Fixed Income A proven approach

The Invesco Global Total Return (EUR) Bond fund embodies our philosophy of only investing when the compensation for doing so is sufficient.

The flexibility of the Invesco Global Total Return (EUR) Bond Fund’s mandate, and the fund managers’ willingness to use it, can be seen in the historical asset allocation and duration positioning.

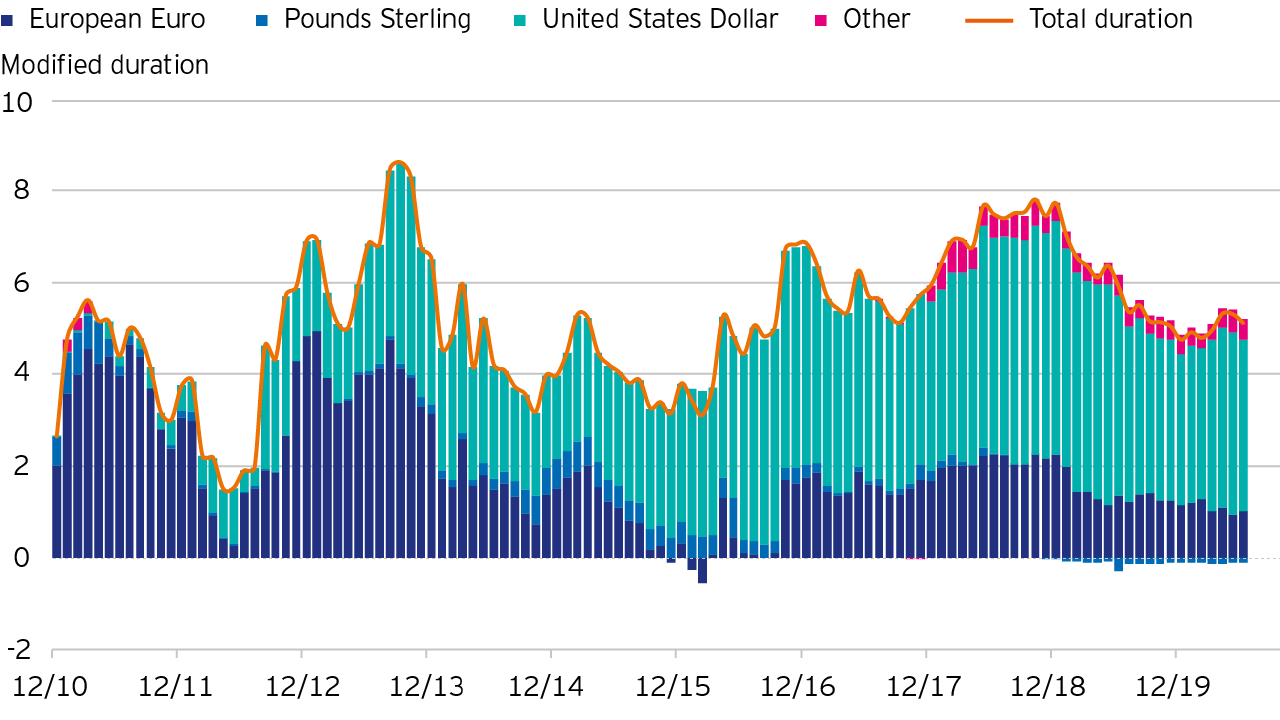

One of the biggest drivers of bond returns over the past 10 years has been duration. As figure 1 illustrates, duration is actively managed in the fund and has ranged from a low of 1.75 in 2012 to a high of 8.5 in 2013.

During the first few years of the fund, duration was biased toward the European market. As the eurozone sovereign debt crisis intensified this was increased to include peripheral European sovereigns along with core holdings in the German Bund market. In more recent years, Treasuries have offered more yield than European counterparts and duration exposure has become more US focused.

