Green investing isn't always easy

As the sun was setting on 2021, the European Commission had one last trick up its sleeve. On New Year’s Eve, it circulated its long-awaited and much disputed proposal to include nuclear energy and natural gas as part of its definition of green activities to its Member States and MEPs. This is known in technical terms as Taxonomy. The move has triggered outrage and applause, depending on who you speak to.

There are strong arguments on both sides of the debate on this latest step. The EU’s attempt to decipher what activities are truly green has proved a long and difficult path. This latest debate exemplifies the challenges in the search of the holy grail for ESG - a single definition of sustainable investing. It should be one that draws consensus, to combat the risk of greenwashing.

In this article, we’ll discuss what the latest Commission proposals to include nuclear energy and natural gas might mean in the context of Net Zero. We’ll also see how this latest debate exemplifies the challenges around defining green within the context of numerous concurrent initiatives in this space. We conclude by considering how investors, can make sense of these competing definitions to choose sustainable investing products that meet their preferences.

Green, greener, greenest

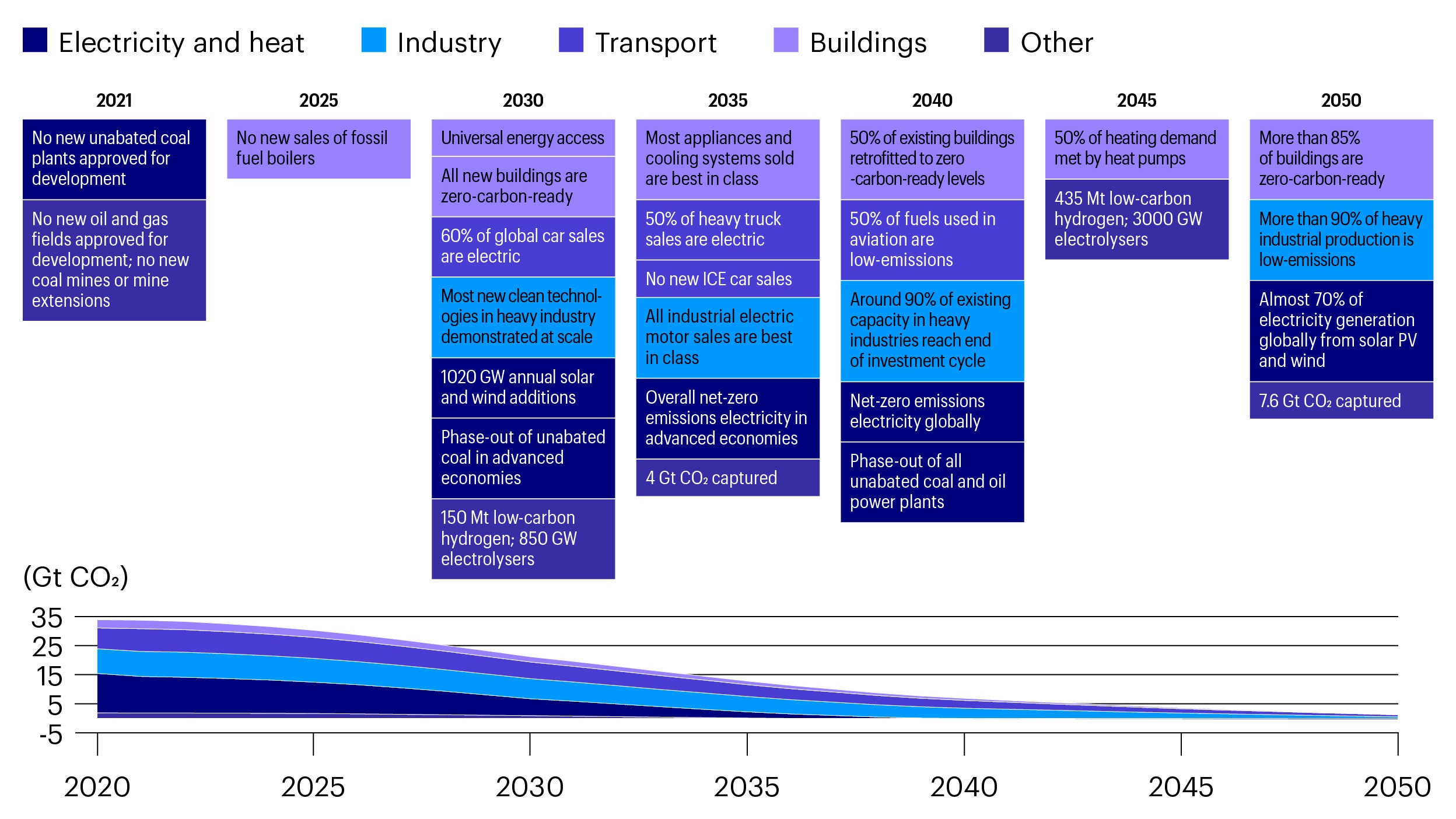

The Paris Agreement was a watershed moment. It defined a clear goal: to limit global temperature rise 2°C, and ideally no more than 1.5°C. To do so, world leaders agreed to achieve Net Zero carbon emissions by 2050. While the end goal is clear, there’s still some question around the paths that lead us there, given the economic and political costs such choices are likely to entail. In Europe, the matter of how to achieve Net Zero both today and in the future has played out through debates about the design of the EU Green Taxonomy.

Background on the EU Taxonomy

The EU Taxonomy defines 6 environmental objectives: climate change mitigation, climate change adaptation, biodiversity, water and marine resources, pollution prevention and control, and circularity.

To be considered environmentally sustainable, an activity must meet 4 tests:

- The activity must be in a sector that is eligible for the Taxonomy

- The activity must meet the significant contribution criteria for one of the environmental objectives, as set out in the technical screening criteria

- The activity must not do significant harm to any of the other environmental objectives

- The activity must meet minimum safeguards

