China’s innovation to become a catalyst for earnings growth: Part 2

Hong Kong’s equity market has become a focus not only for being one of the best-performing markets in 1H 2025, but also for ranking No. 1 in funds raised through IPOs during the same period.

Latest data showed that HK$107 billion (US$13.6 billion) had been raised through Hong Kong’s 42 IPOs in 1H 2025, putting the HK stock exchange in first place for funds raised globally, according to the Financial Secretary.1

Given the strong liquidity and momentum, we believe that Hong Kong equities will continue to see opportunities and growth potential in 2H 2025.

In Part 2 of the series, we focus on a key driver for the equity market – China’s innovation. Many of the leaders in innovation are listed in Hong Kong.

Innovation – a key driver for value-add and profit margins

While some Chinese industries with large market shares have suffered from low margins due to intense competition, we believe that a new wave of Chinese companies has emerged in recent years, achieving high margins through proprietary intellectual property (IP), technological innovation and product differentiation.

Given that many Western listed companies currently enjoy higher gross margins than their Chinese counterparts, the key to avoiding cutthroat competition and improving margins lies in China’s capacity for innovation from the ground up.

We believe that for every 1% increase in R&D investment, gross margins may rise by 1–2%, helping Chinese companies climb the value chain.

We believe that this is the path that China is likely to take over the next decade, with many Chinese sectors already featuring high-margin growth companies today.

The rise in gross margins, driven by technology and innovation, could be the most compelling story for China over the next decade.

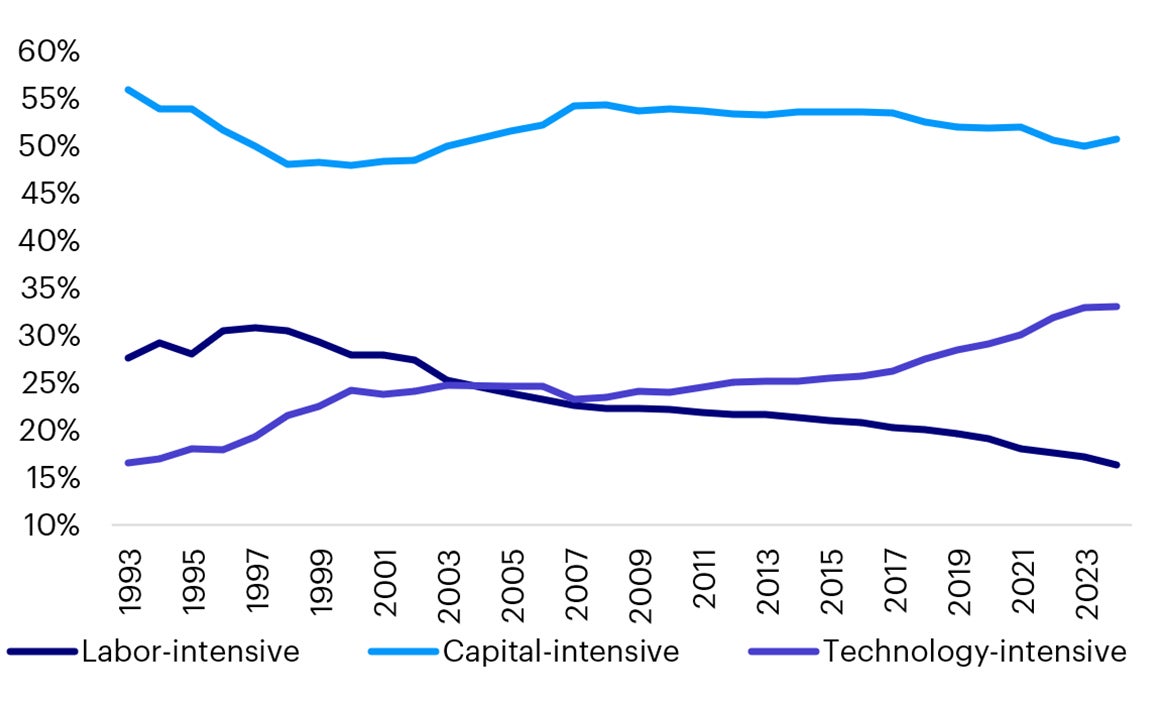

Source: National Bureau of Statistics, Morgan Stanley Research. Note: Labour-intensive industries include food & beverages, textiles, wood and paper products; capital intensive includes metals/minerals and petroleum-related products, non-electrical machinery, technology-intensive includes electrical and computing machinery and medicine-related products.

