Further volatilities and our key takeaways

Chinese regulators published strengthened rules over the weekend that require tutoring services providers for students through compulsory years of education to be run as not-for-profit operations and restrict these companies from capital-raising and foreign ownership. This has triggered sell-off in Chinese educational names, and more broadly Chinese equities.

We believe Chinese government is targeting specific areas such as education. We believe the broad internet sector remain solid, supported by positive prospect with strong earnings growth forecasted into next year.

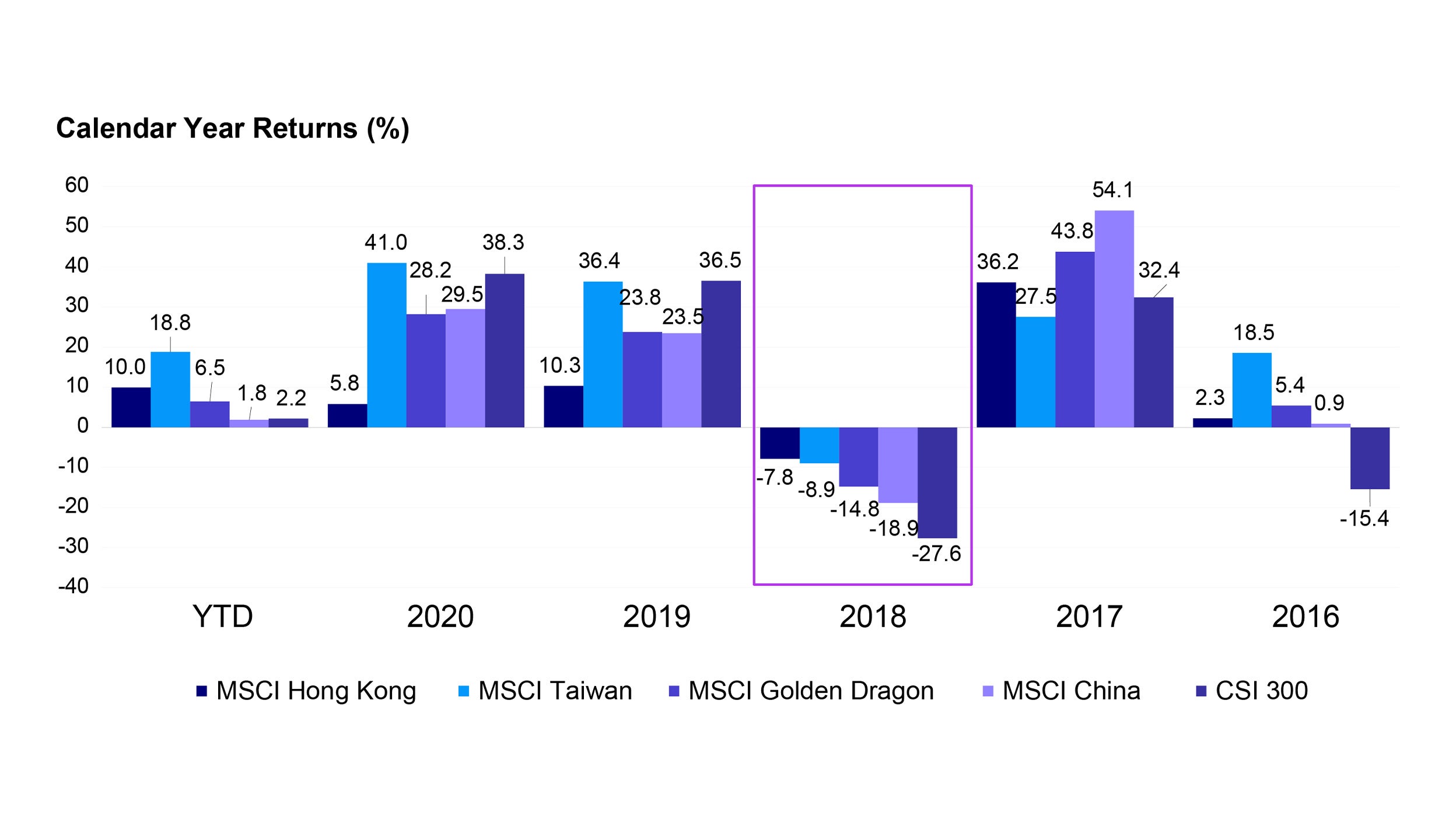

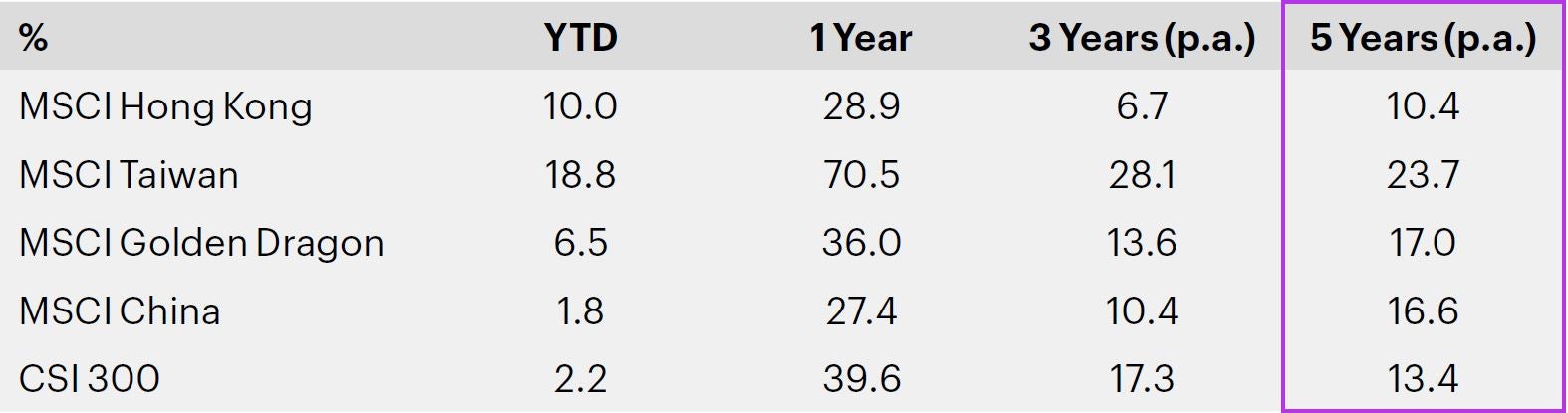

We believe investors can consider a broader exposure into Greater China to diversify risks. The Greater China market has good exposures to China while allocating to Taiwan which also offers attractive opportunities. On a five-year annualized basis, Taiwan returned +23.7% as of end June 2021, outperforming China (+16.6%) and Hong Kong (+10.4%).1

Government actions are targeting specific areas rather than broad-based

We believe investors should distinguish government investigations towards different areas. They are different in nature.

- Market sell-off was indiscriminate. The internet sector, as a medium, is touching on a wide range of underlying economic sectors. We believe the market overreacted without differentiating companies or focusing on their fundamental businesses.

- Seeking profit is not what education is about. The government is taking a more decisive approach towards specific sectors such as education. Education, in our view, carries social value, and should be made available to all citizens in an affordable, common, and open manner. According to the Chinese Society of Education, about 7 in 10 students in kindergarten through 12th grade receive after-school tutoring in major cities. This has created not only financial burden but also mental stress for parents and their children. We foresee this and do not have such exposures.

