Sizing up the potential of the Greater Bay Area for local investors

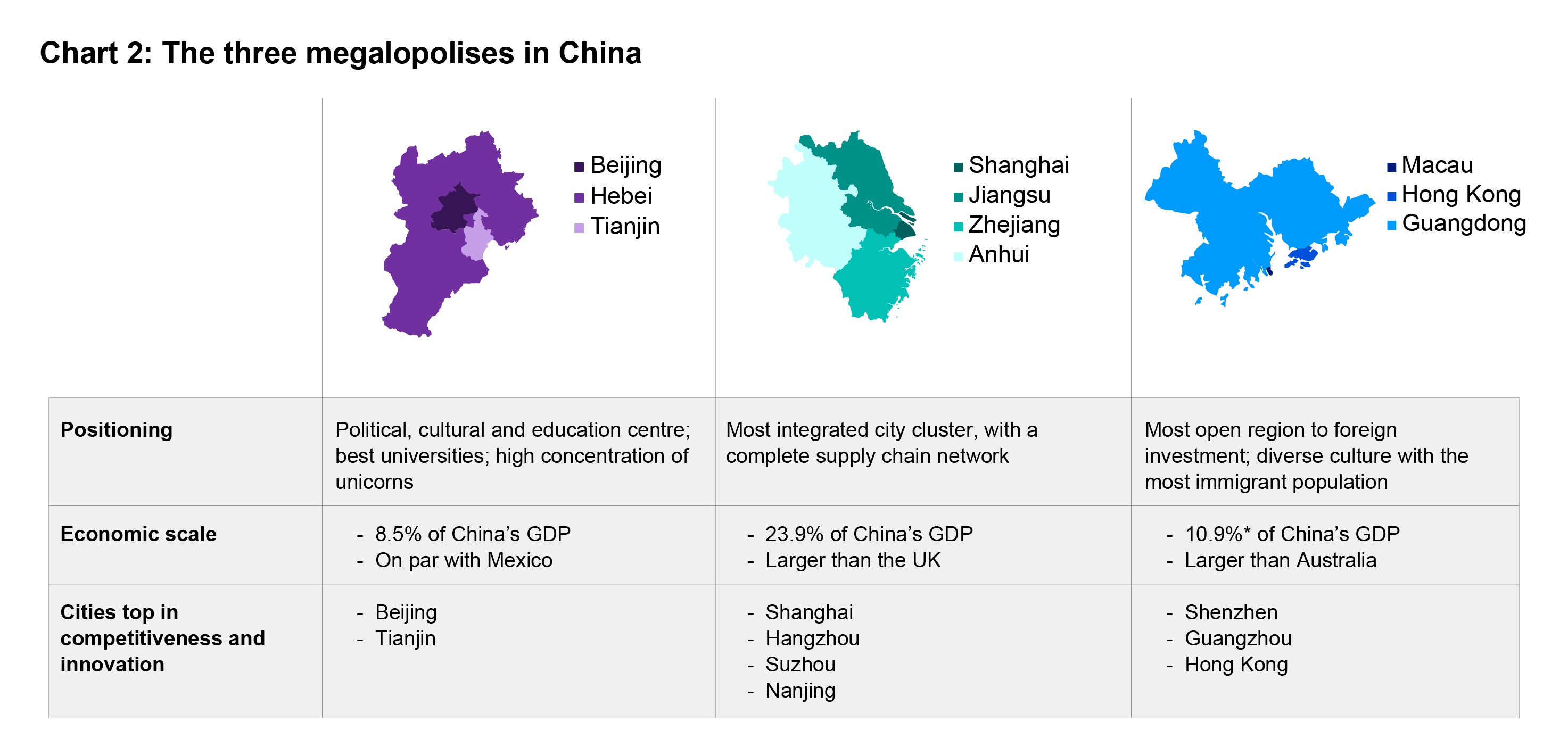

Since it was announced in 2017, the Chinese government’s scheme to link Hong Kong, Macau and nine mainland cities in the Pearl River Delta has been gaining ground. The Greater Bay Area (GBA) undoubtedly represents a unique opportunity for investment managers to serve a relatively untapped client segment. According to one report, over one-fifth of China’s high-net-worth households, with assets amounting to around RMB 10 million or more, were based in the GBA region as of 2019.1 One important development for local investors is the Cross-Border Wealth Management Connect pilot scheme. By leveraging the pilot scheme, mainland residents based in these nine Guangdong cities will soon be allowed to buy cross-border investment products sold by banks in Hong Kong and Macau and vice versa.2 The new demand base for onshore and offshore securities could drive market liquidity, boost product diversity and quality, and facilitate the flow of capital within the region. We speak with Invesco’s experts on the possible opportunities that this scheme and the GBA more broadly can present for their local investment offerings.

Mike Shiao, CIO, Asia ex Japan (Asian equities)

