Cross-border capital investment in U.S. commercial real estate

Cross-border capital has pulled back from investment activity in the US because of tariffrelated and geopolitical concerns. What does that mean for US commercial real estate(CRE)? How might a prolonged pullback affect liquidity and prices? These questions require looking at the historical makeup of cross-border investments by identifying the U.S. locations and types of buildings that have attracted cross-border investors the most.

Purchasing by cross-border investors of U.S. CRE over the past decade has focused on:

- Traditional sectors, especially industrial warehouses and CBD (central business district) offices

- Gateway markets, especially New York City (NYC) in select sectors

- Larger assets

- More expensive locations

Based on this, we believe if cross-border investors were to pullback materially from U.S. CRE over a prolonged period, impacts on asset liquidity and pricing would vary by location, types of buildings, and asset sizes:

Little to no impact

- Non-traditional property sectors

- Smaller and most mid-sized assets, especially in non-gateway markets

Moderate to material impact

- Market/sector combinations where cross-border investors historically have been proportionately more active (e.g., CBD office, full-service hotels, and mid/high rise apartments in the NYC metro)

- Larger assets in gateway metro areas, i.e., NYC, Los Angeles (LA), San Francisco (SF), Washington DC (DC), and Boston.

Modest to moderate impact

- Larger assets in other major metro areas, e.g., Atlanta, Dallas, Denver, Central Florida, Charlotte, Chicago, Houston, Miami/South Florida, Phoenix, and Seattle.

Much of the historical activity of cross-border investors has been in sectors currently undergoing structural shifts like offices and retail malls. We'd expect sector preferences to evolve along with these structural shifts. But if cross-border investors pull back from the U.S., that capital could be deployed to other CRE opportunities across the globe. The structural shifts occurring in U.S. property types, however, don't completely sync with shifts in Europe and Asia Pacific.

Over the past 10 years, Canadian investors have accounted for one-third of direct crossborder CRE investments in the U.S., and two-thirds of cross-border capital has come from investors based in Canada, Singapore, China, Germany, and South Korea. Understanding the investment patterns of these countries is critical to imagining where new CRE investment activity may be directed if the cross-border investor appetite for U.S. assets remains muted for a prolonged period.

For further thoughts about potential implications for other regions of the globe, see the companion piece, "Cross border capital investment across global commercial real estate markets".

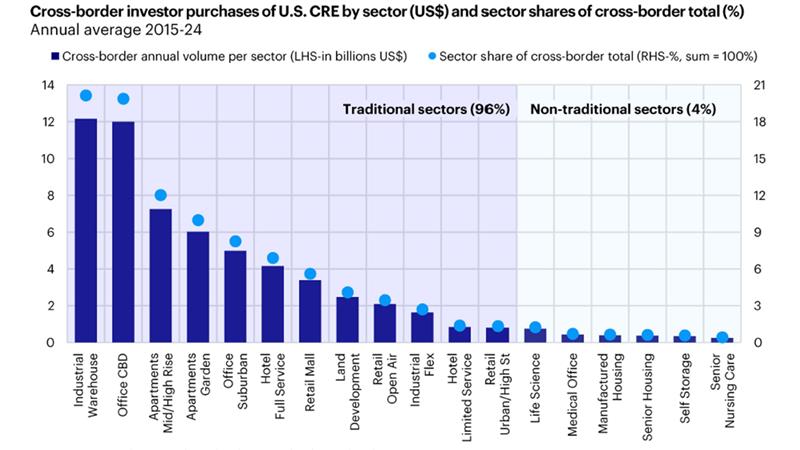

Majority of activity in traditional sectors

Source: Invesco Real Estate, utilizing data from MSC I/Real Capital Analytics, June 2025

40% of activity in two property types; more than 80% in seven

Industrial warehouses (20% share) and CBD offices (20% share) together accounted for 40% of all CRE purchases by cross-border investors over the past decade. These sectors in combination with mid/high rise apartments (12%), garden apartments (10%), suburban offices (10%), full-service hotels (7%), and retail malls (6%) account for 83% of all U.S. CRE purchases by cross-border investors.

Above-average concentrations in four property types

Cross-border capital accounted for 11% of all direct investments in U.S. CRE from 2015 to 2024. This estimate reflects only the share of cross-border capital invested directly in properties. If participation of cross-border capital in comingled funds and the listed REIT market were also included, the overall share would be closer to 17%.4

While direct property investments do not provide a complete view of cross-border CRE activity in the U.S., we believe that information from direct transactions is useful for identifying preferences for property types, locations, and asset characteristics.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Property and land can be difficult to sell, so investors may not be able to sell such investments when they want to. The value of property is generally a matter of an independent valuer's opinion and may not be realised.

Generally, real estate assets are illiquid in nature. Although certain kinds of investments are expected to generate current income, the return of capital and the realization of gains, if any, from an investment will often occur upon the partial or complete disposition of such investment.

Investing in real estate typically involves a moderate to high degree of risk. The possibility of partial or total loss of capital will exist.

Investing in commercial real estate assets involves certain risks, including but not limited to: tenants' inability to pay rent; increases in interest rates and lack of availability of financing; tenant turnover and vacancies; and changes in supply of or demand for similar property types in a given market.