Staying ahead in tracking China's evolving consumption patterns is crucial

There have been discussions around the consumption growth in China. While the current post-pandemic growth may not be the strongest, it remains crucial to track the changing spending patterns.

We believe consumption pattern evolution is the key in current macro environment in China.

We see structural changes in consumption patterns which could drive quality growth in China and facilitate urbanization, including the rise of lower-tier cities, the power of middle-class and affluent consumers (MACs) and the diverse spending pattern across generations.

Lower-tier cities are the new momentum for consumer market

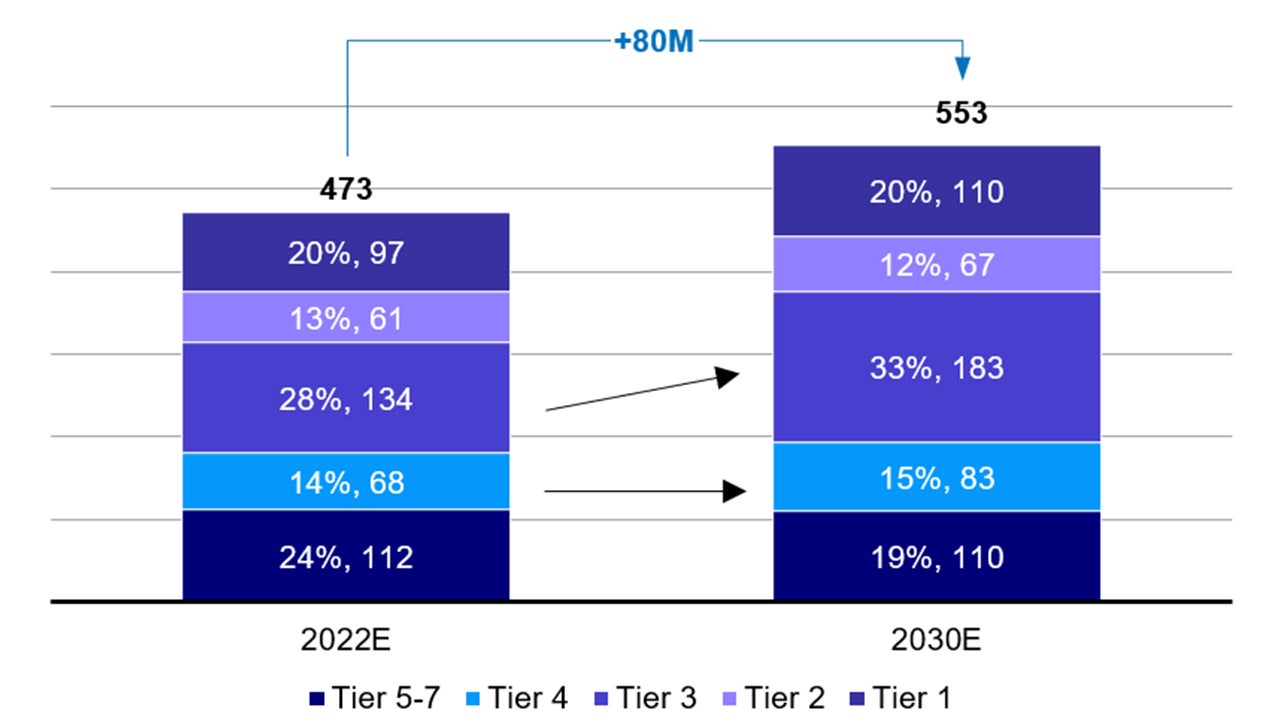

- Going forward, ~70% of new middle-class and affluent consumers (MACs) will come from tier 3 and 4 cities in China.

- It signifies the rising consumption power in lower-tier markets and will play a crucial role in driving consumption growth.

- Lower-tier cities in China hold significant potential, as they comprise over 70% of the country's population.

- Lower-tier cities account for over 50% of monthly average users of China’s top three E-commerce companies.1

- In 2022, tier 3 and 4 cities accounted for ~35% of all food and beverage chains in China.2 We are seeing more international food chains and coffee shops opening restaurants in lower-tier cities.

- We believe the purchasing power of lower-tier cities will fuel China’s consumer market.

Note: Distribution of new MACs by city tier, in million.

Source: BCG MAC Database, BCG analysis, May 2023.

The rise of middle class drives a sustained GDP growth

- Looking ahead, MACs are expected to increase by 80m by 2030, making up 40% of the total population.3

- Consumers, in particular MACs are actively looking for products and services that offer superior quality, durability, and value, emphasizing overall experience rather than price only.

