Does ESG add value to factor investing in China?

Source: Invesco.

We are currently at the forefront of a revolution on ESG factors in China propelled by its environmental and social goals. In the past, Chinese investors have paid less attention to how companies manage environmental and social issues than their bottom line. Governance issues, despite their importance in shareholder rights protection, also often take a back seat to other financial quality factors like profit margin and earnings accruals. The lack of reliable ESG data has also posed an obvious difficulty for its application in factor investing.

Is ESG beneficial for factor investors?

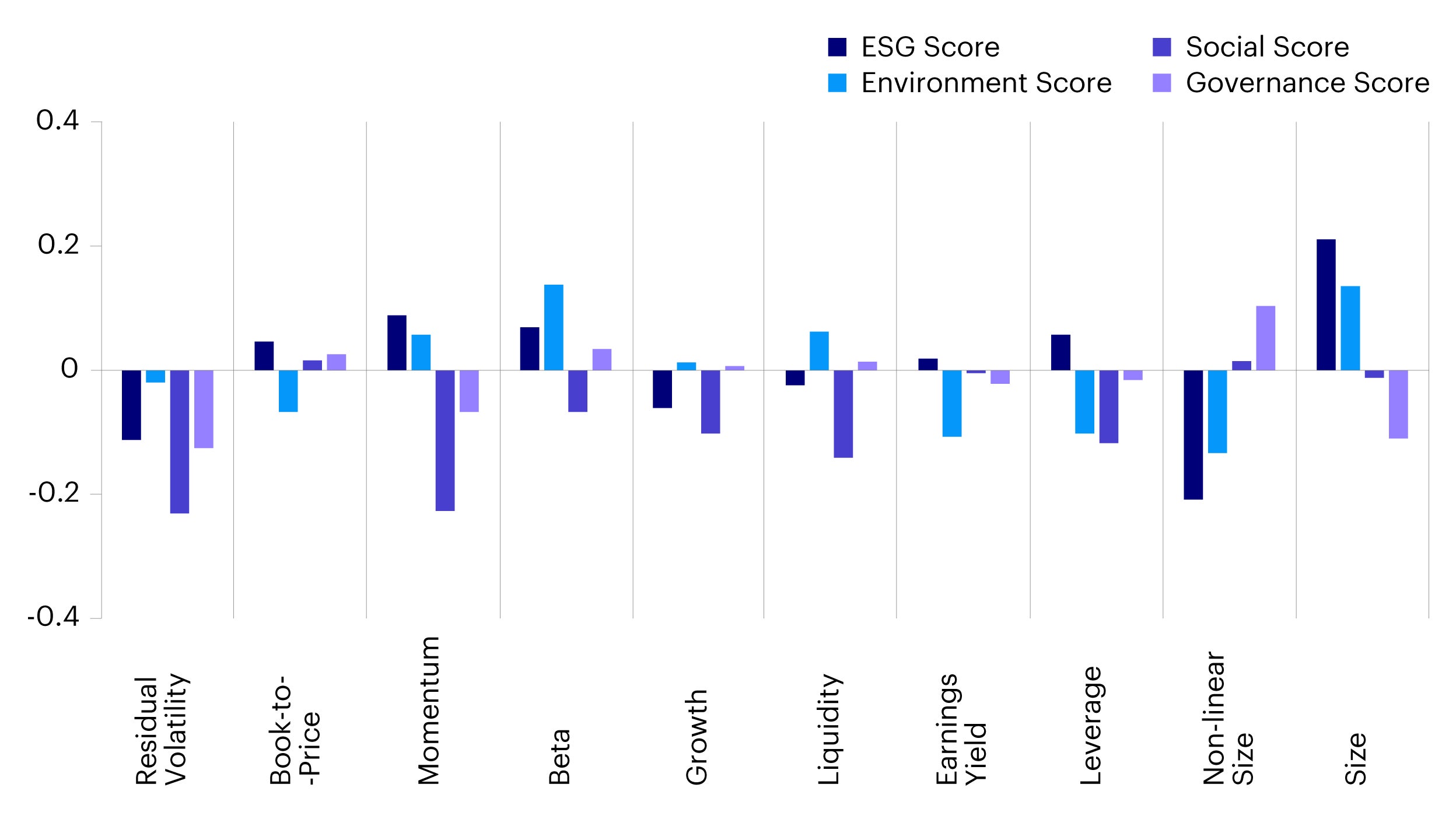

Yet, we believe that ESG factors can no longer be overlooked by factor investors in China. First, environment and social factors have become prominently aligned with China’s strategic goals in carbon neutrality and common prosperity. Second, the corporate disclosures standard of ESG issues are expected to improve in the coming years on the increasing need for transparency from both regulators and investors. Recent reporting guidelines released by the China Securities Regulatory Commission (CSRC), for instance, now require mandatory disclosure of any environment-related administrative penalties in addition to voluntary disclosure of carbon-reduction measures taken. Regulatory oversight on social issues such as consumer protection and community welfare are also on the rise. Third, as ESG factors tend to have relatively low correlation with other traditional factors, they can help provide diversification benefits in a portfolio. The advantages of integrating ESG factors into a systematic portfolio is thus likely to outweigh drawbacks such as limitations in data coverage and history.

Source: IGW, data as of July 31st, 2021. Cross sectional correlation between ESG and major risk factors of 512 China A-shares companies. ESG factors based on MSCI ESG Ratings and risk factors based on Barra China Equity Model (CNE5).

Although ESG data in China is relatively young, we believe there is scope for constructing ESG factors by identifying material issues relevant to the China equity market.

Our research has shown that a company’s overall sustainability profile, as measured by a diverse set of criteria ranging from its environmental pollution management and workplace safety to board professionalism, may have a positive linkage with stock return. The implication is that ESG factors not only provide downside risk protection but also present a possible source of alpha.

This is supported by research from the United Nations Principles for Responsible Investment (PRI) which found that portfolios that systematically select stocks with superior ESG characteristics (best-in-class) or incorporate ESG profiles into weightings (tilting strategy) show an increase in alpha delivered over a six-year period.1

Apart from analyzing structured ESG data obtained from third-party sources, artificial intelligence (AI) and machine learning techniques can also be used to extract subtle ESG insights directly from firms’ written reports. To that end, we have recently partnered with Tsinghua University to study the transformation of carbon-intensive sectors and its impact on ESG investing in China.