So far, the focus of the work to date has been on the two climate change objectives, with the most heated debates centring on the climate mitigation criteria, which saw the European Commission inundated with over 46,000 replies to its consultation on the rules. While NGOs protest that the rules are too lenient and will not lead to the EU reaching Net Zero, industry complain that the rules are too exacting, leading to very few activities meeting the criteria.

While currently intended as a disclosure and reporting framework for companies and investment products, the linking of the Taxonomy the EU Budget and COVID Recovery Facility has set a precedent for the Taxonomy definining of green to be used more broadly to determine investment by both the public and private sector, leading to heightened focus on what is and is not included.

The energy sector is the source of around three-quarters of greenhouse gas emissions today. It holds the key to averting the worst effects of climate change, perhaps the greatest challenge humankind has faced.1 There’s been a rapid scale-up of renewable energy and a phase-out of fossil fuels established by science. But the watering down of the COP26 communique, substituting “phase down” instead of “phase out” of coal shows the political challenges of meeting these targets.

In the complex landscape where science meets political economy there are two related but separate questions: the role of nuclear energy and natural gas. In considering the case for and against the inclusion of these two energy sources, there are several factors that politicians will need to consider:

- The extent to which their inclusion is aligned with the climate science

- The economic and political implications

- Views of investors as to whether their inclusion will undermine confidence in the Taxonomy

- The international context

The case for and against nuclear energy

1. Seen purely through the prism of carbon emissions, nuclear energy is considered compatible with climate science. It has a carbon emission profile like other renewable energies such as wind and solar. Of course, the main issue with nuclear energy isn’t its carbon emissions - it’s the toxic waste produced as a result. This is because it would conflict with the Taxonomy’s requirement that any activity "do no significant harm” to other environmental objectives. While the European Commission’s assessment considers that current regulatory requirements are sufficient to mitigate such risks, critics are unconvinced. 2

2. The economic and political impacts of nuclear vary by country. Some EU countries, including France, Belgium and Hungary, are hugely reliant on nuclear energy, so moving away from it would prove hugely costly. But critics point out that nuclear energy is expensive.

