How are recent regulatory reforms impacting the investment landscape for China healthcare?

Introduction

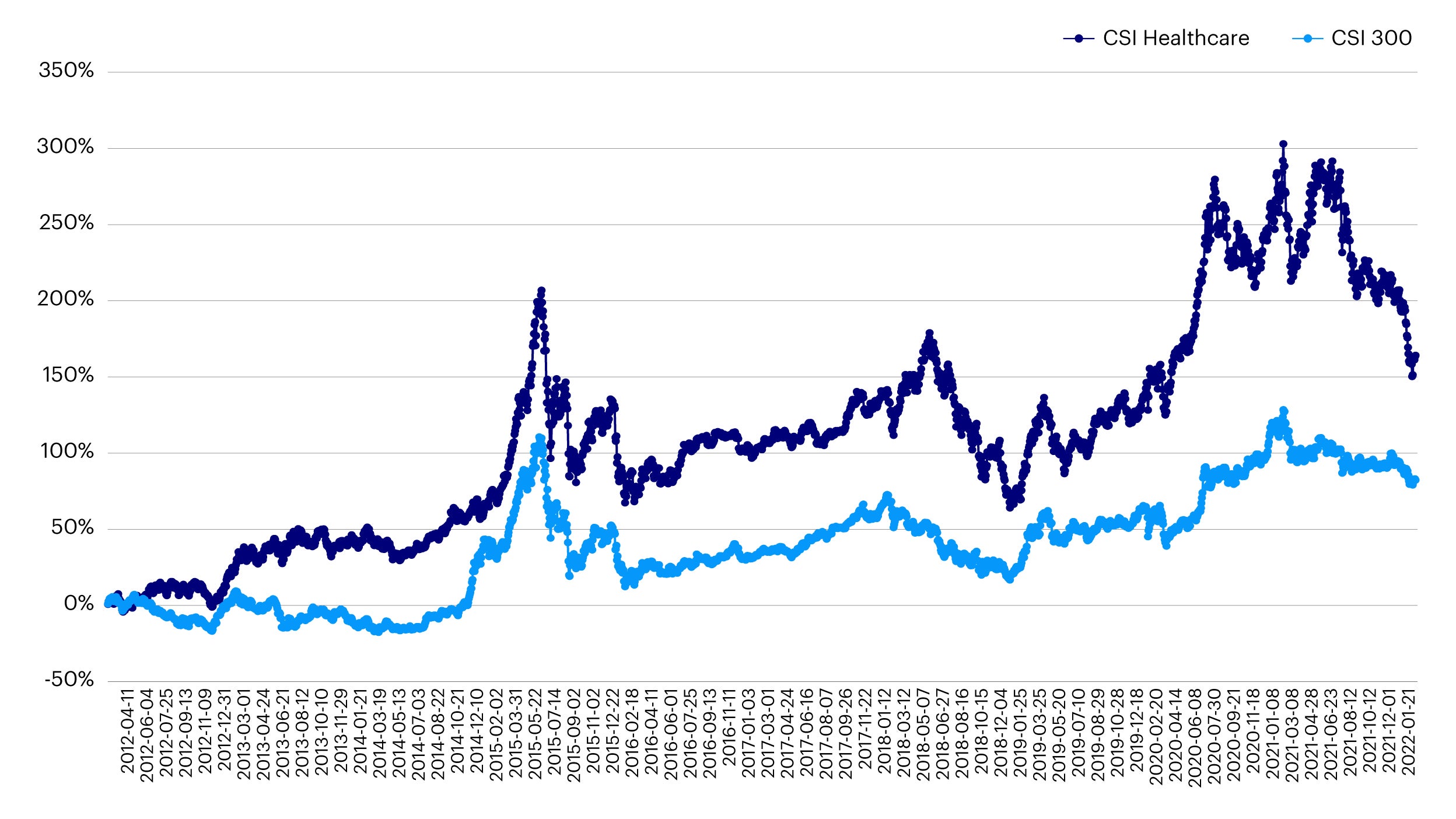

China healthcare is an important investment theme for investors seeking long term growth. The country’s economy has grown at an unprecedented pace over the last 20 years and its healthcare sector has followed suit. In fact, the China’s healthcare sector has delivered a cumulative return of 160% over the past ten years, outpacing the CSI 300 return over the same period. The industry is now the second largest globally after the US.1 China’s demographics are a critical factor supporting this secular story. The population is ageing rapidly and there are expected to be more old people than children in China by 2050.2 The pace of urbanization and growing middle-class population, the largest in the world, is also underpinning the growth in domestic demand for higher quality healthcare products and services.3

Source: Wind, accessed as of February 22nd, 2022. Past performance is not a guide to future returns.