- Earlier probes are related to other issues such as data protection and monopolistic behaviours. In the area of data protection and privacy, companies such as the leading passenger transportation platform, have large quantity of consumer, mobility, and geographical data, and this needs to be handled properly in the government’s view. Regarding monopolistic behaviours, we see fines being placed and follow-up actions by these large internet companies to open up their platforms and cooperate in user services.

Solid fundamentals supported by secular growth opportunities

- Chinese internet platforms have strong fundamentals and are highly competitive. We believe they will continue to gain from repositioning in growth drivers to consumption and services. We believe Chinese internet companies will adapt to the regulatory change and continue to evolve and grow.

- This has been reflected in strong earnings forecast. The consensus now expects Chinese ADRs, most of which are internet stocks, to deliver earnings growth of 29% and 32% in 2021 and 2022, higher than the overall market whose earnings are expected to grow 24% and 16% in these two years respectively.2

- The policy scrutiny is not new or alone in China. As an emerging market, China is constantly developing rules and regulations to cope with fast-paced economic progression and social evolvement. Meanwhile, we see it is a global trend that regulations are becoming more transparent and sophisticated towards the internet sector. We believe China is on its way to becoming more mature and relevant laws and regulations are advancing and catching-up with the global standard.

- That said, we believe Chinese government has no intention to undermine the internet sector. Most internet platforms are private companies. The private sector is a key pillar to China’s growth and represents more than 60% of the GDP and nearly 90% of employment.3 We believe the government wants to promote its healthy growth and efficiency.

- We believe investors can consider a broader exposure into Greater China equities if they wish to diversify related risks.

- The Greater China market offers good exposures to China, while allocating to Taiwan also offers attractive opportunities. If we look at historical returns (Chart 1), Taiwan returned + 23.7% as of end June 2021, outperforming China (+16.6%) and Hong Kong (+10.4%) on a five-year annualized basis.4

- Taiwan also proved to be downside resilient, evidence by its lower drawdown in down- market such as 2018.