Quantitative strategies to optimize Chinese A-share allocation

Numerous studies indicate significant inefficiencies in China’s A-share market, and asset owners who want to exploit them have historically turned to fundamental active managers. In recent years, however, model-driven quantitative strategies have gained more attention. We compare the performance of the two styles, explain some of the differences and derive the optimal quant share in a multi-manager A-share portfolio.

Fundamental active managers are often credited with in-depth company and industry knowledge, while quantitative active managers are credited with stable performance – which is particularly relevant in volatile markets. Given the conceptual differences between the two styles, their excess returns are not highly correlated. Thus, additional diversification benefits can be garnered when they are combined.

We examined the performance differences between fundamental and quantitative strategies for Chines A-shares based on 12 years of mutual fund returns (December 31, 2010 to December 31, 2022). To ensure that the results are benchmark agnostic, the first step was to calculate every fund’s active monthly returns against its own official benchmark. Then, we constructed return time series for a “median fundamental manager” and a “median quant manager” using the median active monthly returns for the two groups. This allows us to quantify and compare the return and risk of these two styles while accounting for the growing number of funds over the study period.

Performance compared

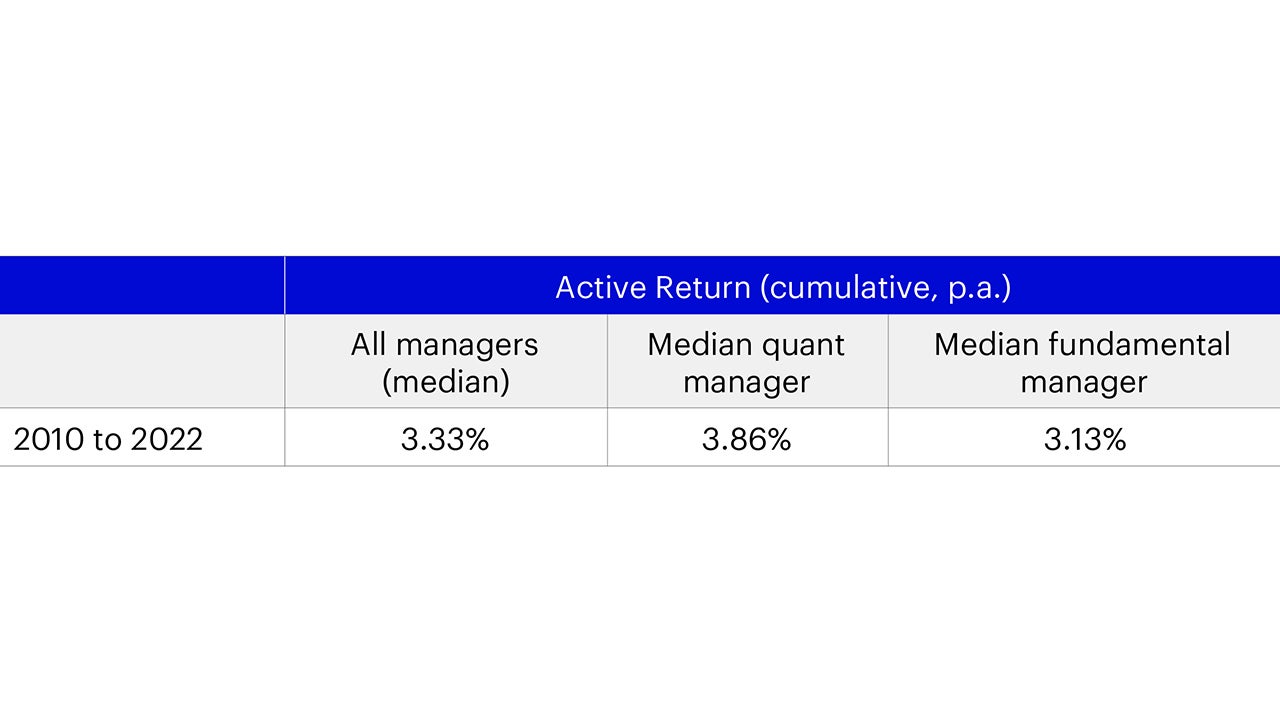

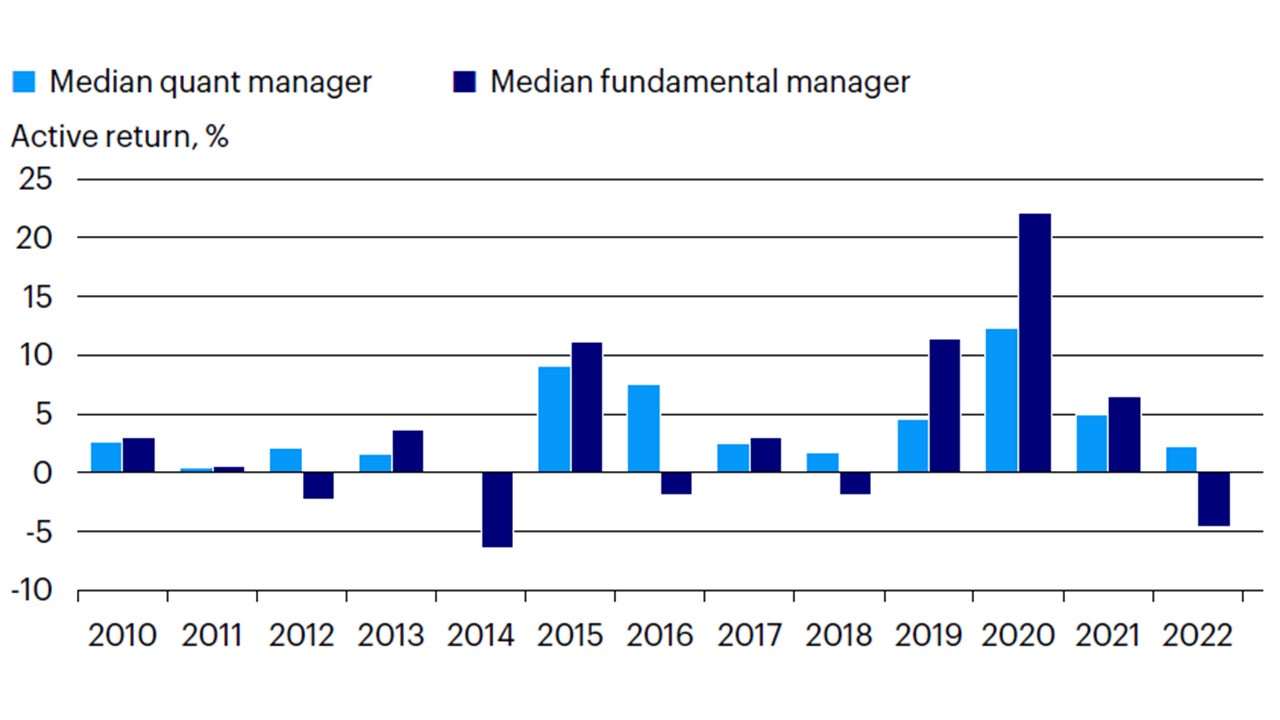

In our sample, the median quant manager outperformed the median fundamental manager (figure 1) and delivered positive active returns every year (figure 2). The median fundamental manager, on the other hand, experienced greater outperformance in some years and larger drawdowns in others. Furthermore, the share of quant managers with positive alpha is higher.

Sources: WIND, Invesco analysis. Mutual fund data from December 31, 2010 to December 31, 2022. Past performance is no guarantee of future results.

Sources: WIND, Invesco analysis. Mutual fund data from December 31, 2010 to December 31, 2022. Past performance is no guarantee of future results.

