ETF The strategic advantage of AAA-rated CLO Notes

Invesco Private Credit’s Kevin Petrovcik discusses new developments for AAA-rated Collateralised Loan Obligation (CLO) note investments and their potential advantages.

The Senior Secured Loans asset class is large and highly diverse.

Over the last several years of heightened uncertainty, loans have produced strong positive returns.

Our data shows that Senior Secured Loans have consistently delivered superior risk-adjusted returns over the last 10 years.

Senior Secured Loans are often overlooked in favour of traditional bonds due to misconceptions about their safety, liquidity and portfolio fit. However, in today’s volatile market these loans are increasingly becoming a compelling option for investors seeking both security and opportunity.

Whilst the market is diverse and offers access to a wide range of industries and companies, it is important to lead with caution; price fluctuations and economic uncertainty pose risks to investments and could result in potential declines. Explore the 10 common myths below to dig deeper into senior loans.

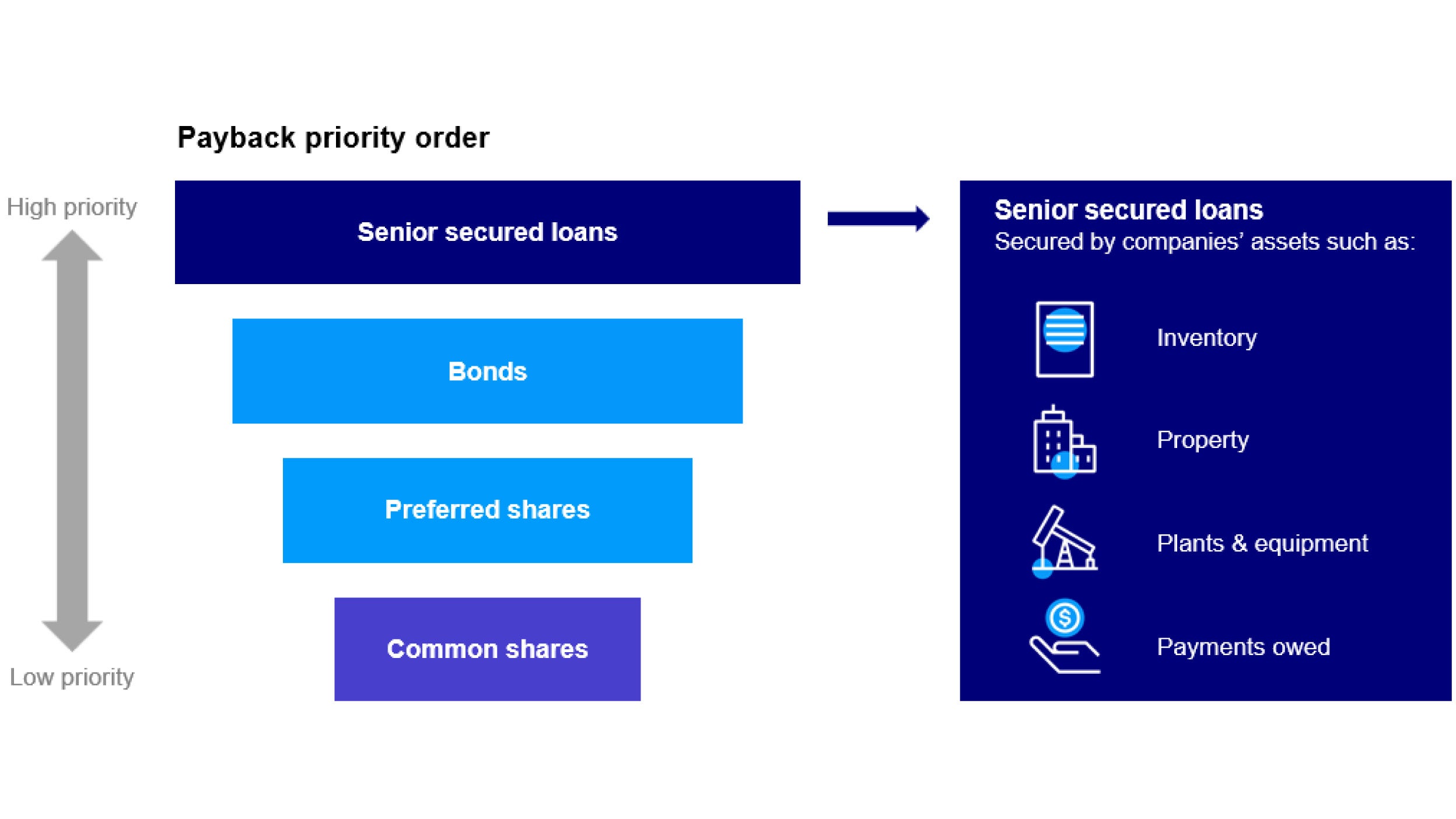

Reality: SSLs are secured by company assets and, depending on the issuer, they may have the highest priority in repayment. In some cases, SSLs may be considered more secure than equivalent bonds issued by the same company. In contrast, bonds are below loans in the capital structure, are unsecured and subordinated in terms of right of repayment and generally mature after the loans.

Source: Invesco. For illustrative purposes only.

Reality: The global SSL market is vast, with a diverse range of issuers across various industries, totaling $1.8 trillion.1 The SSLs market offers broad, global diversification by industry and company, including global brands like Burger King, Dell, Hilton, Chrysler, and Formula 1.

