Alternatives Private credit quarterly roundup: Liberation Day market responses

Experts from Invesco's bank loan, direct lending and distressed credit teams to share their views from the second quarter of 2025.

US inflation is running at a high level. Some of this price pressure is likely to be transitory, reflecting the bounce-back in economic activity from locked-down 2020 to re-opened 2021. But there is considerable evidence of persistent price rises too. The clearest example of this is probably shelter – the largest element in the inflation basket.

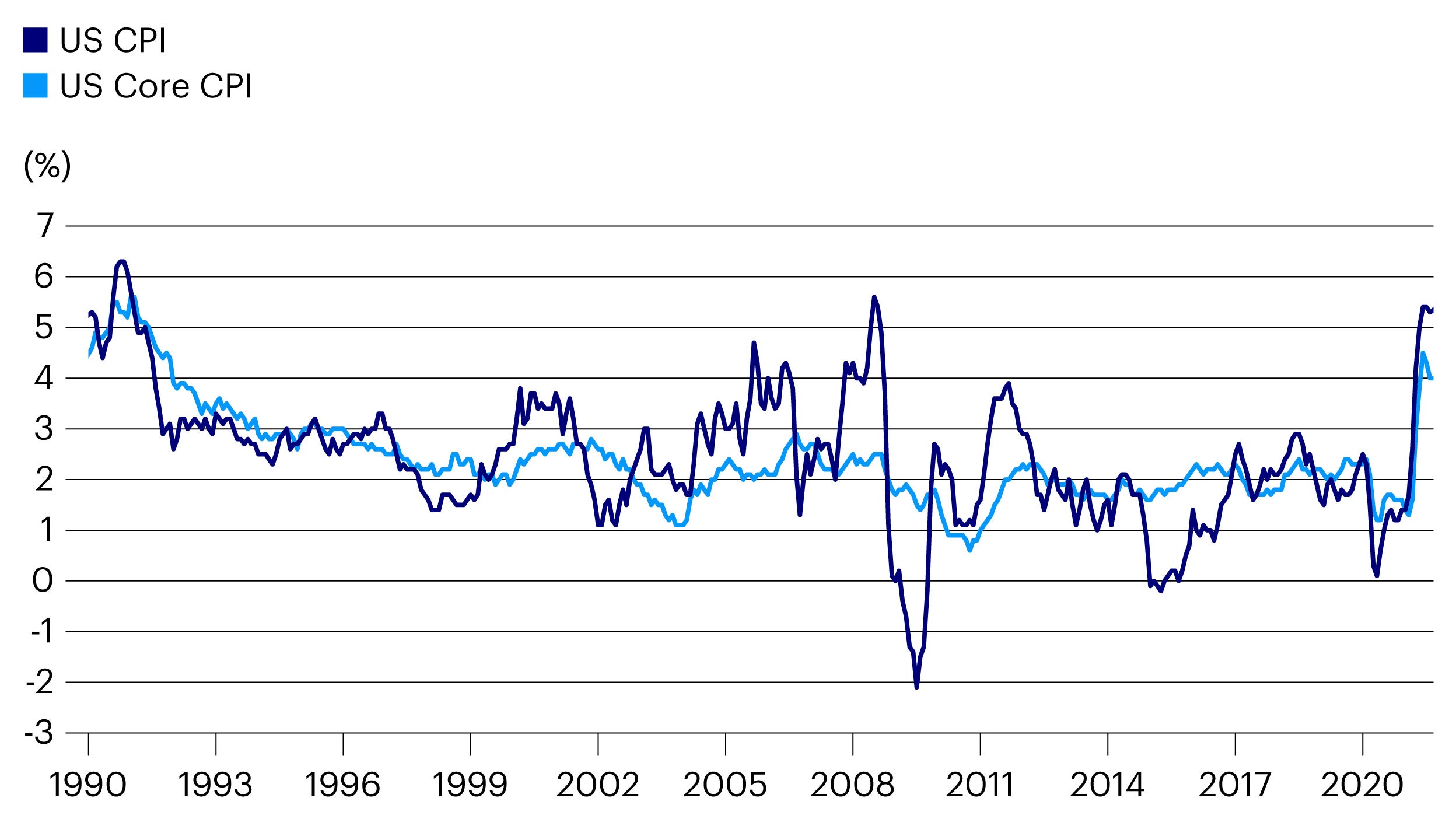

Headline US inflation is 5.4% and has averaged 5.1% over the last six months.1 The equivalent numbers for US core inflation are 4.0% and a six-month average of 3.9%.2 As Figure 1 illustrates, these levels, especially for the core measure, have not been reached often in the last three decades.