Potential for higher risk-adjusted returns and more persistent alpha

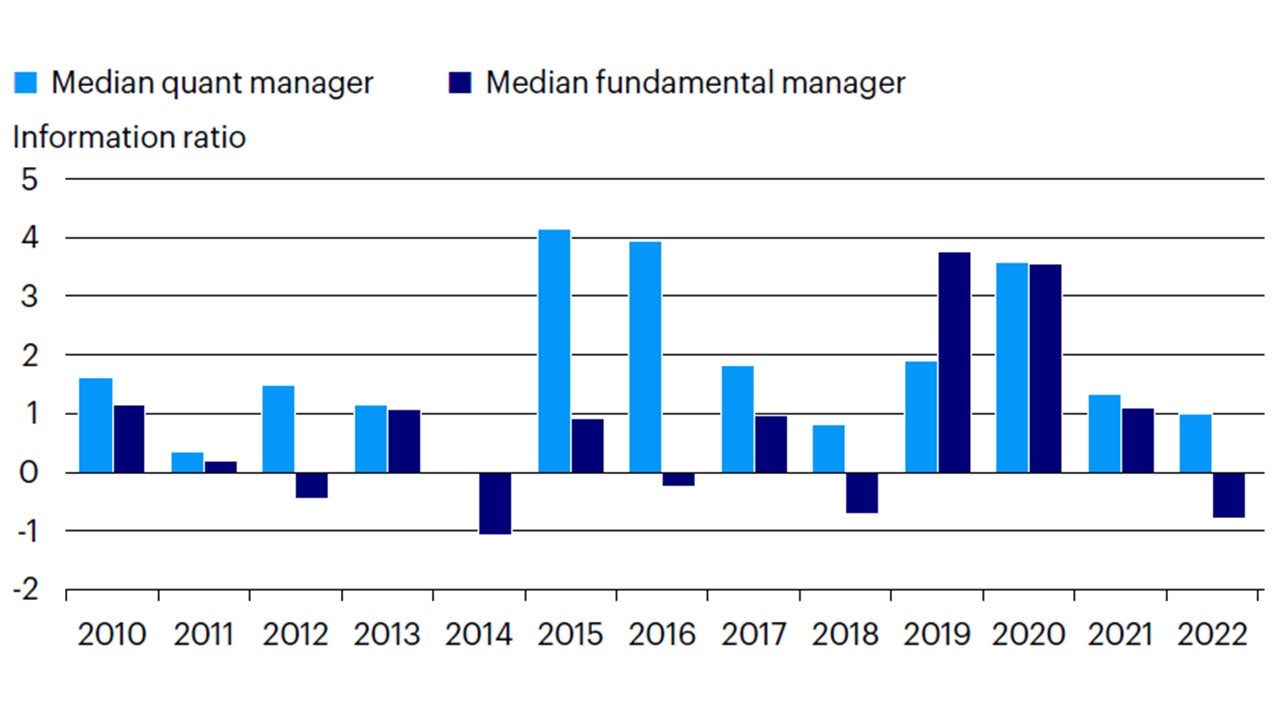

For Chinese A-shares, quant managers‘ returns have historically been less volatile. In our analysis, the active risk (tracking error) of the median quant manager is less than half the active risk of the median fundamental manager (around 2% to 3% p.a. as compared to around 2% to 12% p.a.). Consequently, the median quant manager’s information ratio (IR) is better (figure 3). The aggregate IR of the median quant manager is three times as high as that of the median fundamental manager.

We also gauged the persistence of outperformance, based on the average percentage of months a manager beats the benchmark every year. A higher percentage reflects a more even return stream. We find that the median quant manager shows greater persistence, outperforming the benchmark around 66% of the time.

Diversification benefits

Finally, we analyzed the correlation between the monthly active returns of the two median managers. Over the full study period, we find a relatively low correlation of 0.467, suggesting that the quant manager’s alpha is relatively uncorrelated with that of the fundamental manager. Accordingly, adding quant funds to a fundamentally managed A-share portfolio may improve diversification effects.

Sources: WIND, Invesco analysis. Note: IR is calculated using median active return. Mutual fund data from December 31, 2010 to December 31, 2022. Past performance is no guarantee of future results.

The strengths of quant managers…

The relatively strong performance of quant managers may be attributed to their differentiated investment process and competitive edge in information processing. Most quantitative managers adopt a systematic process that minimizes the subjective biases of their portfolio managers. With such a disciplined risk approach, it is unsurprising that quant managers had highly repeatable performance.

