The outlook for Hong Kong equity market following the recent rally

Hong Kong’s financial markets are currently navigating a period marked by equity outperformance, monetary divergence, and regulatory innovation.

The recent rally in the Hang Seng Index (HSI) is underpinned by both sector-specific and macroeconomic tailwinds, as well as capital inflows catalyzed by Chinese policymaker’s accommodative policy stance and Hong Kong’s open market framework.

Source: Bloomberg, as of August 14, 2025.

Multiple catalysts to give the HK market another leg up

Looking ahead, we believe that market participants can look forward to a few positive catalysts that could give the HK market another leg up.

Namely, we expect the Fed to begin its rate-cutting cycle which could be as soon as next month. Given Hong Kong’s monetary policy framework, which pegs the HKD to the USD, we expect the HKMA to lower its Base Rate in tandem.

Hong Kong interbank rates (HIBOR) have declined sharply this year, and the sustained period of lower rates may provide support for a recovery in domestic lending and consumption.

The residential property market in Hong Kong may experience a more vigorous recovery if mortgage rates (closely linked to HIBOR) continue to ease.

Hong Kong’s economic performance in the 1H has been strong and even above the top range of the government’s 2 - 3% forecast for 2025, with growth picking up sequentially in Q2.

So far this year, growth has been boosted by local consumption and resilient electronics and machinery exports to places such as Mainland China and to Southeast Asia. Still, headwinds remain.

We will closely watch if Hong Kong can sustain its export-led recovery in the face of uncertain trade frictions.

Strong capital flows to Hong Kong markets

The Hang Seng Index has emerged as one of the best performing major indices this year, advancing close to 30% in USD terms.

One reason for the outperformance is that the release of DeepSeek’s high performing AI model has catalyzed a re-rating in Chinese technology stocks, which are mostly found listed in Hong Kong.

The AI narrative has not only lifted valuations but also re-established Hong Kong as a preferred venue for exposure to China’s innovation economy. On the other hand, the CSI 300 Index is dominated by financials and industrials, sectors more exposed to China’s domestic macro economy.

We believe that the upward trajectory of Chinese technology stocks has further room to run. The integration of AI into consumer applications in China is accelerating, driven by advancements such as DeepSeek's development of a leading AI model at a reduced cost, which facilitates broader adoption.

In parallel, Mainland China’s persistently low-interest rate environment is encouraging capital flows into Hong Kong.

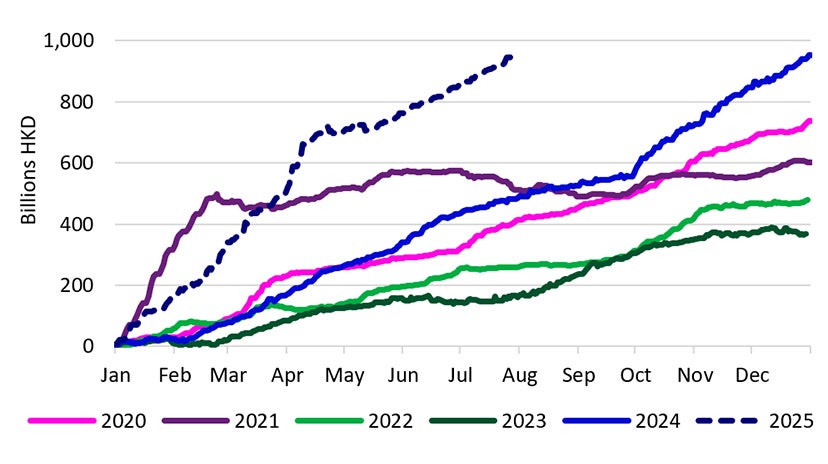

Southbound flows via Hong Kong’s stock connect have surged recently while Chinese government bond yields continue to fall. Southbound cumulative net inflows have reached HKD 968 billion year-to-date1, already comparable to last year’s total and significantly higher than previous years.

Source: Hong Kong Exchanges & Clearing Limited and Invesco calculations. Daily data as of 29 July 2025.

A benefit of stronger flows is that the more active trading volumes enhances appeal for the Hong Kong IPO market, which has shown strong signs of revival.

The Hong Kong Stock Exchange raised USD 13.9 billion in IPO deals in the first half of the year, leading global rankings and topping the second place Nasdaq which recorded USD 9.2 billion in new listings2.

The strong IPO pipeline is a strong signal of corporate confidence and investor appetite. Hong Kong stands to benefit from shifting geopolitical dynamics, as an increasing number of Chinese corporates opt to list in the city, redirecting IPO activity away from US exchanges.

Attractive valuation relative peers

The Hang Seng Index still looks cheap relative to Asian and global peers, with a trailing 1-year PE ratio of 12x and a dividend yield above 3%.3 With an expected rate cutting cycle to start shortly, this should benefit more cyclical sectors and it’s possible the rally could broaden beyond tech and financials.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.