Why APAC real estate now ?

Why APAC real estate now ?

We explore why Asia Pacific stands out as a compelling destination for real estate investment. We’ll dive into the region’s resilient economic growth, dynamic trade flows, attractive valuations, and highlight the sectors we may find promising.

Transcript

Hello and welcome. I’m Catherine Chen, Investment Strategist at Invesco Real Estate for Asia Pacific. In this podcast, we’ll explore why Asia Pacific stands out as a compelling destination for real estate investment. We’ll dive into the region’s resilient economic growth, dynamic trade flows, attractive valuations, and highlight the sectors we may find promising.

Let’s take a closer look at the macro backdrop of Asia Pacific. Amid ongoing global geopolitical tensions, we see compelling opportunities across the region—particularly where policymakers are actively supporting growth to cushion the impact of U.S. trade tariffs.

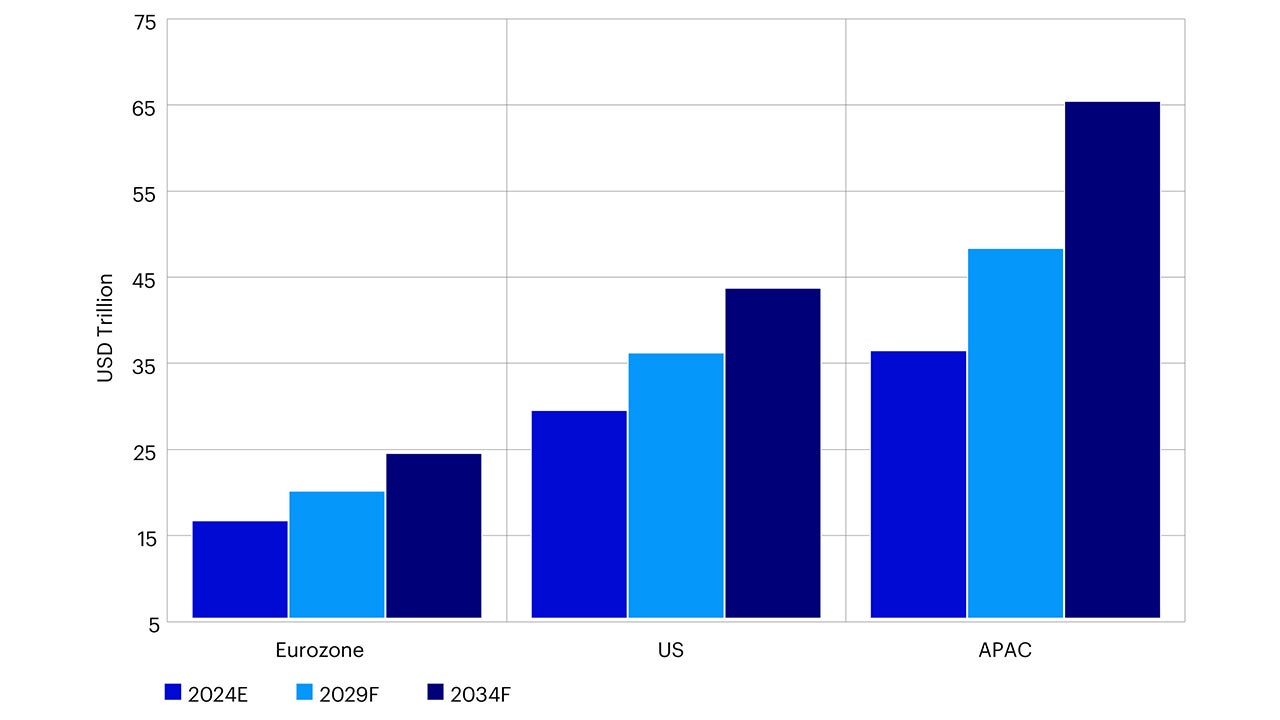

Even prior to the shift in global trade landscape, Asia Pacific had already established itself as a powerhouse in the global economy, currently contributing around 44% of global GDP1. This year, the region is expected to drive over 60% of global economic growth2. Looking ahead, economic momentum is projected to accelerate, with APAC’s GDP projected to be nearly 50% larger than that of the U.S. within the next decade3. While near-term growth may moderate, the region’s underlying fundamentals remain resilient — anchored by the solid economic foundations and proactive fiscal and monetary policy responses.

123Source: Oxford Economics as of April 2025.There is no guarantee that the projection will be reached.

