Are we seeing a revival in Japanese equities?

Earlier this year, Japan started to attract keen interest from overseas investors. The rally was triggered by famous US investor Warren Buffett’s visit to Japan with the intention of increasing his equity investments. After the initial rally, the jury is still out on whether investors believe Japan’s revival is real. On the ground in Tokyo, our view is that while a near-term correction is possible, we are still constructive on the Japanese equity market both from a cyclical and structural standpoint.

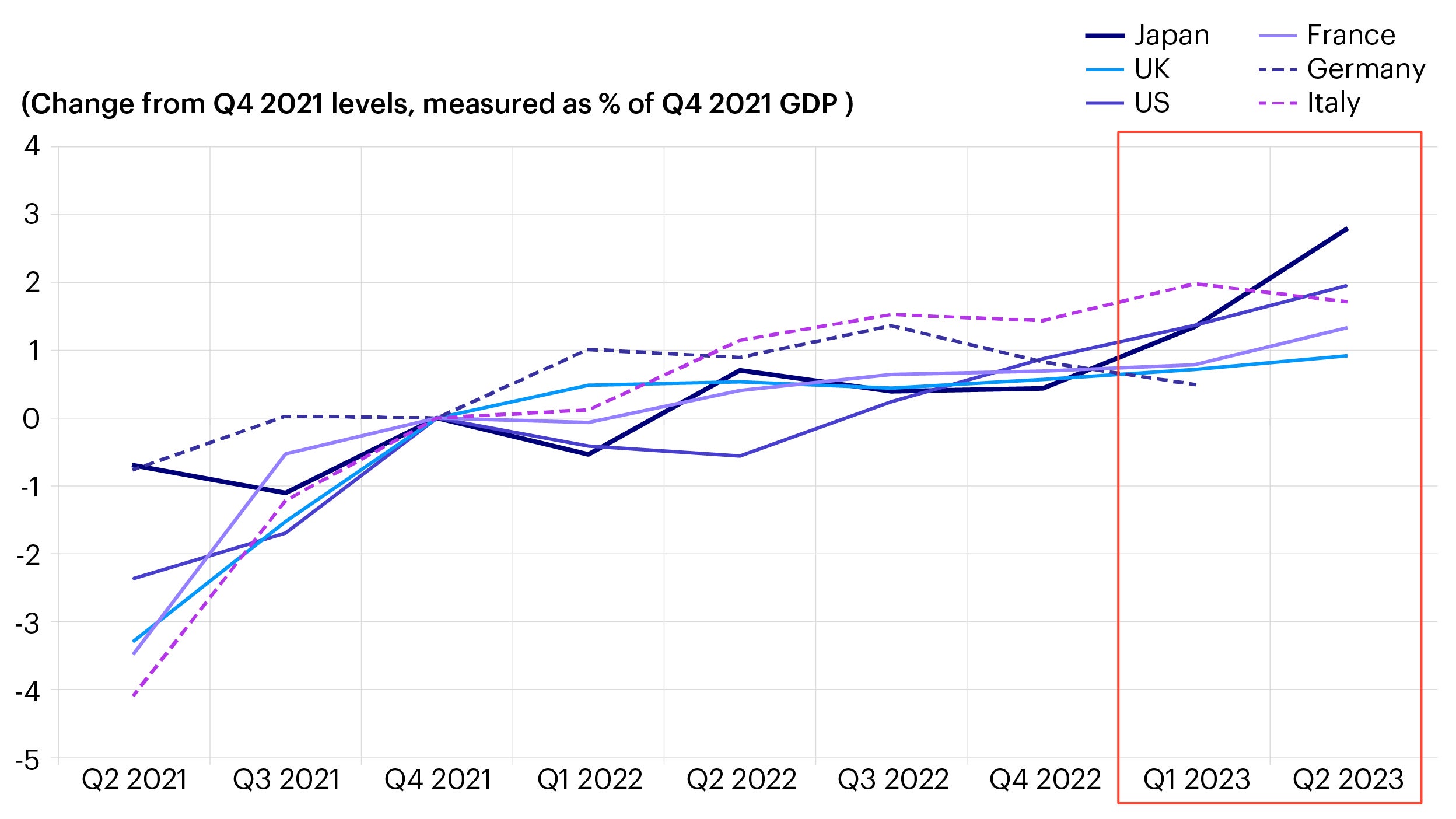

In the near term, we believe Japan’s economic growth momentum is expected to be stronger than the US and Europe, thanks to delayed economic reopening combined with buoyant inbound tourism demand. We have observed a significant recovery in inbound tourists, approaching pre-pandemic levels in Q2 2023. Chinese tourists have also returned and as of August 10th the Chinese government now permits group tours to Japan. We expect inbound tourism to continue to support Japan’s economic activities for the next 6 to 12 months.

Notes: Data for Q1 2023 and Q2 2023 are annualized.

Source: Invesco from CEIC. Data as at 13 August 2023.

As a result, Japan’s economic growth momentum is expected to be stronger than the US and Europe for the remainder of this year. The country’s year-to-date real GDP growth has already outpaced market expectations, with a 3.7% and 6.0% quarter-on-quarter seasonally adjusted annual rate in the first and second quarter.1 Apart from the reopening momentum, auto production recovery from supply chain disruptions and semiconductor shortages have ensured Japan’s manufacturing and exports remain resilient despite slowing global economic growth prospects. Structurally, capex demand remains strong among Japanese corporates thus they can cope with the country’s labor shortages and undergo green and digital transformation.

Source: Invesco from CEIC. Data as at 18 August 2023.

While capex and private consumption growth paused in the preliminary Q2 GDP readings, we believe that this relates to technical or temporal issues given that retail sales and corporate capex planning readings remain robust. Furthermore, the largest pay hike in 30 years was announced at the “Shunto” spring wage negotiations which translated into an actual wage increase since May. We believe this can support private consumption growth going forwards even after post-pandemic revenge spending diminishes. All in all, we believe mid-term economic growth potential is improving.

