Market update: Sell-off in Hong Kong stocks

Hong Kong’s Hang Seng Index has sold off today, down -3.7%1 due to USD re-strengthening (Bloomberg USD Index has moved from 1217 at the beginning of the year to 1240 or around 2%) and a slight miss in the China Q4’23 GDP of 5.2% y/y versus consensus of 5.3%.2

The December monthly data largely came in line with expectations, with industrial production beating consensus while retail sales missed.

The overall 2023 GDP growth for China came in at 5.2% y/y, better than the forecasted 5.0%. Still, nominal growth dipped to 4.6% y/y from 4.8% previously due to a GDP deflator of -0.6%.3

I expect policymakers to set a GDP growth target in 2024 of around 5.0% and that more monetary and infrastructure investment stimulus are rolled out this year.

Rate cut expectations may have been overshot

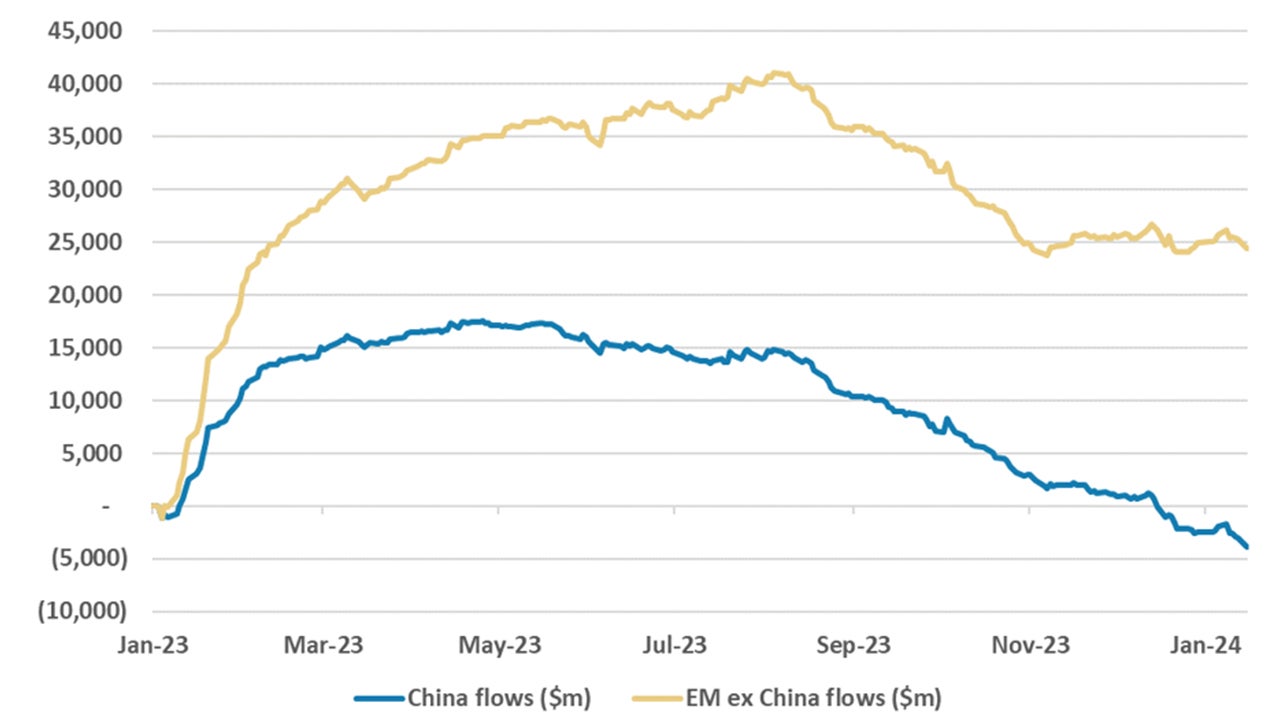

I would like to point out that Emerging Markets (EM) ex China equities have also seen significant outflows YTD (as per the chart below).

Source: Morgan Stanley. Data as at 17 January 2024.

Much of the selling pressure on EM comes from investors re-thinking a front-ended Fed pivot – the Fed Fund’s futures imply a rate cut starting as soon as the March FOMC meeting; these expectations may have been overshot.

I believe that these market swings suggest that there continues to be quite a bit of uncertainty regarding when the Fed is going to pivot with a rate cut.

Investment implications

I wouldn’t be surprised to see some market volatility and reversals in the near-term as the market grapples with Fed’s monetary path forward and what kind of economic landing the US economy is likely to encounter later this year, with the US Treasury bond yields rising, JPY weakening and the shift back to value and defensives outperforming growth.

Certainly, the Fed pivot and US economic performance will be a couple of this year’s most important market catalysts.

Investors may stay well-diversified, with a preference for high quality credit Investment Grade bonds, alternatives such as private credit and EM equities – which are trading at much more attractive multiples after the recent market movements.