- Quality-driven consumption is on the rise, leading to an increased demand for premium products.

- It is expected that Chinese consumers will take up 23% of global luxury goods by 2025, from 18% in 2022.4

- The government's focus on reducing income inequality and improving citizens' quality of life under the common prosperity agenda could lead to a larger consumption base and create opportunities for companies targeting premiumization.

Table: Evolution of Chinese consumers breeds potential opportunities

| Gen Z | 1995–2009 | Tech-savvy, born in an era of rapid globalization and constantly immersed in a vast amount of information through mobile devices. |

| Gen Y | 1980–1994 | The pioneering generation privileged with compulsory education, grew up with personal computers and experienced urban migration. |

| Gen X | 1965–1979 | Through hard work and innovation, the generation has become the backbone of reform, accumulating personal wealth along the way. |

| Baby Boomers | 1950–1964 | A generation characterized by diligence and resilience, with life experiences and deep-rooted commitment to community & family. |

Source: Public info; BCG analysis, June 2023

Diverse spending pattern across generations

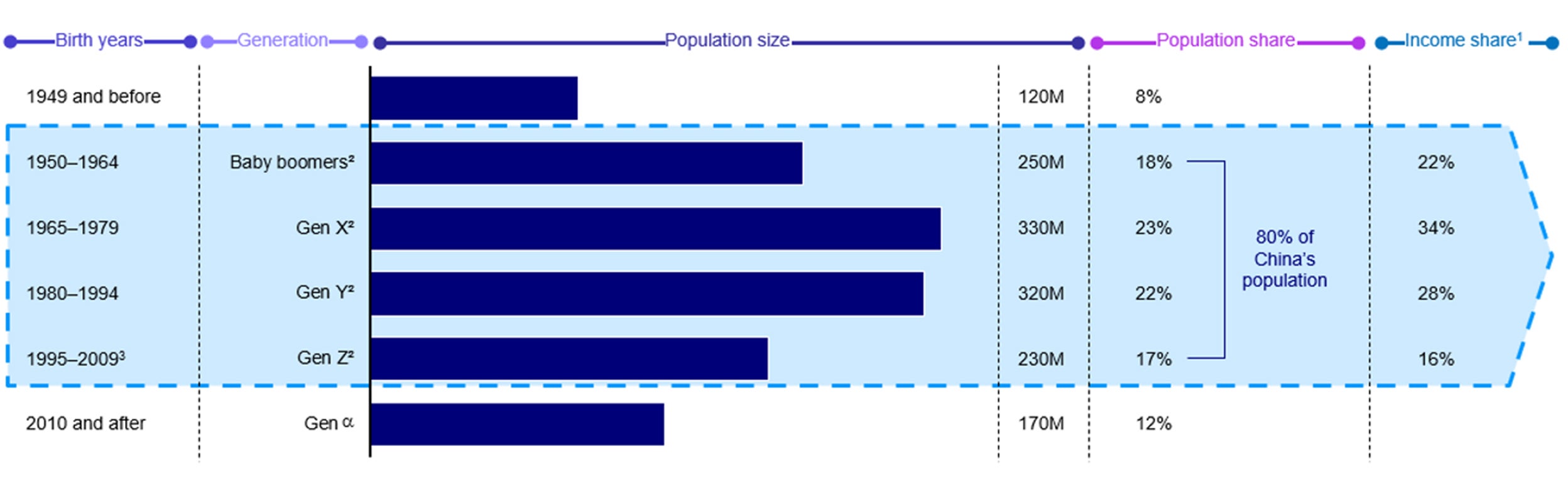

- Four generations of spenders account for 80% of the population, with Generation X and Y have the most potential as they lead the population and income share.

- Generation X, represents the middle-aged demographic with established careers and the highest purchasing power.

- Generation Y, is tech-savvy and driving consumption trends, shaping market preferences.

- Each generation has unique characteristics and consumer behaviour, creating a diverse consumer landscape.

- We believe opportunities will arise from catering to various segments and developing innovative solutions to meet the evolving consumer expectations.

- We believe that consumer preference will lean towards the Internet, E-commerce and technology consumables given the rise of Generation X and Y.

Note: The total income of 4 generations = 100%, as consumer income outside of the 4 generations only accounts for a small %. In 2023, ages of the generations are:

Baby Boomers 59-73, Gen x 44-58, Gen Y 29-43, Gen Z 14-28. Source: 7th Population Census; China Statistical Yearbook 2021, BCG analysis, May 2023.