Greenization series: China's competitive edge and key investment themes

In the earlier piece in this two-part series, we discuss what greenization involves and how China has made this trend one of its key priorities. In this piece, we examine China's competitive edge in greenization and the key investment themes arising from this trend.

Q: What competitive edge does China and Chinese corporations have relative to global peers when moving towards greenization?

A: There are several factors that set Chinese corporations apart from their global peers in the shift toward greenization. These include:

Strength of supply chain

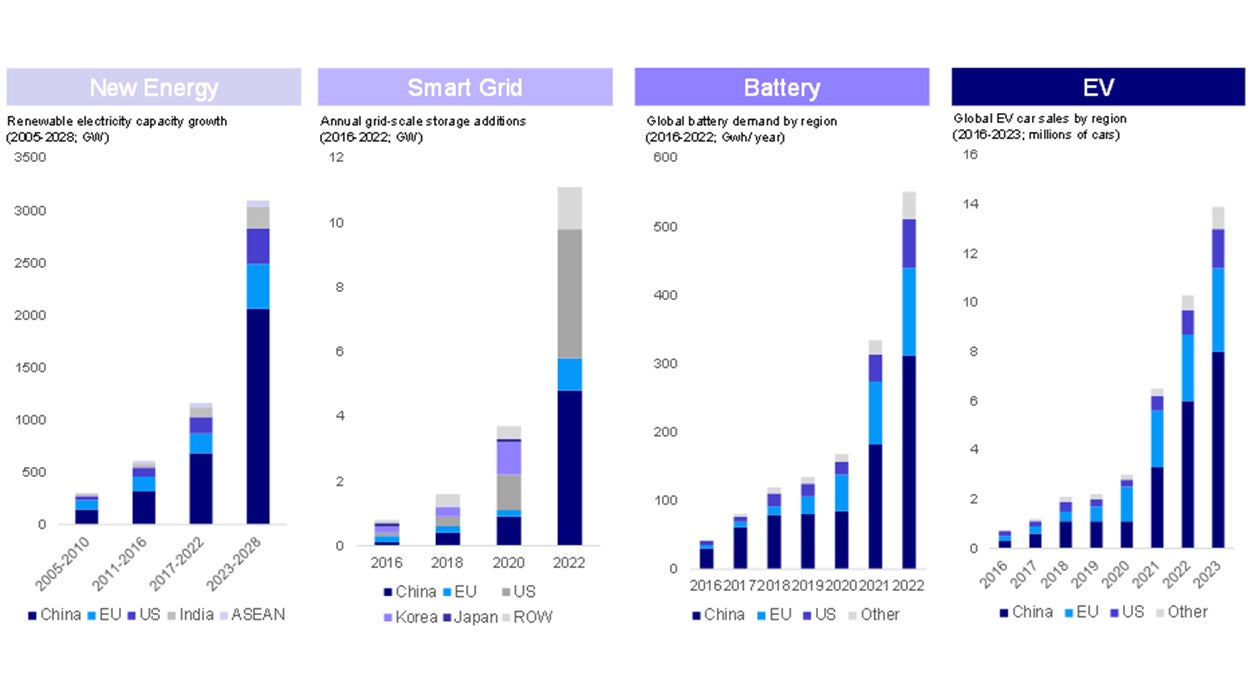

- China has built up one of the most complete green sector supply chains globally.

- China has an average of 60 to 80% of global market share1 in the core segments of renewables and EVs, spanning the entire value chain from processing, core components and end products.

- Deep economies of scale has translated into strong cost competitiveness, for example, a China-made EV is one-fifth cheaper than an EU-made EV.2

Scale and speed

- The size of transition required alongside the speed of transition progress further adds to China’s competitive advantage.

- For example, China is expected to double its solar and wind power capacity by 2025, five years ahead of its 2030 goal.3

Policy support

- State subsidies have greatly supported the building up of green supply chains, with the total Chinese state subsidies for EVs amounting to US $57 billion over the period from 2016 to 2022.4

Q: With greenization being a key policy focus, what are the key investment themes that you see arising from this trend?

