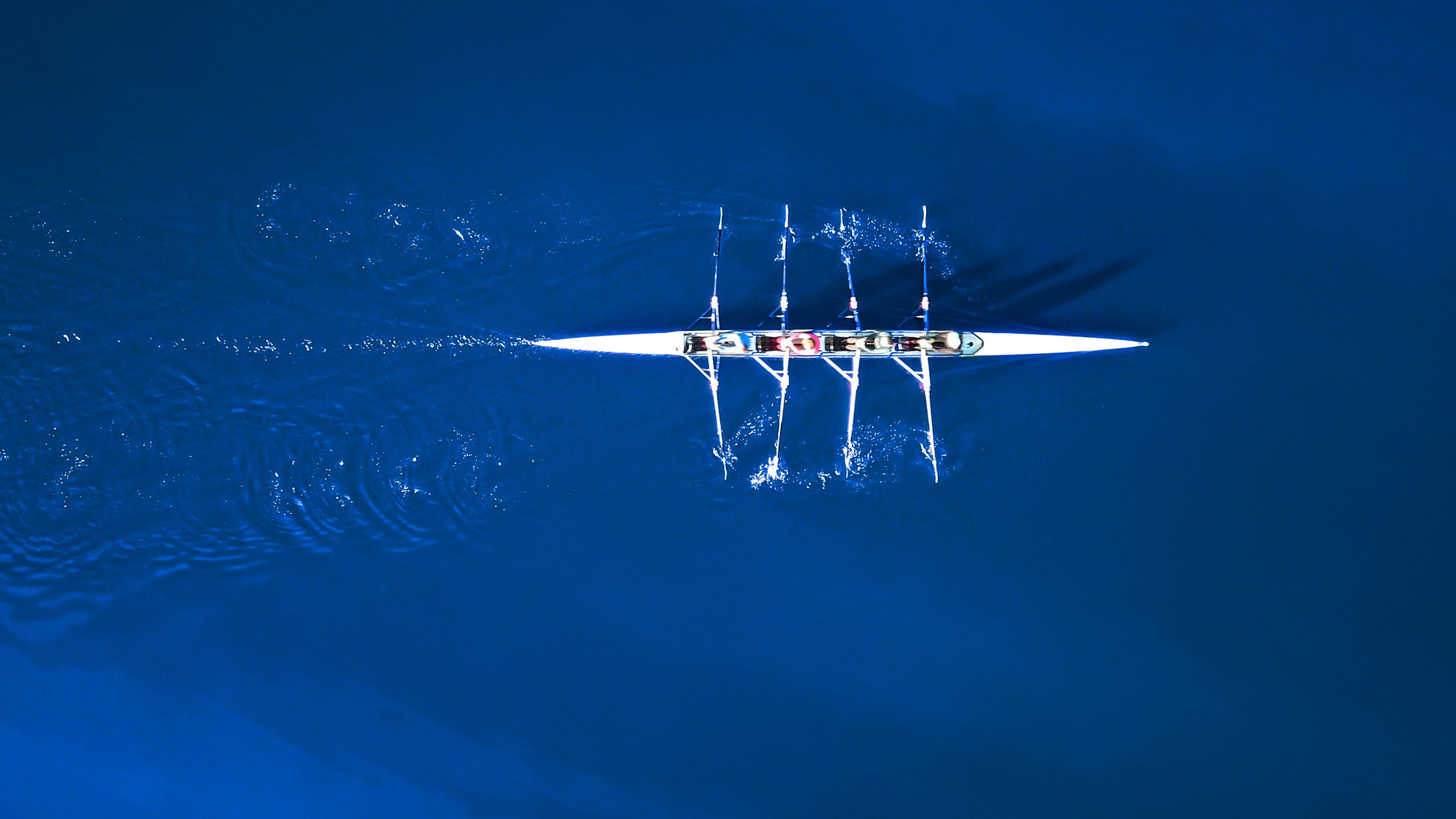

Embark on the journey to a low carbon world with this mixed asset fund, combining fixed income and global equities.

