Extreme weather: Investing into climate resilience

Q1) In the face of extreme weather, are governments and corporations taking actions to alleviate the impact?

Asia lost $2T USD due to extreme weather over the past 3 decades1; key events just from this summer include

- Japan: Hottest day on record and hottest ever June/ July recorded; impact on train and transportation services.

- South Korea: Surge in health and emergency services due to heat-related illnesses.

- Mainland China: Floods, heavy rains and landslides leading to flight delays/cancellations, outbreak of mosquito-borne virus.

- Hong Kong: Heavy rainfall bringing about disruptions to transportation and city infrastructure2.

Some of the key areas that governments have been taking actions include:

- China unveiled a 2025-2030 plan that aimed at improving environmental conditions to safeguard public health; looking at health related impacts from climate change and measures such as improved emergency response capabilities3.

- Singapore injected $5B SGD Coastal and Flood Protection Fund as part of budget announced in Feb 20254.

- UK government committed £2.65 billion to build or maintain up to 1,000 flood defenses, protecting more than 66,000 properties in Feb 20255.

Q2) Are asset owners concerned about this phenomenon? Do we see fund flows to climate-related strategy / products surge recently?

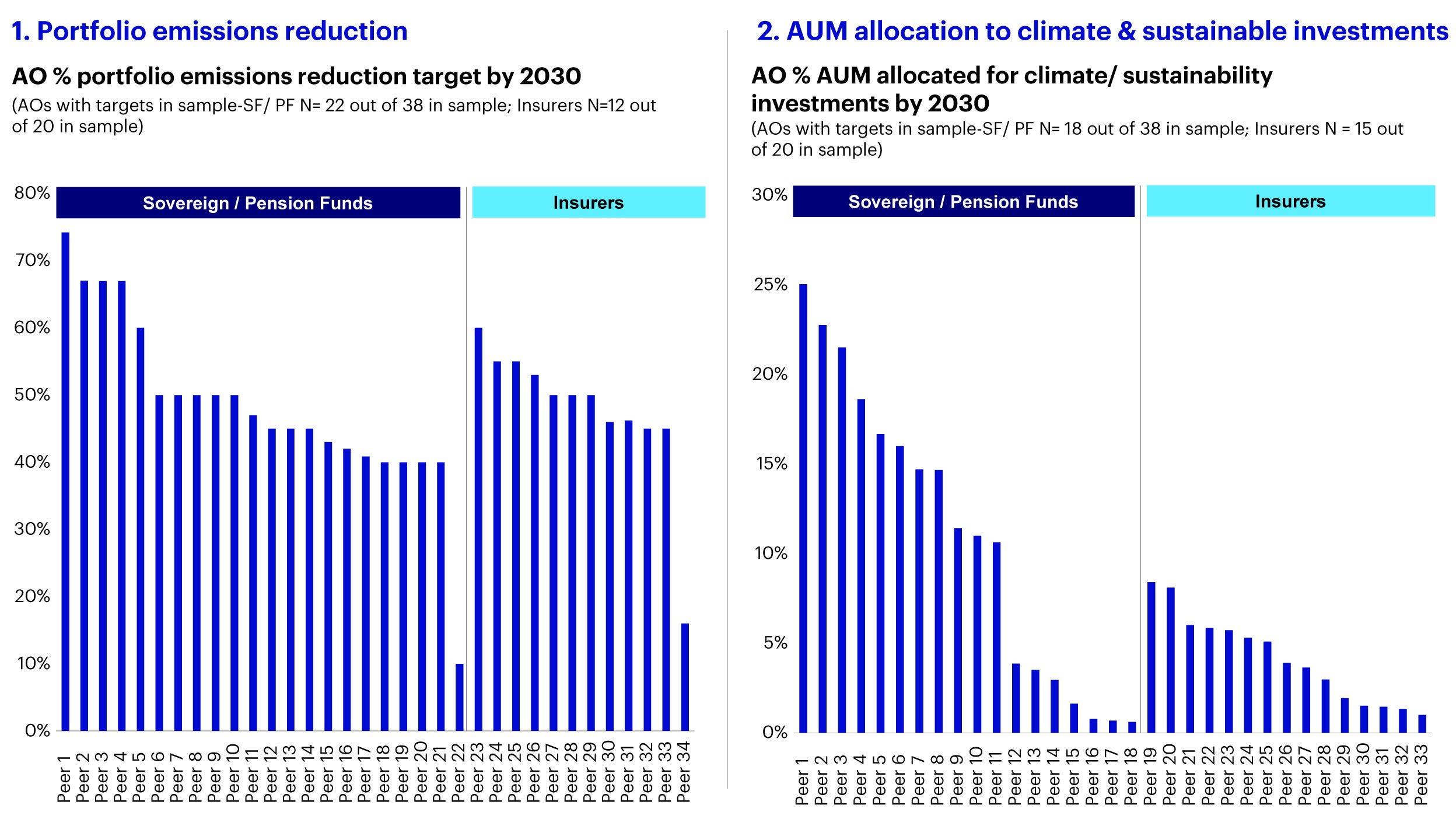

An analysis of global asset owners including sovereign funds, pension funds and insurers highlight that most have 2030 emissions reduction targets in portfolio as well as 2030 AUM deployment targets to invest into sustainable investing.

Source: Invesco Analysis. SF (Sovereign Funds) / PF (Pension Funds) sample is based on top performing SF/ PF by annualized 10Y returns (Top 10 global, Top 10 APAC, Top 10 EMEA). Insurers sample based on top 20 largest insurers in APAC/ EMEA.

Increasing number of asset owners have also identified resilience and adaptation as a focus area; examples include:

- Asia sovereign funds: Releasing whitepapers and researches into the topic of resilience including analyzing the impact on physical risks on real assets6, sizing the investment and revenue opportunity in adaptation7 and looking at private investing opportunities in climate resilience8.

- Asia insurers: Climate investing framework includes a category of investing into climate solutions including that for climate adaptation and resilience9.

- Asia Development Finance Institutions (DFIs): Key development banks in Asia have also set climate finance looking to achieve ~$50-100B USD in accumulated climate finance in the leadup to 2030 with adaptation finance as a priority area to scale10.

Q3) What are the investment implications for investors / asset owners?

- Energy security and transition: Global demand for energy security especially with the growth of AI and electricity demands may drive importance in assessing transition risks in investment portfolios and separating laggards from transition leaders who are better positioned against financially material climate risks. There would also be increasing attention in investing in energy infrastructure like grid, transformers and alternatives like nuclear and sustainable aviation fuel (SAF).

- Physical risks: Continued emphasis on better assessment of physical risks impact on portfolio particularly for real assets like real estate including implications on insurance premiums and expenses.

- Climate adaptation: A whitepaper by an Asia sovereign fund on climate adaptation opportunity highlighted that they expect the investment opportunity set across public and private debt and equity will grow from $2 trillion USD today to $9 trillion USD by 205011. Investors may prioritize climate adaptation solutions that lead to clear incremental revenue or cost reduction and savings. For example, an agriculture project that demonstrates increased agriculture yields could lead to both enhanced food security and additional revenue.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.