Investment real estate, more than office

Investment real estate consists of more than office buildings.

We know this, so why say it? Because headlines about office market risk are crowding out discussion about the other types of investment real estate. A recent Google search on “US office real estate market” generated over 1 billion search results, four times more than for industrial and retail, five times more than for apartment, 10 times more than for self-storage, and hundreds more times than for other property sectors such as medical office, data centers, life science, student housing, senior housing, and single-family rental.1 The media focus on office is understandable given the sector’s risks, but the amount of focus is disproportional to the role of office within the broader real estate market.

The role of non-office sectors is bigger than you think.

We’re missing a lot if we focus solely on office.

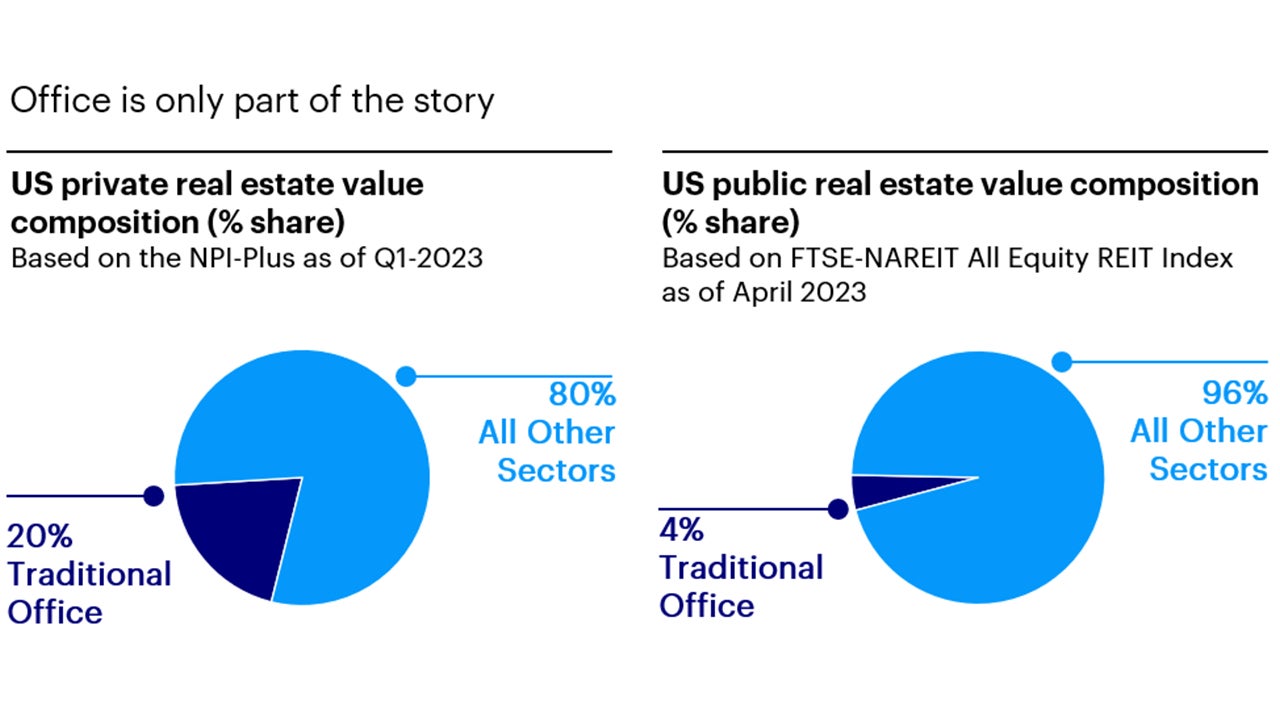

- Roughly 80% of US private institutional real estate market value and 90% of private institutional real estate property counts are represented by sectors other than traditional office.2

- Roughly 96% of US public REIT value is represented by sectors other than traditional office.3

While risks to the office sector are material, the real estate opportunity set spans far beyond office buildings.

Source: National Council of Real Estate Investment Fiduciaries as of March 2023, based on market value within the NPI-Plus Index; National Association of Real Estate Investment Trusts as of April 2023, based on market value within the FTSE-NAREIT Equity REIT Index. For purposes of this article, “traditional office” is defined as office buildings designed and built for general business use, which excludes buildings predominantly purposed for life science use or medical services use.