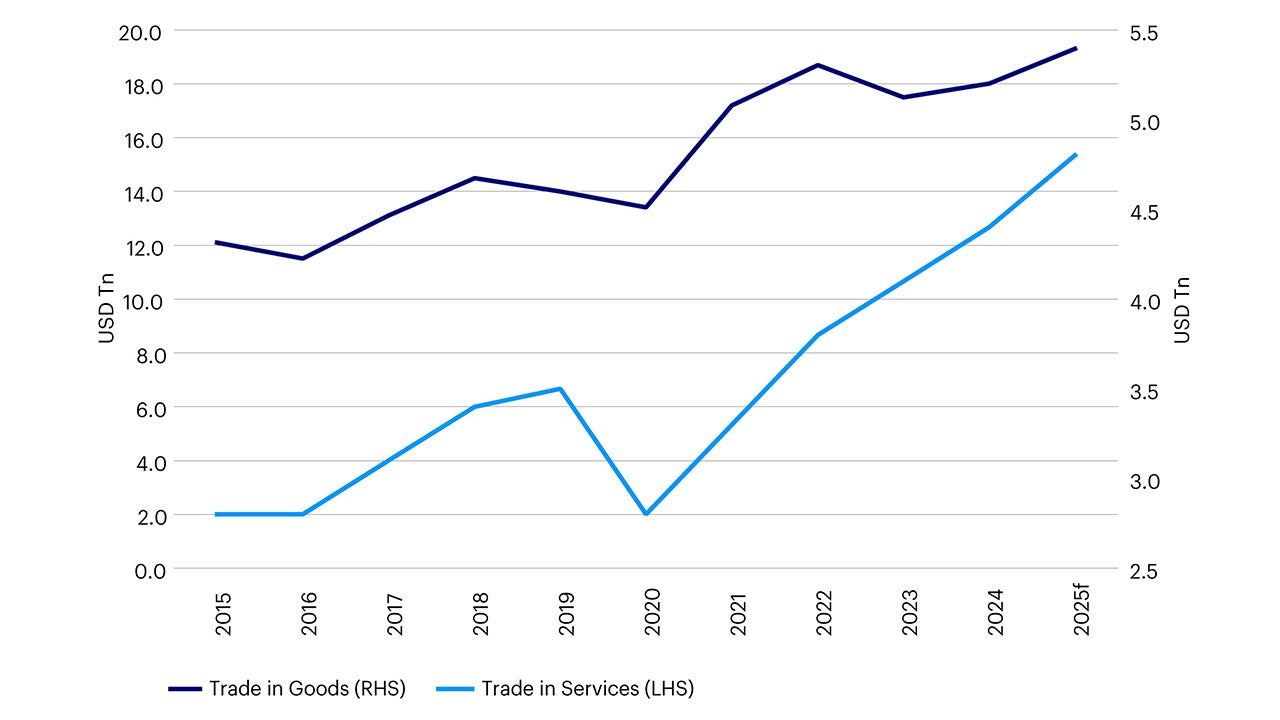

Zooming in on the region, the evolving nature of trade in Asia Pacific continues to support real estate growth. Services trade is gaining momentum, now employing over half of Asia’s workforce. As service industries expand, so does the demand for real estate — from office spaces to logistics hubs and data centers. At the same time, rising urban incomes and greater mobility are fueling housing demand.

Importantly, this transformation is attracting increasing investment volumes of cross-border capital. Strengthening economic ties within the region have laid the groundwork for deeper investment activities, with international investors actively deploying capital into key APAC markets. Over the past decade, cross-border real estate transaction volumes have surged, underscoring the region’s growing appeal and diversification benefits for global real estate portfolios.

Turning to valuations, Asia Pacific’s diverse and less correlated markets have generally seen capital values lag behind other regions.

However, as valuations in other markets begin to bottom out—and select APAC sectors are already showing signs of stabilization—combined with a declining interest rate environment, we believe capital values in the region are approaching a trough. This is a timely opportunity for investors looking to capitalize on recovery and may optimize long-term returns.

In terms of sectoral opportunities, we find the living sector and select specialty sectors particularly attractive right now. We are positive on the living sector in Australia, Japan, Korea and China, and see good potential in Korea’s data centers. When evaluating residential housing, we take a granular approach – analyzing demographic trends to identify cohorts with the most pronounced demand-supply imbalances. We then partner with the right operators to strategically scale businesses that address these gaps and deliver longer term value.

Thanks for listening. You can learn more about Asia Pacific real estate by downloading our white paper.

Stay tuned for our upcoming piece, where we’ll dive deeper into our living strategy across the region.

Thank you.

Transcript

Hello and welcome. I’m Catherine Chen, Investment Strategist at Invesco Real Estate for Asia Pacific. In this podcast, we’ll explore why Asia Pacific stands out as a compelling destination for real estate investment. We’ll dive into the region’s resilient economic growth, dynamic trade flows, attractive valuations, and highlight the sectors we may find promising.

Let’s take a closer look at the macro backdrop of Asia Pacific. Amid ongoing global geopolitical tensions, we see compelling opportunities across the region—particularly where policymakers are actively supporting growth to cushion the impact of U.S. trade tariffs.

Even prior to the shift in global trade landscape, Asia Pacific had already established itself as a powerhouse in the global economy, currently contributing around 44% of global GDP1. This year, the region is expected to drive over 60% of global economic growth2. Looking ahead, economic momentum is projected to accelerate, with APAC’s GDP projected to be nearly 50% larger than that of the U.S. within the next decade3. While near-term growth may moderate, the region’s underlying fundamentals remain resilient — anchored by the solid economic foundations and proactive fiscal and monetary policy responses.

123Source: Oxford Economics as of April 2025.There is no guarantee that the projection will be reached.

Zooming in on the region, the evolving nature of trade in Asia Pacific continues to support real estate growth. Services trade is gaining momentum, now employing over half of Asia’s workforce. As service industries expand, so does the demand for real estate — from office spaces to logistics hubs and data centers. At the same time, rising urban incomes and greater mobility are fueling housing demand.

Importantly, this transformation is attracting increasing investment volumes of cross-border capital. Strengthening economic ties within the region have laid the groundwork for deeper investment activities, with international investors actively deploying capital into key APAC markets. Over the past decade, cross-border real estate transaction volumes have surged, underscoring the region’s growing appeal and diversification benefits for global real estate portfolios.

Turning to valuations, Asia Pacific’s diverse and less correlated markets have generally seen capital values lag behind other regions.

However, as valuations in other markets begin to bottom out—and select APAC sectors are already showing signs of stabilization—combined with a declining interest rate environment, we believe capital values in the region are approaching a trough. This is a timely opportunity for investors looking to capitalize on recovery and may optimize long-term returns.

In terms of sectoral opportunities, we find the living sector and select specialty sectors particularly attractive right now. We are positive on the living sector in Australia, Japan, Korea and China, and see good potential in Korea’s data centers. When evaluating residential housing, we take a granular approach – analyzing demographic trends to identify cohorts with the most pronounced demand-supply imbalances. We then partner with the right operators to strategically scale businesses that address these gaps and deliver longer term value.

Thanks for listening. You can learn more about Asia Pacific real estate by downloading our white paper.

Stay tuned for our upcoming piece, where we’ll dive deeper into our living strategy across the region.

Thank you.

