Insight

China reopening – a strong catalyst for consumption recovery

An earlier-than-expected ease of restrictions

- China has removed quarantine requirements for inbound travelers.

- COVID related travel restriction eased on the same day for international travelers, China has reconnected with rest of the world.

- People who tested positive are no longer required to stay in centralized quarantine centers.

- All these measures signal a reopening and have come earlier than the world have expected.

- There may be potential short-term supply chain concerns, however, we believe the risk is manageable and it will be less likely as impactful as the lockdown in China last year.

A strong positive for consumption recovery

- A consumption recovery will be well supported by a combination of excess household savings and increase in domestic and international mobility.

Excess household savings:

- Chinese households have accumulated excess savings in the past three years as economic activities were restricted by frequent lockdowns.

- It is estimated that an ~RMB 6.55 trillion, about 5.4% of nominal GDP was additional savings accumulated during the pandemic.1

- We believe the unreleased spending power will be a strong tailwinds for consumption in 2023.

Increase of mobility:

- Intra-city mobility has recovered swiftly and already back to 75% of pre-pandemic level within a short period of time.2

- We anticipate that mobility and activities will step up to the next level with the upcoming Chinese New Year.

- The relaxation for international inbound travelers will link China back to the rest of the world.

- Mobility and activities will pick up quickly and we should see decent economic growth recovery.

Source: CEIC, Wind, Morgan Stanley Research, January 2023

A rapid and sustained recovery is in sight

- The earlier-than-expected and rapid reopening timetable suggested China’s recovery will come earlier and stronger than expected.

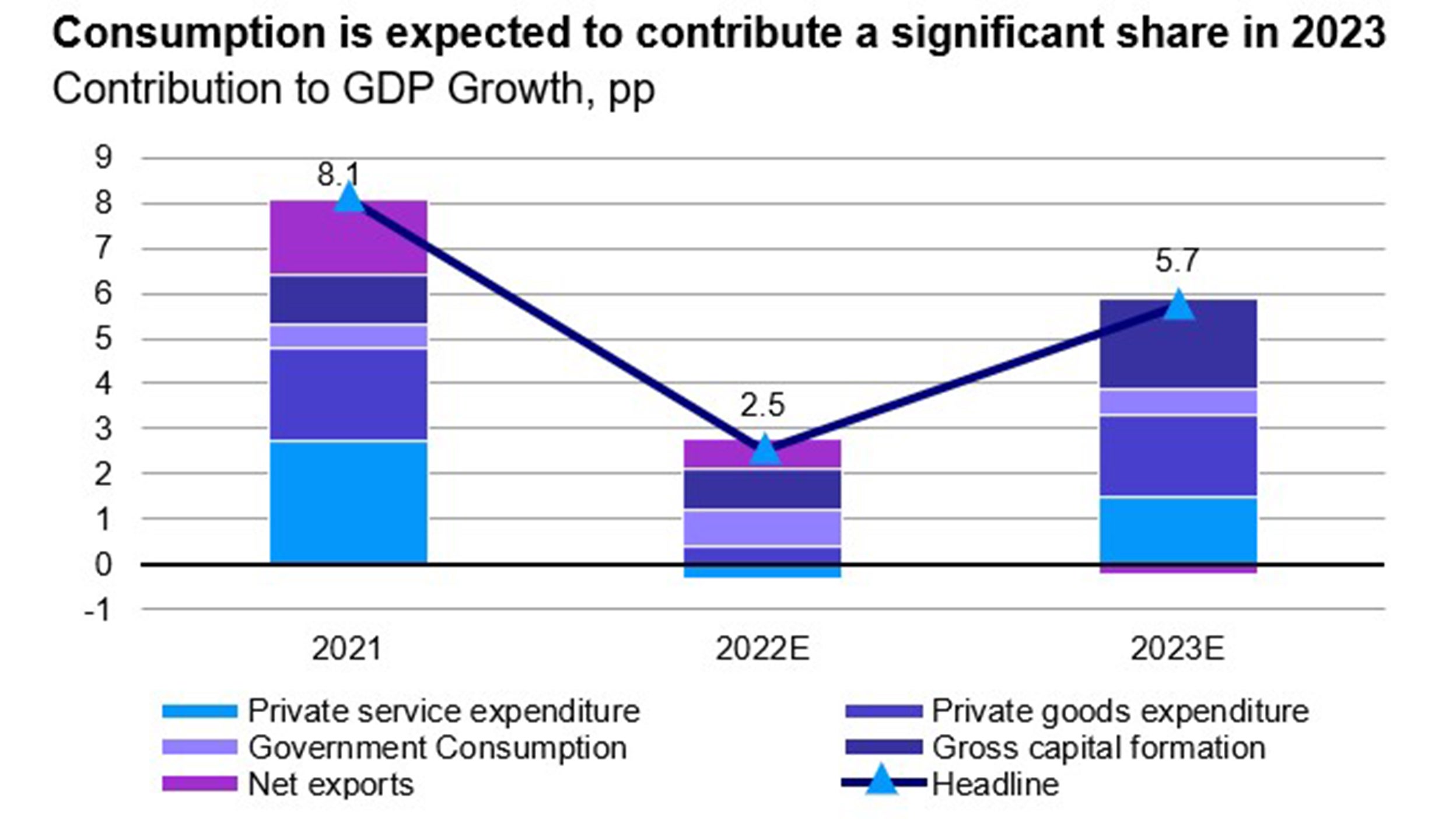

- We believe China’s GDP growth will likely reach mid-single digit in 2023 due to the surge in domestic demands and consumption recovery given strong domestic demand.