According to the annual World Nuclear Status report, the cost of nuclear energy ranges between $112 and $189 per megawatt hour (MWh). This is well above the cost of other renewables, including solar (from $36 to $44 MWh), and onshore wind ($29–$56 per MWh). Also, while the lifetime cost of renewables has dropped between 70-90% over the past decade, the cost of nuclear has increased 23%. Added to the average time to build new nuclear reactors of around ten years, critics argue that nuclear energy is inefficient and too slow in the context of mitigating climate change. According to Statista, only China currently has plans for large scale deployment of new nuclear capacity.

Source: Statista

3. When it comes to investor sentiment, it’s clear that investors have been and are increasingly wary of nuclear energy. According to Eurosif, nuclear was one of the top sectoral exclusions that investors applied to their portfolios, alongside other ethical screens such as tobacco and weapons. Leading ESG and green investor labels have also lined up against nuclear. For example, the Febelfin Towards Sustainability label puts nuclear on a par with coal in its criteria.

4. From an international point of view, the inclusion of nuclear is in step with other major jurisdictions. For example, China’s green projects catalogue includes nuclear energy. The UK, which is also developing its own Taxonomy, is likely to look at including nuclear as well. It’s a core component of the country’s plan to decarbonise the energy sector. While the US is slightly late to the party, nuclear is also expected to be part of the mix for the Biden Administration’s Net Zero strategy.

The case for and against natural gas

1. Natural gas is considered a transitional fuel since its carbon emissions are around 60% of those from coal. This is the primary case made for its inclusion. It’s suitable for countries looking to move away from coal in the short-term, while building up their renewable energy capacity.

However, natural gas remains well above the 100g CO2e/MWh recommended by the Technical Expert Group for an energy source to be eligible for Taxonomy. While supporting investment to speed up the transition away from coal for these countries may seem logical, such a step is out of sync with most Net Zero pathways.

The EU draft rules include a sunset clause that would see natural gas phased out of the Taxonomy by 2030. But this seems inconsistent with the very clear statement from the IEA’s Net Zero scenario. The statement considered that, beyond projects already committed to as of 2021, there should be no new oil and gas fields approved going forward. The focus for oil and gas producers should be switching entirely to output from the operation of existing assets.

2. Politically and economically, the inclusion of natural gas is seen as critical for Poland, Czechia and Bulgaria, who are transitioning away from coal much more slowly than the rest of the EU. Between 2015 and 2030, combined electricity generated from coal will fall just 42% in these three countries, compared to 99% in the rest of the EU-27. These three countries will be responsible for over 95% of the EU’s planned electricity generation from coal in 2030: Poland (63%), Czechia (18%) and Bulgaria (14%). But it’s not only the countries still dependent on coal that are supporting the inclusion of natural gas as a transitional fuel. Germany is also relying on natural gas to substitute as it moves away from coal and nuclear energy, as exemplified by the political importance attached to the Nordsteam 2 pipeline.

Source: Our World in Data based on BP Statistical Review of World Energy & Ember

3. When it comes to investor sentiment, we expect climate conscious investors to be concerned by the inclusion of natural gas. While natural gas doesn’t feature in the list of most common exclusions, we’re seeing a growing trend towards the exclusion of fossil fuels more generally. Some investors are more targeted, focusing on coal or unconventional oil and gas (such as shale or tar sands). Others are increasingly moving away from fossil fuels in general. The Febelfin criteria for example, set a maximum of 5% of revenues derived from oil and gas.

4. The inclusion of natural gas is also likely to tarnish the EU’s credentials as a leader in the climate and sustainable finance space. Even China, who had previously been criticised for including “clean coal” in a previous iteration of its green projects catalogue has now firmly moved away from fossil fuels. South Korea, who recently published its own Taxonomy has also recently been criticised for including natural gas.

Who’s the greenest of them all?