These current levels are well above the 2% targeted by the Federal Reserve. But this target is an average inflation rate, and the Fed gives itself flexibility to look through periods above 2% after periods below that level. As Chairman Powell stated last year, in such circumstances, ‘appropriate monetary policy will likely aim to achieve inflation moderately above 2% for some time’.3 It seems reasonable that the Fed could look through shorter-term factors today, including bottlenecks that have resulted from the Covid-related disruption.

So, the more important question for Fed policy is: what level of inflation will there be over the next couple of years, when the base effects of 2020 roll off and the global trading system has had time to deal with pinch points? What will inflation look like in 2022 and 2023? The Fed itself has been examining this recently.

The Dallas Fed has been looking at one part of inflation in particular – shelter. It argues that this factor will push overall inflation up considerably over the next two years, a period the Fed cannot easily ignore in setting monetary policy.

Shelter is the biggest factor in US inflation. It is broken down into two elements – Rent and Owners’ Equivalent Rent (OER). OER is a measure of cost for home ownership. In the Consumer Price Index, Rent has a 7.6% weight and OER has a 23.6% weight.4 The Fed’s preferred measure of inflation is the Personal Consumption Expenditures Index (PCE). In the core PCE index, the Rent and OER weights are 4.1% and 12.9%.5 On either measure, shelter sums up to a significant weight in the inflation basket.

According to the Dallas Fed, Rent inflation is expected to increase from 1.9% in June 2021 to 3.0% at year-end 2022 and to 6.9% at year-end 2023. OER inflation is expected to rise from 2.3% in June 2021 to 3.8% by year-end 2022 and to 6.9% by year-end 2023. Both of those 2023 rates would be the highest in more than 30 years.

Given their weights, this would contribute 0.6% to core PCE inflation at the end of 2022 and about 1.2% at the end of 2023. That is projected to result in a core PCE inflation rate above 2% at the end of 2023.

