Japanese stock markets hit a 33-year high for good reasons

Last week, both the Nikkei 225 and TOPIX Price Indexes hit a fresh 33-year-high, ending 19th May at 30,808.35 and 2,161.69. The rally seems to be led by overseas investors’ cash equity purchases as we have witnessed their comebacks since April, especially after Warren Buffett visited Japan and said his company Berkshire Hathaway increased its position in five Japanese trading companies. Japan is now the second biggest region in his portfolio, next to the US.

And we believe there are good fundamental reasons to buy Japan from both near-term and long-term perspectives.

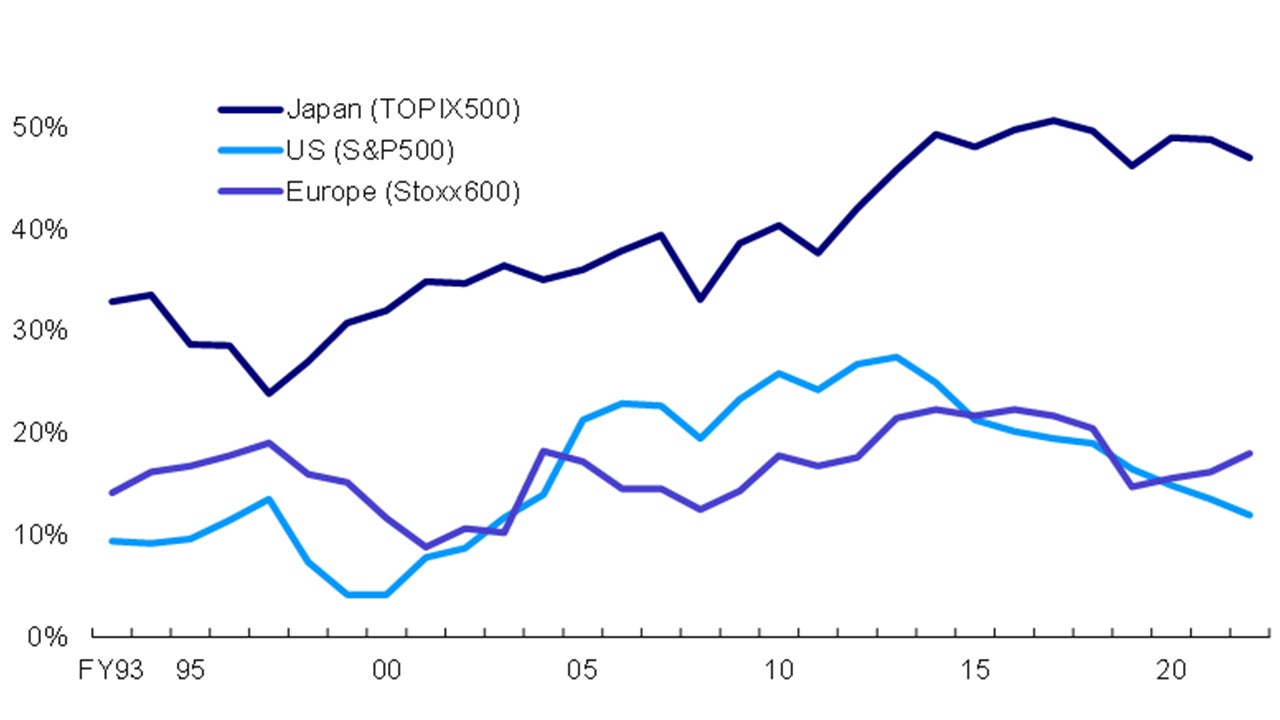

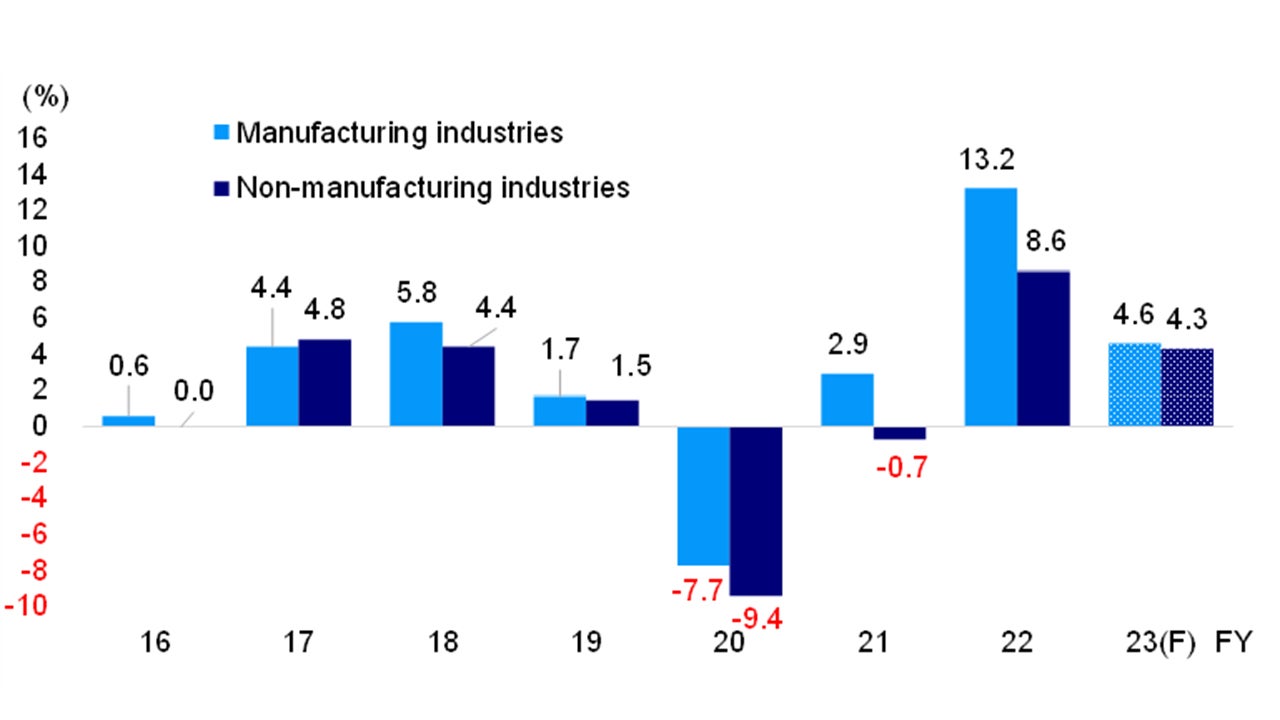

Indeed, Japan is in a different economic cycle as economic and border reopening are commencing. On top of pend-up domestic consumption demand, a significant recovery in inbound tourists and their spending, which reached nearly 60% and 90% of the pre-pandemic level in 2019 during the first three months of 2023, supported domestic economic activities. Besides, cash-rich Japanese companies maintain buoyant capex demand for automation, digitalisation and green investment to achieve future growth (please refer to Chart 1 and 2).

● Source: FactSet, data compiled by Goldman Sachs Global Investment Research

● Note: Net cash companies are defined as the companies whose liquidity in hand (cash + short-term securities) exceeds total interest-bearing debt. Excluding financials.

As at March 2023

Note: Capex is Capex : BoJ Tankan Fixed Investment (Software, R&D, and Fixed Investment excluding Land Purchasing Expenses) Source: Bank of Japan, “Tankan”. Data as of March 2023.

In fact, despite slowing external demand and the resultant declining exports, the January-March real GDP grew at a 1.6% quarter-on-quarter seasonally adjusted annual rate, well above Bloomberg consensus of 0.8%, thanks to acceleration in consumer spending and rebound in corporate capex.

Besides, the market concerns toward monetary tightening in the near term have been eased after the arrival of new Bank of Japan (BoJ) Governor Kazuo Ueda in April. So far, he reiterates the BoJ’s sustained commitment to the monetary easing policies to support ongoing economic recovery and to pursuing the target of sustained 2% core inflation against the rather tamed inflationary backdrop.

