China’s new consumerism fueled by the young generation: Part 1

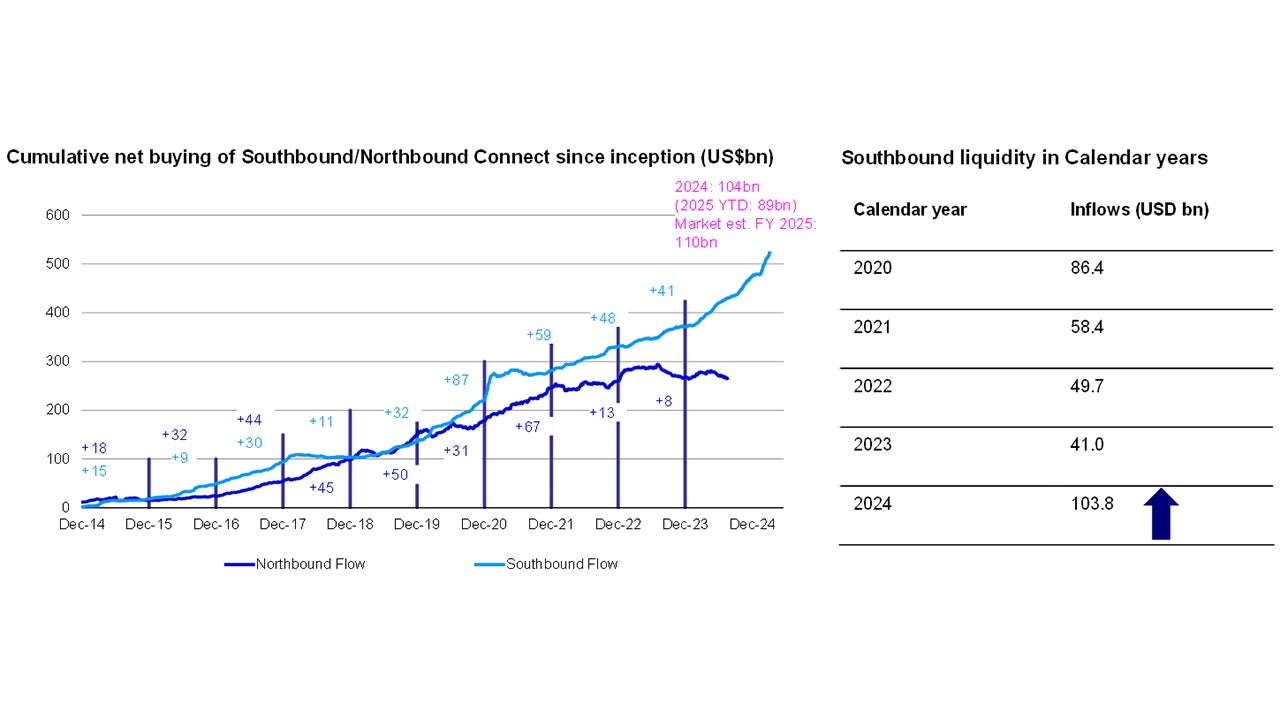

Hong Kong stock market is one of the best performing equity markets year-to-date, up 20.8%.1 We have seen strong liquidity, mainly Southbound liquidity (chart), propelling Hong Kong stock index.

The rally has been partly fueled by investors chasing the theme of “China’s new consumerism”, which sees Chinese intellectual properties (IPs) becoming very popular among the younger generation. Many of the sector leaders in “China’s new consumerism” are listed in Hong Kong.

We believe that “emotional consumption” helps to explain this phenomenon, which sees Chinese IPs not only achieve success locally but are also going global. We believe the next decade will be a “golden era” for Chinese IPs.

Another catalyst fueling the stock market rally is the continuous innovation that results in technological breakthrough in sectors such as China healthcare which could lead to higher margins.

In a two-part series, we will detail our thoughts on each of these drivers. In Part 1, we will focus on “China’s new consumerism”. In Part 2 we will focus on “Innovation”.

“China’s new consumerism” - a trend driven by the younger generation

Specifically, “emotional consumption” differs from “impulse shopping.” IP-based consumption is essentially a form of emotional transference: consumers are not just buying products, but projecting their feelings onto them.

Unlike traditional functional purchases like alcohol or handbags, IP consumption serves as emotional support or companionship. As a prime example, in the past year, some Chinese designer toys have become hugely popular among the younger generation, in which we attribute to the resonance of the younger generation with the emotional aspects of the designer toys, which have various unique outfits and facial expressions.

Following the success in mainland China, Hong Kong and Macau, Chinese IPs are going international, expanding into Southeast Asia and even breaking into Western markets.

We believe the universal emotional appeal embedded in Chinese IPs gives them a natural edge in becoming global cultural leaders.

Source: FactSet, HSBC, Goldman Sachs estimate, as of 17 June 2025. *Northbound data is no longer disclosed from 16 Aug 2024

How do we value “Emotional Value”?

Some new consumer stocks are already highly valued, with static and trailing twelve months price-to-earnings (P/E) ratio nearing or exceeding 100. Valuing “new consumerism” has become a major challenge.

We propose using multiple valuation methods. For growth stocks, the PEG ratio (P/E divided by EPS growth) is commonly used. For example, if a company has a P/E of 100 and an expected EPS CAGR of 68% over the next three years, its PEG would be 1.4. Generally, a PEG below 1 indicates undervaluation, 1 is fair, and above 1 suggests overvaluation.

However, we believe that “soft metrics” like emotional value, user stickiness, and IP longevity should also be considered. The higher the emotional index and the greater the proportion of female users, the more valuation premium a company may command.

The key is to build an analytical framework to assess the “soft metrics”.

Valuation also depends on variables like the lifecycle of IP, which hinges on creativity and sustained output.

For example, the growth of designer toys depends on whether companies can continuously develop or license new IPs. Purely visual IPs without support from films or games may quickly lose appeal.

Chinese IPs going global

Going global is also critical. For instance, a major China IP toy company plans to open 90 stores across Southeast Asia and 25 new outlets in Australia in 2025.

While data for Europe and the US is unclear, the company’s international expansion is expected to be significant.

We believe the next decade will be a “golden era” for Chinese IPs.

While the current high valuations are still largely driven by the domestic market, the emotional resonance could stand Chinese IPs at good stead in international expansion, which could potentially drive growth further.

The outlook for “China’s new consumerism” and Hong Kong equities

Looking ahead to 2H 2025, institutions expect the consumer sector to continue outperforming the broader market, driven by high-growth stocks.

Categories like designer toys and new beverages will benefit from shifting consumer behaviour among Gen Z and millennials, as well as the growing popularity of domestic brands.

The bullish outlook of “China’s new consumerism” is attracting inflows to sector leaders, which are listed in Hong Kong.

As the Hong Kong market continues to see inflows, we believe that investors will discover more opportunities in the Hong Kong stock market, where a lot of the stocks are attractive valued.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.