Summer is here! From the rise in matcha and coffee prices to asset owners’ priority on sustainable investing, what are the investment implications?

The recent heat wave has led to impacts on our daily lives, e.g. matcha & coffee prices are on the rise. On the other hand, asset owners have stepped up sustainable investing such as Japan’s US$1.7 trillion pension fund has boosted ESG investments. What are the investment implications on these phenomena?

Q1) Heat wave in many parts of the world, including Asia and Europe, has created great impact in areas such as food production. What’s your expectation on the economic impact of these heat wave?

Summer has officially arrived. The first quarter of 2025 was already the second warmest on record1 and the arrival of summer will likely see even higher temperatures. Some of the economic impact includes:

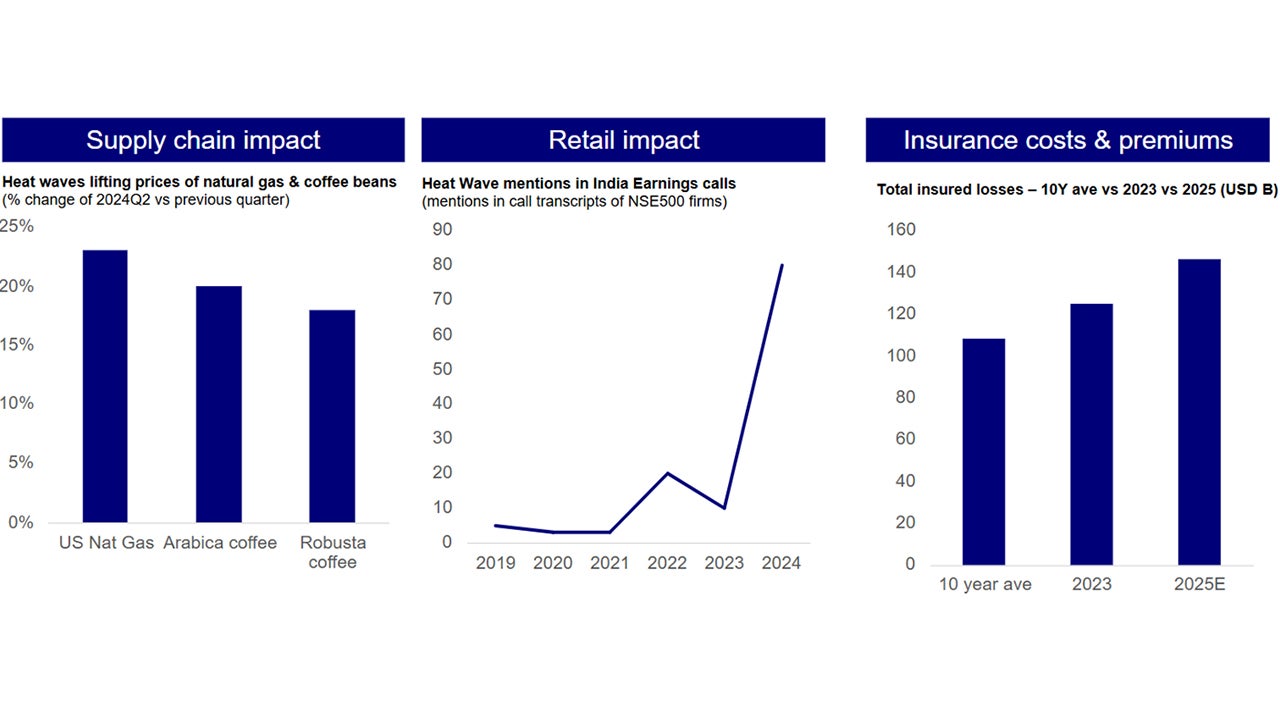

Supply chain impact: Heat and extreme weather could impact supply of agriculture and food products and lead to tightened supply and elevated prices. Heat wave and record temperature in Japan have strained matcha green tea supplies and prices have surged to all times high2. Similarly extreme weather in coffee producing regions like Brazil, Colombia and Vietnam has also led to poor harvests and inflated prices3.

Retail Impact: Heat wave in India in 2024 had a direct impact on reduced retail footfall (as more consumers stayed home in the heat). It also affected labor productivity at construction firms. Heat wave was mentioned significantly in India earnings calls amongst NIFTY 500 firms in 20244.

Insurance premiums: Extreme weather could cause up to $145B USD in insured losses in 20255 leading to both impact on insurers and also to rising insurance premiums such as for real estate players.

Source: Nikkei, Coffee prices jump 20% as global heat hits commodity markets, Jun 2024, https://asia.nikkei.com/Business/Markets/Commodities/Coffee-prices-jump-20-as-global-heat-hits-commodity-markets ; Economic Times, Mention of heatwaves at all-time high in India’s earnings calls, Aug 2024, https://economictimes.indiatimes.com/small-biz/trade/exports/insights/mention-of-heatwaves-at-all-time-high-in-indias-earnings-calls/articleshow/112392374.cms?from=mdr ; WEF, Cost for climate disasters to reach $145B in 2025, Jun 2025, https://www.weforum.org/stories/2025/05/costs-climate-disasters-145-billion-nature-climate-news/ ; Invesco Analysis.

Q2) We are seeing some governments and corporations step up sustainability-related investments. What’s your outlook on this trend?