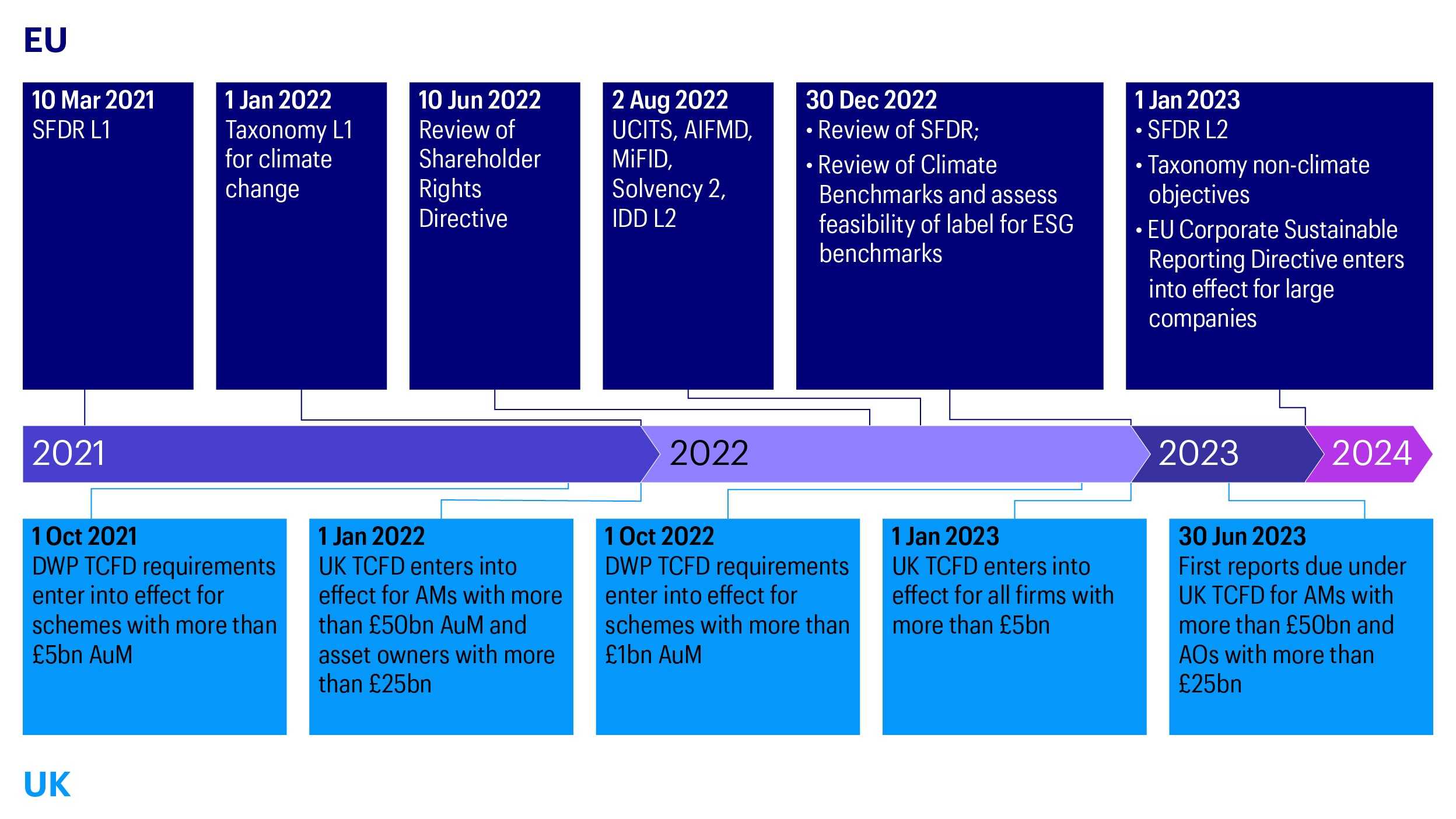

Taxonomy is seen as foundational to the EU’s sustainable finance endeavours. It’s also increasingly leaching into other policy spheres such as the EU Budget and COVID Recovery financing. But it’s not the only initiative that is currently underway with the aim of defining what we mean by green. The multiplying initiatives and lack of consistency between them can be challenging for investors when deciding which standards are right for them.

