Cross-border capital investment across global commercial real estate markets

While the majority of global real estate transactions in the most liquid real estate markets are by domestic investors, cross-border capital flows where the capital source isn't the same country as the asset purchased, are also significant. Due to the recent shift in US tariff policy, cross-border investments into the US are being delayed or deferred. Since the US is the largest global commercial real estate (CRE) market, accounting for 38% of global transaction activity in the past 10 years, if capital flows are reallocated away from the US, how might this impact other key global real estate markets? (We also look at the implications on US commercial real estate liquidity and pricing in our companion piece, "Cross-border capital investment in U.S. commercial real estate".)

A look at cross-border CRE investments since 2010 can help answer that question:

- US is the largest market for in-bound, cross-border CRE investment globally.

- As a share of total investment activity, however, cross-border CRE US investment is lower than other key global CRE markets.

- Canadian investors are the largest investors in US CRE, investing more than twice as much as in the next 10 markets combined.

- Any reallocation away from the US would have a significant impact on the next largest global CRE markets, such as the UK, Germany, France and Australia.

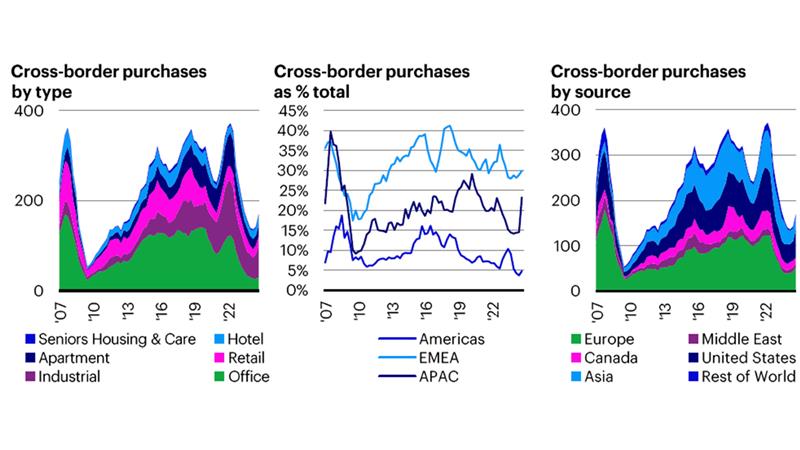

International real estate capital flows are heavily pro-cyclical

The volume of overall global CRE transactions demonstrate far greater cyclicality than domestic transaction volumes. When separating out cross-border transactions, in periods of market stress, investors tend to focus on their domestic markets and return to international expansion as global liquidity eases.

- Sentiment towards offices fell significantly during COVID-19, with a more than 80% fall in cross-border office asset purchases by type (See chart below, left).

- The Americas are less reliant on cross-border purchases than Europe or Asia Pac, (see middle chart below) but even their share of cross-border investments is down considerably in the past couple of years.

- The right-hand side looks at where that capital comes from, and the data shows that the share of flows from Europe and the US declined the most in the last two years. We shall expand further on these flows in the remainder of this piece.

Source: Invesco Real Estate using data from MSCI RCA as of June 2025, trailing 4-quarter data, US$ billion

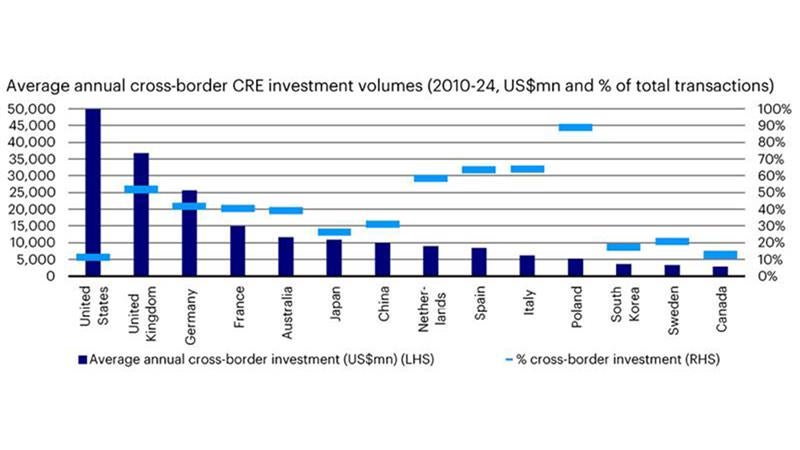

The US is the largest market for cross-border real estate investment

The US has seen long-term average in-bound annual cross-border investments of almost US$50 billion. Despite being, by far the largest market for inward investment into CRE, cross-border investors only represented 11% of all US CRE purchased from 2015 to 2024.

LHS: Left-hand side; RHS: Right-hand side

Source: Invesco Real Estate using data from MSCI RCA as of June 2025, covering the period 2010-2024

Three key takeaways from this analysis:

1. The impact of any pullback of cross-border capital from US real estate will be relatively limited in terms of the pricing and liquidity. In fact, cross-border capital was disproportionately concentrated in certain US metros and sectors - see the companion piece, "Cross-border capital investment in U.S. commercial real estate".

2. Most other key global real estate markets are more reliant on cross-border investment:

- The potential share of the domestic real estate investor base varies by market, for example dependent on how pension and investment vehicles in it are structured. For example, as we see in the chart above, Poland stands out for its high share of cross-border CRE transactions, partly due to the lack of legislation to encourage local investors to invest in CRE on a similar tax-efficient basis as other markets.

- A CRE markets tends to have a higher share of cross-border capital when it offers strong transparency, liquidity, and legal protections, which makes it attractive and accessible to international investors.

- There are regional differences; European markets tend to see a high share of intra-European cross-border capital flows.

3. Any shift in capital flows out of the US would likely have a greater positive impact on pricing and liquidity in other markets versus the US, in our view.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Property and land can be difficult to sell, so investors may not be able to sell such investments when they want to. The value of property is generally a matter of an independent valuer's opinion and may not be realised.

Generally, real estate assets are illiquid in nature. Although certain kinds of investments are expected to generate current income, the return of capital and the realization of gains, if any, from an investment will often occur upon the partial or complete disposition of such investment.

Investing in real estate typically involves a moderate to high degree of risk. The possibility of partial or total loss of capital will exist.

Investing in commercial real estate assets involves certain risks, including but not limited to: tenants' inability to pay rent; increases in interest rates and lack of availability of financing; tenant turnover and vacancies; and changes in supply of or demand for similar property types in a given market.