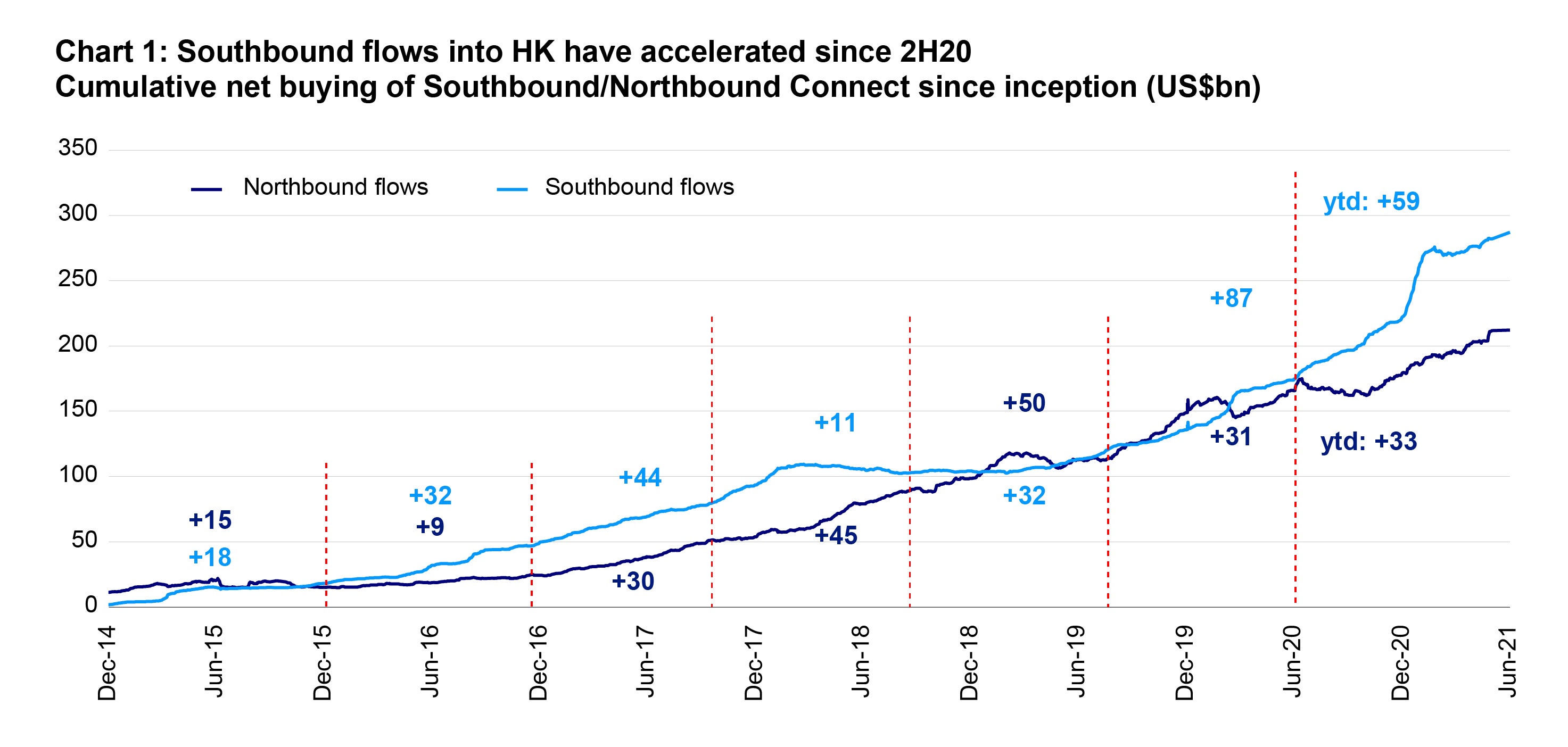

The Wealth Management Connect scheme will provide opportunities for domestic investors to diversify their current holdings and hold products that are otherwise not available to them. In the past half year, we have seen strong demand from domestic investors for offshore Chinese equities. Southbound Stock Connect flows amounted to US$59bn year to date as of late June, compared with US$87bn for 2020 (see Chart 1). Most notably, we see unique opportunities in structural growth sectors such as internet, consumer, and healthcare. While this is encouraging, details of the scheme are yet to be announced, and we are following these developments closely.

From an investment perspective, we expect the financial services industry to benefit from this scheme, as ongoing liberalization efforts will help expand their customer base and enrich their product offerings.

Chin Ping Chia, Head of China A Investments (China A shares)

The most immediate benefit of the Wealth Management Connect scheme is the broadening of investment choices available to investors in the GBA. The scheme will allow GBA domestic investors to gain exposure to a larger variety of non-RMB offshore equity investment products. At the same time Hong Kong and Macau-based investors will be able to tap into a large pool of RMB-based onshore equity investment products.

From a policy angle, the success of this scheme will also pave the way for further integration between China’s onshore and offshore financial markets.

Freddy Wong, Head of Asia Pacific, Fixed Income (Fixed income)

The Wealth Management Connect scheme will enable GBA residents to move away from investing in traditional wealth management products and gain access to specific onshore and offshore fixed income solutions. Investor interest in ESG-related bonds can also be expected to rise as ESG reporting by mainland corporates becomes more commonplace (on the back of China’s Net Zero target). More broadly speaking, the GBA is home to many private companies and entrepreneurs in fields such as technology or innovation that are looking at debt financing options to fund expansion overseas or via the Belt and Road Initiative.