In assessing and considering which frameworks best meet investors’ needs, there are several elements that differ across some of the main frameworks currently in this space:

- Decarbonisation trajectory vs climate solutions: while many frameworks focus on decarbonisation of portfolios (such as SBTs, Paris Aligned Benchmarks), the Taxonomy, like some green revenues databases, focuses on defining climate solutions. The IIGCC’s Net Zero Investment Framework includes both dimensions.

- Climate-related sectoral exclusions: many frameworks focused on decarbonisation don’t exclude specific energy sources but rather focus on the broader decarbonisation approach. Many investor-driven approaches focus on engagement rather than divestment as the main tool to address climate laggards. This may not always meet the needs of clients who have specific views on controversial sectors. The Paris-Aligned Benchmarks combine a decarbonisation approach with sectoral exclusions while the Taxonomy only covers eligible sectors.

- Do No Significant Harm principle: Many EU-driven initiatives, including the Taxonomy, take a climate-first approach as well as including a “do no significant harm” principle. This is in relation to broader environmental and to a more limited extent, social issues. Many global and market-led initiatives however are more targeted in their approach with a clear focus on climate.

| Climate solutions | Decarbonisation trajectory | Sectoral exclusions | Broader environmental or social criteria | |

|---|---|---|---|---|

| EU Taxonomy | Yes - Defines activities that make a substantial contribution to an environmental objective | No | No - solid fossil fuels (i.e. coal) is explicitly excluded from the Taxonomy, but otherwise the Taxonomy takes a technology neutral approach. However, only certain sectors are currently covered and expansion to certain sectors, such as nuclear and natural gas have proved controversial | Yes - the Taxonomy requires that any activity also meets rigorous requirements to limit harm to other environmental and social issues |

| Net Zero Investment Framework | Yes - the framework recommends that investors establish a target for climate solutions, however this is secondary to the main requirement to decarbonise portfolios. | Yes - the framework requires investment portfolios to set decarbonisation targets, with a suggest target of -50% by 2030. | No - the framework focuses on decarbonisation of the most material sectors and engagement rather than sectoral exclusions | No - the framework is focused on climate change and doesn’t mandate an approach to other environmental or social issues, although the standard does recommend consideration of the social issues linked to climate change |

| Climate Transition and Paris-Aligned Benchmarks | No - the rules don’t currently mandate a target for climate solutions, however the European Commission is considering aligning the methodologies with the Taxonomy in the future. | Yes - in addition to an immediate decarbonisation of 30% and 50% respectively for CTBs and PABs, the benchmarks must also reduce carbon emissions by 7% per year. | Yes - the PABs (but not CTBs) include a number of exclusions relating to fossil fuels and energy. | Yes - the rules include exclusions based on social issues (weapons, UN Global Compact violators) as well as harm to other environmental objectives. |

| Science-based Targets | No - the SBTs don’t necessarily require investment in carbon solutions | Yes- the main pillar of SBTs is for companies to set decarbonisation targets | No - the framework does not mandate exclusions and in fact is targeted at the highest emitters. | No - the framework is solely focused on carbon emissions reductions and does not consider wider environmental or social issues. |

The bigger picture

The developments on the EU Taxonomy are taking place against a very busy landscape. There are multiple connected and overlapping initiatives both in the EU and around the globe. While the EU hopes that the EU Taxonomy will ultimately serve as “one ring to rule them all”, it’s likely to be a while before the EU Taxonomy is sufficiently developed and mature enough to do so.

Ultimately, there’s a good chance that the plethora of diverging standards risks will breed mistrust and could disengage investors. This in direct contradiction with the aims to combat greenwashing and encourage investors into sustainable investing.