Macro backdrop

The global investment landscape remains highly uncertain, shaped by rapidly evolving geopolitical tensions and economic developments. Our base case reflects a combination of escalation and de-escalation scenarios regarding the trajectory of US tariffs. While we cannot predict how US tariff levels are ultimately going to shake out or the timing of the Federal Reserve’s first rate cut, we remain focused on navigating this volatility with a balanced perspective.

In this environment, we see compelling opportunities in regions where policymakers are actively supporting growth – particularly in Asia Pacific (APAC). The APAC region is a powerhouse in the global economy, currently contributing around 44% to the world’s GDP.1 The region is projected to drive over 60% of global GDP growth in 2025.2 Looking ahead, economic momentum is projected to accelerate with APAC’s GDP anticipated to be nearly 50% larger than that of the US by 2034.3

Source: Oxford Economics as of April 2025.

Growth in the APAC region is expected to moderate in 2H 2025 but remains resilient, supported by proactive policy responses. Several economies including China and Korea have started to stimulate their domestic economies via easing monetary policy measures and fiscal stimulus. Many central banks in APAC have also begun easing rates, despite the Fed maintaining a more cautious stance.

For over a decade, foreign investors have been recycling surpluses into US dollar assets. This trend may start to reverse. We continue to expect the US dollar to weaken in 2H 2025 as growth concerns mount and will likely add to disinflationary pressures around the APAC region. A weaker US dollar, growth concerns and disinflationary forces could catalyze local central banks around the region to further cut rates and ease monetary policies.

In our view, current market conditions present an opportune time for investors to invest in Asia Pacific real estate. Investors seeking shelter from public market gyrations are increasingly looking to alternative investments, such as real estate.

With real estate valuations in Asia Pacific at attractive levels relative to peak pricing4 and monetary conditions turning more accommodative across the region, the backdrop is becoming increasingly favorable for deploying capital ahead of a broader market recovery. The region’s long-term economic resilience and robust growth trajectory further support the case for real estate investment, as rising economic activity is expected to drive demand and underpin potential growth and appreciation in property values.

APAC is a region marked by significant diversity, spanning a wide range of economies, demographic profiles, and stages of urban development. This diversity offers investors a broad spectrum of real estate opportunities across different markets, allowing for strategic portfolio diversification and risk management.

Global trade and tariffs

Trade has long been the backbone of many Asian economies, particularly in North Asia where countries are more reliant on global trade than in the US. But the nature of trade is evolving. While Asia’s goods trade has slowed in recent years, services trade is accelerating - now employing over half of Asia’s workforce, up from 22% in 19905, and is expected to continue to grow. International Monetary Fund studies have shown that the shift to services-led growth delivers stronger productivity gains than manufacturing6, particularly when paired with Asia’s rapid advances in digitalization and AI.

This structural shift is reshaping real estate demand in Asia across property sectors. As service industries expand, so will the need for commercial real estate. At the same time, rising urban incomes and mobility will drive demand for housing and hospitality assets. For investors, this evolution presents broad and resilient opportunities across real estate sectors.

Source: Data are estimated by ESCAP (United Nations Economic and Social Commission for Asia and the Pacific), based on WTO annual merchandise and commercial services data (accessed November 2024). Data from 2024 onwards are estimated by ESCAP, using EIU database for selected economies. Note: f indicates forecast.

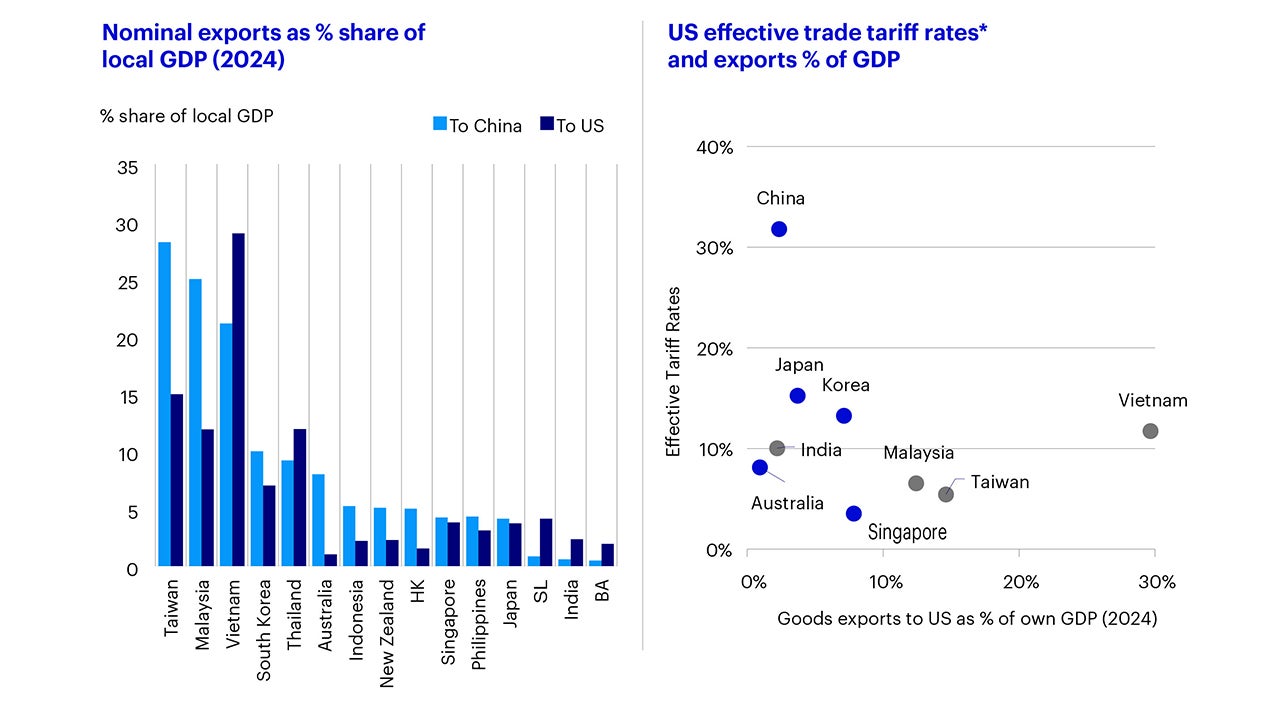

Despite tariff uncertainties, we do not believe that the world is becoming “de-globalized” nor that global trade is in structural decline. Instead, trade patterns are re-aligning with stronger intra-regional APAC and “South-South” trade flows.

