Alternative Opportunities - Q2 2025

Recently announced tariffs from the Trump administration have widened public spreads, which has yet to be reflected in the private markets.

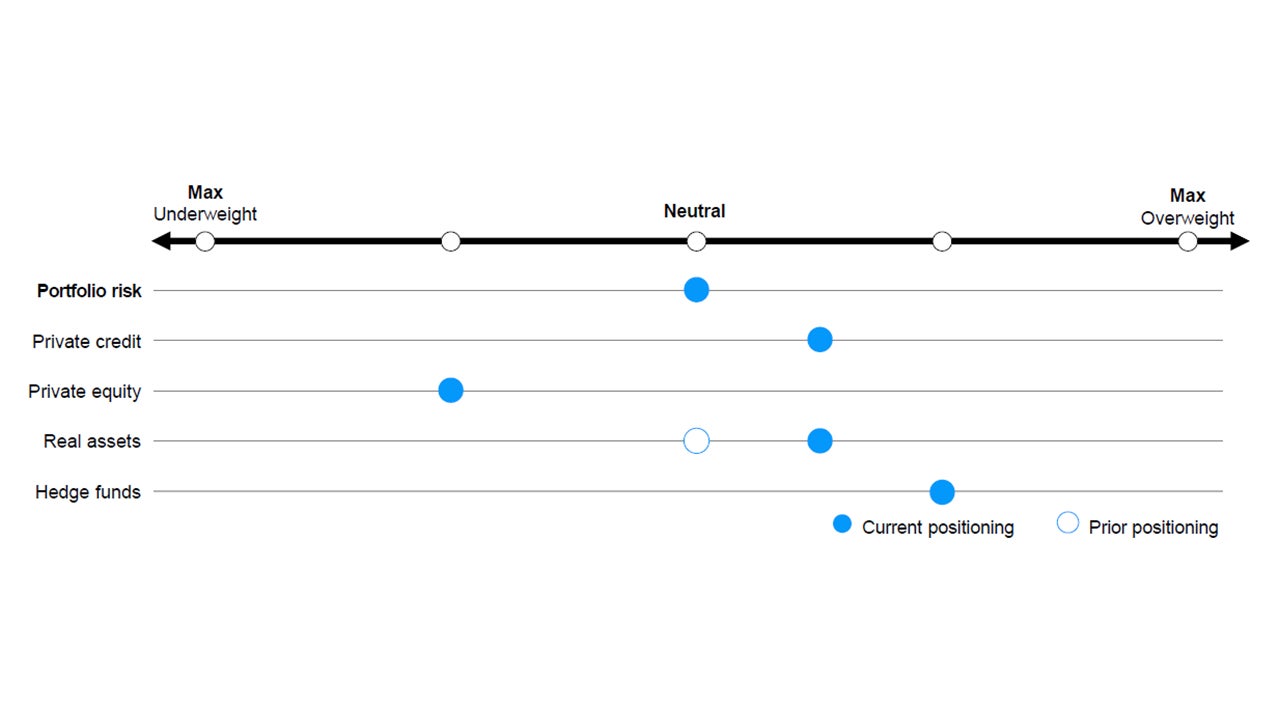

Portfolio risk: We remain neutral on how we’re allocating risk within our alternatives portfolio, primarily due to the combined impact of high equity valuations with an elevated cost of financing. In general, we’re more bullish on defensive alternatives, favoring private debt, real assets, and hedged strategies versus private equity.

Private credit:

Private equity: We remain underweight private equity, especially traditional buyout strategies which generally require leverage to generate returns. The combined impact of high equity valuations with an elevated cost of financing may be a significant headwind.

Real assets: We’re slightly increasing our exposure to real estate as our conviction for the outlook that valuations have bottomed is beginning to firm. While we are optimistic amid easing financial conditions, we remain vigilant given tight cap rates and a murky outlook from policymakers.

Hedge funds: We believe hedge funds with lower betas to market risk may be a valuable alternative within a portfolio. Spreads within event-driven strategies remain high due to the limited capital markets activity from mergers and acquisitions as private equity remains sidelined.

Source: Invesco Solutions, views as of Aug. 19, 2025. The opinions expressed are those of the author, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations), and investors may not get back the full amount invested.

Alternative strategies may include investments in private equity, private credit, private real estate and infrastructure, which may involve additional risks such as lack of liquidity and concentrated ownership. These types of investments may result in greater fluctuation in the value of a portfolio. Private Market investments are exposed to risk, which is the risk that a counterpart is unable to deal with counterparty obligations. Changes in interest rates, rental yields and general economic conditions may result in fluctuations in the value of any underlying strategies. These types of strategies may carry a significant risk of capital loss and other market risks.

Recently announced tariffs from the Trump administration have widened public spreads, which has yet to be reflected in the private markets.

We believe 2025 is setting up favorably for the small-capitalization distressed credit and special situations opportunity set.

In this quarterly outlook we cover the opportunities in the alternatives space, focusing on the five areas of private credit, private equity, real assets, hedge funds and commodities.

Connect with us for in-depth presentation focused on your investment challenges and opportunities.