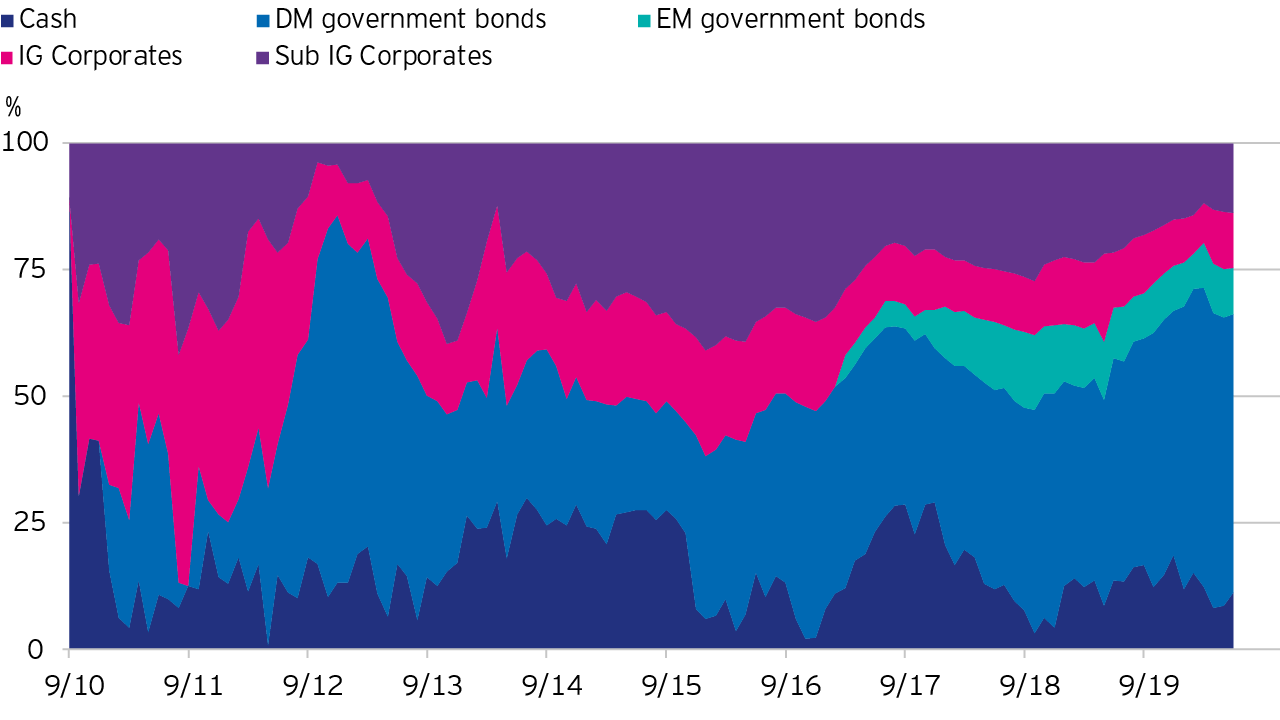

Figure 2 shows that since launch, the fund has had 4 distinct periods of asset allocation. The following section provides an overview of each of these periods.

Following the launch of the strategy in September 2010, a high allocation was held in cash. The eurozone sovereign debt crisis erupted in 2011 and against this backdrop, credit spreads widened significantly. This provided the opportunity to build exposure and lock in attractive yields. One area of particular interest was subordinated financials. Credit risk remained the dominant allocation until late 2012. This allocation benefitted from the strong central bank support, in particular, ECB President Mario Draghi’s now famous proclamation “to do whatever it takes” to save the euro.

As credit spreads tightened the fund managers took profits on the credit exposure and positioned the fund more defensively. 2013 was the year of the ‘taper tantrum’ in which US Treasury yields rose in response to more hawkish rhetoric from the US Treasury. In response, the fund managers increased both US and German bund duration. Government bond yields subsequently fell back again, and the fund managers took profits and held the proceeds in cash. This high cash allocation helped to offset the fund’s rising allocation to sub investment grade bonds. The financial sector remained an important allocation, in particular Additional Tier 1 bank capital.