Over the past forty years, intra-regional Asia trade has grown by over 43%7 and now accounts for nearly 60% of the region's total exports, up from 54% in 2020.8 The trend is also reflected in foreign direct investment (FDI) flows. For example, Asian countries have nearly doubled their FDI flows to Japan over the past ten years due to the country’s booming technology industry.9

This increase reflects strategic adjustments in supply chains which could mitigate some of the adverse effects of recent US trade tariffs. As the US becomes a less reliable trading and security partner, we expect Asian economies to foster closer commercial ties with each other to enhance their collective resilience and stability.

Already, trade and investment between many Asian economies and China exceed trade and investment with the US, underscoring China's pivotal role as the key trade and investment partner in the region. Despite higher US tariffs, the direct exposure of APAC countries, in terms of export share relative to their own GDP, is generally manageable.10

As China navigates higher tariffs from the US, the rest of the APAC region could be impacted as trade originally bound for the US is diverted elsewhere. Still, the recently concluded US-China trade truce suggests that trade between the two countries is likely to continue. Fears of a complete trade de-coupling have largely abated with recent developments suggesting a more measured recalibration of supply chains rather than broad-based disengagement.

Ultimately, we think that global trade is undergoing a period of realignment and readjustment driven by the shift to services trade, digitalization and AI, as well as higher regional trade. This re-alignment is likely to have winners and losers as supply chains reposition themselves. We think that the APAC region is already well-positioned for these upcoming shifts. The region’s supply chains are remarkably diverse and resilient, which should offer some insulation from ongoing economic and tariff uncertainties.

Note: * as of 21 May 2025, Assumes unchanged volumes and fixed import shares by source country.

Source: (LHS) OECD, HSBC, April 2025; (RHS) Fitch Ratings, US Census, PMA, May 2025.

APAC provides strong diversification benefits and uncorrelated opportunities

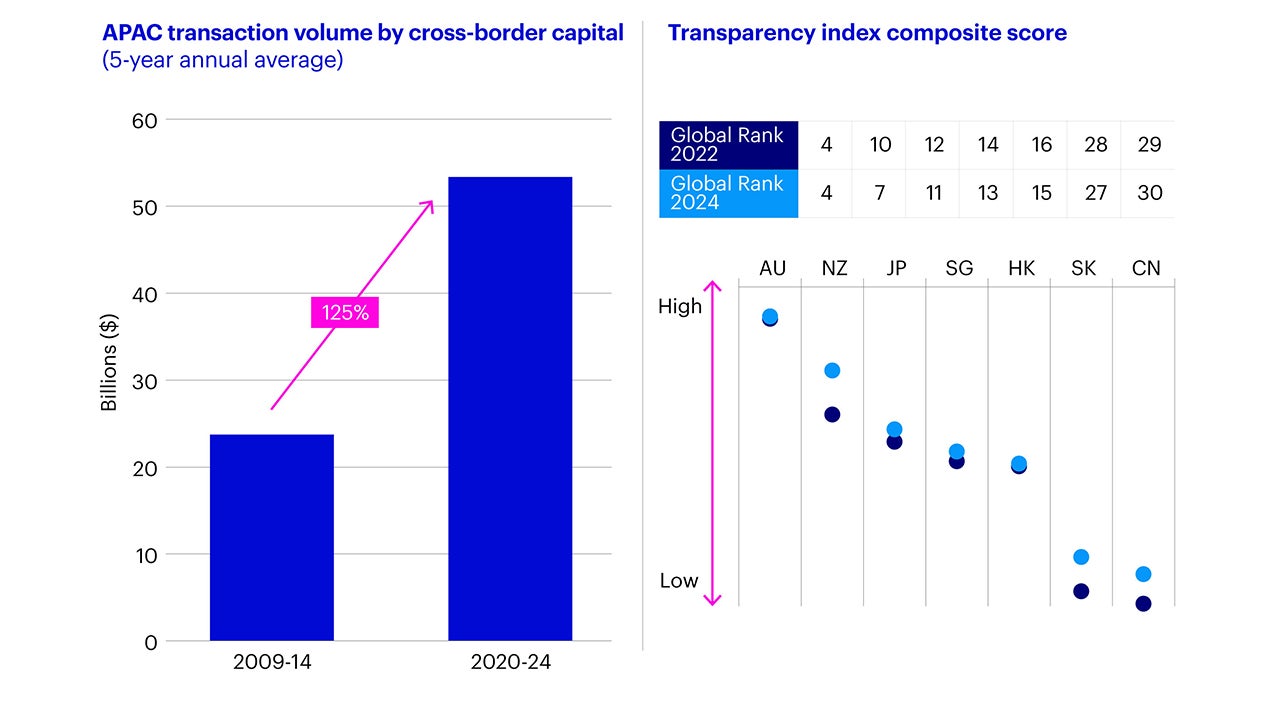

Growth of cross-border capital

Strengthening economic ties within the APAC region is enhancing the region’s overall investment appeal. This economic integration has laid a strong foundation for increased capital mobility and deeper cross-border investment activity. Cross-border capital flows into APAC real estate have expanded significantly over the past decade. Comparing the two periods between 2009 to 2014 and 2020 to 2024, the average cross-border transaction volume has increased by 125% (Figure 4). In fact, according to a recent research report, cross-regional inflows to APAC grew by 221% year-over-year in 2H 2024 to US $6.3 billion.11 North American investors were particularly active in Australia and Japan with landmark deals in the industrial and logistics, office, and hotel sectors. This underscores the growing appeal of APAC markets to international investors.