Chang Hwan Sung, Portfolio Manager (Invesco Investment Solutions)

Traditional onshore wealth management products with implicit guarantees are becoming a thing of the past given the recent regulatory reforms. Considering this, GBA residents can look to invest in multi-asset products to achieve attractive risk adjusted returns in the current low interest rate environment. Also, volatility overlay strategies based on multi-asset investments can help investors control for volatility while also providing diversification benefits.

Catherine Chen, Asia Pacific Real Estate Investment Strategist (Real Estate)

From a real estate perspective, investors can consider investments in modern logistics, data centers and office markets within the GBA. Fundamentals remain stable in logistics and we foresee low supply risk in the near future. Relative to other city clusters in China, the GBA recorded the lowest vacancy rate for this market in 1Q21 at 2.8%.3 The rollout of 5G and the high concentration of technology firms in the GBA (from start-ups to unicorns and listed companies) is also expected to underpin strong demand for low latency data centers. Regarding offices, as the Chinese government’s 14th Five-Year Plan focuses on developing the new economy, we expect stronger demand to come from the TMT, online services, healthcare, and financial sectors in the medium term (despite the short-term risks of a supply surge in Hong Kong and Shenzhen in 2022 and 2023)4.

^1 Wealth Manageent Connect Scheme in the Greater Bay Area, June 2020, https://www.hkma.gov.hk/eng/news-and-media/insight/2020/06/20200629/

^2 GBA Wealth Connect scheme becomes effective on June 5, May 2021, https://www.theasset.com/asset-management/43574/gba-wealth-connect-scheme-becomes-effective-on-june-5

^3 JLL, data as of 1Q21

^4 JLL, data as of 1Q21