The real estate fundamentals your portfolio needs now - and a while from now

How will property sector incomes perform through the current evolution of the US economy? Today’s needs for property income stability and resilience amid higher interest rates and slowing economic growth will no doubt evolve when eventually rates moderate and growth picks up.

This note highlights which US sectors we believe to be best positioned for current economic conditions from a property income perspective, and which may be best positioned for what may come next in the economic cycle. But we won’t keep you in suspense – here’s how that analysis plays out:

Source: Invesco Real Estate based on consensus data as of September 2023.

Let’s acknowledge up front that property sector income growth is only one piece of a complex real estate performance puzzle. Other factors merit their own attention including the price/growth relationship, property value movement within existing portfolios, comparative expense drag across sectors, types and terms of leverage, etc. And the interaction of macro and non-macro factors also influence performance. But to keep things manageable, this note will focus on the macro drivers of property sector income growth potential for near-term and intermediate-term forward time periods.

Let’s also acknowledge that our near-term and intermediate-term US economic scenarios do not cover the full range of plausible outcomes being debated by investors today. For example, a scenario of continued interest rates increases amid stronger-than-expected growth poses risk for flatter income streams, especially those priced at comparatively lower cap rates. However, simplifying the exercise provides the benefit of stripping away the endless list of what-ifs and caveats.

Analyzing property income growth means jumping into data. And for readers who enjoy a nice dive into the data pool, you won’t be surprised that the waters are sometimes murky – different sets of data tell different stories, not all of which seem consistent with each other. This challenge requires an integrated data approach that involves the build-up of sector growth convictions based on three C’s:

- Correlations historically of property sector income growth with economic indicators

- Current fundamentals across property sectors

- Combine the above, along with long-term demand trends, to form a forward view for both the short term and intermediate term.

Looking at three C’s across US property sectors

Correlations of property income growth with economic indicators

Over the past couple of years, no single economic indicator has influenced investors and policy makers more than inflation. And no wonder with year-over-year growth of the US Consumer Price Index having approached 9% in the summer of 2022, the highest rate in 40 years. Historical real estate performance has been highly correlated with high rates of inflation, and real estate performance surged in 2021 and 2022 amid a sharp recovery from the brief COVID recession.