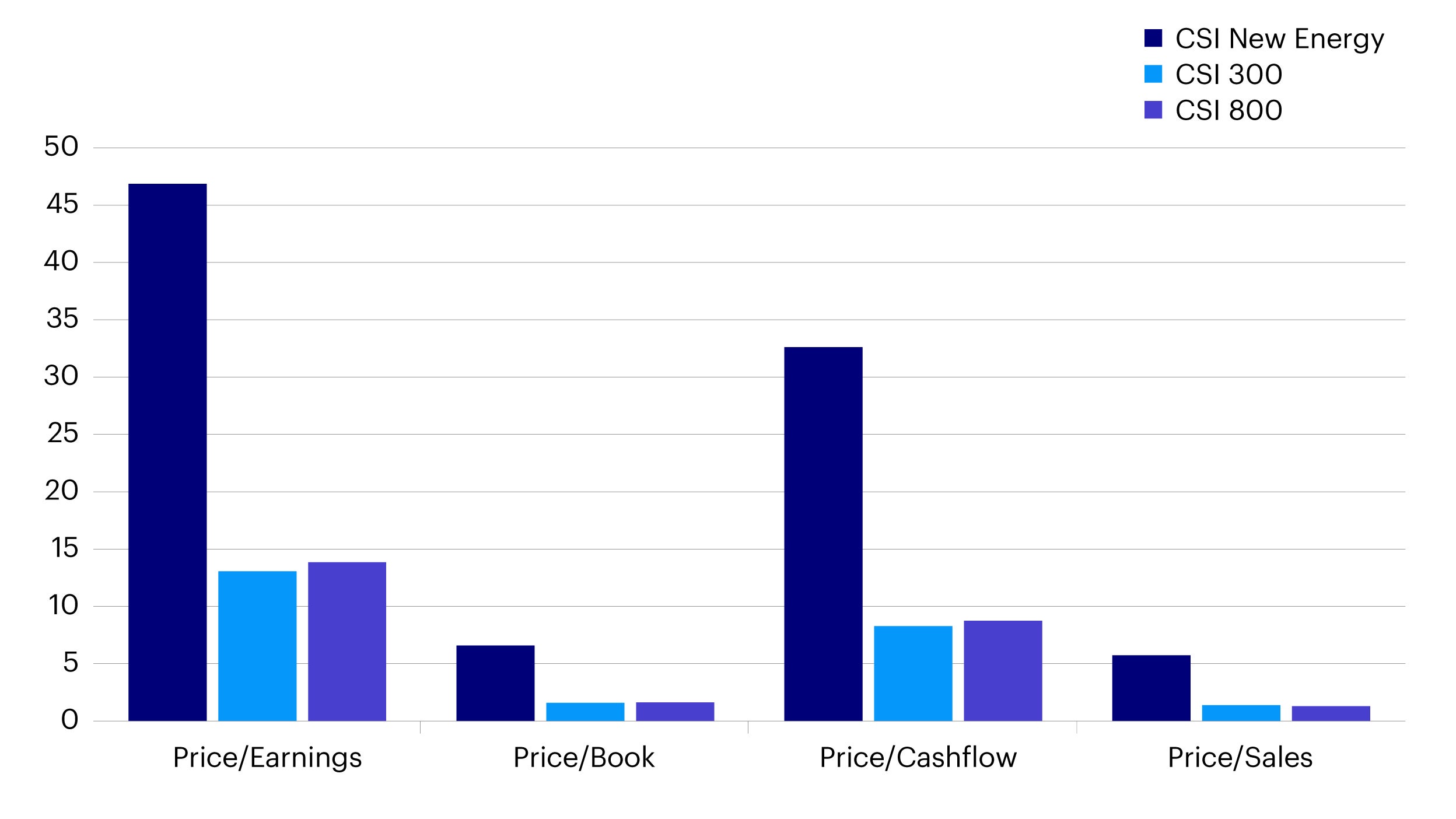

Low carbon risk premium

We believe that the low carbon transition in China may be developing into a major source of risk premia. To meet the dual goals of reaching peak carbon emissions before 2030 and achieving carbon neutrality by 20602, China’s non-fossil fuel consumption is expected to account for a quarter of its total energy consumption by 2025 before growing to 80% by 2060 according to the State Council’s target. This has already led to a rise in the valuation premium of new energy related industries ranging from electric vehicles to wind- and solar- power supply chains (Figure 2).

Source: Wind, data as of January 28, 2022.

