Recent market volatility of Chinese stocks and the outlook

The Event: Market Volatility on Monday, Oct 24, 2022

Market volatility rose following the end of the 20th National Party Congress on Sunday (Oct 23).

There was a steep sell-off on Monday (Oct 24). MSCI China dropped 8.7%1, including large cap companies such as leading ecommerce companies. The sell-off was indiscriminate, although the drop is more significant in the real estate and internet sectors.

The market was disappointed as (1) no announcement of a concrete COVID reopening timeline was made during the congress meeting, and (2) the newly appointed top leadership was seen to be relatively less experienced on economic policies. Instead, they are strong supporters of President Xi.

The pros of the leadership team mean more efficiency in policy decision-making and implementation. However, the market is worried about the possibility of unfriendly economic policy and that economic development will not be its highest priority.

Although market sentiment remains fragile, it is largely stabilised today (Oct 25). The leading ecommerce companies also rebounded.

Our view

What was announced in the 20th Party Congress did not surprise us. We believe the selloff in China and Hong Kong equities is overdone.

We did not anticipate a swift COVID reopening. Instead, we believe the reopening will likely be gradual in 2023. We believe economic growth will be a crucial priority for China.

China emphasized the importance of economic development, focusing on high-quality, balanced and inclusive growth. While there may not be a short-term concrete growth target, China seeks to become a "moderately prosperous" society by 2035.

Looking ahead, we expect a moderate growth in mid-single digit. While it will be lower than the almost double-digit growth in the past decade, it is still a relatively decent growth. A stable growth environment for the second largest economy in the world will definitely provide ample investment opportunities.

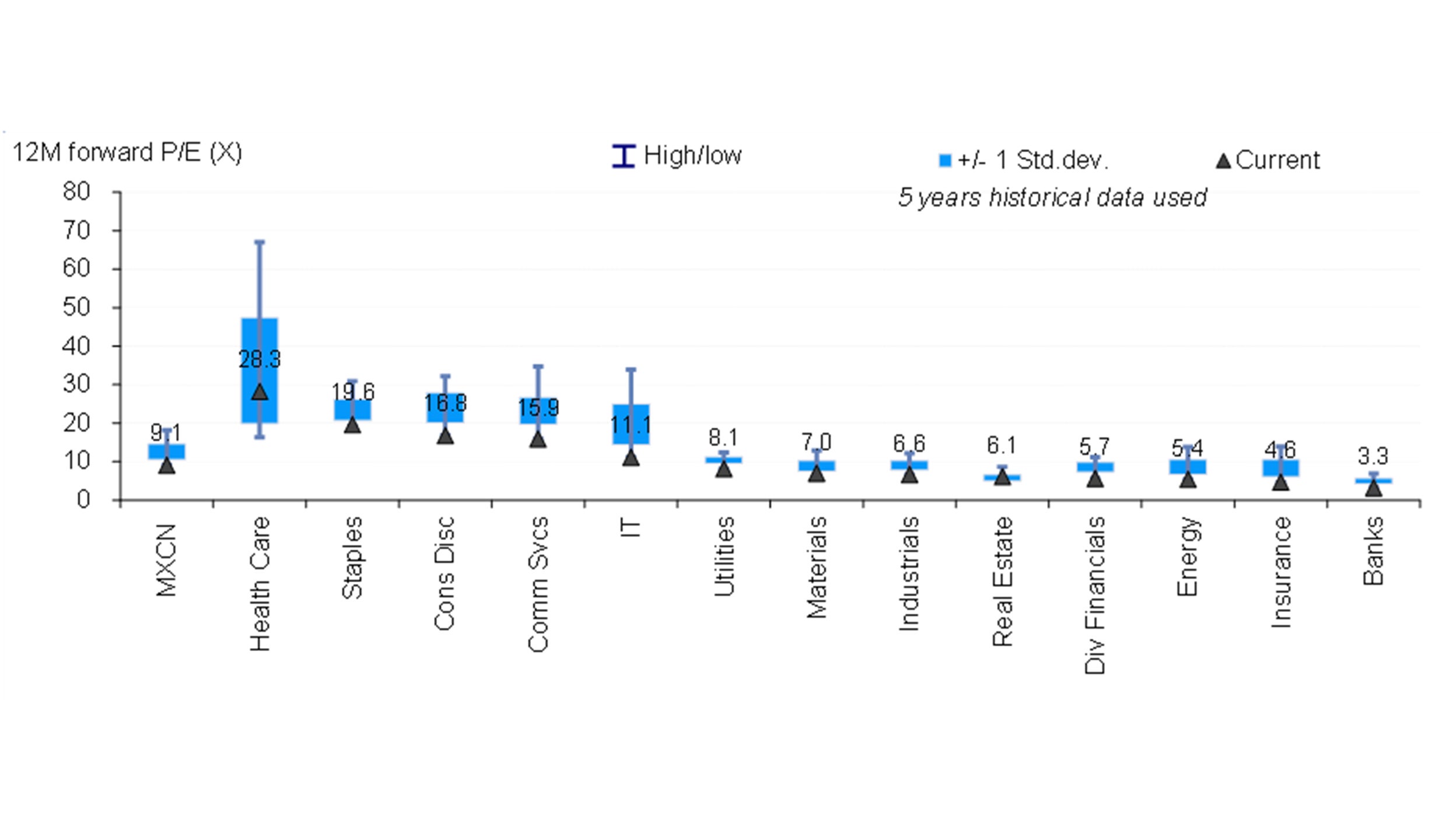

Meanwhile, the valuation of China equities is still comfortable. MSCI China is trading around its historical low end and at a significant discount to developed market equities.

Source: FactSet, I/B/E/S, MSCI, Wind, 14 October 2022