2026 Investment Outlook – Chinese Equities

China’s equity market made a strong comeback in 2025 after years of uncertainty, supported by breakthroughs in technology, structural economic transformation, proactive policy support, strong liquidity, and attractive valuations. Looking ahead to 2026, we remain constructive, as improving fundamentals and long-term growth drivers continue to support a more sustained and structural growth cycle.

Externally: Global rate cuts could reignite flows into China

Externally, the global monetary environment is expected to enter a rate-cut cycle in the coming year, which usually historically trigger capital rotation away from the U.S.-centric markets toward more attractively valued emerging economies like China. Chinese equities, characterized by their scale and improving corporate fundamentals are well-positioned to benefit from this shift. This anticipated rebalancing could offer medium- to long-term support, especially as global investors increasingly seek diversification beyond developed markets.

In 2026, we expect three key trends to shape opportunities in China’s equity market.

Industrial upgrading: A new growth engine

In China, we expect the industrial transformation to remain a key theme for equity investors, as China continues to shift from its traditional role as a low-cost exporter to a global leader in high-end manufacturing and innovation. Key sectors, such as electric vehicles (EVs), pharmaceuticals, and automation, are set to drive the next phase of growth, supported by a competitive industrial ecosystem and increasingly cost-efficient technologies.

R&D investment continues to rise, signaling a strong commitment to innovation-led growth. Companies with robust R&D pipelines have the potential to deliver favorable long-term returns as they capitalize on rising demand for advanced products and solutions. The rise of Chinese brands is also reinforcing the value of “Made in China,” with EV companies now exporting vehicles built on fully localized supply chains. China’s leadership in EV and battery technology positions it at the forefront of the global energy transition. For example, the Chinese brands EV accounted 76%1 of global EV and plug-in hybrid electric vehicle (PHEV) sales this year. Moreover, China largest EV battery company market share was about 37%2 in the global market. The leadership in EV and battery technology places China at the forefront of the global energy transition and electrification trend.

Pharmaceutical innovation is another critical area to watch. Chinese firms are expanding beyond oncology into broader therapeutic areas, moving from fast-following to pioneering first-in-class drugs. This evolution marks a significant step in China’s journey toward becoming a global innovation powerhouse—one that could unlock new investment opportunities in 2026 and beyond.

AI momentum: Building the future

Looking forward, artificial intelligence is set to be a key growth engine for China. The launch of DeepSeek in early 2025 showcased China’s ability to deliver high-performing, cost-efficient large language models, signaling its emergence as a formidable contender in the global AI race. While the U.S. continues to lead in software, China is rapidly narrowing the gap and is well-positioned to drive the next wave of AI transformation.

Looking ahead, China’s advantages in data scale, energy efficiency, and infrastructure will be increasingly important. With one of the world’s largest internet user bases and relatively low energy costs, China has the foundation to support large-scale AI development and deployment. On the hardware side, we expect continued progress in robotics, drones, and humanoid applications—key components of the broader AI ecosystem.

China’s deep talent pool, vast data resources, and ability to scale automation efficiently give it a competitive edge in converting AI innovation into real-world productivity gains. As AI adoption accelerates across industries, China is well-positioned to capture long-term value through both innovation and application. This presents a compelling opportunity for investors to tap into China’s long-term potential across AI innovation and application.

Consumption evolution: Unlocking new growth frontiers

Looking forward, China’s consumption landscape is set to undergo a significant transformation, driven by shifting demographics and evolving consumer preferences. While the national savings rate remains high, it is likely to decline as younger generations embrace more experience-driven and emotionally resonant spending. This demographic is increasingly allocating their budgets toward services and domestic intellectual property (IP), including online gaming, travel, entertainment, and social media.

IP-based consumption, often serving as a form of emotional engagement or companionship, is gaining traction. For instance, the surge in popularity of Chinese designer toys reflects younger consumers’ preference for expressive designs and emotional appeal. As this service-oriented and emotionally driven consumption model expands, we anticipate the rise of new billion-dollar companies across these sectors—creating compelling opportunities for investors seeking exposure to China’s next wave of consumer growth.

Beyond these investment themes, China’s equity market outlook remains positive, supported by strengthening fundamentals and favorable market dynamics.