The fund’s bias in this period was toward credit risk. A relatively large allocation was maintained in government bonds; however, this was held alongside cash as a counter-balance to the fund’s higher yielding credit allocations. Derivatives were used to reduce duration risk.

As yields in developed market credit fell to ever lower levels, the fund managers added exposure to emerging market issuers. Positions were, and continue to be, held in both hard and local currency sovereigns with a small allocation to corporate high yield issuers. In 2018, US government bond yields were once again rising, and credit spreads were widening. The fund gradually increased both duration and credit risk which led to strong returns in 2019 and another phase of profit taking.

The market dislocation that occurred in March 2020 as a result of concerns over the economic impact of Covid-19 provided the opportunity to build exposure. This included adding investment grade corporate bonds as well as local currency Mexican and South African bonds. These purchases enabled the fund to benefit from the subsequent strong bounce back in financial markets.

The Invesco Global Total Return (EUR) Bond fund embodies our philosophy of only investing when the compensation for doing so is sufficient.

The flexible approach of the Invesco Global Total Return (EUR) Bond fund has helped it to outperform its sector during this challenging period.

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested. Debt instruments are exposed to credit risk which is the ability of the borrower to repay the interest and capital on the redemption date. Changes in interest rates will result in fluctuations in the value of the fund. The fund uses derivatives (complex instruments) for investment purposes, which may result in the Fund being significantly leveraged and may result in large fluctuations in the value of the fund. Investments in debt instruments which are of lower credit quality may result in large fluctuations in the value of the Fund. The fund may invest in distressed securities which carry a significant risk of capital loss. The fund may invest extensively in contingent convertible bonds which may result in significant risk of capital loss based on certain trigger events. The fund may invest in a dynamic way across assets/asset classes, which may result in periodic changes in the risk profile, underperformance and/or higher transaction costs.

This marketing communication is exclusively for use by Professional Clients and Financial Advisers in Continental Europe (as defined below), Qualified Investors in Switzerland, Qualified Clients/Sophisticated Investors in Israel and Professional Clients in Cyprus, Jersey, Guernsey, Isle of Man, Malta and the UK. This document may also be used by financial intermediaries in the United States as defined below. By accepting this document, you consent to communicate with us in English, unless you inform us otherwise. This document is not for consumer use, please do not redistribute. Data as at 30.06.2020, unless otherwise stated. This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

For more information on our funds and the relevant risks, please refer to the share class-specific Key Investor Information Documents (available in local language), the Annual or Interim Reports , the Prospectus, and constituent documents, available from www.invesco.eu. A summary of investor rights is available in English from www.invescomanagementcompany.lu. The management company may terminate marketing arrangements.

This marketing communication is not an invitation to subscribe for shares in the fund and is by way of information only, it should not be considered financial advice. This does not constitute an offer or solicitation by anyone in any jurisdiction in which such an offer is not authorised or to any person to whom it is unlawful to make such an offer or solicitation. Persons interested in acquiring the fund should inform themselves as to (i) the legal requirements in the countries of their nationality, residence, ordinary residence or domicile; (ii) any foreign exchange controls and (iii) any relevant tax consequences. As with all investments, there are associated risks. This document is by way of information only. Asset management services are provided by Invesco in accordance with appropriate local legislation and regulations. The fund is available only in jurisdictions where its promotion and sale is permitted. Not all share classes of this fund may be available for public sale in all jurisdictions and not all share classes are the same nor do they necessarily suit every investor. Fee structure and minimum investment levels may vary dependent on share class chosen. Please check the most recent version of the fund prospectus in relation to the criteria for the individual share classes and contact your local Invesco office for full details of the fund registration status in your jurisdiction. Please be advised that the information provided in this document is referring to Invesco Global Total Return (EUR) Bond Fund Class A ( accumulation - EUR) exclusively. This fund is domiciled in Luxembourg.