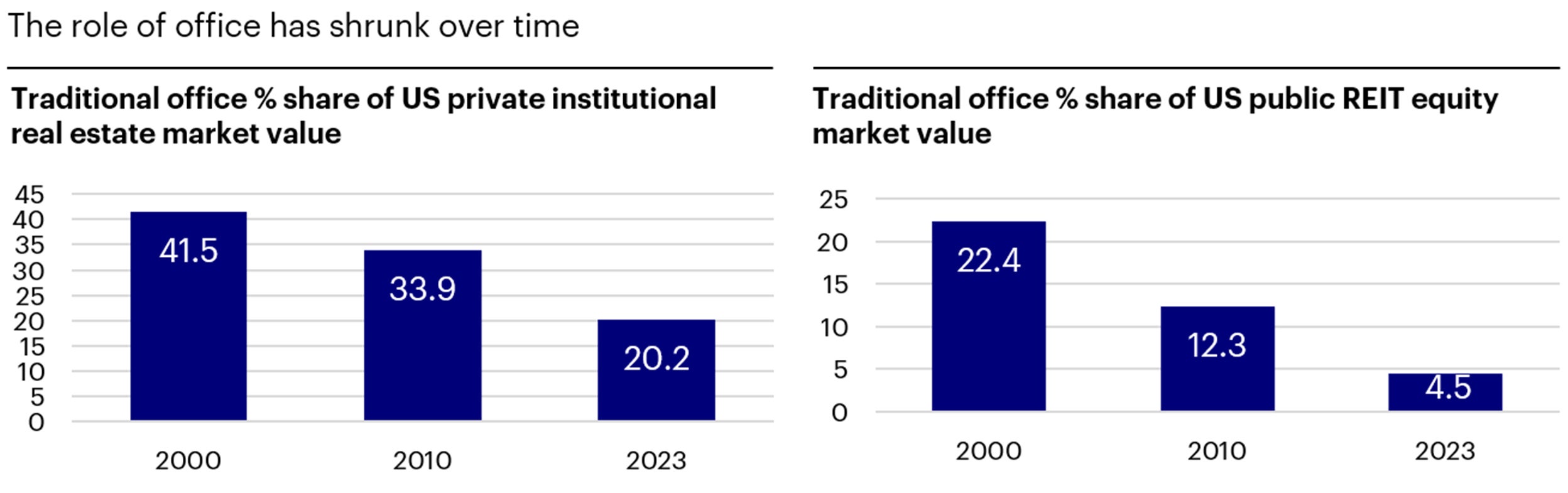

The relative role of office has shrunk over time.

The office sector once played a larger role in investment real estate than it does today. (See Figure 2)

- Private real estate: Traditional office comprised over 40% of US institutional real estate market value at the end of 2000. That share dropped to just below 34% by the end of 2010 and has fallen further to 20.2% in Q1-2023, only half of the share from the turn of the century.

- Public real estate: Office share composition among US REITs fell from roughly 22% in 2000 to just over 12% in 2010, and eventually to a mere 4.5% in April of this year.

Source: National Council of Real Estate Investment Fiduciaries as of March 2023, based on market value within the NPI-Plus Index; National Association of Real Estate Investment Trusts as of April 2023, based on market value within the FTSE-NAREIT Equity REIT Index. For purposes of this article, “traditional office” is defined as office buildings designed and built for general business use, which excludes buildings predominantly purposed for life science use or medical services use. “2000” reflects Q4 for NPI-Plus and December 31, 2000 for NAREIT. “2010” reflects Q4 for NPI-Plus and December 31, 2010 for NAREIT. “2023” reflects Q1 for NPI-Plus and April 30, 2023 for NAREIT.

