Invesco Real Estate House View - Asia Pacific Market Outlook H1 2022

Below is an excerpt from the Invesco Real Estate House View - Asia Pacific Market Outlook H1 2022. The full outlook is available on this dedicated webpage.

Investment context: Economic recovery; accelerating inflation

The current macroeconomic backdrop for real estate in Asia Pacific is steadily improving. However, while key regional economies are on the path to post-COVID recovery, the pace of normalization is uneven.

In terms of occupier fundamentals, confidence is returning, driven mainly by the relaxation of COVID restrictions with occupancy rates stabilizing or rising. Capital markets transaction volumes are expected to rise as both buyers and sellers are turning more active.

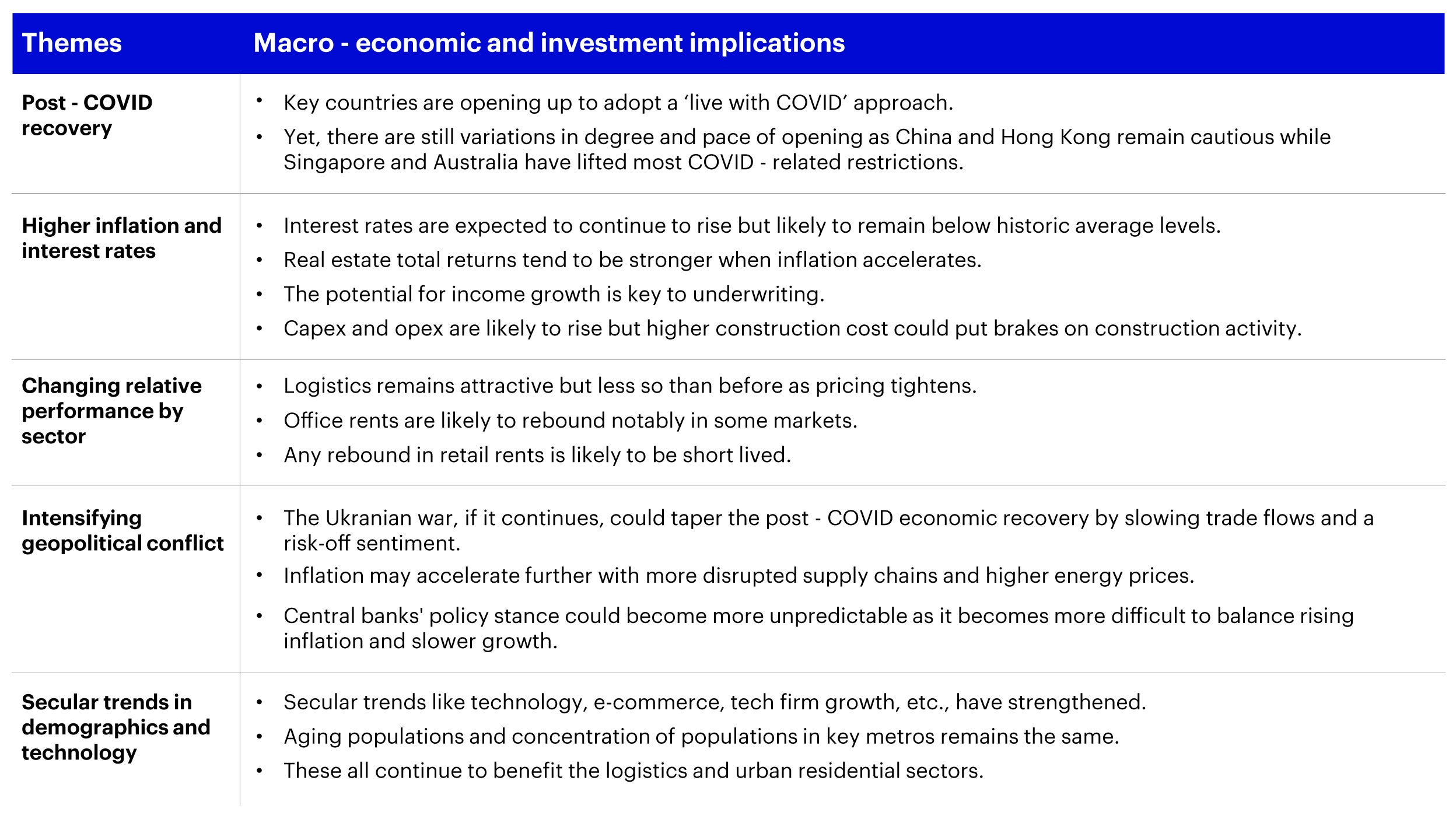

We outline five key macroeconomic themes that are currently impacting the Asia Pacific real estate market and could continue to do so in the second half of 2022.