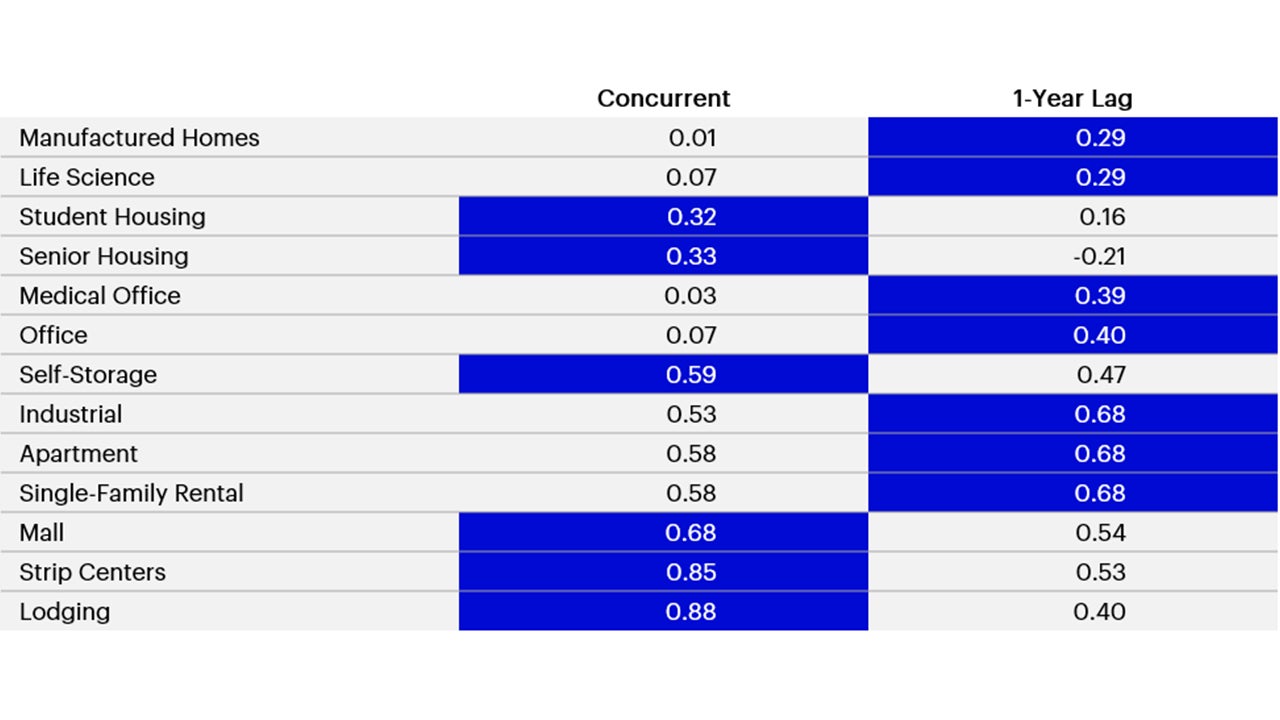

But the recent abatement of inflation means that real estate investors are now more concerned with the asset class’s correlation with other economic indicators, namely growth of the economy and interest rates. These relationships are summarized below for the 2005-2019 period. While we examined these correlations through 2022, the pre-COVID correlations through 2019 seem to be more indicative of the sectors’ enduring characteristics.

- Correlations with economic growth: Historical property income growth for several sectors has tended to be acyclical, that is, they have demonstrated a low correlation (0.4 and lower) with annual growth of gross domestic product (Figure 2). These sectors include:

- Manufactured homes: necessity-driven demand base

- Life science: driven by aging demographics and medical research advances

- Student housing: demand can rise when workers seek to boost skills in a recession

- Senior housing and medical office: driven medical needs and aging demographics

- Office: income stream is stabilized through the prevalence of long-term leases

Note: Shaded cells are the period with the higher correlation per sector. The higher correlations of each sector are ranked from lowest to highest. Sources: Invesco Real Estate, utilizing data from Green Street and Moody’s Analytics as of August 2023

Some of these sectors are well-positioned to provide stability amid our current environment of higher interest rates and slowing economic growth. The obvious exception on this list is office, which particularly in the US is contending with historically high vacancy and the further evolving needs of hybrid work environments. Two other exceptions include manufactured housing and life science as we’ll see when we address interest rate correlations.

What about sectors with high historical correlations between property income growth and GDP growth? The high correlation sectors should face weaker property income growth in the near term, and then jump to the front of the performance line on the intermediate term outlook, right? Well, not exactly. Let’s touch briefly on each of the high correlation sectors:

- Industrial: Expect growth to slow in the near term and accelerate again in the intermediate term. Also expect the long-term trend of ecommerce to support tenant demand in the near term more than past correlations would suggest.

- Single-family rentals (SFR): The lack of available for-sale units and moderate levels of new construction mean that a dearth of supply will mitigate the expected moderation of near-term demand, supporting income growth both near term and intermediate term.

- Apartments: The current construction pipeline for apartments is at significantly high levels. Thus, the downside impact of slower near-term economic growth will likely be more acute for apartments, and the upside rebound will likely be muted initially.

- Lodging: Historically, property income growth for US lodging has been six times greater than the average volatility of other sectors. This could lead to an intermediate-term growth surge, but that degree of volatility greatly impedes a highly tactical execution.

- Malls: This sector continues to be impacted by a downward shift in long-term demand conditions due to the consumer shift toward ecommerce.

- Strip centers: While altered by ecommerce, strip centers are currently benefiting from several years of industry restructuring that has pushed vacancy rates to record lows. But the sector’s income growth faces constraints by anemic rent growth in the 2010’s, thus lease expirations will drive only nominal rent increases from current contract rents.