According to Invesco research undertaken in 2021, the lack of trust and difficulty in understating sustainable finance concepts acts as a barrier to retail investors engaging in this trend.

(Source: Invesco, 2021. Base: all respondents – 201)

* SI Knowledge: Low: 43%, Medium: 44%, High: 23%

** Under 45: 30%

† 'Other' is made up of:

- Knowing how sustainable organisations really are

- Ability to genuinely determine sustainable claims

- Greenwashing

- Understanding about what returns are

- Universal definitions / measures

- Huge amounts of data

- Too many metrics

- Lack of track record given recent emergence

The new rules due to come into effect in August 2022 in the EU will require financial advisors to assess their client’s sustainability preferences according to one of three criteria:

- The percentage of the product invested in Taxonomy-aligned investments

- The percentage of the product invested in sustainable investments (as defined under SFDR)

- The consideration of principal adverse impacts

Based on our research, less sophisticated investors may struggle to express their sustainability preferences in line with these regulatory-defined criteria and definitions. The reliance on regulatory defined frameworks such as the Taxonomy might not be enough to ensure that investors understand exactly what is and isn’t included in their portfolio. This is especially true of those instances where more controversial energy sources are included. Clear information and dialogue with clients will be key in understanding their preferences and mitigating risks of the perceived greenwashing of products.

Footnotes

-

1 IEA, Net Zero by 2050, May 2021

2 European Commission, “Opinion of the Group of Experts referred to in Article 31 of the Euratom Treaty on the Joint Research Centre’s Report Technical assessment of nuclear energy with respect to the ‘do no significant harm’ criteria of Regulation (EU) 2020/852 (‘Taxonomy Regulation’)”, July 2021

Risk warnings

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

This marketing communication is exclusively for use by Professional Clients and Financial Advisers in Continental Europe as defined below and Professional Clients in Dubai, Ireland and the UK. It is not intended for and should not be distributed to, or relied upon, by the public. It is not intended for and should not be distributed to, or relied upon, by the public or retail investors. By accepting this document, you consent to communicate with us in English, unless you inform us otherwise.

Data as at January 2022, unless otherwise stated.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

The article is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

For the distribution of this document, Continental Europe is defined as Austria, Belgium,

Denmark, Finland, France, Germany, Italy, Luxembourg, Netherlands, Norway,

Portugal, Spain, Sweden and Switzerland.

This document may not be reproduced or used for any other purpose, nor be furnished to any other person other than those to whom copies have been sent. Nothing in this document should be considered investment advice or investment marketing as defined in the Regulation of Investment Advice, Investment Marketing and Portfolio Management Law, 1995 (“the Investment Advice Law”). Investors are encouraged to seek competent investment advice from a locally licensed investment advisor prior to making any investment. Neither Invesco Ltd. Nor its subsidiaries are licensed under the Investment Advice Law, nor does it carry the insurance as required of a licensee thereunder.

Further information on our products is available using the contact details shown.

- In Belgium, Denmark, Finland, France, Italy, Luxembourg, Netherlands, Norway, Portugal, Spain and Sweden by Invesco Management S.A., President Building, 37A Avenue JF Kennedy, L-1855 Luxembourg, regulated by the Commission de Surveillance du Secteur Financier, Luxembourg.

- In Austria and Germany by Invesco Asset Management Deutschland GmbH, An der Welle 5, 60322 Frankfurt am Main, Germany.

- In Dubai by Invesco Asset Management Limited, PO Box 506599, DIFC Precinct Building No 4, Level 3, Office 305, Dubai, United Arab Emirates. Regulated by the Dubai Financial Services Authority.

- In Ireland and the UK by Invesco Asset Management Limited, Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire, RG9 1HH, United Kingdom. Authorised and regulated by the Financial Conduct Authority.

- In Switzerland by Invesco Asset Management (Schweiz) AG, Talacker 34, 8001 Zurich, Switzerland.

RO 1996550