Quant managers’ ability to analyze large datasets swiftly is also a significant advantage in the A-share market – which now includes over 5,000 listed companies. While, due to resource constraints, most fundamental managers and brokerage firms limit their research to just a fraction of the entire stock universe, quant models can sift out asset mispricing from the entire market.

Market inefficiencies in China can arise from factor risk premia, retail trading behavioral bias and even top-down policy effects. Quant strategies can utilize these diversified alpha sources because of their capacity to more quickly process and analyze information.

… and the optimal quant allocation

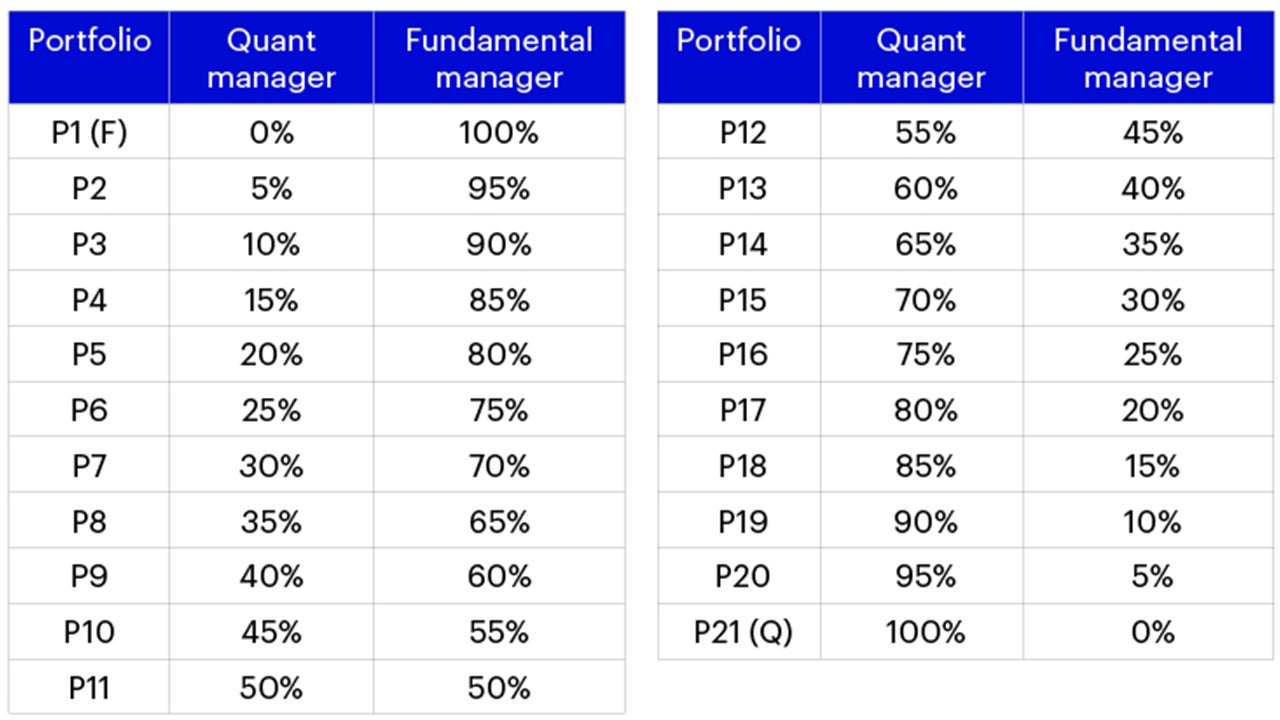

So, what allocation to quant strategies would be optimal in an A-share portfolio? We examine this from the perspective of a hypothetical asset owner who has selected both a fundamental manager and a quant manager. To disentangle manager selection from weight allocation effects, we’ll analyze two cases: one based on median-performance managers (“base case”) and another based on top-quartile managers (“high performance case”).