The sector witnessed a huge correction in 2021 amid a series of regulatory tightening measures implemented by the China government. Investors worried that the government might act to contain the fast-rising healthcare costs faced by Chinese families thereby affecting the profitability of domestic healthcare companies.

To make sense of this, it is important to understand how the healthcare system has developed in China. The sector has evolved considerably since the market-oriented reforms implemented by Deng Xiaoping, chairman of the CPPCC, in the late 1970s. Primary healthcare facilities and disease prevention institutions were initially underfunded by the government and the sector was left to market forces. This led to an escalation in drug and treatment costs and a decline in basic service levels, not to mention inequalities in healthcare provision among urban and rural populations.4

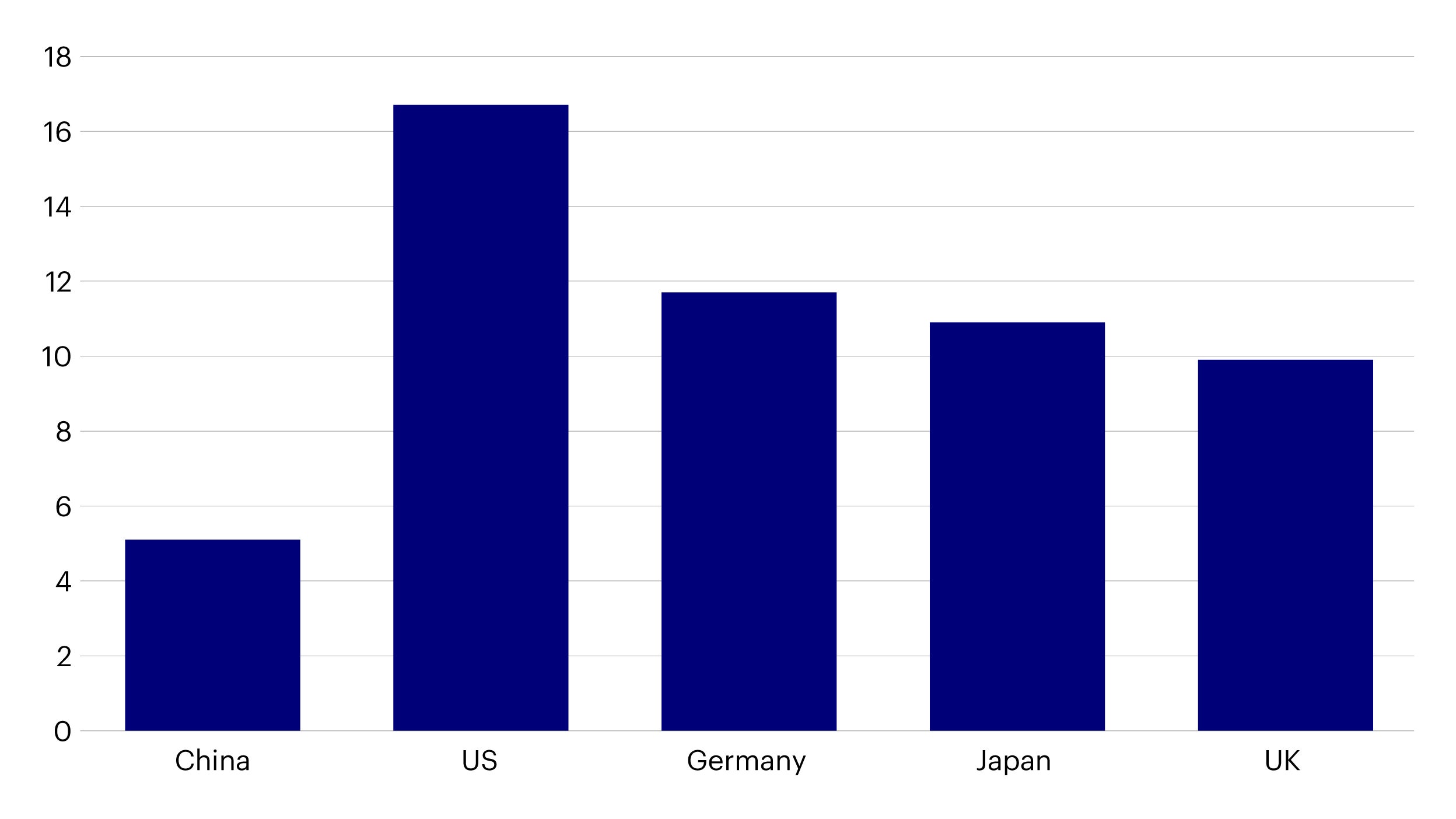

Source: OECD data, accessed as of February 15th, 2022. [Differences in methodology exist and some values are estimates. 1Calculated manually based on 2018 data from China National Healthcare Commission: No. of hospitals: 32,000; Total population: 1.393 billion.]

