Breakthrough in Chinese stocks after further stimulus

Key takeaways:

- Mainland China / HK equity markets have surged around 10% since 24 Sept1 as investor sentiment does a 180 degree change as China unleashes trillions of RMB of monetary stimulus.

- More support is along the way - fiscal stimulus is likely to pick up meaningfully in the coming months that should boost household sentiment and put a floor to the property market.

- Despite the rally, valuations remain low compared to historical averages – which suggest another +20% upside from current levels.

- We expect global investors to go risk-on for the rest of the year as central banks cut rates and the economy experiences a soft landing; bigger Fed cuts have opened the door for the PBOC to ease with more velocity.

- Emerging Markets (EM) and particularly China is likely to outperform as the USD weakens and investors hunt for higher returns; foresee possible rotation out of the expensive and crowded global tech trade into cheaper EM assets.

- Monetary easing alone in China won’t right-size the economy and provide the structural solutions that are needed longer-term but it is the solution to turn-around investor and household confidence – which is exactly what the markets need.

- China markets are about momentum and I see certain parallels between the existing rally and that of the 2014-2015 rally where the rally lasted around 9 months and China stocks rose around 100% despite GDP trailing off at that point.

Following a slew of monetary stimulus by the People’s Bank of China (PBOC), Chinese policymakers have announced a further volley of supportive measures to turn the economy and stock markets around.

Its particularly encouraging that these measures are increasingly targeted, taking aim at the consumer, housing market and banking system – with the intention for subsequent spillover effects into the broader economy.

- One-time cash handouts will be given to citizens deemed to be under a certain living standard, and recent graduates who are unemployed will receive increased social security benefits. On a local level, Shanghai will issue 500 million RMB in consumption vouchers to residents.

- A Politburo pledge for the property market “to stop declining” alongside new home construction limits to lower supply, coming right off the heels of lower mortgage costs and lower downpayment ratios on second homes.

- Sizable cash injections of up to 1 trillion RMB into top banks are being considered, to replenish capital and encourage loan growth.

The series of policy support executed at swift pace indicates to us that the government is responding more forcefully to headwinds and are pragmatically addressing concerns.

Further, the coordination of support measures bundled together – deviating from a previous incremental approach – may compel sentiment to improve more persuasively.

Fiscal transfers in the form of cash handouts will provide an important source of income security and social stability.

It is also timely, in anticipation of the weeklong National Day break in China when retail sales typically experience a boost.

One can argue these handouts aimed at the lower range of the income spectrum is the most direct way to raise consumption and overall demand.

It's been our view that stabilizing the housing market would be a cardinal step in revitalizing the Chinese economy.

About 70% of household wealth is tied to property, meaning stemming the downfall in prices has potent wealth effects and confidence implications.

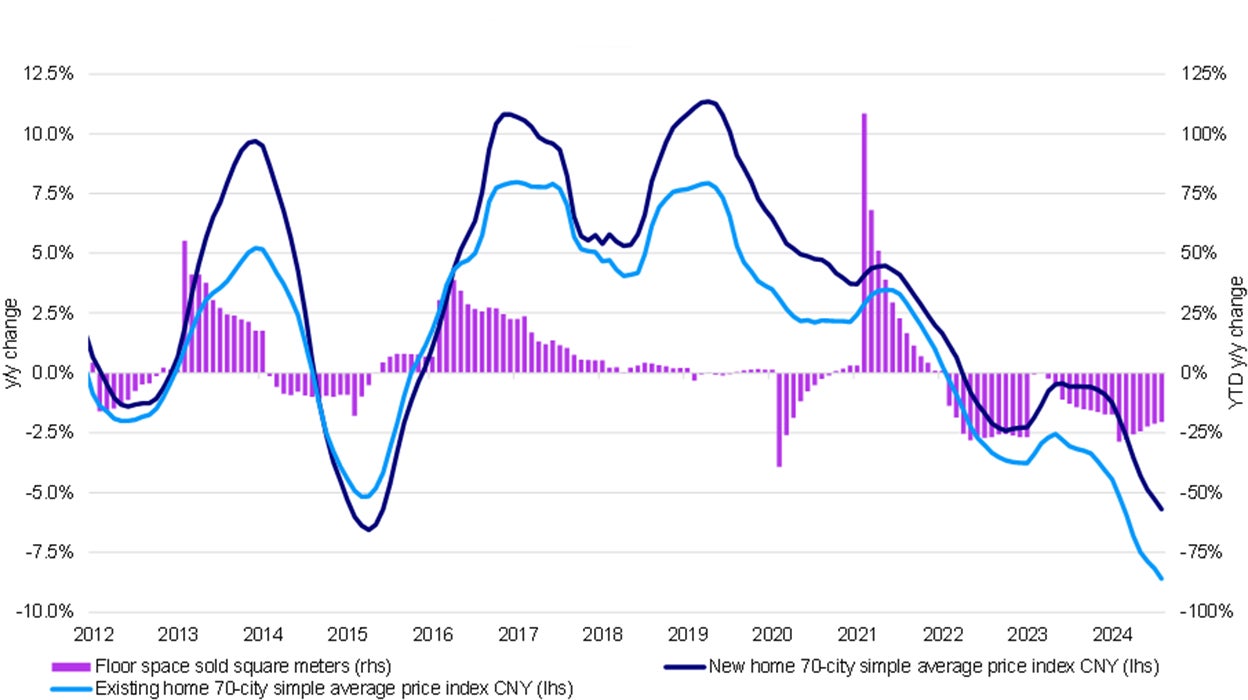

Official NBS statistics revealed that new home prices fell by -5.7% y/y and existing home prices fell by a greater -8.6% y/y in August.2

Source: National Bureau of Statistics (NBS). Data as of August 2024.