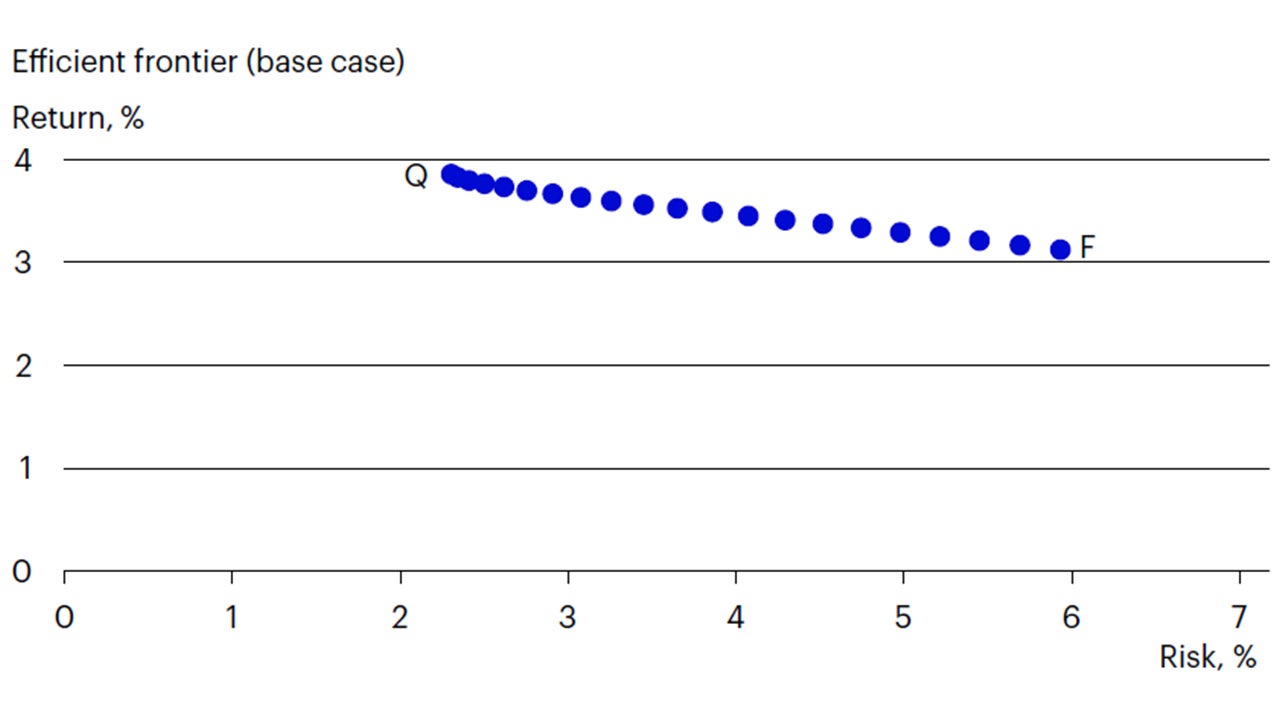

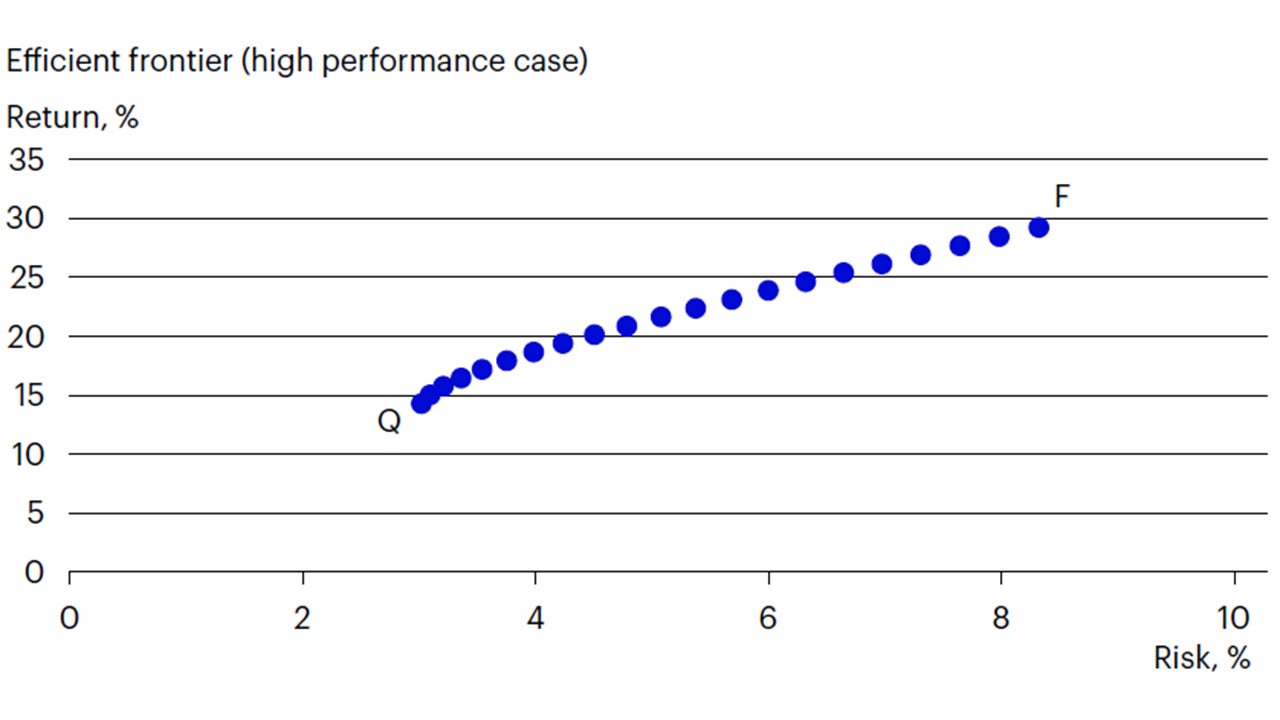

In both cases, we construct an efficient frontier plot representing 21 portfolios of varying manager weights (figure 4) and rebalance them every month. In each plot, F represents the portfolio that is 100% allocated to the fundamental manager, while Q represents the portfolio that is 100% allocated to the quant manager.

Sources: Invesco analysis.

For illustrative purposes only.