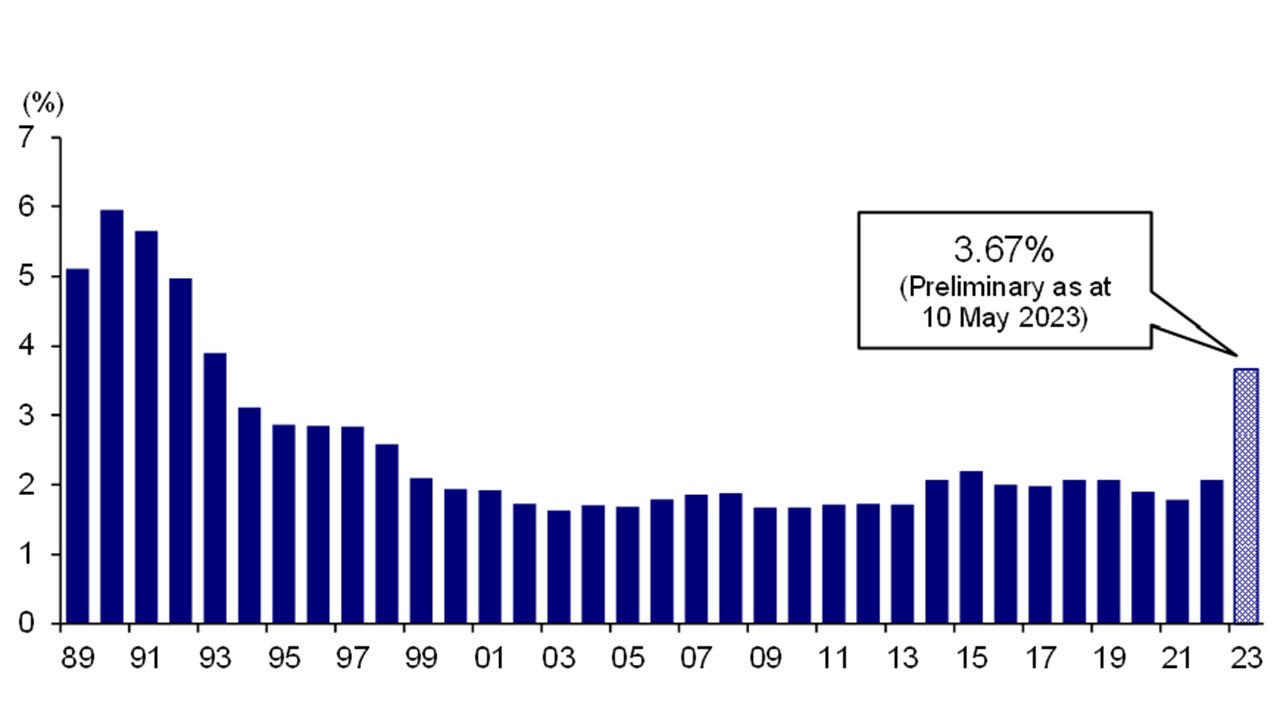

More structurally, there are green shoots of long-awaited “real” wage growth in Japan. The “Shunto” spring wage negotiations between large enterprises and employees have yielded a 3.67% rise (as at 8th May), the highest level in 30 years, again exceeding economists’ expectations (please refer to Chart 3).

Source: Japanese Trade Union Confederation - RENGO

All in all, given the recovery in domestic service sectors, a pickup in wages and structural capex demand combined with consistent monetary policy support, there is a chance that Japan could achieve its multi-decade goal – sustained reflation and economic growth – in our opinion. Accordingly, if we see another round of a significant wage rise next spring, long-awaited reflation and the resultant policy normalisation finally come into view.