Source: Invesco Real Estate as of March 2022.

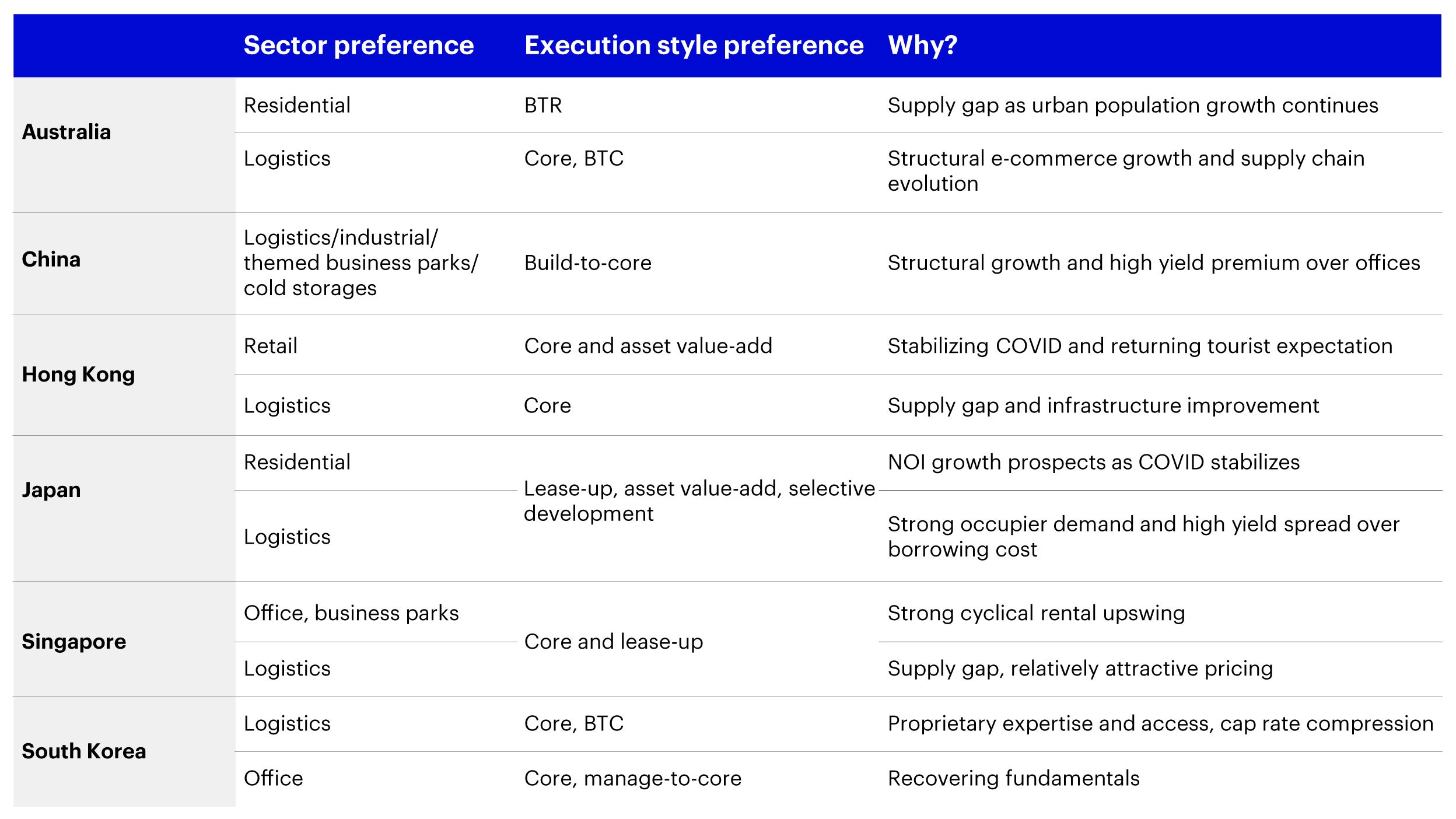

Accounting for this investment context, Invesco Real Estate have put together a summary of execution themes for the major markets in the region.

Source: Invesco Real Estate as of March 2022.

For the second half of 2022, our team sees opportunities in real estate strategy and execution in the following key areas:

Office: We continue to invest in high-specification offices with high ESG+R standards in locations with strong business clusters.

Logistics, residential: We intend to move up the risk curve to access the market by BTC (Build-To-Core) amidst high investor demand and strong long-term fundamentals.

Counter-cyclical opportunities: We intend to monitor the retail and hotel sectors closely for mispricing/distress/structured finance/debt opportunities. Conversion of assets into other higher and better uses should also be considered.

Secular trends: Development of data centers as well as healthcare-related assets in gateway cities could be feasible.