The base case

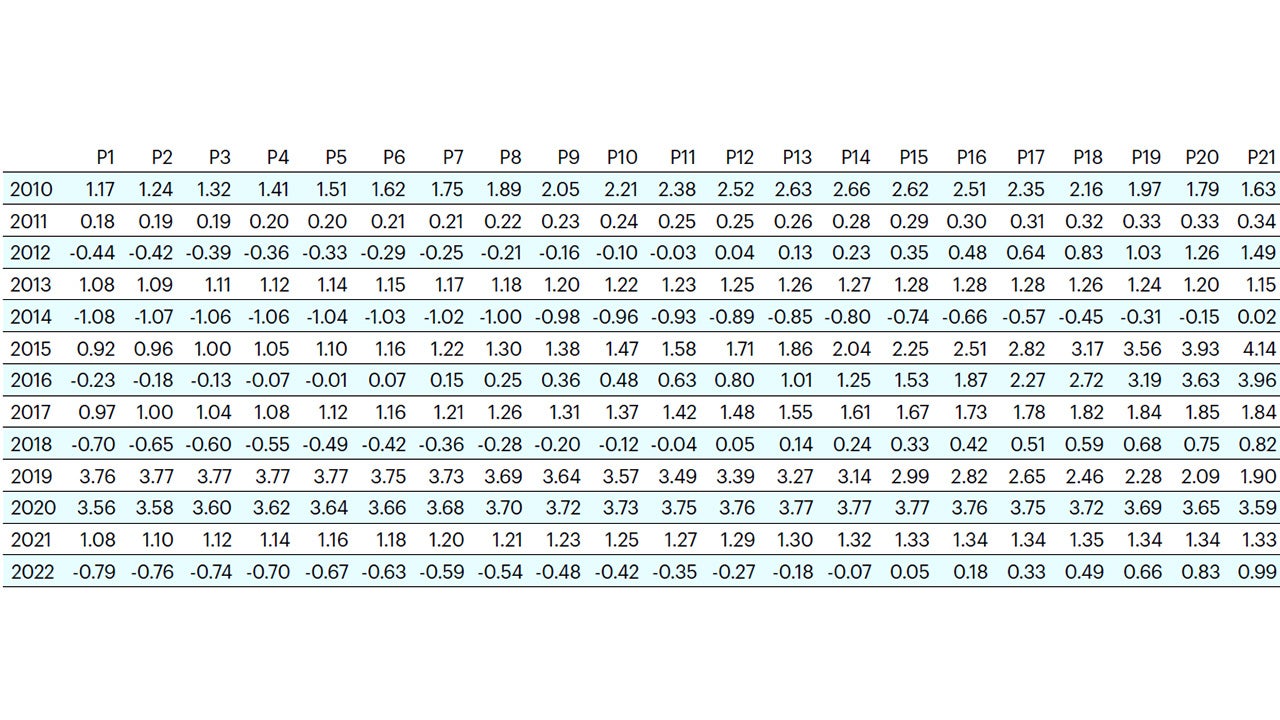

In the base case, we assume that the asset owner cannot forecast manager performance – implying that the selected managers can be approximated by the two median managers. Since, over the full study period, the median quant manager (Portfolio Q) achieves a higher return with lower risk, the overall information ratio of this manager is also higher. Therefore, the efficient frontier is a monotonic decreasing function, favoring a 100% allocation to the quant manager (figure 5).

Sources: WIND, Invesco analysis. Annualized cumulative monthly median returns from December 31, 2010 to December 31, 2022. Past performance is no guarantee of future results.

Even though the median fundamental manager achieved a higher return in most years, the higher drawdowns associated with this manager lead to lower returns overall, and a very high tracking error. Therefore, in most years, larger allocations to the quant manager lead to a higher information ratio (figure 6).

Sources: WIND, Invesco analysis. Past performance is no guarantee of future results.