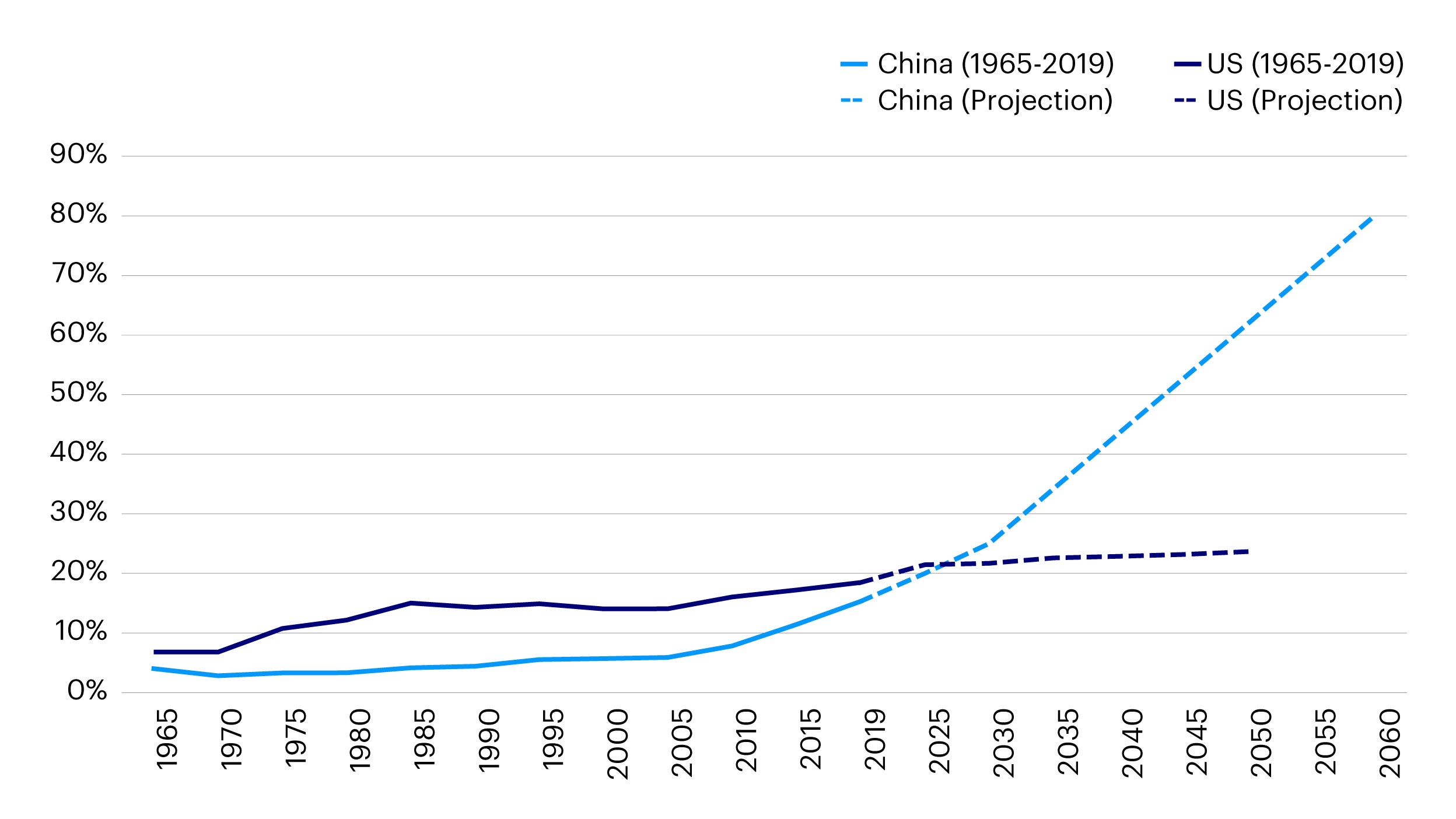

China’s transition to a low carbon economy is often headlined by the projected growth of its non-fossil fuel as a proportion of total energy consumption (Figure 3). However, it is more likely to entail a much more pervasive change for all types of companies. To achieve carbon neutrality while remaining a major industrial powerhouse, we expect that Chinese companies in the energy intensive sectors such as mining and heavy industries will eventually need to adopt a carbon reduction mandate in their operations with the help of technological innovation and business transformation. On the other hand, consumer companies will also need to cater to a growing middle class whose preferences are gravitating towards greener choices. The competing demands of economic growth and decarbonization could mean that a sweeping transformation will eventually touch every industry in China in the coming decades, albeit at a difference pace.

Source: Invesco, The State Council of the P.R.C., U.S. Energy Information Administration, BP Statistical Review of World Energy, data as of 30 November 2021. Projections are based on linear interpolation of publicly announced energy consumption targets or forecasts.

We have already seen subtle signs that investors are beginning to price in the cost of carbon emissions to utilities company share prices.3 Over the long run, we expect a low carbon factor risk premium to be better achieved by a broad-based systematic strategy than a narrow sector-focused one. Greater industry diversification may lead to more stable risk premia from a wider spectrum of economic sectors as they each undergo decarbonization at different pace. It may also help lower the cyclical volatility of the portfolio.

Systematic process and technology provide an edge

A systematic strategy for low carbon risk premia also allows a more objective analysis of a company’s low carbon premium against its peers and over time. This is important as the pricing mechanism of low carbon premium may differ between industries due to the varying regulatory environments and carbon transition pathways they are subject to. The development of green financing and carbon credit trading in China will also influence the low carbon risk premium in the future. To accurately adjust a company’s low carbon premium for these data points as well as other ESG and financial exposures is a challenging but necessary task to isolate the risk premium. Thus, systematic investment processes with the ability to handle large datasets using AI, natural language processing and other advanced technologies will have an edge in refining their strategy for efficient harvesting.

Conclusion

Factor premia exists because of economic rationale and behavioral biases in asset pricing. Therefore, ESG may play an increasingly important role for factor investors in China. China’s carbon neutrality goals are expected to effect a long-term low carbon transition across all industries which may also lead to a source of risk premium for factor investors.