AI and global consumer trends

Artificial intelligence and consumer sectors

AI will generate market share-shift and profitability changes across the economy in every sector. Perhaps an area that is not fully appreciated yet is the impact it will have on the consumer.

Areas we typically favor within the consumer space – such as eCommerce, digital media and ridesharing – are all being enhanced now with AI. Some examples include using generative AI to summarize hundreds of customer reviews into a short paragraph, using AI to optimize streaming quality based on internet speed and device capabilities, and implementing rules-based machine learning models for driver-rider matching.

Rather than focusing solely on AI infrastructure buildout, which is what has moved the equity markets over the last year, we are taking a longer-term view. While we have exposure to semiconductors, we believe that AI software and services are a longer dated and potentially bigger opportunity overall.

The market has been fairly concentrated in mega cap winners recently and we believe there is more room for them to grow as they have plenty of cash to fund new opportunities.

Over the next few years, the cash flow will flip for them, from outflows/spending on AI infrastructure… to inflows/selling AI cloud products and services to almost every publicly traded company.

How will AI play out as an investment theme overall?

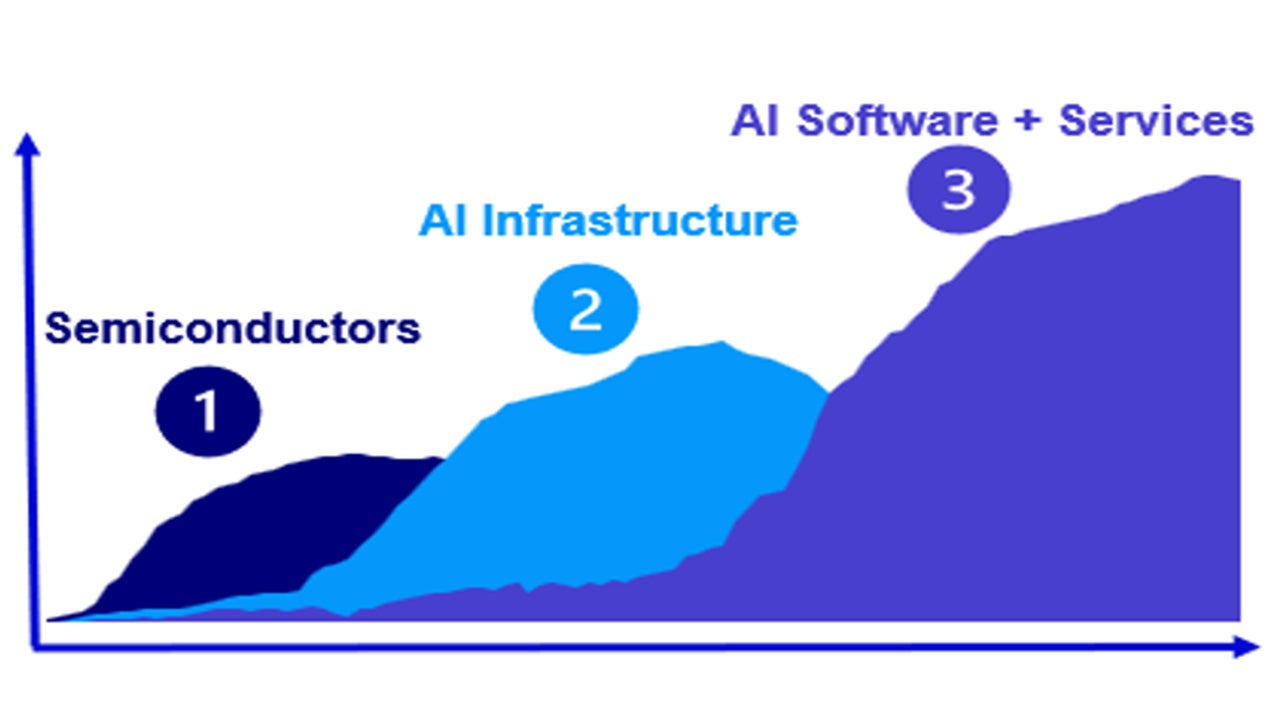

We think about AI as a larger cycle and believe it will come in 3 waves

Source: Invesco, for illustrative purpose only, hypothetical growth over time

1st wave - Datacenter and semiconductor is current opportunity

- Large ramp in server capacity – Money is coming from Hyperscalers (cloud services providers).