The high performance case

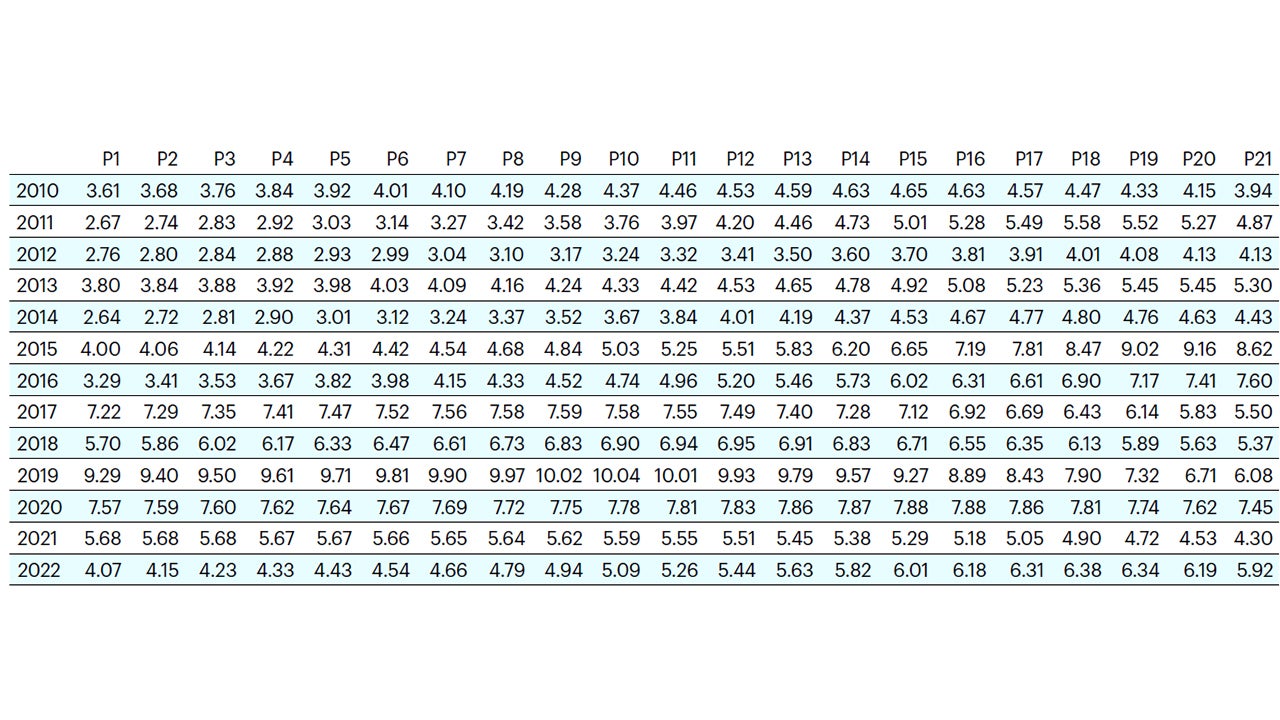

In the high performance case, we assume that the asset owner can forecast manager returns fairly accurately and only selects managers from the top performance quartiles of both investment styles. We therefore construct return time series for a “top-quartile fundamental manager” and a “top-quartile quant manager”. Rather than median monthly returns of the full sample, we now use the top 25th percentile monthly return – and then follow the same procedure as in the base case. Again, we construct 21 hypothetical portfolios with varying weights allocated to the two managers (figure 7).

Unlike the base case, there is now a clear trade-off between risk and reward (figure 7).

Over the full study period, Portfolio F, which is 100% invested in the fundamental manager, has the highest return but also comes with the highest risk. As the portfolio allocation shifts to the quant manager (towards the bottom left of the efficient frontier), portfolio return and risk decrease monotonically until we reach Portfolio Q, which has the lowest return but also the lowest risk.

Despite the higher returns, a 100% allocation to the top-quartile fundamental manager would be optimal in less than half of the years – because a balanced allocation to both managers is more likely to lead to higher information ratio and satisfy the overall portfolio objectives (figure 8).

Sources: WIND, Invesco analysis. Annualized cumulative monthly median returns from December 31, 2010 to December 31, 2022. Past performance is no guarantee of future results.

Sources: WIND, Invesco analysis. Past performance is no guarantee of future results.

Conclusion

We have analyzed the long-term performance of actively managed fundamental and quantitative portfolios of Chinese A-shares. In our sample, the median quant manager achieves higher active performance and a higher information ratio. Although the median fundamental manager’s active return is higher in most years, this is offset by larger and more frequent drawdowns.

We then provide a dual-case framework to help investors determine their optimal allocation to a quant strategy. In the case of a hypothetical investor who cannot forecast manager performance, we find that a higher allocation to the quant strategy better satisfies the overall return and risk objectives. On the other hand, if the investor has a consistently strong forecasting ability, there is a trade-off between return and risk. Then, on average, return objectives are better satisfied through higher allocation to the fundamental manager, while risk objectives can be better achieved through higher allocation to the quant manager. However, the gradient of the trade-off function varies significantly each year, suggesting that higher-risk portfolios are not consistently well compensated. Hence, we believe that long-term investors should not ignore the diversification benefit of lower-risk quant strategies, which can smooth out their portfolio return streams and improve the portfolio information ratio.

Methodology

• Our sample covers 707 China- domiciled A-share mutual funds (as of December 31, 2022) that pursue either an active fundamental or active quantitative investment style.

• To avoid survivorship bias, the historical monthly returns of terminated funds are included in our sample.

• To allow benchmark-agnostic comparison, each fund’s active return is calculated relative to its own official benchmark, which is usually a weighted composite of an equity index and the risk-free rate (for example, 95% x CSI300 Index + 5% x bank deposit interest).

• Fund returns are net of fees.

• Active risk or tracking error is the annualized standard deviation of active returns.

With contributions from Monica Uttam, Thought Leadership and Insights, Asia Pacific

This is an abridged version of the whitepaper What is the optimal allocation to quant strategies for China A-share investors?, May 2023.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value. Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.