Adviser investment solutions

Turn our expertise into your edge

We know that life as an adviser can be a fine balancing act. Keeping up with the regulatory landscape and ensuring you’re making the right decisions takes up time.

More and more, advisers are turning to adviser investment solutions to manage client portfolios. In fact, in a recent study we found that 65% use some form of investment solution (as at 14 December 2021) – from DFMs to multi asset fund of funds.

Explore our solutions

Invesco is well-known for providing a wide range of investment capabilities, supporting a variety of financial objectives that can contribute towards a diversified client portfolio. We also provide comprehensive holistic investment solutions to meet the needs of your clients.

Invesco Investment Solutions drive all of our advisory solutions. They’re a team of asset allocators with broad experience in building portfolios to meet differing client needs. And leaning on the vast capabilities of Invesco’s 13 global investment centres, representing 500+ active funds and 300+ ETPs, they have unrestricted access the underlying resources required to deliver.

70 + Investment professionals

20 Years of average investment experience

£70bn+ Assets under management

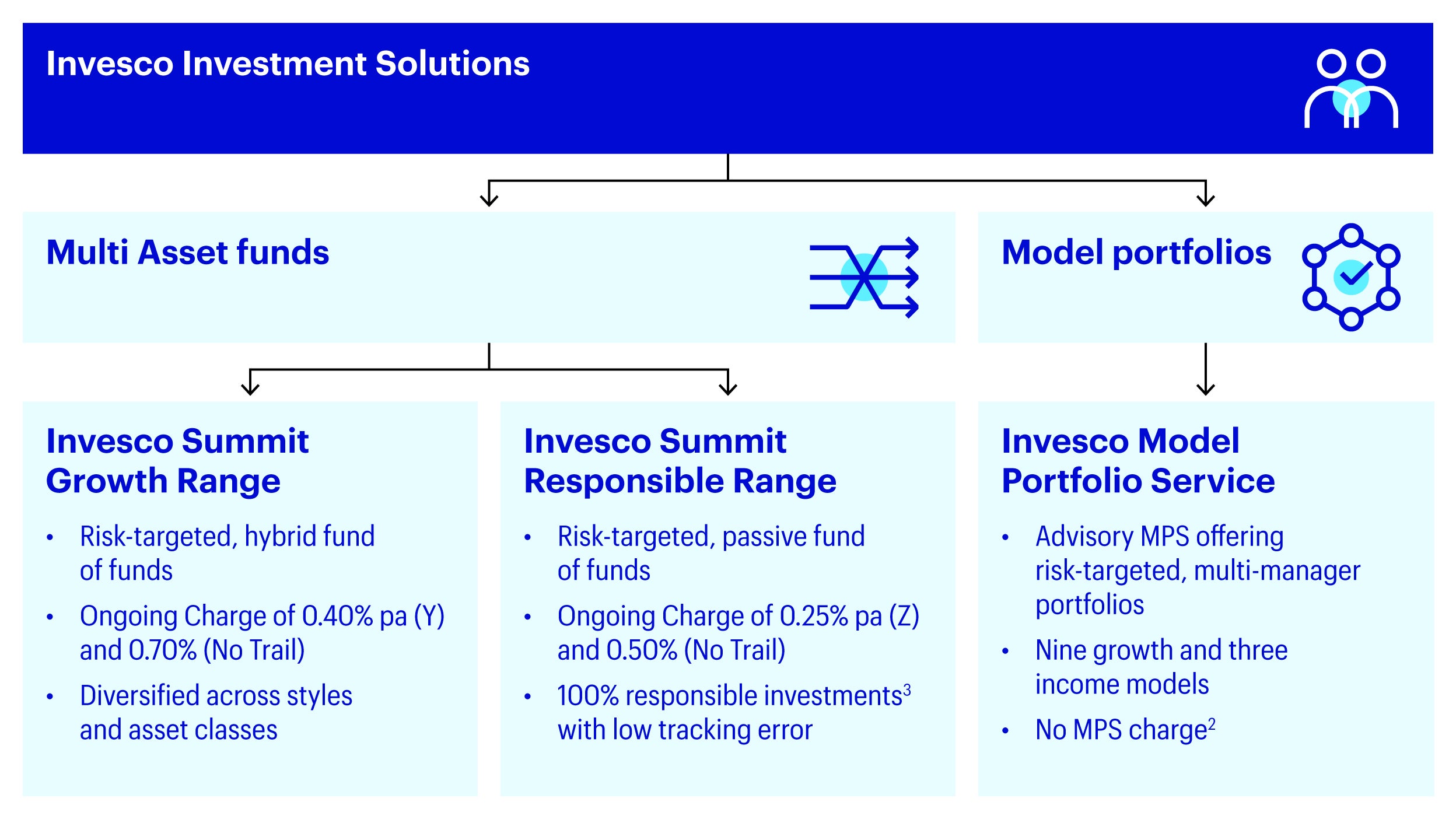

Explore our range of model portfolio and multi-asset solutions below, all rated by major risk agencies and available on leading platforms:

Investing isn’t a part of what we do – it’s the only thing we do

Why use investment solutions?

Footnotes

-

*

1 OCF = Ongoing Charges Figure (annual charge).

2 Your clients only pay the OCFs of the underlying funds, the relevant platform charge and your advice fee. Your firm pays a maximum flat fee of £70 + VAT per month.

3 Invesco Summit Responsible funds aim to invest 100% of their assets (excluding cash) in investments meeting certain ESG criteria. Further information can be found in the Prospectus and Key Information Document.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Invesco Summit Growth RangeThe range has the ability to use derivatives for investment purposes, which may result in the funds being leveraged and can result in large fluctuation in the value of the funds.

The funds may be exposed to counterparty risk should an entity with which the fund does business become insolvent resulting in financial loss.

The securities that the funds invest in may not always make interest and other payments nor is the solvency of the issuers guaranteed. Market conditions, such as a decrease in market liquidity for the securities in which the fund invests, may mean that the fund may not be able to sell those securities at their true value. These risks increase where the fund invests in high yield or lower credit quality bonds.

The funds invest in emerging and developing markets, where there is potential for a decrease in market liquidity, which may mean that it is not easy to buy or sell securities. There may also be difficulties in dealing and settlement, and custody problems could arise.

Invesco Summit Responsible Range

The range has the ability to use derivatives for investment purposes, which may result in the funds being leveraged and can result in large fluctuations in the value of the funds.The funds' risk profiles may fall outside the ranges stated in the investment objectives and policies from time to time. There can be no guarantee that the funds will maintain the target level of risk, especially during periods of unusually high or low market volatility.

The funds may be exposed to counterparty risk should an entity with which the funds do business become insolvent resulting in financial loss.

The securities that the funds invest in may not always make interest and other payments nor is the solvency of the issuers guaranteed. Market conditions, such as a decrease in market liquidity for the securities in which the fund invests, may mean that the fund may not be able to sell those securities at their true value. These risks increase where the fund invests in high yield or lower credit quality bonds.

The funds invest in emerging and developing markets, where there is potential for a decrease in market liquidity, which may mean that it is not easy to buy or sell securities. There may also be difficulties in dealing and settlement, and custody problems could arise.

The use of ESG criteria may affect the product’s investment performance and therefore may perform differently compared to similar products that do not screen investment opportunities against ESG criteria.

Important information

-

All information as at 30 June 2022 and sourced by Invesco, unless otherwise stated.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

For the most up to date information on our funds, please refer to the relevant fund and share class-specific Key Investor Information Documents/Key Information Documents, the Supplementary Information Document, the Annual or Interim Reports and the Prospectus, which are available on this website.