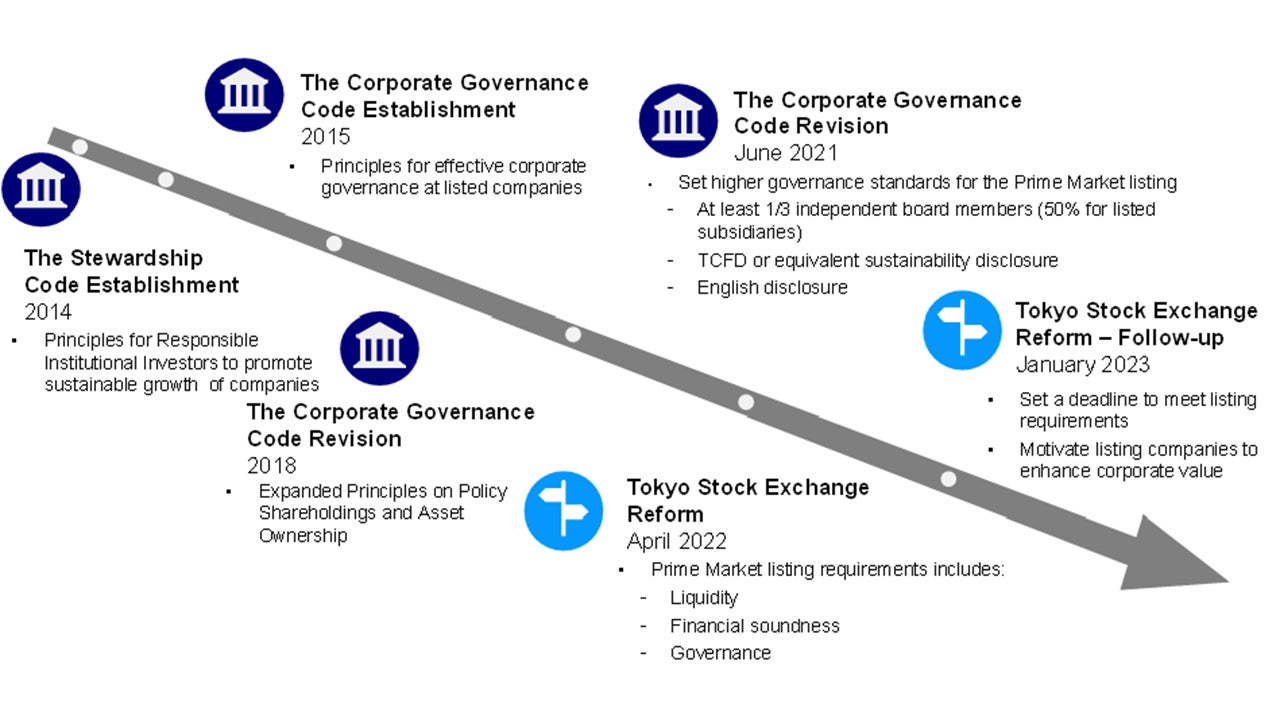

Most importantly, corporate governance has been progressing (please refer to Chart 4).

Sources: Japan Exchange Group and Japanese Financial Services Agency.

This year, the Tokyo Stock Exchange (TSE) published action plans to follow up the last year’s market reform in January and requested to disclose capital efficiency improvement assessment, plans and initiatives among the TSE Prime and Standard Market listed companies in March. While it does not impose penalties, the stock exchange’s formal requirement puts unavoidable pressure on Japanese corporate managements. Besides, while the market and media tend to highlight cash-rich companies traded at a discount, the TSE’s goal is not a one-off big hike in dividends or share repurchase programs but increasing profitability exceeding the cost of capital and sustained corporate value growth among all listed companies. Such episodes prove the betterment of corporate governance in Japan, leading to consistent improvements in capital efficiency and profitability and the resultant revival of Japanese equities.

In summary, we believe the Japanese stock markets’ rise to a 33-year high despite global economic growth worries has good reasons from both near and long-term perspectives. Firstly, recovery from the pandemic is on the way, and an end to multi-decade deflation or ultra-low inflation and the resultant stagnated economic growth finally come into view. Furthermore, Japan’s corporate governance has been producing step-by-step incremental improvements. While we might see profit-taking in the near term, this under-owned asset class should still give further upside to investors who have or will build strategic allocation.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.