Source: OECD data, accessed as of February 15th, 2022.

To tackle the inequalities in the system and address the growing needs of its citizens the government has implemented several rounds of healthcare reforms over the past 20 years. The latest round of measures since 2016 are based on the Healthy China 2030 initiative, a framework that aims to achieve universal health coverage by 2030 in line with the United Nations Sustainable Development Goals.5 The plan focuses on strengthening healthcare delivery, health security, and the provision of essential medicines.

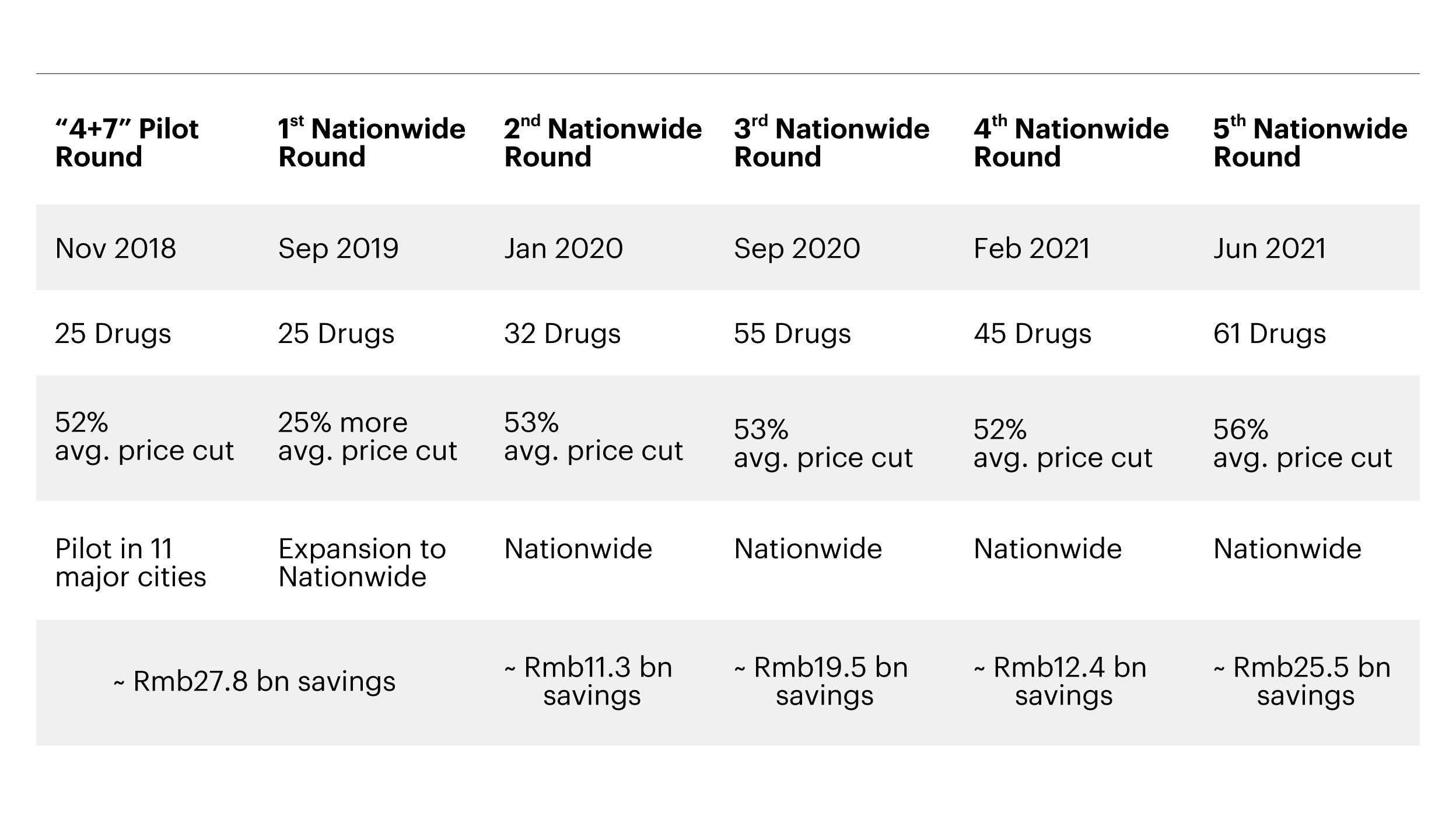

In line with this, the National Healthcare Security Administration (NHSA) was set up in 2018 to oversee all the basic health insurance schemes in the country that were previously controlled by different ministries. The centralized structure, directly reporting into the State Council, has enhanced efficiencies in areas such as cost controls, service quality and value for money.6 A national volume-based drug procurement policy (called Group Purchase Organization, GPO) was also launched in November of the same year to contain drug costs by improving the availability of quality, cost-effective products for patients. Since then, we have seen five national rounds of GPO for generic drugs that have led to accumulated savings of over RMB 150 billion.7