R&D investment on healthy uptrend

We believe the key to innovation lies in Chinese firms’ investment in research and development (R&D).

Increased R&D investment could lift China’s overall gross margin to 30%, significantly improving cash flow and profitability across the market. This could also boost per capita consumption.

China’s R&D efforts have been on an upward trend and in various industries. The following are some examples of the leaders in different industries.

HK-listed Chinese company demonstrating strong commitment to R&D |

Global market share |

R&D spending in the past 10 years

|

Gross margin in Dec 2015 |

Gross margin in Mar 2025 |

|---|---|---|---|---|

A leading PHEV player |

~38% |

~RMB 80bn |

15.3% |

19.2% |

A leading lithium battery player |

>30%

|

~RMB 35bn |

-- |

24.0% |

A leading smartphone player |

~14%

|

>RMB 60bn |

4.0% |

21.2% |

Source: Bloomberg, March 2025. For illustrative purpose only.

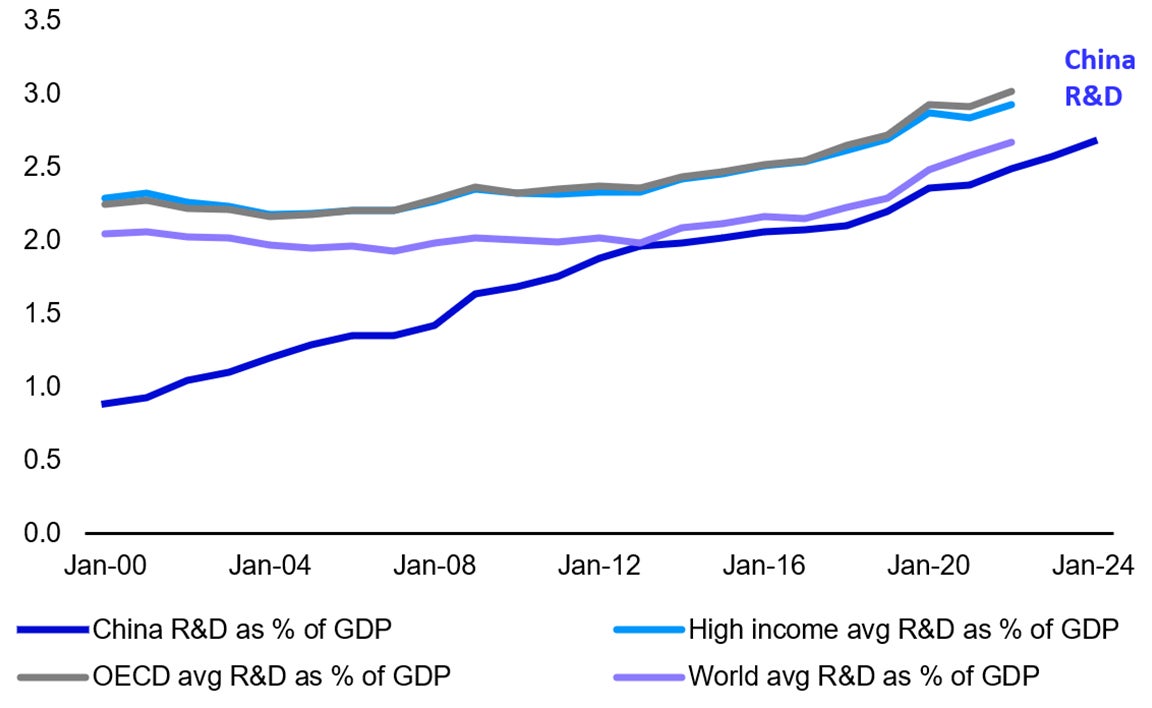

Source: CEIC, Morgan Stanley, May 2025

China has strong competitive advantages in R&D and industry upgrade, including

- Talent pool of engineers with 1/3 tertiary students graduating with engineering majors in 2022 (latest available data)

- Large domestic market

- Strong entrepreneurship culture

- Diligent and efficient labour

- Strong digital capability

- Low funding cost

Investment Implications

We expect innovation and AI application to be a long-term driver for both China and Hong Kong equities.

We believe that Chinese companies are likely to focus on improving gross margins over the next decade, supported by advancements in technology and increased R&D investment.

Innovation and AI application are moving beyond traditional sectors, becoming more immersive and transformative across the real economy. These advancements are leading to increased efficiency and wider use in AI applications.

The development of more efficient AI models is enabling wider adoption, making AI solutions more accessible and applicable in everyday business operations.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.