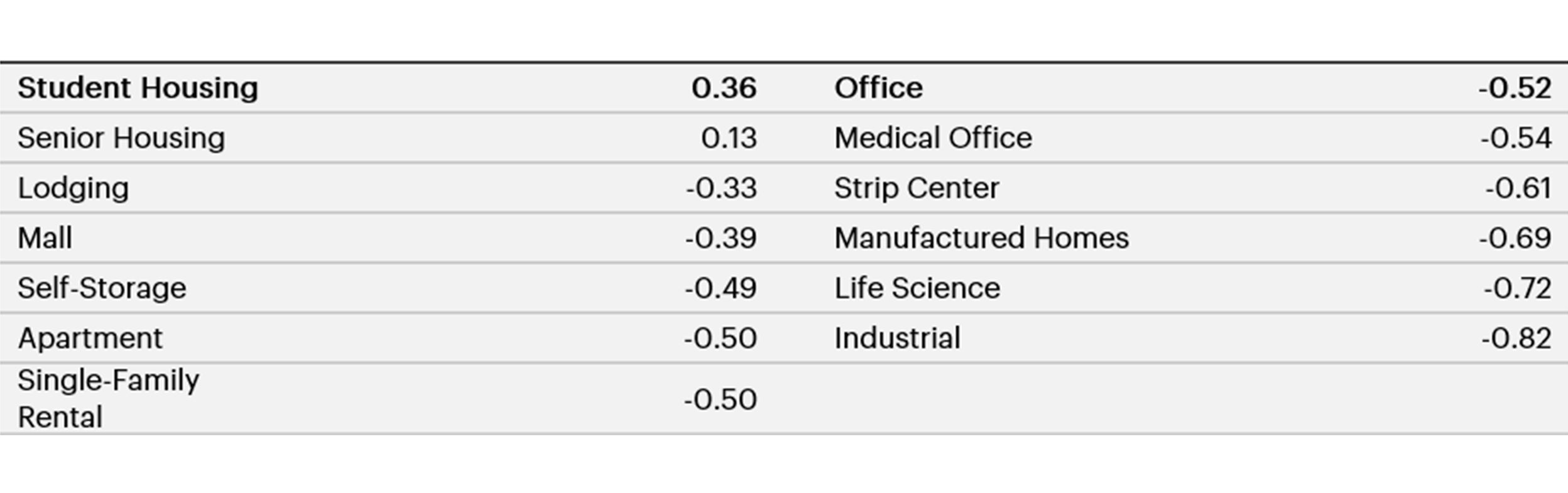

- Correlations with interest rates: Property incomes of four sectors have demonstrated very low historical correlations with corporate interest rates in the US (on a one-year lagged basis, see Figure 3):

- Senior housing: needs-based demand

- Student housing: demand driven largely by demographics and life-stage timing

- Malls: historically, long-term leases of large anchor tenants stabilized income streams

- Lodging: daily contracts make income growth in lodging more dependent on economic growth than interest rates

Note: Correlations per sector are ranked from lowest to highest.

Sources: Invesco Real Estate, utilizing data from Green Street and Moody’s Analytics as of August 2023

Senior housing and student housing may provide stability as interest rates remain elevated.

Three sectors have demonstrated high historical correlations between property income growth and corporate interest rates, reflecting cost of capital sensitivities of tenants in these sectors:

- Industrial: particular sensitivity among logistics providers

- Life science: greatest impact on venture capital-funded tenants

- Manufactured housing: reflects weaker credit quality on average of unit owners

Interest rate sensitivity of these sectors could prove challenging in the near term as rates linger at higher levels. Yet this sensitivity runs in both directions – these sectors could experience stronger income growth as interest rates eventually moderate in the intermediate term.

One sector missing from the analysis above is data centers. The historical income growth series for this sector does not stretch back far enough to include in this 2005-2019 analysis. But current conditions warrant a further look, as we will see in the following section.

