Real Estate

Creating innovative investment strategies and performance driven capabilities to uncover opportunities across the real estate investment spectrum.

$91B+ AUM

Our team manages over $91 billion real estate assets globally across the public and private sectors1

40+ yrs of investing experience

Invesco Real Estate (IRE) has over four decades of experience in real estate investing1

586+ dedicated professionals

IRE has over 586 real estate professionals across 21 global offices in competitive local markets1

Data-driven ideas and the power of partnerships

Navigating the risks and opportunities of a diverse and nuanced asset class requires deep and varied experience through multiple market cycles. IRE has more than 40 years of expertise building data-driven global real estate investment programs and funds that may benefit investors. Our ability to build lasting partnerships and deliver performance for some of the world’s most sophisticated clients, has earned us the trust to manage over $91 billion.

Investing pioneers

We have led the market expanding into new sectors and geographies, launched new vehicles to meet investors’ evolving needs, and strategically expanded our global team. Our focus has always been rooted in our ability to illuminate opportunities for our clients by identifying emerging themes, seeking strong risk-adjusted returns, and provide differentiated portfolio exposure.

Invesco, As of Dec. 31, 2024

Asia Platform

- Real estate professionals across 7 regional offices – true pan-Asian footprint with our “boots-on-the-ground” approach gives us a true pan-Asian footprint.

- In-house operator capabilities with local asset managers, construction engineers and investment specialists

- US $28+ billion transaction volume since 2008 – expertise across disciplines with significant experience

Real estate capabilities

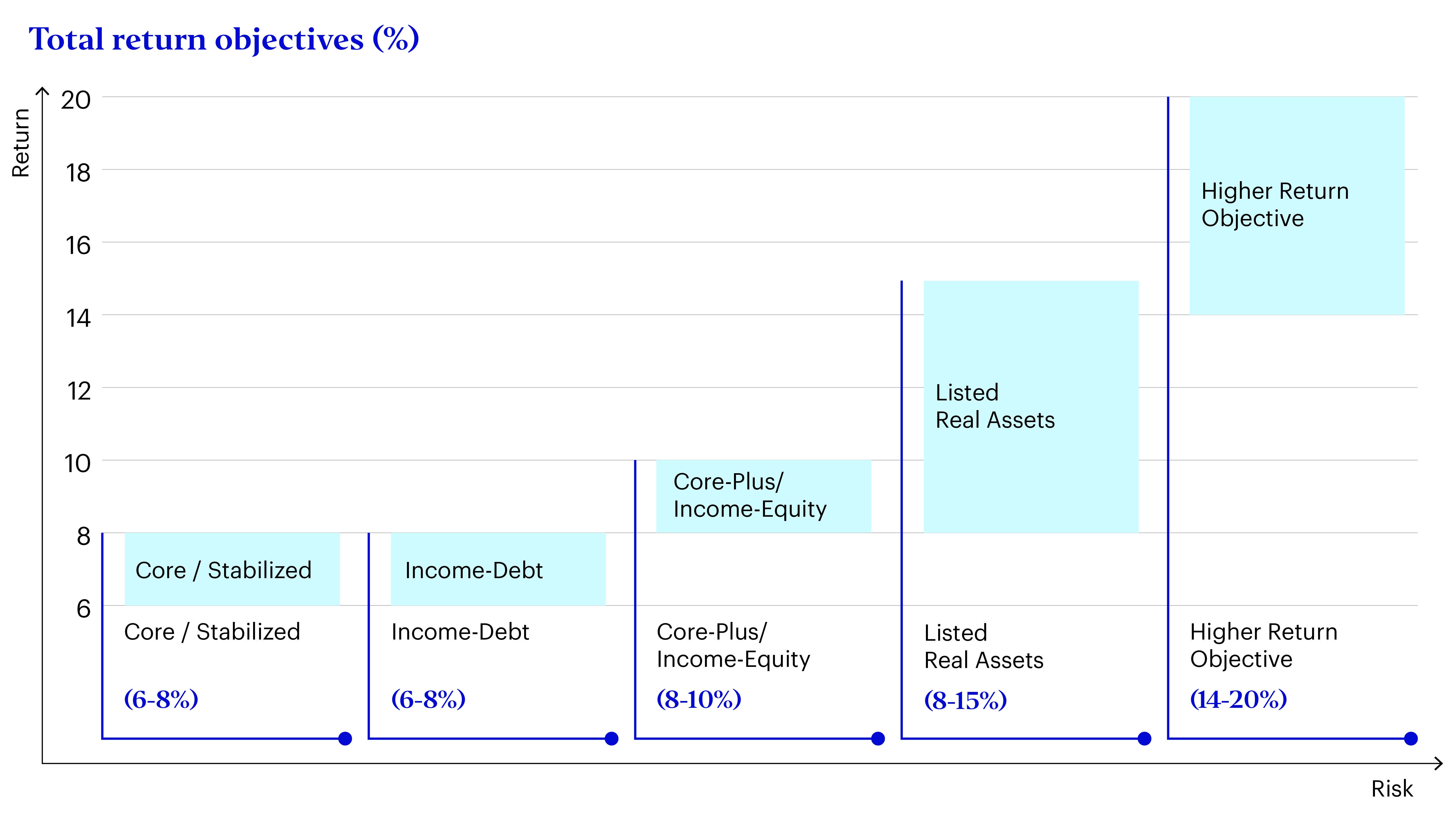

We constantly leverage proprietary data and analytics to identify emerging themes, risks and ideas across the global opportunity set that requires viewing the asset class from every possible angle. Our multi-dimensional view of real estate across the capital structure, sectors and regions helps us create innovative solutions across the risk-return spectrum.

Core real estate refers to high-quality, low-risk investment properties, typically located in prime locations with stable cash flows and long-term lease agreements. Our flagship core strategies are market-leading throughout the US, Asia Pacific, and Europe. Globally, we offer diversified portfolios of high-quality assets, with a focus on potential durable, growing income and strong appreciation characteristics over time.

A value-add strategy in real estate involves acquiring properties that are believed to have untapped potential and making improvements designed to enhance their value and income-generating capabilities. This can include a range of actions, from cosmetic upgrades to significant renovations or repurposing underutilized spaces.

Opportunistic investing in real estate is a strategy that focuses on acquiring properties with significant potential for value enhancement, often involving higher risks and the possibility of substantial returns. This approach typically targets distressed or underperforming assets that require substantial renovations, repositioning, or redevelopment.

Real estate credit refers to investments in debt instruments secured by real estate assets. This strategy involves providing capital to real estate sponsors or operators, typically in the form of loans, to finance property acquisitions, developments, or renovations.

Providing investors access to high value physical assets that may offer competitive income, portfolio diversification and the potential to hedge inflation.

Source: Invesco Real Estate as of 30 September, 2024 for illustrative purposes only, ranges shown are approximate and based on current market conditions which are subject to change. It is not known whether these return objectives will be realized.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investment Insights

Meet our team

Co-Chief Investment Officer, Managing Director, Head of Core Funds, Invesco Real Estate Asia Pacific Ian Schilling

Managing Director, Client Portfolio Management-Asia Pacific, Invesco Real Estate Kent Yang

Managing Director, Senior Portfolio Manager Jason Choi

Senior Director, Client Portfolio Management, APAC Anna Chew