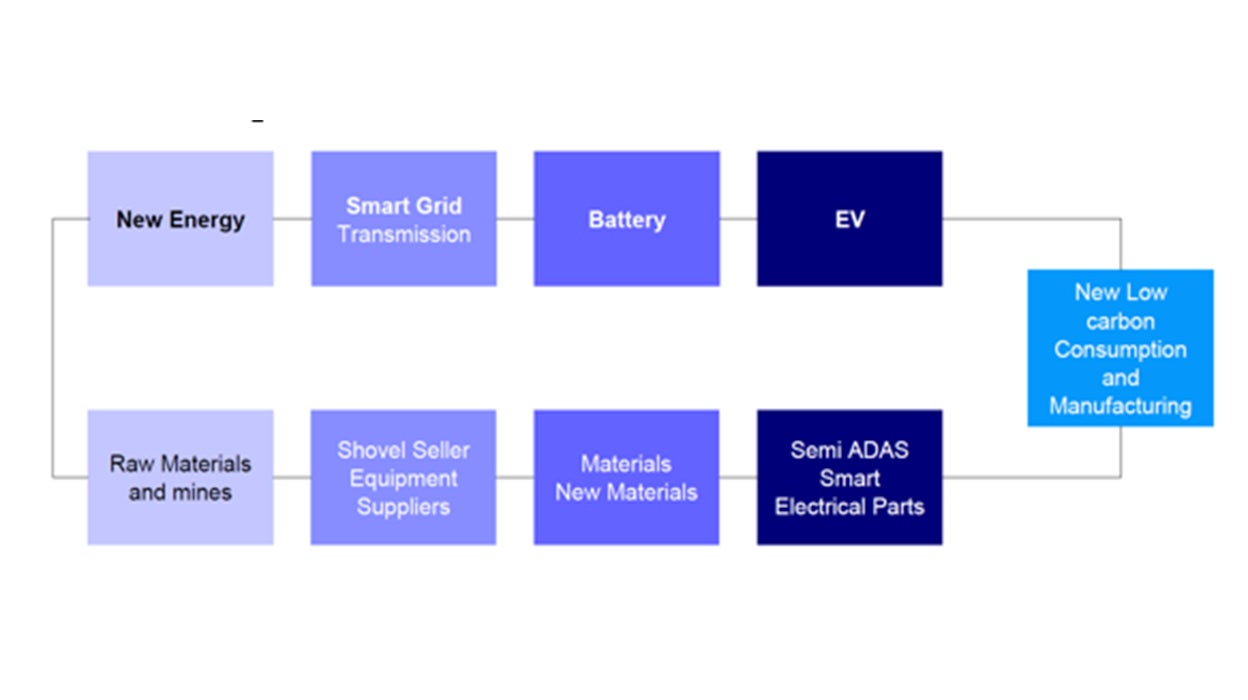

A: We see ample investment opportunities arising from China's green energy transition:

- The green industry could be worth US$ 2 trillion, and China possesses the full skill set and supply chain.5

Source: Invesco, for illustrative purpose only

- The electric vehicle (EV) and battery supply chain: We believe that policies have played a key role in the growth of new energy vehicle (NEV) sales, as this market continues to demonstrate strong growth and increase its sales ratio within the overall passenger vehicle market.

- The development of low-cost batteries and higher energy-density batteries are driving factors the growth of the supply chain.

- Electrification: Emphasis is being placed on power efficiency and high voltage.

- Energy Revolution: China holds a cost advantage in manufacturing components related to thermal management, such as transmission, inverters, copper, and aluminum. We believe China exhibits better capability and scale in the energy revolution.

Source: IEA New Energy (https://www.iea.org/reports/renewables-2023/executive-summary); Smart Grid (https://www.iea.org/data-and-statistics/charts/annual-grid-scale-battery-storage-additions-2017-2022); Battery (https://www.iea.org/data-and-statistics/charts/battery-demand-by-region-2016-2022); EVs (https://www.iea.org/data-and-statistics/charts/electric-car-sales-2016-2023 )