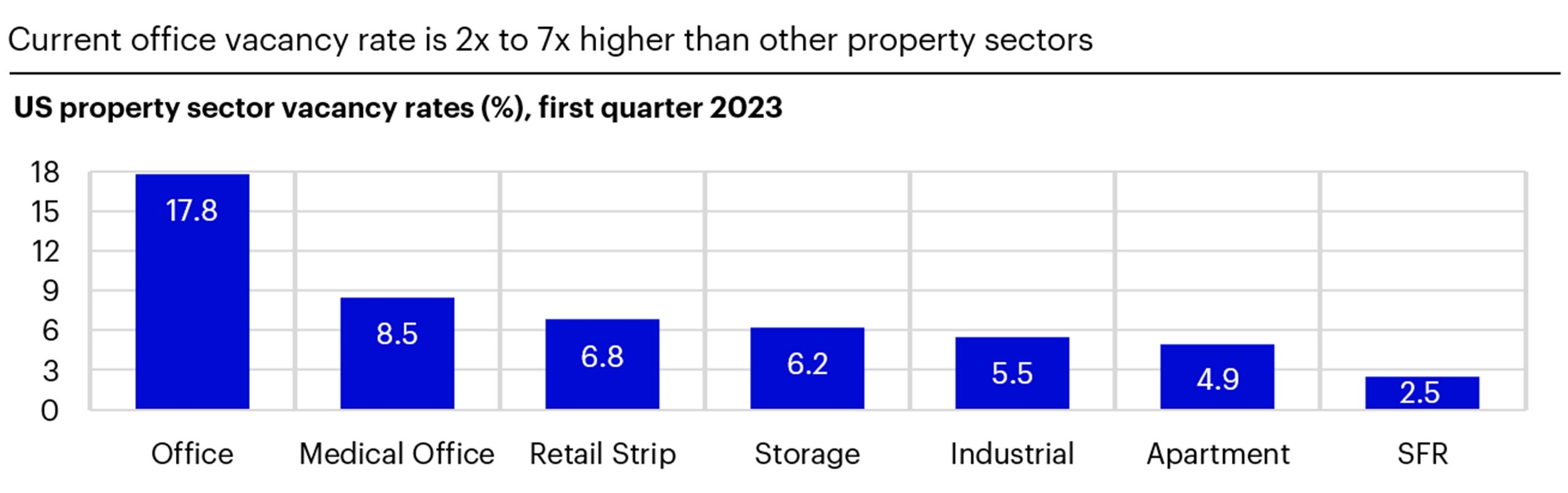

Stronger demand is driving tighter vacancy in non-office sectors.

While office demand continues to adjust to remote work and hybrid work trends, stronger demand in non-office sectors has spurred tighter vacancy conditions.

- National office vacancy in Q1-2023 averaged 17.8%, which is considerably higher than the past 10-year average of 14.1% and the pre-COVID rate of 12.3% in Q1-2020.

- In contrast, most commercial sector vacancy in Q1-2023 was below 10% and average residential vacancy was below 5%. (See Figure 3).

- The average US office vacancy rate in Q1-2023 was 2-times to 7-times higher than the vacancy rates for other sectors.

Based on CBRE-EA’s sum of markets series for primary sectors; data for industrial and retail strips represent availabilities; storage and SFR data represents aggregation of REIT data; MOB data from Revista. “SFR” stands for single-family rentals.

Source: Invesco Real Estate using data from CBRE-EA, Revista, and company financial reports as of June 2023