- We expect consumer services such as retailing, catering, tourism, entertainment and E-commerce would be first to recover, followed by the broader economic growth in 2023.

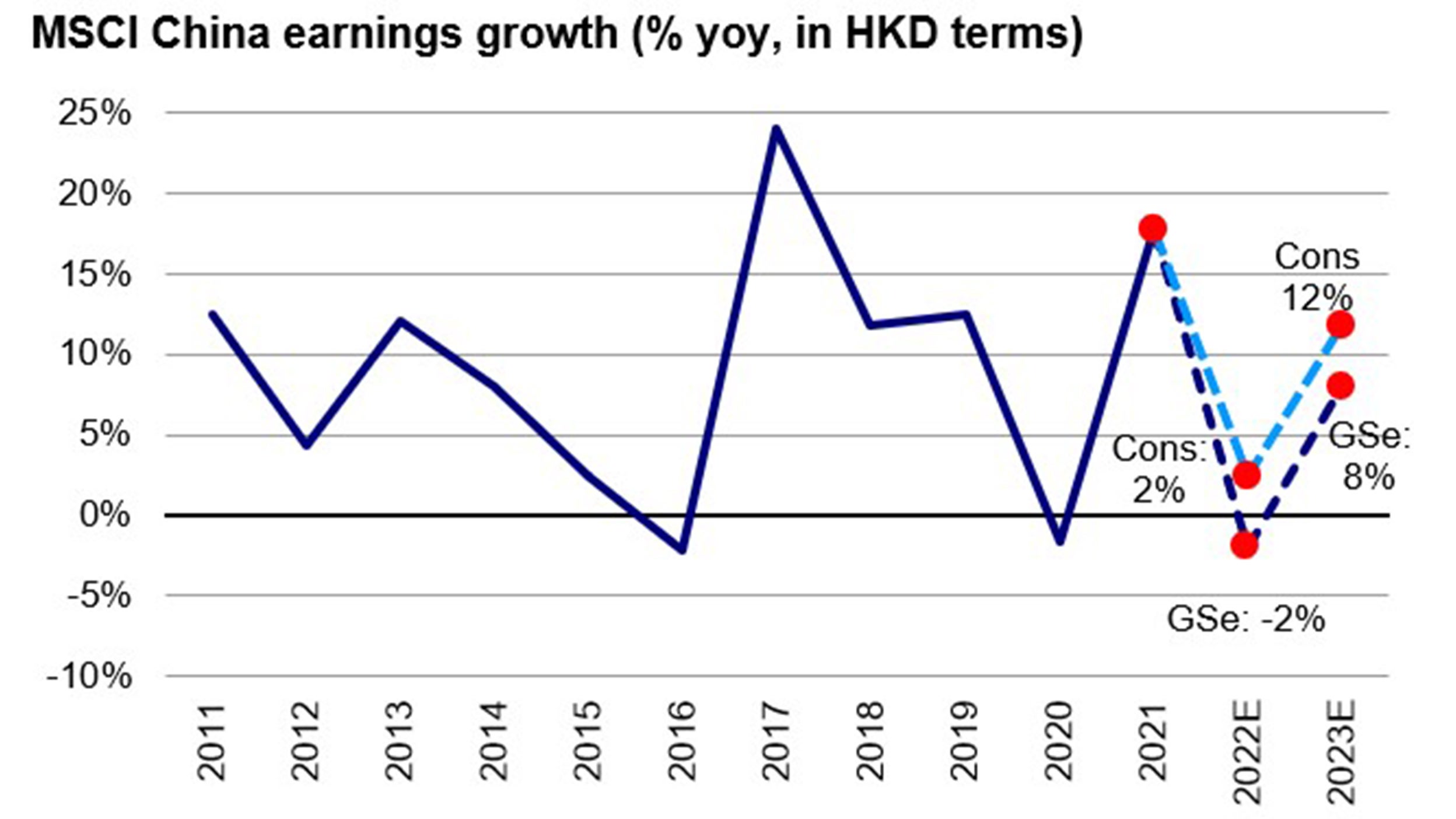

- We expect a further upside in Chinese economy and decent company earnings recovery in 2023. Earnings is expected to pick up strongly this year and we should also see a decent rebound in ROE. Earnings growth will likely be in double-digit with a strong year-on-year increase, particularly in consumer discretionary, staples and communication services sectors.

- Earnings growth will be a strong driver for re-rating looking ahead.

Source: Goldman Sachs Global Investment Research, January 2023.