Understanding CLOs in Today’s Dynamic Financial Landscape

As the financial landscape continues to evolve, investors are constantly seeking new opportunities to diversify their portfolios and generate attractive returns. One such investment that has gained significant attention in recent years is Collateralized Loan Obligations (CLO).

CLOs offer a unique and compelling investment proposition, providing exposure to the dynamic and often resilient leveraged loan market. This white paper aims to provide a comprehensive overview of CLOs, explore their key features, potential benefits, and the factors that make them a compelling investment option.

1. Introduction to Leveraged Loans and CLOs

A. What is a Leveraged Loan?

Leveraged loans are loans secured by a first or second lien on the assets of an issuer, rated BB+/Ba1 or lower, and typically floating rate. Other names for these assets may include high yield bank loans, senior loans, or syndicated loans. Leverage loans are typically used as a funding source in mergers and acquisitions (M&A) and leveraged buy outs by private equity sponsors. They differ from high yield bonds in that they are not “securities” and are not SEC registered. A bank or group of banks first structure the loan and subsequently syndicate it to a group of lenders (institutional investors, banks, finance companies) in the “new issue” or primary market. Thereafter the loans trade in the secondary market generally between dealers and institutional investors. Leveraged loans comprise the majority of CLO collateral.

B. What is a CLO?

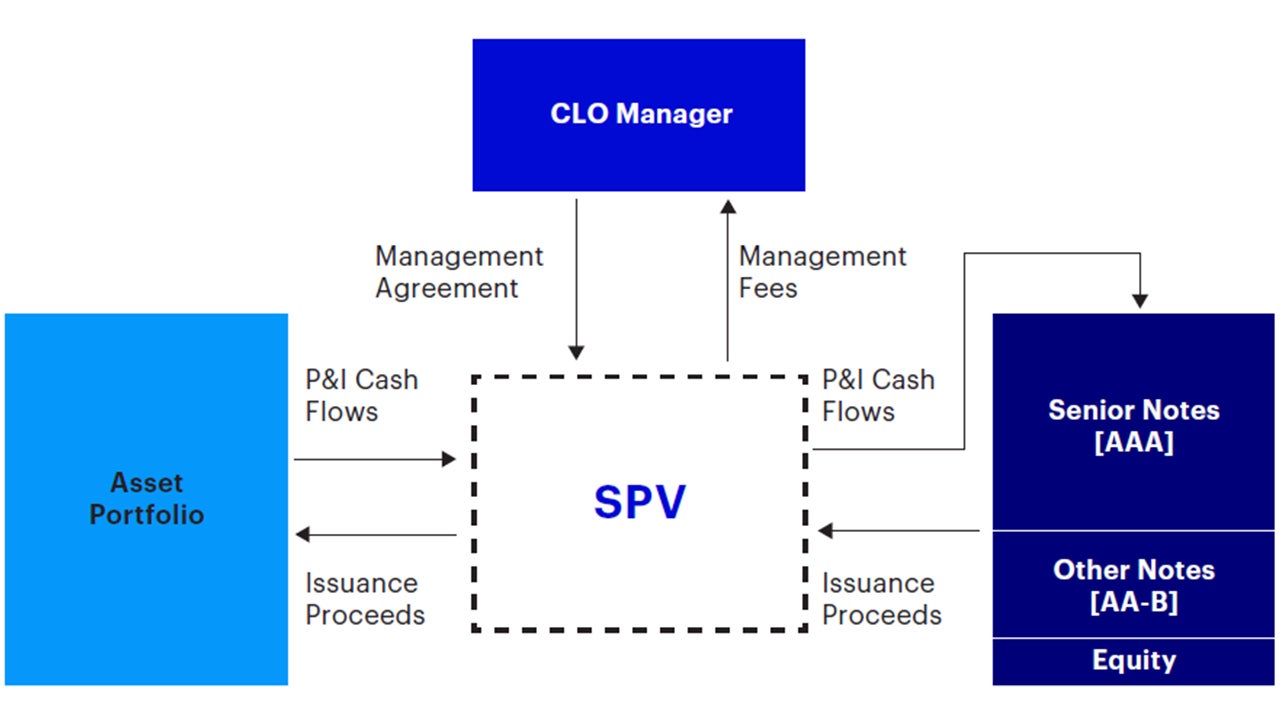

A CLO, collateralized loan obligation, is a special purpose vehicle (SPV) securitized by a pool of assets, including senior secured leveraged loans and bonds. The CLO collects interest and principal distributions from the pool of assets – typically 200-400 unique borrowers – and governs the distribution of these collections based on a waterfall clearly outlined within the CLO indenture.

Before issuance, the CLO vehicle is capitalized via the sale of debt tranches and equity. Once issued, a CLO portfolio is actively managed by a CLO manager who selects the initial pool of assets and may trade in and out of the assets over a typical four-to-five- year investment period. After two years, CLO debt tranches are typically callable. CLO managers receive a fee in exchange for their active management of the portfolio.

Coupon and principal payments collected on the underlying assets (loans) are used to make coupon and principal payments on the CLO’s liabilities (CLO notes). Payments first flow to the highest debt tranche of the CLO structure and continue to the lowest debt tranche. Thereafter, the residual cash flows are distributed to the equity. This is referred to as the “cash flow waterfall”. CLOs are structured to capture the spread, or arbitrage, between income from its underlying assets and payments to its noteholders, which benefits its equity holders.

In certain instances, CLO managers retain a 5% interest in the CLO to comply with risk retention requirements. As of 2018, risk retention for the majority of U.S. broadly syndicated loan CLOs ended, however, European CLOs still require risk retention compliance and U.S. fund managers may choose to retain at least 5% to attract European investor interest. The 5% interest may be retained through holding equity or a mixture of debt and equity.

Source: Barclays Research, 22 January 2021. For illustrative purposes only.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Many senior loans are illiquid, meaning that the investors may not be able to sell them quickly at a fair price and/or that the redemptions may be delayed due to illiquidity of the senior loans. The market for illiquid securities is more volatile than the market for liquid securities. The market for senior loans could be disrupted in the event of an economic downturn or a substantial increase or decrease in interest rates. Senior loans, like most other debt obligations, are subject to the risk of default.