At the same time, the Bank of Japan (BoJ) has broadly maintained accommodative monetary policy measures to foster economic recovery, making a stark contrast to the stance of other developed countries’ central banks to combat sticky inflation. The BoJ also unexpectedly tweaked its monetary policy in August by relaxing the yield curve control to increase policy flexibility amid recent higher-than-expected inflation readings. If the long-awaited price and wage pick-up continues, the bank can step up the policy normalisation process by gradually expanding the long-term interest rate band. Such policy adjustments may also provide a backstop to the weakening Japanese yen, which has led to hesitation among foreign investors investing in Japan over the last couple of years.

On the other hand, the Tokyo Stock Exchange (TSE) has already geared up its corporate governance initiatives, which was the biggest positive surprise this year. The stock exchange’s formal request to disclose capital efficiency improvement assessments, plans and initiatives puts unavoidable pressure on Japan’s corporate management. The TSE’s goal is not to achieve a one-off rise in shareholder return but to ensure sustained corporate value growth among all its listed companies. This move also coincides with the government’s decision to enhance its tax exemption saving account scheme, or NISA (Nippon Investment Savings Account), from January 2024 to facilitate the shift of JPY 2,000 trillion (approximately USD 14 trillion) in household assets (the majority of which is kept in cash and cash equivalents) to investments. Households have also gradually been shifting their investment priorities away from safety and toward profitability, as cash is no longer king amid emerging inflation.

Source: BofA Global Research, The Central Council for Financial Services Information

(Note) Items related to safety, liquidity, profitability, and other fall include the following categories, respectively Safety: "Because the principle is guaranteed" and "I feel comfortable trusting the financial institution“ Liquidity: "Because I can make deposits and withdrawals freely, even small amounts” and "because it is easy to convert to cash“ Profitability: "Because it has a high yield" and "because the price can be expected to rise in future“ Other: "Because the product is easy to understand" and "other“ Based on Public Opinion Survey on Household Financial Assets and Liabilities (2022)

We see the possibility of a virtuous cycle and expect the TSE’s corporate governance initiatives to lead to consistent improvements in capital efficiency and profitability and, as a result, may encourage Japanese households to invest in equities along with the significant enhancement in the NISA. The return of inflation could also encourage households to take more risks and seek higher returns.