What are these hybrid securities?

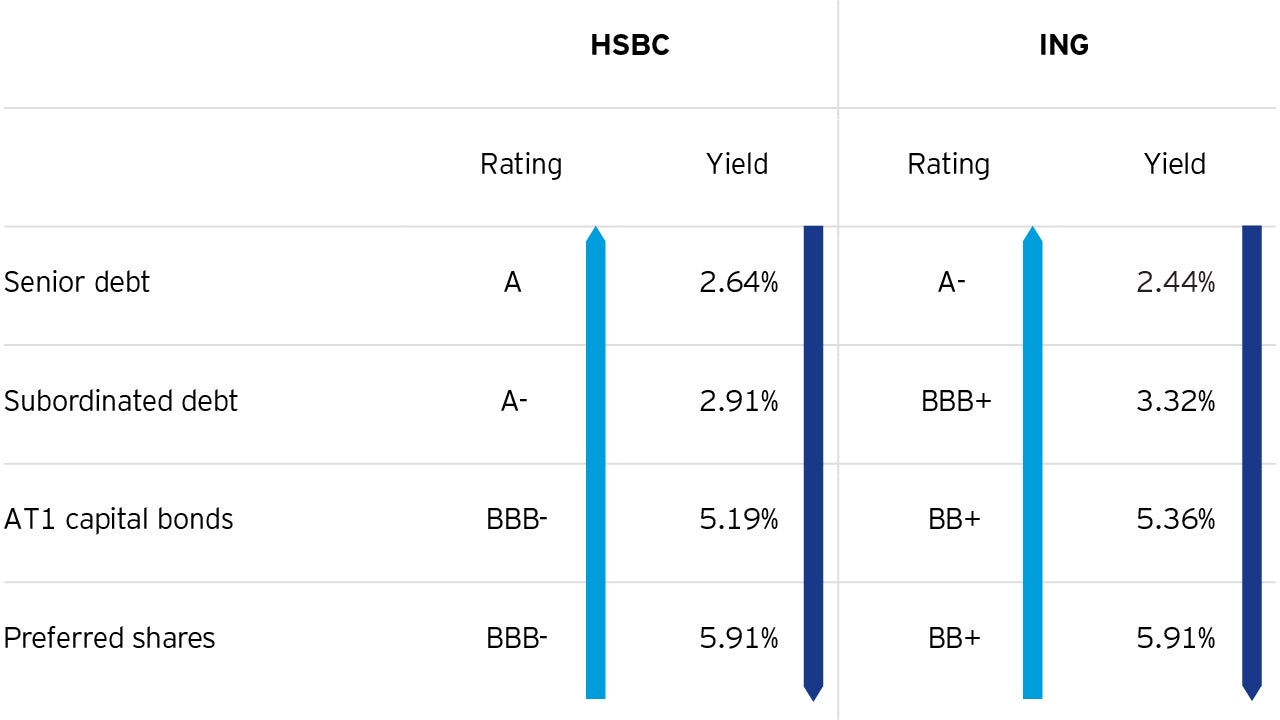

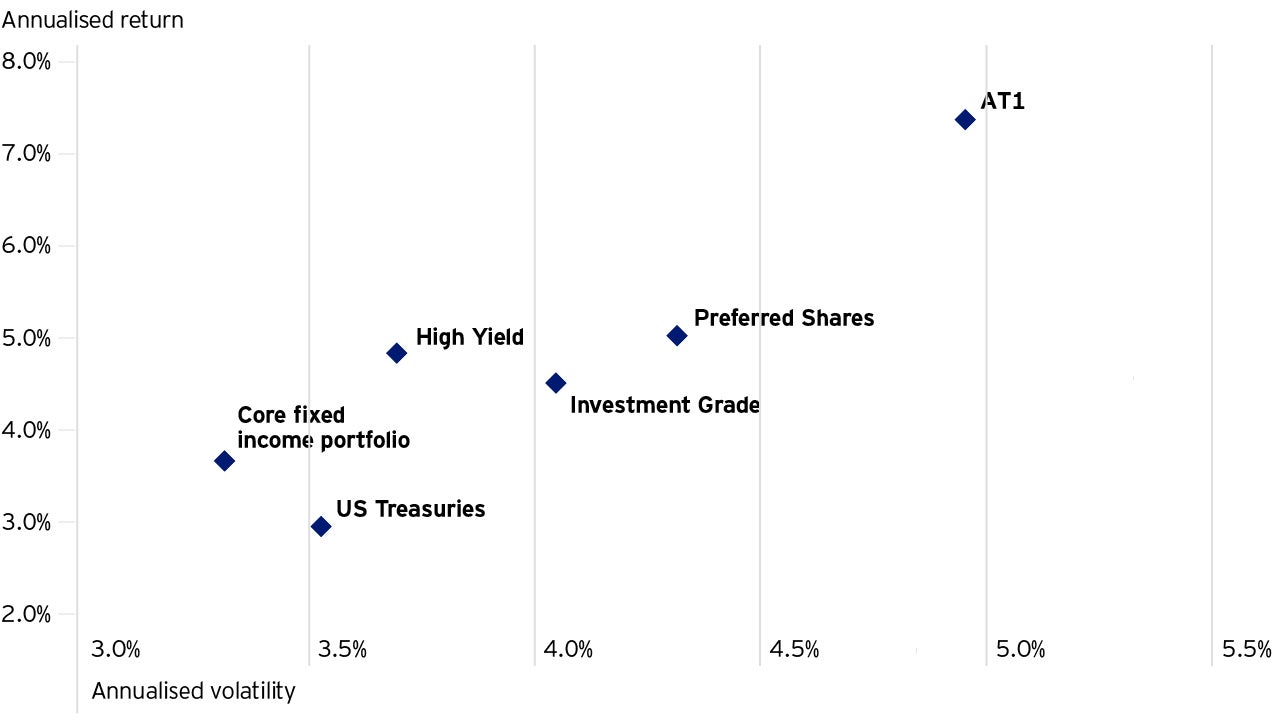

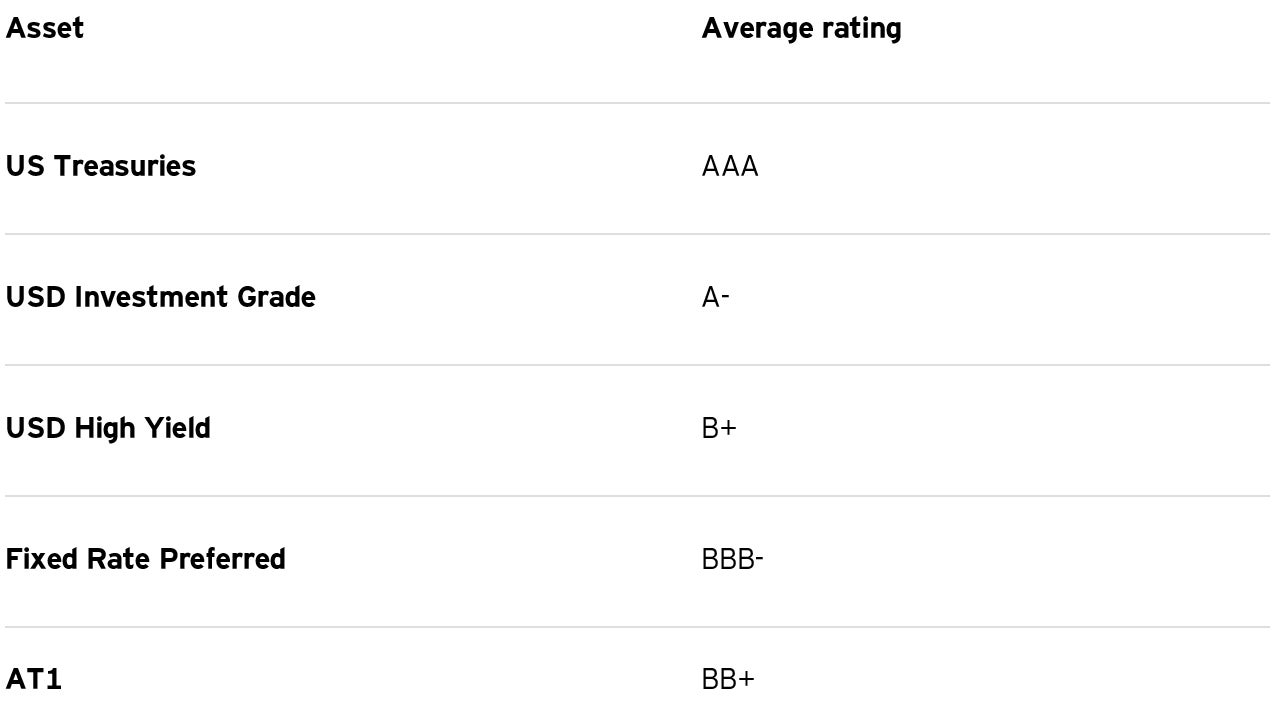

AT1s and Prefs are higher yielding segments of a bank’s capital structure. They offer investors yields generally found in the High Yield credit market but issued by banks and corporates often with investment grade credit ratings.