- It’s a big name game as these are the only companies that can spend $50B+ a year to create these products.*

- Capex more than doubled last 3 years. During May alone, company guidance for 2024 capex was revised from $157B to $182B (an increase of $25B) (Capex was $128B in 2023).*

- -This is an arms race and there is visibility on continued high spend into at least mid 2025.

- -Chips for computers and phones to run better games faster, chips for cars to do more autonomous safety and self driving.

- Money is going to the GPU chipmakers

- -Even faster GPU’s / Accelerators are coming out this year, with even higher average selling prices.

- Network tools, components, electrical, Heating, ventilation, and air conditioning (HVAC) cooling solutions are also benefitting from the AI data center buildout.

2nd wave is AI infrastructure:

- Money will go to: Large language models (LLM) and Cloud Services Providers will sell AI solutions capabilities to every company.

- These companies are spending today to get paid later, because they realize the attractive Return on Investment (ROI) from AI.

- Money will come from: Most public companies on the planet are evaluating AI ‘proof of concept’ projects now to determine their ROI.

- Some will quickly deploy these capabilities, generating revenue for the hyperscalers and LLM’s.

- Most will take another 12-36 months before they begin paying to deploy AI capabilities for their business.

3rd (and we think the biggest) wave is the AI software, services & edge devices:

- Just like in mobile & internet cycles - most wealth creation will come from share-shift from productivity enhancements, time efficiencies and/or from improved profits from labor displacement.

- Application deployments in many cases are a longer time horizon with beneficiaries emerging in 2025 and beyond.

- AI content recommendation, content creation and task/productivity assistants will change the way consumers interact and consume.

- Generative AI is not software – it’s an assistant that displaces the software. Chatbots are on their way to becoming seamless intelligent interactions.

- A digital assistant to improve efficiency, with ability to interact among multiple applications.

- Ability to translate in real time, such as texting in another language.

- Hyper-stimulating engagement and leading to increased ad-sales through AI in the newsfeed.

- Developing video games faster and cheaper, as well as integrating chatbots to interact with players within a game.

- Automation: Companies using AI to automate and control physical things, such as robots that perform tasks, or vehicles that provide transportation.

- Automated driving has been taking longer than anticipated as it is very complex task and consequences of mistakes can be severe. AI will help get us closer.

- Our current view is the biggest early beneficiaries of autonomous driving will be the ridesharing services / a taxi-like solution.

- Paying the driver is currently the biggest cost to rideshare companies.

- Potential to operate the vehicle more hours / day (given no driver, will not need sleep or breaks).

- Also becomes more efficient as the car is sent to where the rides are most needed (given no driver, will not override location).

Potential beneficiaries – video games developers and media content creators

- Video Games: Game developers can program much faster and cheaper with AI coding suggestions.

- They are taking advantage of this to program richer content and the consumer benefits from a better gaming experience.

- In some cases, game developers will use this to cut costs and deliver games faster, potentially increasing profit or sales.

- Media Content: The emerging high quality of user generated content with AI tools is amazing, and continually improving. We expect it will impact the value of media company content libraries.

- Some are already doing very well. If they can get additional high quality user generated content for free, the benefit accrues to the platforms.

- Some LLM makers will eventually swallow other businesses with these potential capabilities.

Areas at risk

- Outsourcing business services and call centers: We see outsourcing business services and call centers at immediate risk. AI is 1/6th price of a human in a call center, i.e. 80% cost savings.

- Media Studios: The emerging high quality of user generated content with AI tools makes us more worried about the Media Studios. While they also get benefits of improved content generation, but in long run it could compete with premium content.

- Graphics processing unit (GPU) demand will come from people wanting to create AI-powered content.

- On the horizon is the emergence of “text to video” product where a few lines of description give you a lifelike video which you can then edit to taste.

Conclusion

It’s not so much a question of will there be growth in global consumption from AI, but more of a question about share shift. Which companies will be the beneficiaries and who will be left behind. We believe that, rather than just focusing on semiconductors or AI infrastructure, looking ahead to AI services and software will be the bigger, longer-term opportunity.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.