Why this fund?The Invesco Transition Global Income Fund aims to support the transition to a low carbon economy over the medium to long term with a view to supporting the long-term goals of the Paris Agreement. As part of achieving its sustainable investment objective the fund has a flexible allocation of debt securities and global equities.

As we move towards a net-zero world, winners and losers will emerge as some businesses flourish and others fail to adapt. Companies that are ill prepared or incompatible with the new economy could suffer defaults, losses and impairments. We select companies with strong climate characteristics that are well positioned for the future. We believe this will help to reduce investment risk over the long-term.

Not all sustainable companies issue green bonds and so we don’t restrict ourselves to only green bonds. For example, if a company we like issues green and non-green bonds, we choose which offers the best value.

Furthermore, we can finance companies in carbon intensive sectors if they are going a step further than their peers in their efforts to reduce emissions. Good examples of this include companies in the power and automotive sectors. We believe that this is the best way to encourage real world change.

As well as delivering on our climate objective, we aim to provide income and growth by investing in bonds and equities globally. We allocate between 35% and 65% to debt securities from across the credit spectrum, with the rest of the portfolio in global equities. One of the benefits of including an equity component is that it has the potential to deliver capital growth as well as dividend income.

The investment concerns the acquisition of units in an actively managed fund and not in a given underlying asset. Any investment decision should take into account all the characteristics of the fund as described in the legal documents. For sustainability related aspects, please refer to www.invesco.com/lu-manco/en/home.html.

Portfolio managers Edward Craven, Alexandra Ivanova, Stephen Anness and Andrew Hall bring a combined 80+ years of industry experience. They are members of the Henley-based investment teams and have worked together for several years. They draw on the support of their colleagues in the fixed interest and global equities teams. Invesco’s global ESG team is also available to provide support and analysis.

To fulfil the goals of the Paris Agreement, countries, corporates and consumers will have to take steps to reduce their carbon footprints. The switch from a carbon-intensive economy will require huge public and private sector investment in innovative technology and green infrastructure. Meanwhile, any delay in the transition to net zero could exacerbate the climate crisis and pose risks to portfolios and assets. Investment portfolios and asset allocation will increasingly reflect the realities of the transition to net zero.

Green bonds are debt securities designed to finance climate and environmental projects. For example, they may support energy efficiency, sustainable agriculture, clean transportation, sustainable water management, and so on.

Green bonds can be good at promoting ESG outcomes, however it is also important to remember that some companies which are sustainable don’t issue green bonds. That’s why we don’t restrict ourselves to green bonds only in our management of the fund. Instead, we form our own judgement on a company’s financial and green credentials. For example, if a company we like issues green and non-green bonds, we can choose which is the best value.

One benefit of the bond portion of a mixed asset portfolio is that it has the potential to deliver a steady income stream while offsetting stock market volatility. Meanwhile, a benefit of the equity component is that it has the potential to deliver shareholder value.

SFDR stands for Sustainable Finance Disclosure Regulation. This is a European regulation that came into effect in 2021. Its aim is to increase transparency around sustainable investment products and to reduce the risk of greenwashing. Funds are classified as Article 6, Article 8 or Article 9 depending on their ESG approach. Article 9 is deemed the ‘greenest’ categorisation. To be categorised as Article 9, a fund must have sustainable investing or carbon reduction as part of its investment objective.

Discover market conditions that could make an equal-weight approach worth considering for gaining a more balanced exposure to large-cap US equity benchmarks.

Unlike market-cap indices, which naturally concentrate exposure in the largest companies, Equal Weight strategies assign the same weight to each constituent. Invesco’s Equal Weight UCITS ETFs offer access to this approach across both global, US and European markets.

We are excited to announce a new partnership designed to help investors realise the full return potential of the global economy by unlocking new opportunities in private markets.