In addition, market transparency has further improved in many APAC countries in recent years, attracting cross-border capital to increase their allocations to APAC real estate. Improved transparency enhances investor confidence and facilitates better decision-making, making the region more attractive for real estate investments. The more mature and liquid markets in APAC such as Japan and Australia have particularly benefited from investors seeking to diversify away from China which has experienced a slowdown in growth in recent years.

Note: CN = Shanghai and Beijing in China. Source: (LHS) MSCI, April 2025; (RHS) JLL, LaSalle, 2024.

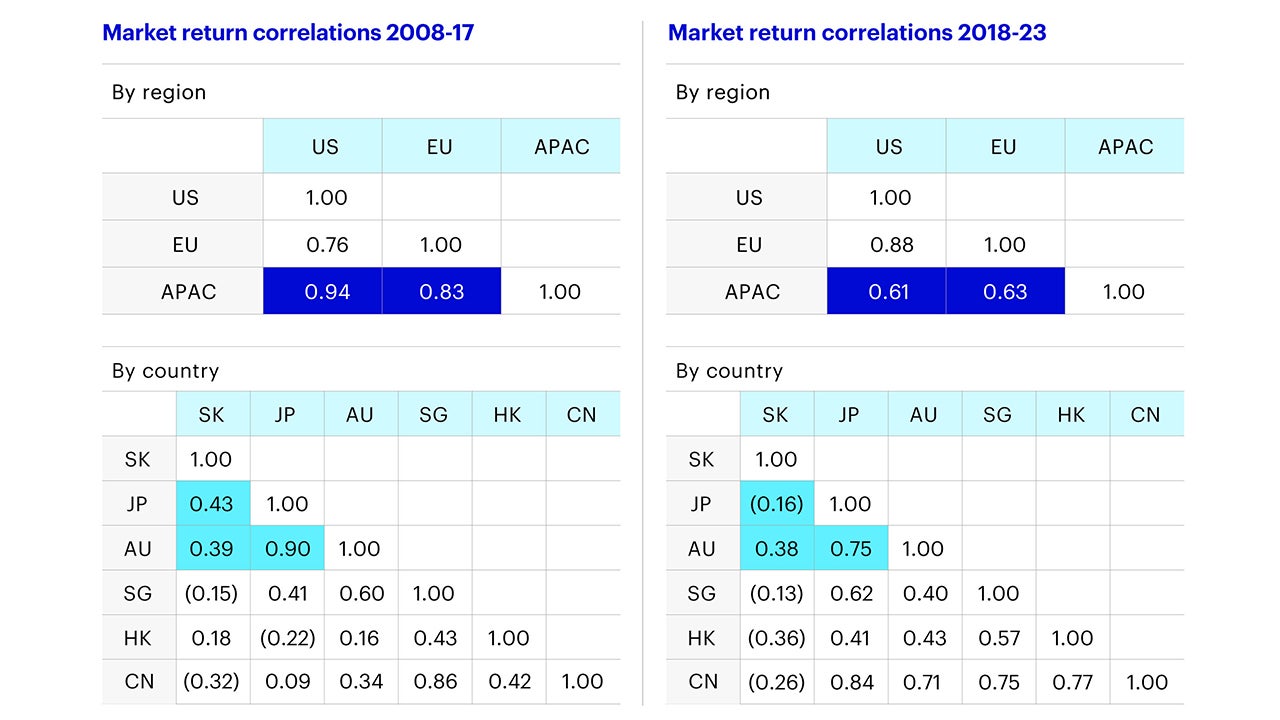

Correlations of commercial real estate total returns

APAC real estate offers investors significant diversification benefits. These have become more pronounced recently. Return correlations of APAC commercial real estate with other regions have decreased in the last decade compared to the period from 2008 to 2017, making the region a valuable addition to investment portfolios amid macro uncertainties (Figure 5).

Within APAC, we have seen return correlations among Japan, Korea, and Australia declining during the period between from 2018 and 2023 (relative to 2008 to 2017). Korea, in particular, shows low and often negative correlations with other APAC countries, making it well-positioned for diversification strategies.

The varying stages of different markets within the cycle (e.g. Australia logistics vs. Korea logistics, Japan office vs. Australia office) create “uncorrelated opportunities”, emphasizing the importance of strategic market entry timing to maximize returns.

Note: MSCI APAC Index covers only Australia, China, Hong Kong, Indonesia, Japan, South Korea, Malaysia, New Zealand, Singapore, Taiwan and Thailand. Source: MSCI, Invesco Real Estate Research as of October 2024.