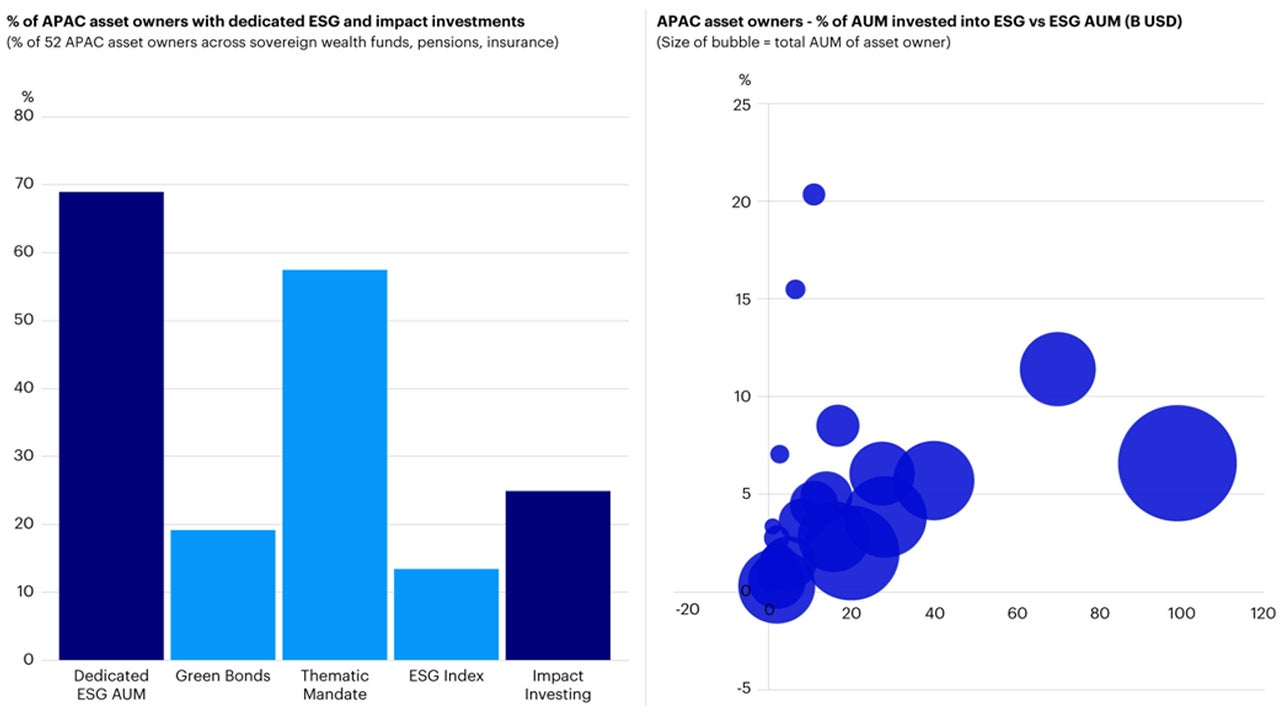

Asset Owners’ priority on sustainable investing: Invesco’s analysis of 52 APAC asset owners across sovereign wealth funds, pensions and insurance companies with over US $15 trillion in assets under management highlights that ~70% of these asset owners have made allocations to sustainable investing across green bonds, thematic mandates and ESG index6. Recent examples of sustainable investing developments across Asia Pacific include:

China: The Ministry of Finance debuted sovereign green bond worth $824M USD in April 20257. Another example is the recent regulatory development on sustainable investing such as a newly issued “Rules on Publicly Offered Fund Managers Participating in Corporate Governance of Listed Companies” encouraging investors actions on stewardship and voting in the market.

Hong Kong: HK’s central bank and exchange fund’s latest sustainability report highlights that sustainable investments across different asset classes constitute over 10% of their fund’s investment portfolio. This includes allocations to public equities mandate on sustainability and transition and low carbon equity indexes8.

Taiwan: Taiwan’s pension fund issued a $1.6B USD climate equity mandate with requirements for investors to track a climate related benchmark index9.

Japan: Latest annual reporting from major Japanese’s pension fund GPIF highlighted that 15% of the fund’s equity investments have exposure to ESG-themed index as of March 202510.

Source: Invesco Analysis

Two strategic opportunities ahead: We believe asset owners have 2 strategic priorities relating to sustainable investing ahead.

- Better understanding the financial linkages of sustainability factors to manage portfolio risks and capture performance upside.

- Meeting their sustainability targets (and often relating to their regional or governmental targets).

Both of these strategic priorities will shift asset allocation and investments.

Financial linkage: Increasing emphasis on evaluating how sustainability factors affect investment returns. Many global asset owners such as Norges Bank Investment Management (NBIM) and GPIF have emphasized the impact of systemic sustainability risks on portfolios. For example, GPIF in Japan released an “Evaluation Project on effects of engagement” in 2024 has shown that engagements on board structure have achieved demonstrable results, with the market capitalization of the engaged companies increasing by 6% as compared to non-engaged companies11.

Meeting sustainability targets: Invesco’s analysis of Asia Asset Owners highlights that 50% of asset owners have climate targets such as portfolio decarbonization objectives and 50% also have made climate investment allocations with some having targets to deploy a % of their AUM towards sustainability and climate allocations12.

Q3) What are the investment implications?

Physical and transition risk management: Climate index and ETFs for example will factor such sustainability risks in the index construction such as looking at whether companies have validated targets and transition plans and forward-looking indicators like capex and revenue alignment.

Investment into adaptation solutions: Financing interest in climate adaptation has grown in the past year with newly developed standards like Climate Bonds Initiative’s Resilience Taxonomy. Singapore sovereign wealth fund GIC has released of a guide on investing into the climate adaptation opportunity - where they expect the investment opportunity set across public and private debt and equity to grow from $2 trillion USD today to $9 trillion USD by 205013. Agriculture and food productivity, water access and security and resilient infrastructure are key themes of focus.

Fixed income: Labelled fixed income bonds have sustained momentum in issuances and continue to be an effective credit quality screen for investors, with ESG regulatory requirements in EMEA affecting access to broader pools of investors and funds. Such fixed income strategies continue to be effective strategies for risk compression amidst volatility in markets.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.