Note: RMB savings estimated as reported, Source: NHSA, Credit Suisse

The sector still faces many challenges including the pressing need for further drug and medical device reforms to encourage R&D and expedite the introduction of innovative products. Hospital reform is also ongoing with the aim to encourage fair rewards of about 3 million physicians in over 32,000 hospitals, by incentivizing them to launch new items, provide quality services and improve operating efficiency. These goals cannot be achieved with public funding alone and policymakers are encouraging private and foreign investment in this space.

The outbreak of COVID-19 has further emphasized the strategic importance of healthcare provision. China’s fast control of the pandemic has enabled onshore medical device companies to break into the overseas market. The more recent impact of the Omicron variant on China's economy has been somewhat muted, given China’s "zero-tolerance" policy and successful prevention of widespread contagion of the Delta variant. We believe that COVID related businesses such as vaccines, COVID testing and even vaccine contract development and manufacturing organizations (CDMOs) could see sustained demand over a longer time horizon.

Investment implications of recent reforms on the industry

This note focuses on three recent regulatory trends in China’s healthcare industry and assesses their impact on various sub-sectors in the short to medium-term.

1. Price cuts previously targeted at generic drugs via GPO are now being extended to other areas.

GPO for generic drugs has been in effect since late 2018 but the same policy is now being extended to many other areas. Market participants fear the recent GPO expansion into areas such as insulin, medical devices and traditional Chinese medicine are having a detrimental impact on the industry as a whole. The GPO on insulin that took place in November 2021 is noteworthy given China’s has the highest number of diabetics worldwide and the market for diabetics treatment is booming. Last year the market for insulin products was worth US$ 3.9 billion.8 China’s medical device sector has also been growing exponentially and was worth over US$ 126 billion in 2020 with an annual growth rate of about 20% since 2015.9

By sub-sector:

- Generic pharma: Generic drug manufacturers have been exposed to GPO over the past four years and this is set to continue. However, most high-quality generic drugs have already been included into the National Reimbursement Drug List (NRDL), so we expect the price cut pressure on generic pharmaceutical companies to be much less in 2022.

- Innovative pharma: More innovative drugs are likely to be included into the NRDL but only in a very gradual way. The government has been encouraging domestic drug makers to shift away from generic and toward innovative drug development in order to promote more import substitution.10 We believe the policy direction is unlikely to change. We expect that the price cuts, if implemented, will be a lot more benign to ensure pharmaceutical companies’ long-term R&D expenses can be recovered.

- Traditional Chinese Medicine (TCM): GPO has already been underway for TCM generics. Innovative TCM manufacturers with unique products are likely to be exempt from this policy. Many TCM leaders have also expanded their product range to include products such as personal care, F&B, and cosmetics, where there is still little price regulation. Based on our assessment, the overall policy tone for TCM remains encouraging as the government is trying to promote these products both domestically and abroad. In late December last year, the NHSA and the National Administration of Traditional Chinese Medicine released guidance that qualified TCM drugs and services will be included in public medical insurance.11 We expect this policy to be positive for leading TCM manufacturers but do not rule out future pricing pressure to occur as more TCM drugs are added to the NRDL over time.

- Medical devices: GPO expansion into medical devices such as consumables and in-vitro diagnostic devices (IVD) will continue in the next few years, there will be price cuts and margin pressure for the sectors. However, this might also lead to positive changes in the competitive landscape as domestic medical device players can easily take market share from foreign players. Besides, volume growth can help to offset the pressure on margins and profit coming from price cuts, and most price cuts pressure will be borne by distributors rather than producers. Chinese medical device manufacturers are increasingly expanding into overseas markets by exporting their products to developing countries.

- CROs/CDMOs (Contract Research Organizations/Contract Development and Manufacturing Organizations): We see little to no impact on CROs/CDMOs given their revenues are mainly sourced overseas. Regulators are only likely to regulate domestic products for the purpose of relieving pressure on their national insurance system. As Chinese policymakers encourage exports, we expect little policy regulation impact on this sector. The same goes with some of the API (active pharmaceutical ingredient) players who are selling raw materials used in drugs to foreign pharmaceutical companies.

- Vaccine manufacturers: No expected impact. Regulators are encouraging pharmaceutical players to conduct R&D on the COVID vaccine, so the potential risk to this group is low. As the overall vaccine market in China is still dominated by foreign brands, regulators are supporting domestic vaccine players in order to shift toward an import substitution model.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.