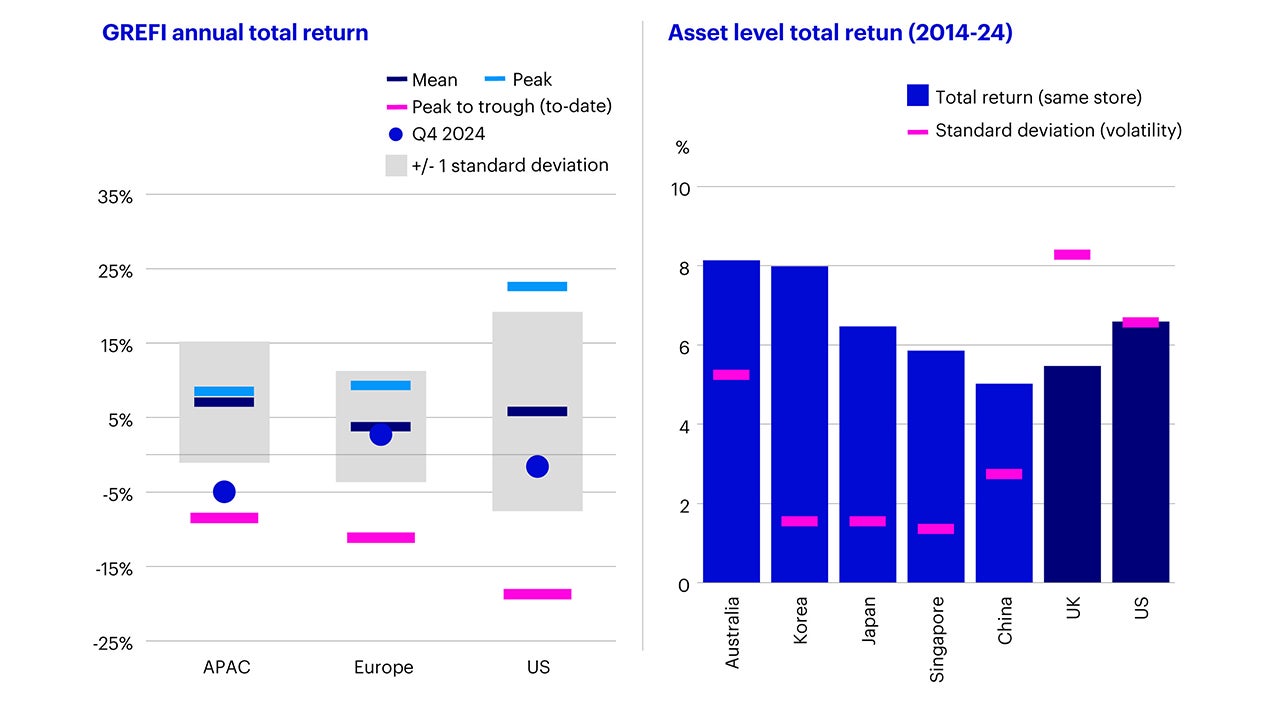

Lower return volatility in APAC real estate

Relative to other regions, total real estate return volatility in APAC is generally lower, both at the fund and asset level. Stronger markets and sectors, including offices in Korea and Japan, Australia logistics, as well as Japan residential, contribute to the stability of APAC real estate returns.

Lower return volatility makes APAC real estate investments more stable and predictable, appealing to investors seeking long-term growth and stability.

Note: Peak periods refer to 3Q22 for Europe, 4Q22 for the US and 2Q23 for APAC.

Source: (LHS) ANREV, INREV, NCREIF ‘Global Real Estate Fund Index Q4 2024’; (RHS) MSCI, as of May 2025. Data period 2014-2024.

Why now and which APAC opportunities look interesting?

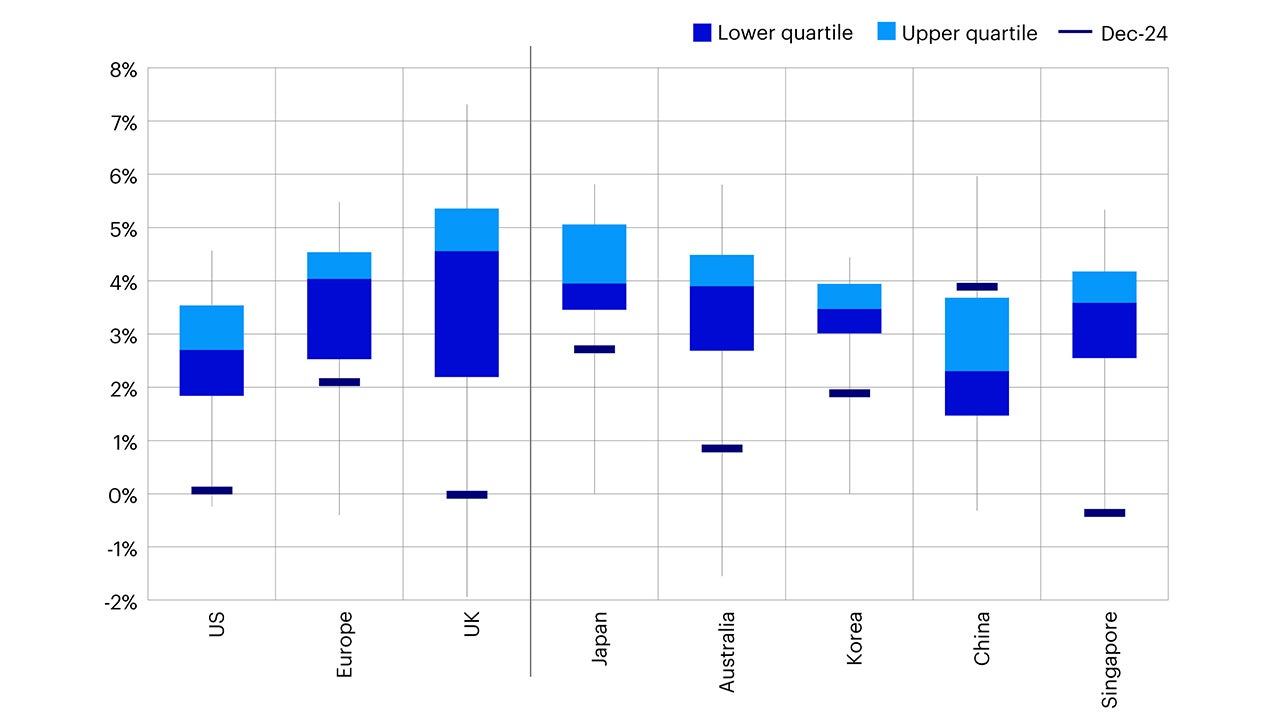

Outside of China, spreads are below historic ranges but to varying degrees

Many global markets are seeing tighter property yield spreads than historical averages, while APAC countries maintain positive spreads or have returned to positive territory, offering higher risk-adjusted returns.

Despite rate hike pressure, Japan still offers a wider margin than other developed markets. Even with potential rate normalization, the current property yield spread remains wide. As the property market recovers further, income growth is expected. This stability in Japan’s market provides a favorable investment environment, that may offer consistent returns despite potential rate hikes.