On the banking front, capital injections via special bonds could allow for a fiscal push without counting to the top line budget deficit for the year.

We shouldn’t read into this as the banks being distressed. China’s systematically important banks have an average core tier 1 capital adequacy ratio of 11.8% against an 8.5% requirement.3 Rather, it would seek to ensure lending capability and possibly take more credit risk.

Is this the policy bazooka we have been waiting for?

We believe that its certainly one part of it, though not quite in whole. The latest easing measures are positive, and policymakers have indicated more aggressive fiscal expansion is likely to come. It would be apt to focus on boosting consumption and sustaining investor confidence, taking a holistic approach to support the economy.

Market implications

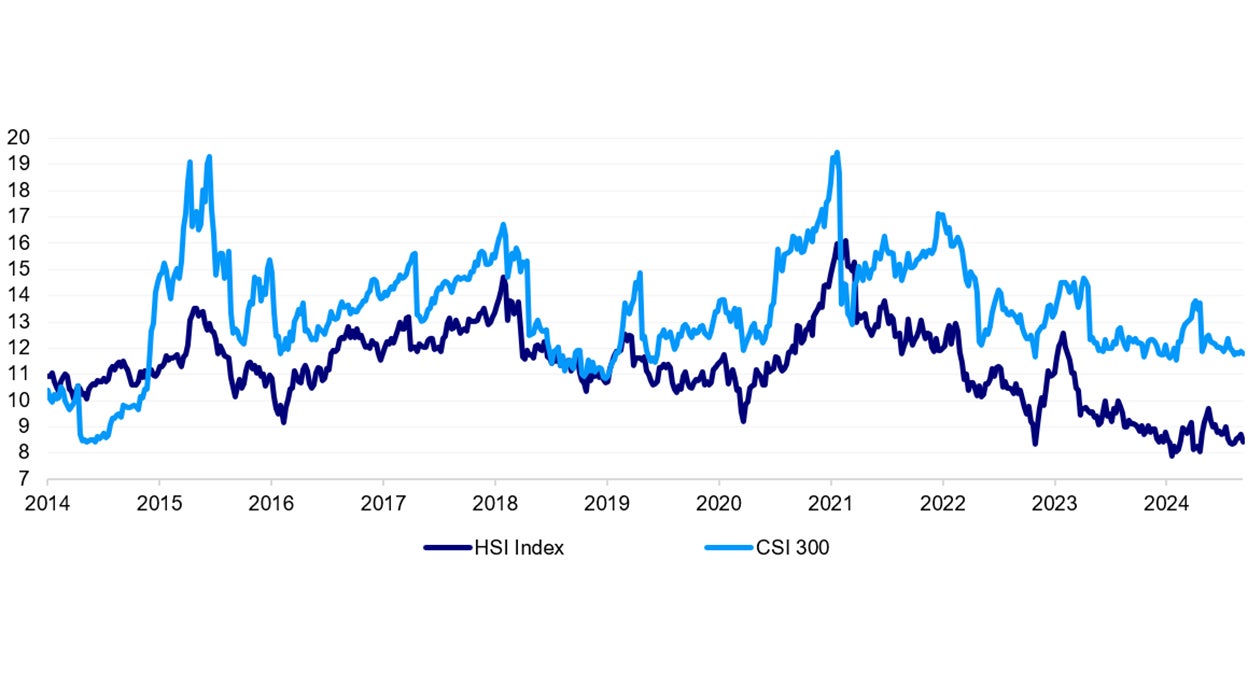

Asian markets have taken in the news of Chinese stimulus very optimistically. Its clear risk sentiment has turned to the upside, especially taken together with the Fed’s outsized rate cut. The CSI 300 has posted double digit gains from year lows and is now positive for the year. The HSI rally has been even stronger and is approaching technical bull market territory year to date.

It helps that the positive catalyst of stimulus measures comes at a time when Chinese equities are trading at attractive valuations, acting as an adrenaline shot.

Source: Macrobond and Bloomberg. Data as of 10 September 2024. Note: Past performance does not guarantee future results. An investment cannot be made directly into an index.

We like large cap names. Consumption stocks have potential should the macro demand picture shift more decisively.

The signs emerging from policymakers that they are now actively looking to support the stock market is telling.

The prospect of rising stock prices offers to position an appreciating asset on household balance sheets and also lifts confidence. Approximately half of mainland stocks are owned by corporates and individuals; retail investors own roughly a quarter.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.