Insight

China's economic recovery series: Is it closer?

China’s economic activities continue to show improvement, including manufacturing, domestic services and trading.

Recent economic data, including the Purchasing Managers’ Index (PMI) data released this week, indicates that the economy is gaining solid ground in 2024. We believe that the government’s proactive policy stance will be key to maintain the recovery momentum.

While market expectation on US interest rate movement may lead to short-term volatility, we believe the recent signs of economic recovery in China could lay the foundation for a rebound for Chinese equities.

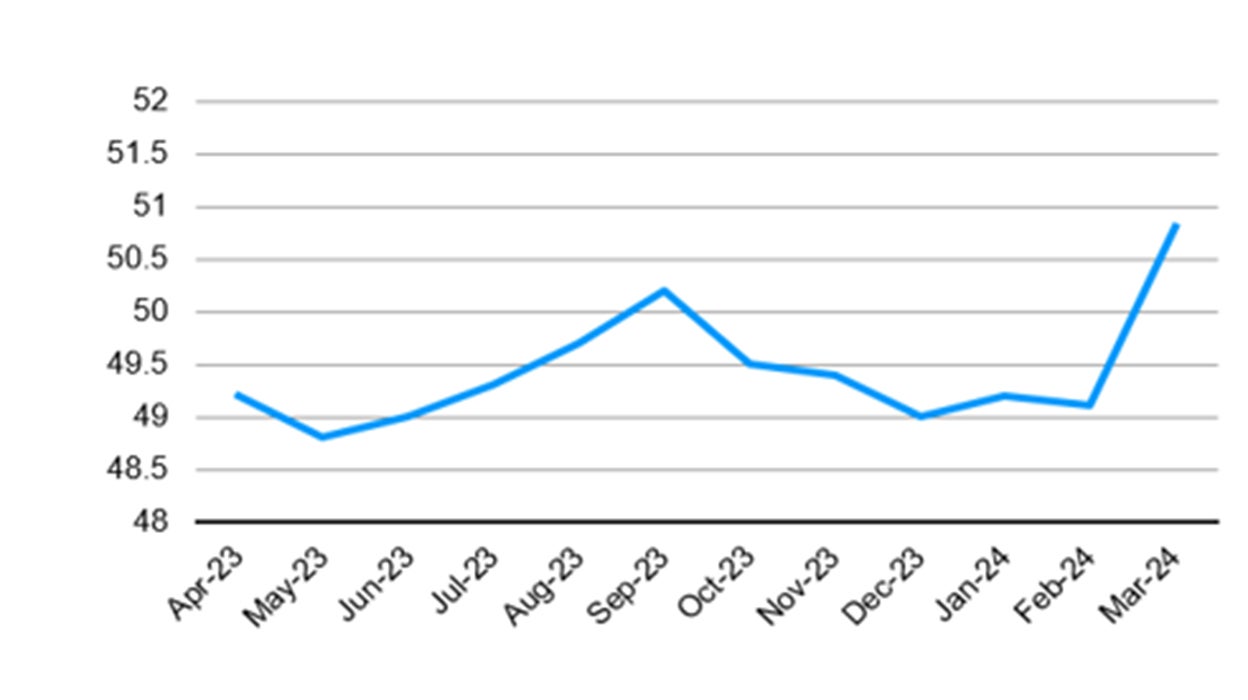

1. PMI data shows expansionary trend

- The official Manufacturing PMI rose to 50.8 in March 2024, beating market expectation.1

- The index rebounded broadly across most industries and back to expansionary territory for the first time since October 2023.

- The increase was led by production and new export orders.

- Early signs of recovery have emerged and we will continue to monitor upcoming data in order to determine its sustainability.

Chart: Official Manufacturing PMI

Source: NBS, March 2024

2. Industrial profit back to a positive growth trend

- China's industrial firms recorded a 10.2% increase yoy in profits during January and February, reversing a profit decline for the whole of 2023.2

- The surge in profits signals that a recovery is gaining traction.

- Computer, communications and other electronic equipment manufacturing sectors exhibited robust growth, which should be attributed to tech self-sufficiency and a consumer electronics upgrade. 3

- We believe a sustained recovery momentum will require more supportive policies.

3. Positive rebound in Fixed Asset Investment

- China's fixed-asset investment (FAI) increased by 4.2% yoy in the first two months of this year, surpassing the full-year growth rate of 2023 by 1.2%. 4

- In particular, FAI in railways was 65.2 billion yuan in the first two months of 2024, up 9.5% compared to the same period last year.5

- In addition, FAI from the private sector has rebounded to positive growth after eight months of decline, indicating a recovery in investment activity from the private sector. 6

- We will continue to closely monitor the sustainability of investment growth going forward.

Investment implications

- The rebound in PMI, industrial profit and FAI, together with the earlier released data, including exports and power consumption, all pointed to signs of economic recovery in China.

- We believe that the pace of recovery is getting back on track, and it could potentially boost corporate earnings and overall market sentiment.