Source: Invesco Real Estate using cap rate data from NCREIF, CBRE and PMA, interest rate data from Citi and Macrobond. Notes: All spreads relative to 3-month money market rates, except US which uses 10-yr Treasuries. US, Europe and UK are quarterly spreads since 2000, APAC markets are annual spreads since 2000 for Australia, 2003 for Japan, 2004 for Korea and 2006 for China and Singapore. US cap rate data is the weighted average market, Europe is weighted average prime, other markets are an unweighted average of key city cap rates (minimum of three of office, logistics, retail and residential).

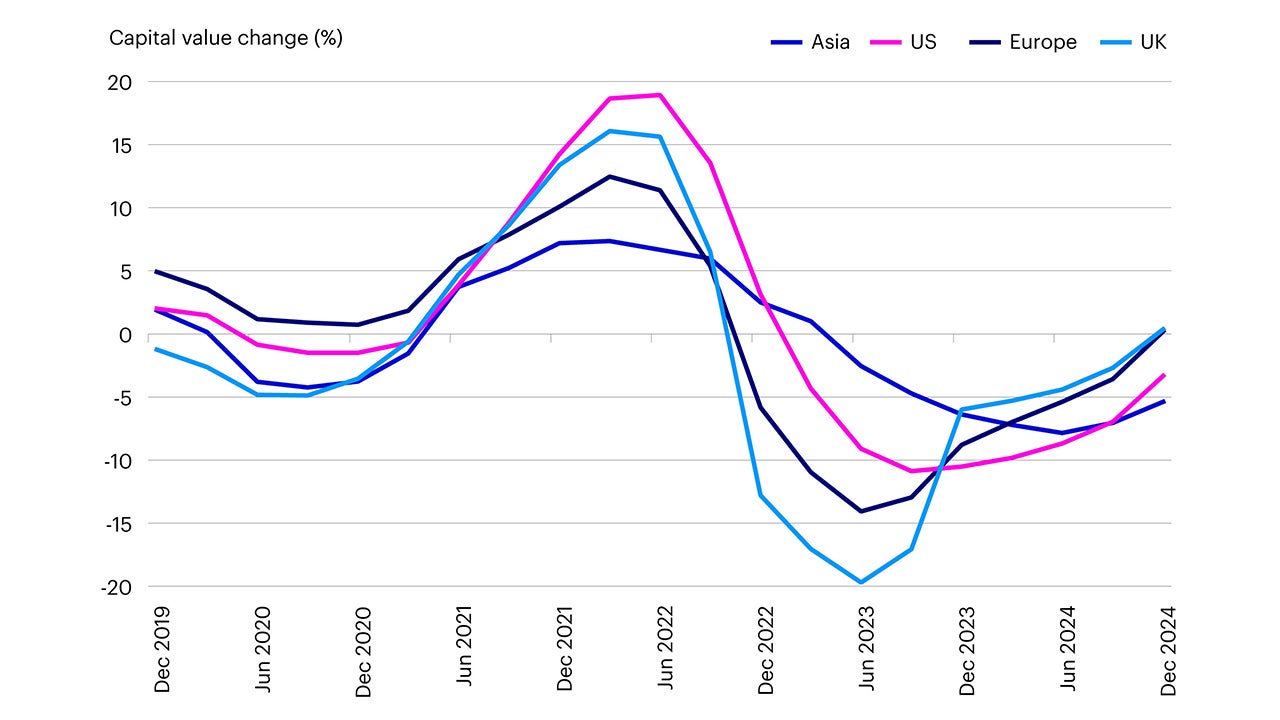

Current APAC real estate valuations lag other regions and may bottom soon

Given the divergent and less correlated markets, APAC capital values have generally been lagging other regions. As other regions bottom out and some APAC markets and sectors show signs of stabilization, coupled with the decline in interest rates, we believe that APAC capital values are bottoming. This suggests that now is the opportune time for investors to enter these markets to maximize returns.

However, it is crucial to carefully select the right markets and sectors at this point in the cycle to ensure optimal investment outcomes. Value creation in this stage is appropriate to capture the subsequent market recovery.

Source: MSCI data as of 26 March 2025, last available data point 31 December 2024. Note: Asia – MSCI Global PFI Asia Pacific Funds Quarterly Property Index, US – MSCI Global PFI North America Funds Quarterly Property Index, Europe - MSCI Global PFI Continental Europe Funds Quarterly Property Index, UK - MSCI Global PFI UK Funds Quarterly Property Index.

