Insight

Indian equities - Valuations have declined

- Indian equities have been a strong outperformer in the broader EM in the recent years, with all sectors performed positively.

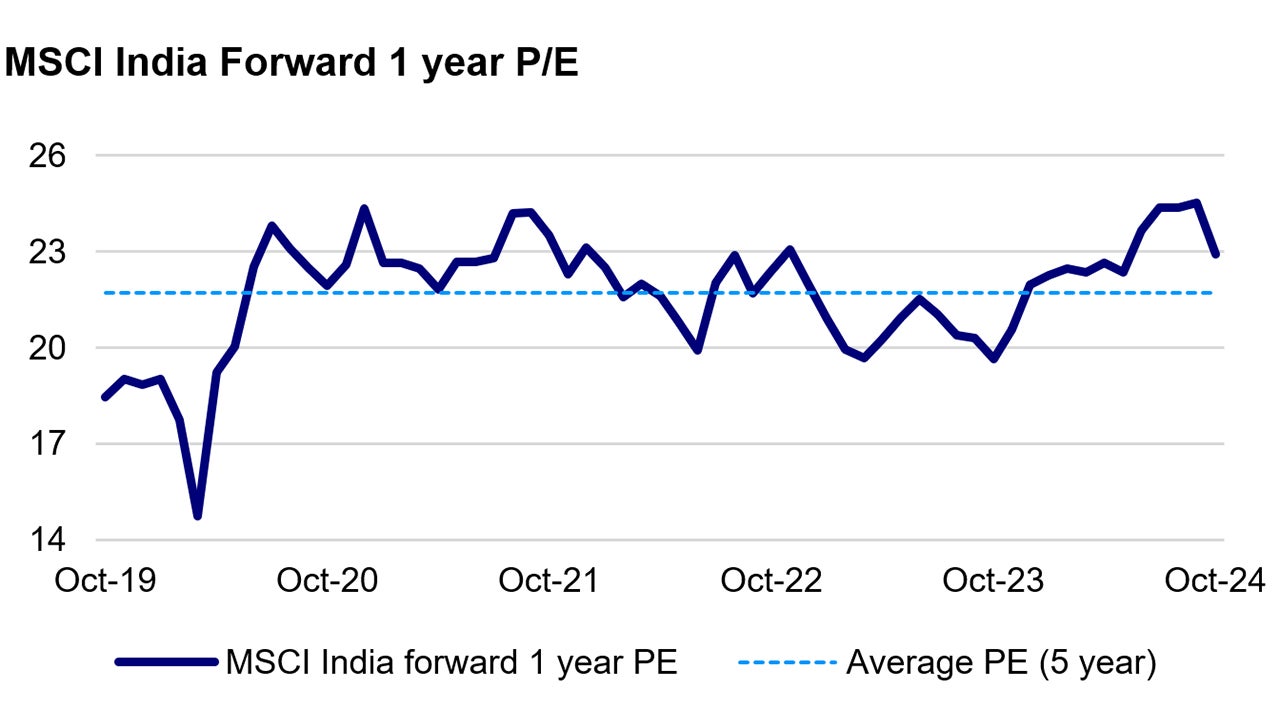

- Recently, Indian equity valuation has come down after market correction, partly because of profit taking, geopolitical dynamics in the Middle East, and the upcoming US presidential election.

- From a valuation perspective, Indian equities (as represented by MSCI India) are currently trading below 1 standard deviation level of the past 5 years.1

- Selected mid-cap stocks with strong fundamentals and better earnings visibility have also experienced corrections, resulting in more reasonable valuations compared to a few weeks ago.

Source: FactSet, 25 Oct 2024.

Given the long-term growth drivers remain intact, we expect valuation of Indian equities to remain within the range of the longer-term trend.

Robust earnings growth

- The EPS growth of Indian companies is strong, and notably better than that of most developed economies and selected emerging markets such as Thailand, Indonesia, Brazil.

- Market consensus for MSCI India forecasts earnings growth of 15% to 16% in 2024 and 2025 respectively2, with mid-teen profit growth expected to be sustained in the coming years.

- Currently it is the earnings season of the India market and so far as we see, the latest earnings announcements remain solid.

Strong corporate fundamentals

- The Return on Equity (RoE) of MSCI India reached a 13-year high of 16.9% in FY 2024, indicating improved returns for investors. 3

- Indian companies are projected to achieve higher and more sustainable RoE going forward, having transitioned from low to mid-teens RoE in recent years.

- Over the past decade, Indian companies have effectively managed their balance sheets, maintaining under-leveraged positions that support participation in demand-driven growth.

- The debt ratio for MSCI India is much better, as represented by total debt divided by total assets, has decreased from 28% in 2019 to 21.2% by Q3 2024.4

- Free cash flow relative to sales has also risen sharply and is currently above the long-term average. We anticipate that corporate balance sheets will continue to strengthen.

Liquidity is supportive

- Liquidity remains strong in the Indian equity market, supported by robust domestic liquidity in addition to foreign institutional flows.

- This trend reflects the high confidence that the Indian public has in their economy and the market, with these positive structural flows expected to persist.

Valuation has come down

- Indian equity valuation is getting back to a more comfortable level.

- As investors, we believe the key will always be bottom-up stock selection.

- There are always companies & hidden gems with upside potential; however, it's crucial to maintain a disciplined valuation strategy.

- Recognizing the strong fundamentals and macro stability that support India's equity valuations suggests further upside potential.

- We believe a disciplined investment process is essential for valuation assessment.

- We carefully assign fair values that reflect the intrinsic worth of our investments when it comes to portfolio construction. This approach ensures we do not overpay while effectively capturing the upside potential in the opportunities we pursue, allowing us to adjust our positions as needed.

Conclusion

- Our constructive positive view on Indian equities is supported by consistent policy continuity, macroeconomic resilience, supportive domestic flows and strong economic growth leading to mid-teen earnings growth.

- We believe that current valuations make Indian equities more interesting for investors seeking opportunities in the Indian market.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.