Current fundamentals

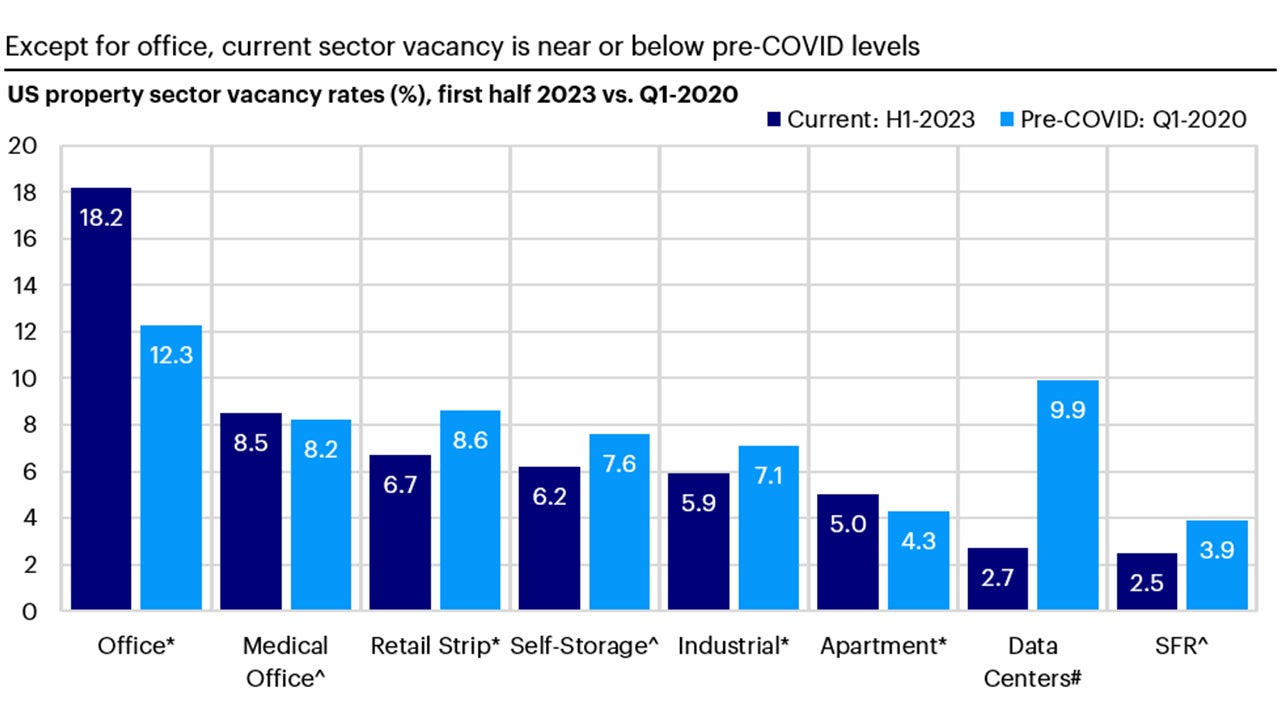

Current vacancy rates compared to pre-COVID levels (Figure 4) clearly tell a couple of stories.

- Office vacancy, currently at a 30-year high and almost 600 basis points higher than pre-COVID levels, constitute a separate discussion from other sectors.

- Current vacancy rates in most other sectors are near or below pre-COVID conditions, despite recent upward movement amid the historic escalation of interest rates.

Current vacancy rates are especially low for SFR and data centers. As previously noted for SFR, steady demand growth amid a dearth of home inventory availability is responsible for today’s tight vacancy conditions. Data centers have been experiencing rapid demand growth amid constraints to delivering sufficient power to existing locations, which has curtailed supply growth and compressed vacancy rates. These conditions should lead to strong income growth for both sectors, though the income growth attributes of data centers must be weighed against the sector’s heavy capital requirements that can dilute the impact of property income growth.

Based on CBRE-EA’s sum of markets series for primary sectors; data for industrial and retail strips represent availabilities; self-storage and SFR data represents aggregation of REIT data; MOB data from Revista. “SFR” stands for single-family rentals.

^ = 2023 data is for first quarter; * = 2023 data is for second quarter vacancy; # = Pre-COVID data is for year-end 2019.

Source: Invesco Real Estate using data from CBRE-EA as of August 2023; Revista, and company financial reports as of June 2023