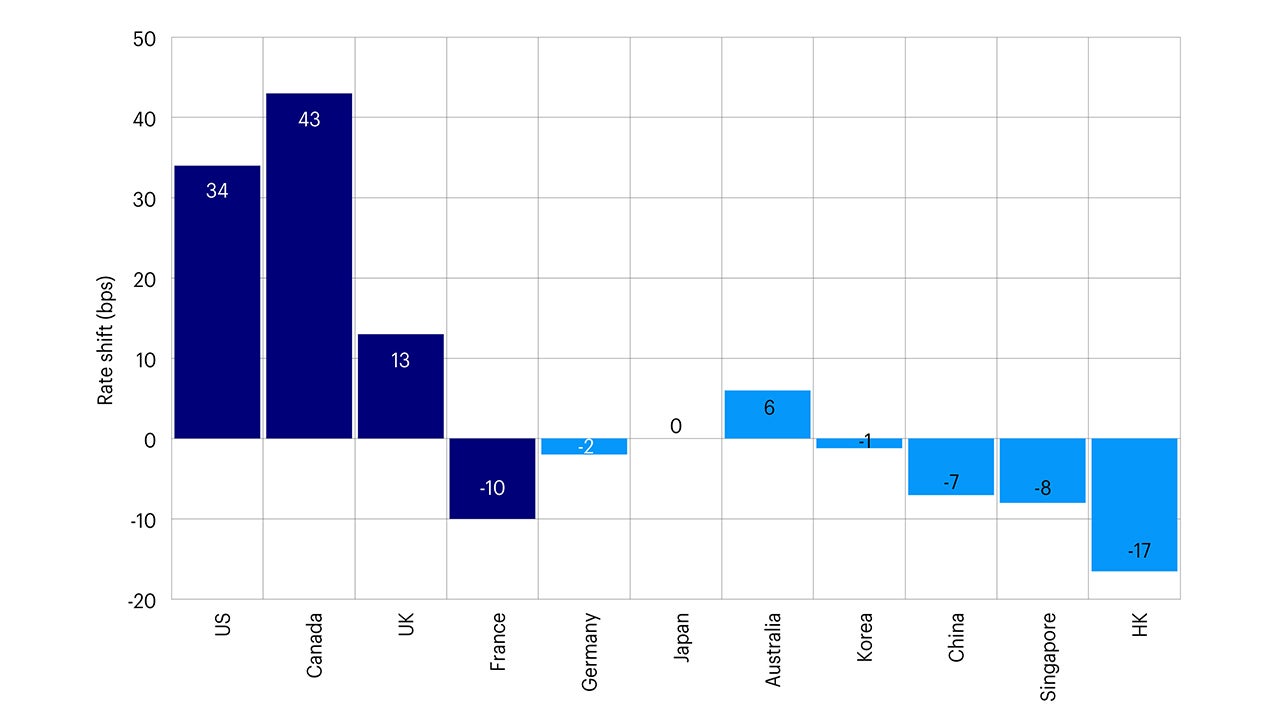

Many APAC countries have seen government bond yields tighten since the tariff announcement

Following recent tariff announcements12, long-term government bond yields have either remained stable or tightened across various APAC markets, contrasting with the upward trajectory seen in other regions. This trend indicates a favorable environment for real estate investment, as lower bond yields provide a basis for a potential reduction of borrowing costs and lowered cap rates, making real estate investments more attractive.

However, the situation is still extremely fluid, and it is important to consider other factors at play that could influence these dynamics.

Source: Macrobond, data as of 22 May 2025.

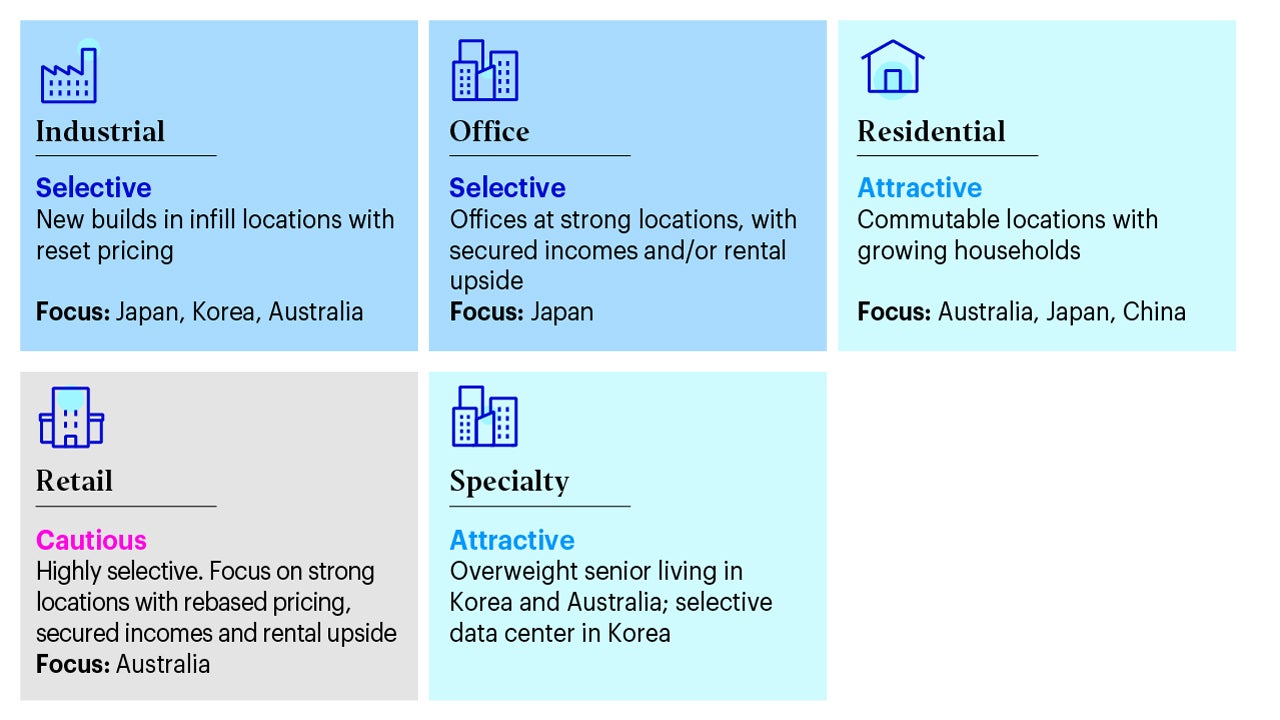

Sector allocations across the region

In terms of APAC sectoral opportunities, we find residential and specialty real estate attractive right now. We are positive on the living sector in Australia, Japan, Korea and China and are overweight Korea and Australia senior living as well as Korea data centers. When assessing residential housing, we are also careful to analyze granular demographic trends to identify cohorts with the most pronounced demand-supply imbalances, and partner with operators to strategically scale businesses that address these gaps.

Source: Invesco Real Estate as of May 2025.

Conclusion

APAC's resilient economic growth, robust trade dynamics, strong diversification benefits and improved market transparency make it a compelling destination for real estate investments.

Attractive yield spreads, especially in markets like Japan and Australia, combined with easing borrowing costs and stable bond yields, create favorable conditions for investors. At the same time, sector-specific opportunities—such as the living sector in Japan, China, Korea and Australia, senior living in Korea and Australia, and data centers in Korea—offer targeted avenues for growth.

We think value-add and opportunistic strategies, as well as real estate debt in “high borrowing rate” markets, are particularly well-suited to the current phase of the cycle.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.