Reality: SSLs generally can offer higher yields with minimal duration risk compared to traditional bonds.2 This is because they provide a hedge against rising interest rates and inflation. They can also offer multiple layers of credit risk protection.3

Reality: Compared to higher yield bonds which are typically unsecured, SSLs have consistently delivered higher levels of reliable income, even during market fluctuations. Between 1987 – 2020, the average debt recovery rate, as measured by ultimate recoveries for US SSL, was 80%, compared to 47% on average for US high yield bonds.4

As shown in the graph below, loan income comprises the base rate (dark blue bars), plus a credit spread (the light blue bars). As you can see, coupons rise and fall in lockstep with changes to base rates and, over the last 12 years, the total coupon has averaged about 5.5% p.a. in US dollars (the pink line).

Source: PitchBook Data, Inc. as of March 31, 2024. Base rate reflects the average during the quarter. Uses three-month LIBOR (prior to 2023) or SOFR (2023 or later) plus the weighted average institutional spread. Updated quarterly.

Reality: Because SSLs are secured by assets and are positioned at the top of a company’s capital structure, they have the potential to mitigate risk effectively. This means that investors are effectively ranked first for any repayment in the event of a default by the issuer.

As the graph demonstrates, since 1998, loans have produced a very stable and upwardly sloping line. Downticks in loan valuations during the coronavirus pandemic were short-lived with very rapid and strong recoveries, which is testament to the senior secured status.

Source: Credit Suisse as of 31 May, 2024

Reality: SSLs have historically been insulated from interest rate volatility.

Figure 4 demonstrates that we have had uncertainty in the form of rate hikes and the possibility of a hard landing over the past 2+ years and loans have produced strong positive returns of 15.2% cumulative through this period with low volatility, benefiting greatly from the floating rate feature and senior secured status. In contrast, traditional bonds have produced negative returns and been highly volatile, with treasuries losing 15.3% and investment grade credit losing 8.4%, while high yield bonds have recovered recently to be +2.4% cumulative. SSLs can sometimes produce risk-adjusted returns because of their high coupon as rates remain stubbornly high.

Sources: PitchBook Data, Inc. ; Bank of America Merrill Lynch; Bloomberg as of March 31, 2024. The Morningstar LSTA US Leveraged Loan Index represents US Loans, the ICE BofA US High Yield Index represents US High Yield, the ICE BofA US Corporate Index represents US Investment Grade, the ICE BofA Current 10-Year US Treasury Index-TR represents Treasury. An investment cannot be made directly in an index.

Reality: Borrower leverage has been declining, and interest coverage ratios remain positive.

Reality: The SSL market is highly liquid compared to private credit. SSLs are priced daily and offer daily liquidity. About half of the loans on issue trade each day, whereas for corporate bonds only 20% of issues trade on any given day.

The liquidity of the market allows for a number of daily liquid access methods including ETFs, daily liquid retail mutual and comingled institutional loans funds.

Reality: For a low-risk asset class, we believe the market consistently prices Senior Secured Loans incorrectly – and the data backs us up.

Over the 3, 5 and 10 year periods, loans have produced far superior risk-adjusted returns versus the fixed rate debt spectrum.

Whether you consider risk as volatility, frequency of negative returns (only three in the last 32 years) or risk of permanent capital loss, senior secured loans have consistently provided a low-risk outcome over the last 30+ years.

Source: Credit Suisse, Bloomberg L.P., and Barclays Data as of 3/31/24. Updated quarterly. US Senior Loans is represented by the Credit Suisse Leveraged Loan index, US High Yield by the Credit Suisse High Yield Index, US Corporate by Bloomberg US Corporate Index, US Aggregate by the Bloomberg US Aggregate Index, and US Treasury by the Bloomberg US Treasury Index. An investment can not be made in an index. Sharpe ratio utilizes annualized total return of 90-day T-Bills for the periods ending 3/31/24. Past performance is not a guarantee of future results.

Reality: Including SSLs in a portfolio has the potential to improve risk-adjusted returns. Loans are suitable for a core allocation within both diversified and income focused portfolios. Within diversified portfolios, loans are a complement to core bonds as a means of diversifying away from fixed rate assets like government bonds. We have demonstrated the consistency of income across all rate cycles and we expect that coupons will remain elevated above historical levels even after the rate cut cycle is complete.

Understanding the nature of Senior Secured Loans can help investors make informed decisions and potentially leverage the benefits of this often-overlooked asset class.

Invesco Private Credit’s Kevin Petrovcik discusses new developments for AAA-rated Collateralised Loan Obligation (CLO) note investments and their potential advantages.

Explore the benefits of incorporating AAA-rated CLO notes may provide to an investment strategy including consistent income potential and possible hedge against interest-rate volatility.

Significant focus on the uncertainty of the US macroeconomic backdrop and its potential headwinds on the market remain top of mind for investment opportunities globally. Against this cautious outlook, we asked the experts from Invesco’s bank loan, direct lending and distressed credit teams to share their views as the first quarter of 2025 begins.

1 Barings, Jun 2024, Senior Secured Loans: 101 (barings.com)

2 Senior secured loans: investing in a “higher for longer” interest rate environment, Nov 2023, Senior Secured loans investment insights | Invesco Netherlands

3 Barings, June 2024, Senior Secured Loans: 101 (barings.com)

4 Invesco Investment Insights, March 2022, 2759432_OMG464229_Senior_Secured_loans_white_paper_UK_EN.indd (invesco.com)

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Alternative investment products may involve a higher degree of risk, may engage in leveraging and other speculative investment practices that may increase the risk of investment loss, can be highly illiquid, may not be required to provide periodic pricing or valuation information to investors, may involve complex tax structures and delays in distributing important tax information, are not subject to the same regulatory requirements as mutual portfolios, often charge higher fees which may offset any trading profits, and in many cases the underlying investments are not transparent and are known only to the investment manager.

Information is provided as at 30 June 2024, sourced from Invesco unless otherwise stated.

This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. Views and opinions are based on current market conditions and are subject to change.

EMEA33944696/2024