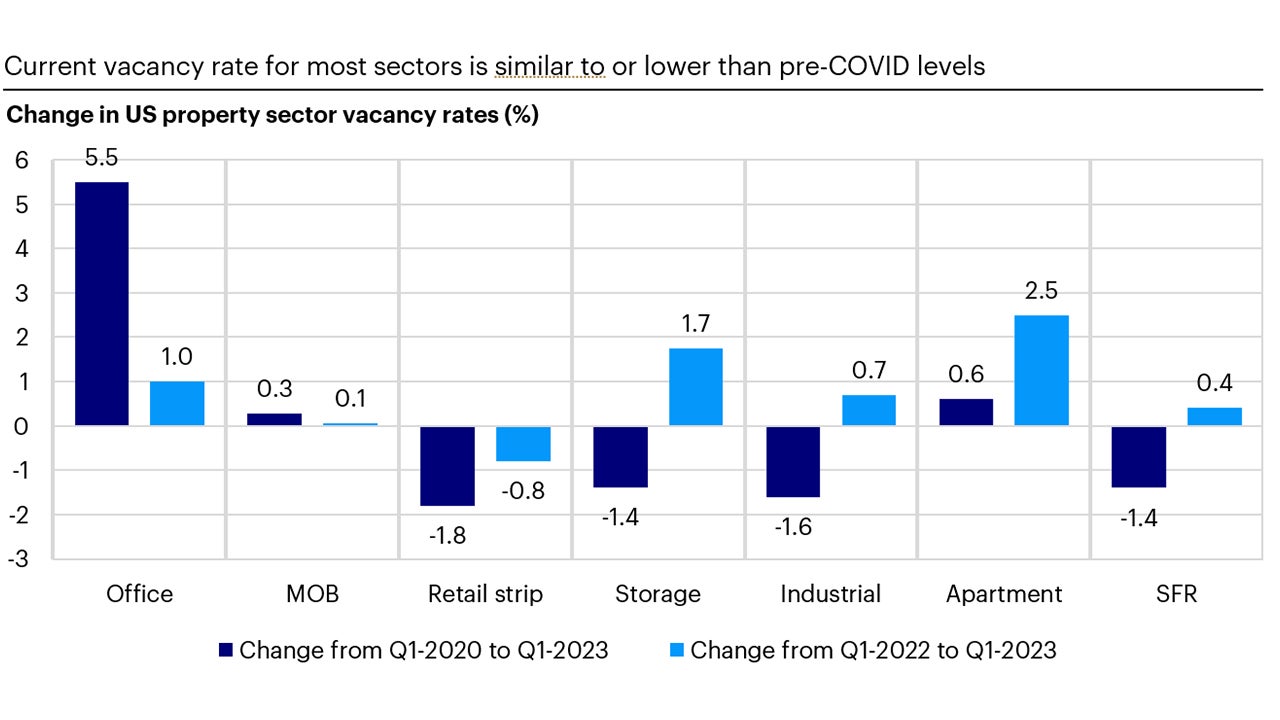

Current vacancy in most sectors is similar to or lower than pre-COVID vacancy.

While office vacancy rates have increased by 5-percentage points since the start of COVID late in Q1-2020…

- Vacancy rates in Q1-2023 for strip retail, industrial, self-storage, and single-family rentals stood below pre-COVID levels (See Figure 4, dark blue bars) with each sector reaching record low vacancy rates at various times within the past three years.

- Medical office vacancy has increased only mildly over the past three years, demonstrating low volatility during one of the most variable economic periods in US history.

- Current apartment vacancy is moderately higher today than three years ago after have having reached all-time lows in early 2022.

Based on CBRE-EA’s sum of markets series for primary sectors; data for industrial and retail strips represent availabilities; storage and SFR data represents aggregation of REIT data; MOB data from Revista. “SFR” stands for single-family rentals.

Source: Invesco Real Estate using data from CBRE-EA, Revista, and company financial reports as of June 2023

Vacancy in some sectors including office has increased over the past year.

Sectors that have experienced the sharpest annual rise in vacancy rates since the Federal Reserve started raising the Fed Funds rate in March of last year (Figure 4 light blue bars) are apartments (up 2.5 percentage points through Q1-2023), self-storage (up 1.7 percentage points), and office (up 1.0 percentage points).

- The rise of vacancy rates for apartments and self-storage is owed to a reduced leasing pace, elevated levels of new supply deliveries, and exposure to shorter-term leases that accelerate changes in supply and demand trends (typically annual leases for apartments and monthly leases for self-storage).

- Despite the office sector benefiting from the stability of longer-term leases (typically 10 years for higher credit tenants), the rise in office vacancy demonstrates tenant sensitivity to higher interest rates and the on-going impact of remote and hybrid work models.

More resilience is evident in other sectors.

Some sectors have experienced either nominal increases of vacancy rates or tightening for the year ending Q1-2023.

Medical office and single-family rental vacancies have increased only mildly.

- Strip retail vacancy rates have fallen to record lows.

- Each of these sectors benefits from limited levels of new supply and steady demand growth, thereby reducing the impact of higher interest rates on sector vacancies.

- The industrial sector experienced a moderate vacancy rate rise in the year ending Q1-2023 as record levels of new construction are being delivered against moderating demand.

Non-office real estate: Much larger, much healthier.

The next time you read a piece about the commercial real estate market, observe carefully whether the article addresses the broad, multi-sector real estate market or just the office market. Investment real estate is more than office.

- The non-office segment is much larger than the traditional office sector.

- Several of the non-office property sectors are posting tight vacancy rates, even in a rising interest rate environment.

Assuming interest rates eventually moderate in step with the sustained moderation of inflation, tenant demand recovery in real estate is expected to follow. And most sectors other than office should begin their demand resurgence from a favorable position of low to moderate vacancy rates.