Valuation, liquidity, and earnings support the case for Chinese equities

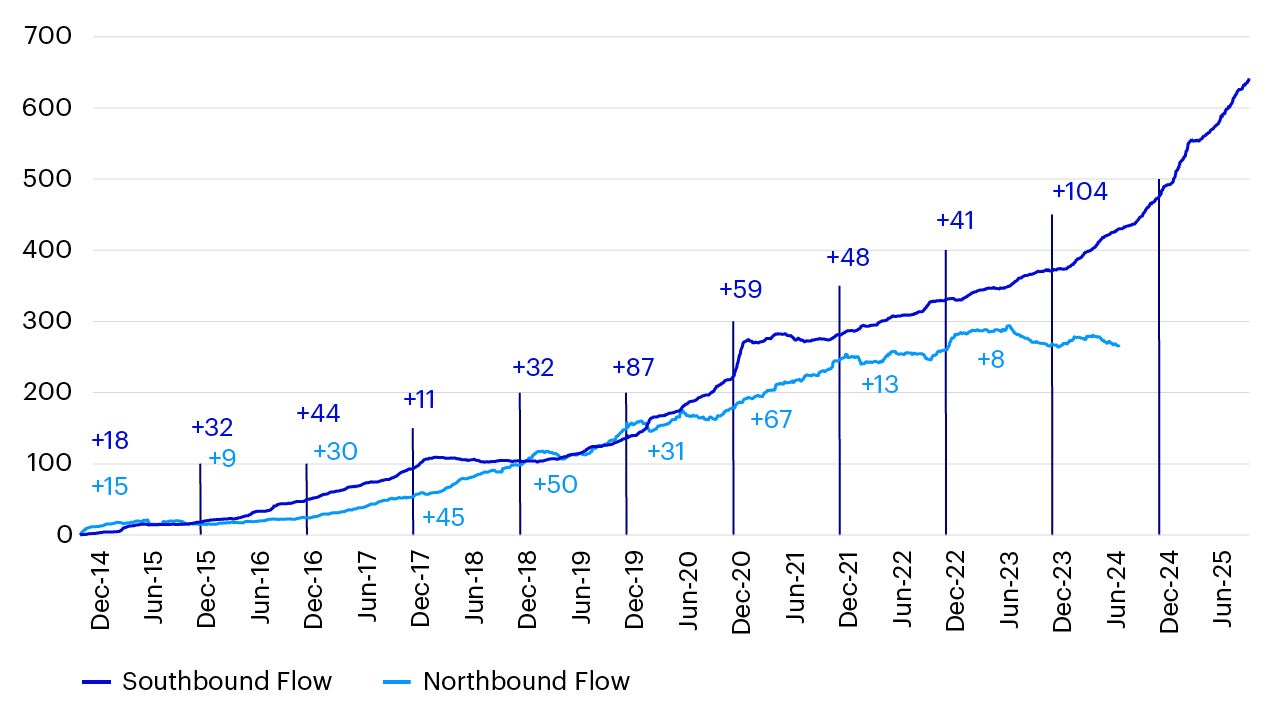

Despite the strong rebound in 2025, Chinese equities continue to trade at attractive valuations, with the MSCI China Index still trading at around 40% discount3 compared to developed markets. Liquidity trends are also encouraging, substantial southbound inflows into the Hong Kong market reflect growing interest from domestic investors in offshore Chinese assets, and we anticipate this momentum to continue in the coming year.

Source: FactSet, HSBC, October 31, 2025. *Northbound data is no longer disclosed from August 16, 2024.

On the fundamentals side, corporate earnings have shown clear signs of recovery. We believe earnings per share (EPS) levels have likely bottomed and are poised to improve further, while return on equity (ROE) and earnings before interest and taxes (EBIT) margins have reversed previous declines. Enhanced operating efficiency and better leverage are driving stronger net margins, reinforcing the case for continued performance and long-term investor confidence.

Source: Factset, Invesco, data as of September 2025.

Positive shift in risk sentiment

While some volatility may persist due to uneven geopolitical dynamics, particularly in the U.S.-China relationship, recent developments are encouraging. High-level discussions between the two nations have led to pragmatic progress, including agreements to roll back trade barriers in key sectors such as semiconductors and rare earths. Both sides have committed to reviewing these agreements annually, laying a constructive foundation for continued dialogue. We believe this marks a positive step forward and strengthens the fundamental backdrop for Chinese equities.

We maintain a constructive outlook on Chinese equity market, supported by a combination of improving macroeconomic conditions, resilient corporate fundamentals, growing investment trends, and ample market liquidity - all of which reinforce the case for long-term investment in Chinese equities.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.