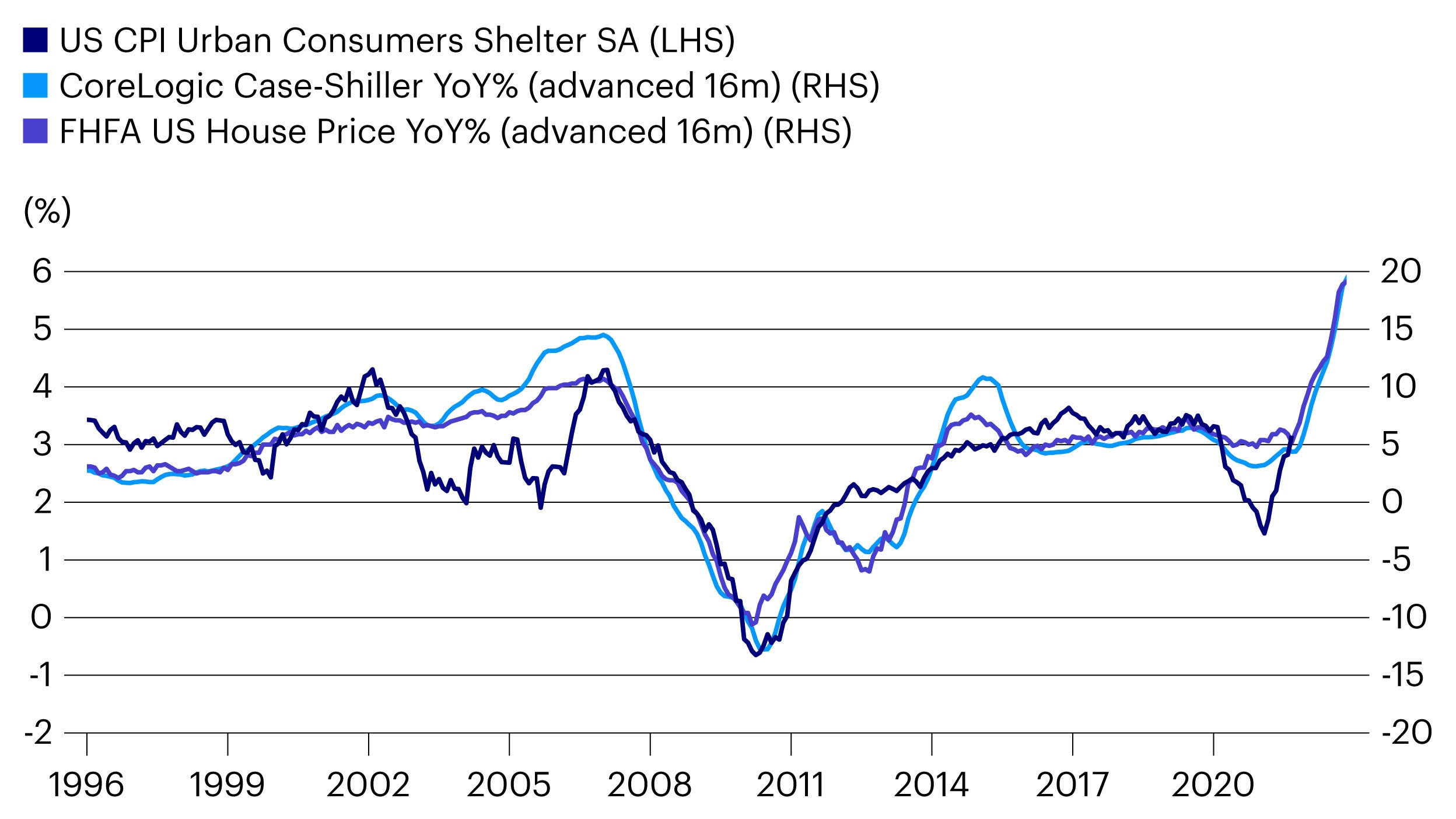

This projected rise is based on the link that both Rent and OER inflation have with house price growth. The Dallas Fed’s analysis shows that current house price growth is strongly correlated with Rent and OER inflation, with a lag of about 16-18 months. In other words, the forecast strength in 2023 shelter inflation is a lagged response to the surge in house prices that we are seeing now (Figure 2).

The latest house price data shows prices rising at an annual rate of 20%.6 Monthly increases have been above 1% for 14 consecutive months to the latest reading in July.7 More forward-looking data, such as the Zillow Rental Price Index, suggest the trend remains strongly positive.

We think the risk of higher inflation makes US dollar duration less attractive. We have been concerned about the balance of risk and reward in this area for several months and are holding a low allocation.

We have been reducing exposure to US dollar duration since late-2020. With the emergence of effective Covid vaccines, the outlook for growth in the US and elsewhere improved significantly. This increased inflation risk and reduced the justification for stimulative policy, bringing the prospect of tightening nearer. We felt that valuations in the dollar bond markets were becoming a less attractive reward for the risk.

This shift in strategy is especially clear in our most flexible products. In the Invesco Tactical Bond Fund (UK), modified duration was 4.9 in September 2020 and USD duration accounted for roughly half that total. Now fund duration is 0.6 and we have a negative position in USD duration. The fund has benefitted from recent weakness in the US Treasury market and would be boosted further if yields rise from here.

In the Invesco Global Total Return (EUR) Bond Fund, we still have some positive exposure to USD rates, but our dollar duration has been reduced by nearly two thirds in the last year. More than half our US Treasury holdings in this fund are in TIPS, a type of Treasury security that offers protection against inflation by adjusting both the coupon and principal payments in line with the US CPI.

Experts from Invesco's bank loan, direct lending and distressed credit teams to share their views from the second quarter of 2025.

We speak with IFI portfolio managers about the factors driving US investment grade and how they are navigating the current fixed income environment.

Mike Sobolik, Regional Investment Strategist, North America, shares insights into the dynamic nature of real estate cap rates, including the importance of taking a long-term view when making real estate investment decisions.