AT1s are high yielding perpetual bonds1 issued by European banks. First appearing after the 2008 financial crisis, they are designed to prevent contagion in the financial sector by acting as a readily available source of bank capital.

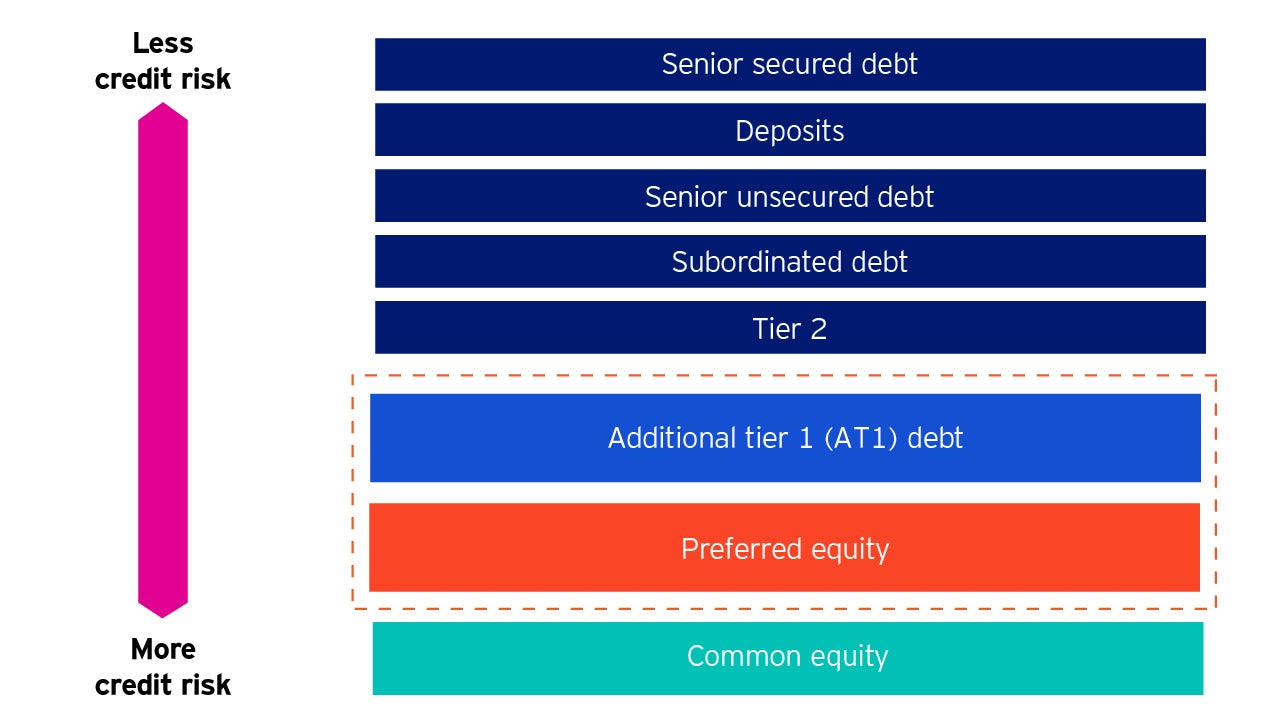

The bonds fall towards the bottom of the issuer's capital structure and are among the first debt instruments to absorb losses in times of financial distress. This position on the 'hierarchy of loss absorption' is what drives the higher yields during benign market conditions, where AT1 holders are compensated for assuming additional risk.

Like AT1s, Preferred shares are deeply subordinated in the capital structure and are often issued as a perpetual security with a call option, usually after five to seven years. For this analysis, we will focus on fixed-rate prefs. The other most common type, variable-rate prefs, have a fixed coupon until the first call date, and the rate then becomes floating or variable.

Prefs are primarily issued by banks and insurance companies for regulatory purposes but may also be issued by industrial and utility corporations. They are equities that exhibit bond-like characteristics such as having defined dividend or interest payments, defined par amounts and are rated by credit rating agencies. They can usually defer or skip payments without creating a default event.

1 Although AT1s are issued with no fixed maturity date, they are callable