Nasdaq 100 Index – Commentary

Accessing Innovation in the US

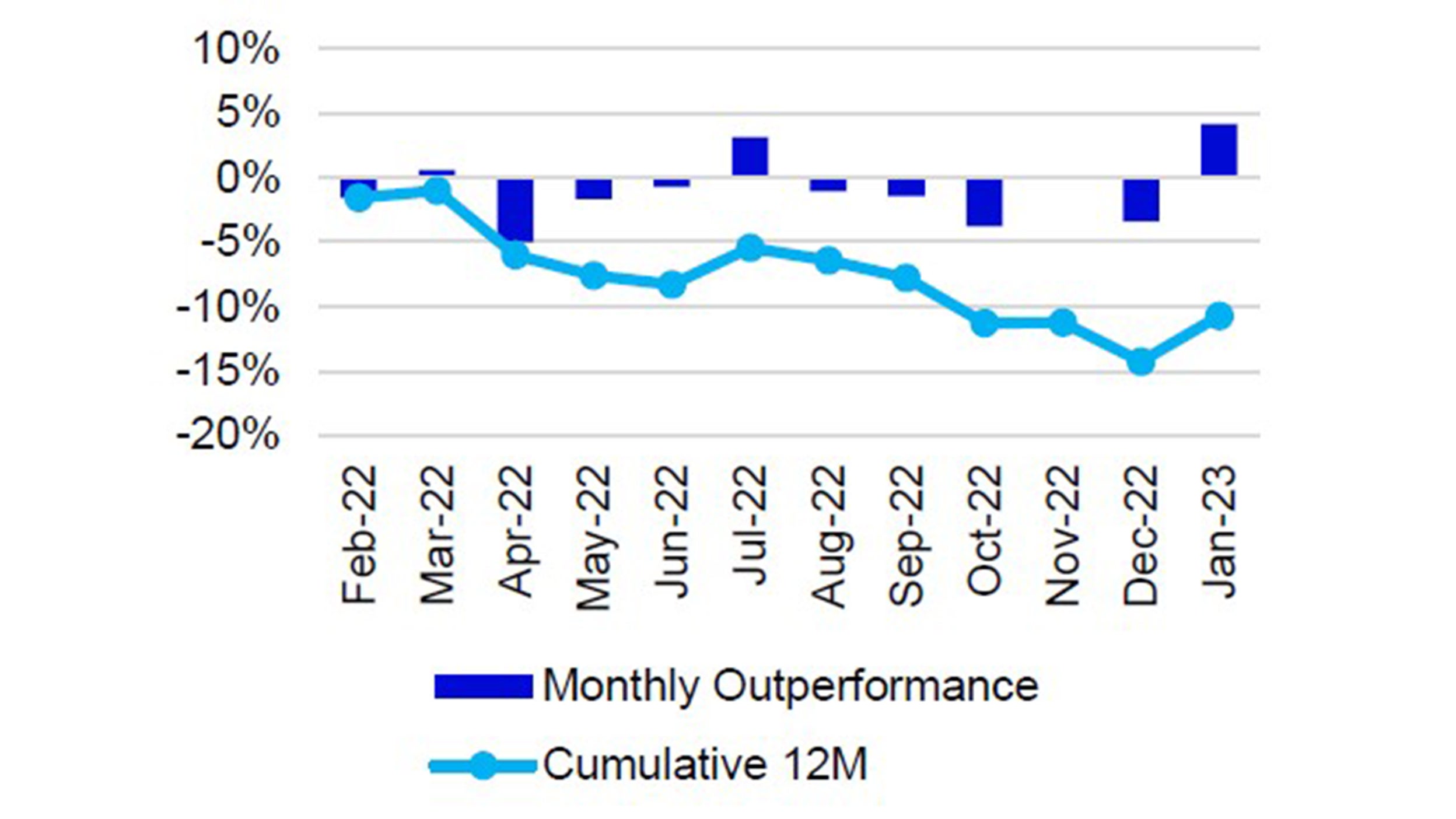

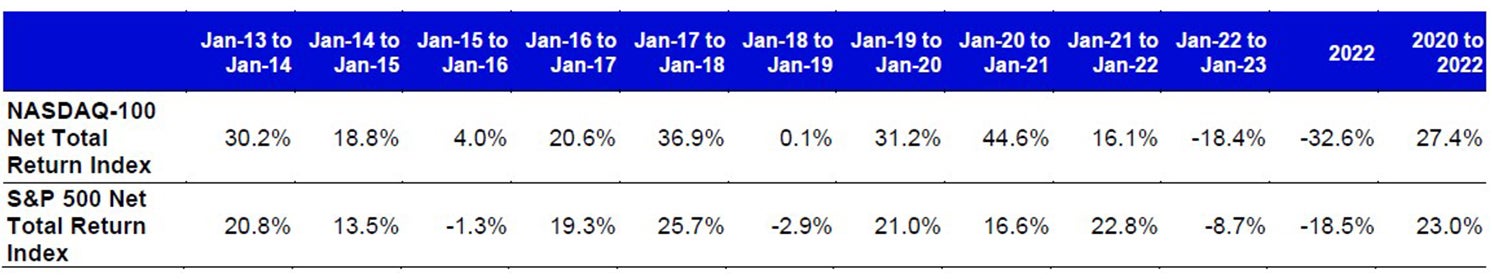

For the month of January, the Nasdaq 100 Index (NDX) returned 10.7%, outperforming the S&P 500 Index, which returned 6.3%. Investors turned back to equities for January as optimism for a “soft landing†of the economy grew, and potential for the slowing pace of rate hikes from the Federal Reserve (Fed) started to get priced into the market. The start of 2023 was much different from 2022, where the S&P 500 was down 5.17%.

US inflation, as measured by CPI (Consumer Price Index), continued its downward trend and printed its first negative month-over-month reading since May 2020. The -0.1% month-over-month reading met analysts' expectations. The year-over-year reading was reported at 6.5%, lower than the previous reading of 7.1% and the lowest print since November 2021. Energy and commodities were the largest contributors to the drop in year-over-year inflation and the cost of food declined slightly while the cost of services continued to rise. The continued decline of CPI and PCE gave hope to investors that this may lead to fewer rate hikes from the Fed and was additive to the bullish sentiment seen during the month.

The Bureau of Labor Statistics also released an updated unemployment rate at the beginning of January which came in at 3.5%, lower than the previous revised number of 3.6%. Despite ongoing layoffs that have predominately been in large tech-focused companies, US initial jobless claims did not see a significant spike in January. Investors have continued to wait for an increase in unemployment numbers as the Fed had signaled higher unemployment as a side effect of the rate hikes. The ongoing strength in the labor market continued to give hope that a soft landing is achievable. It also has the potential to support future Fed decisions to increase the target rate to continue their fight against inflation.

Fed futures illustrated by Bloomberg showed that investors believed there was potential for the FOMC to have its first rate cut this cycle in the second half of this year. This could be another catalyst for the positive market action observed in January.

Index performance

| 1M | YTD | 1Y | 10Y(ann.) | |

|---|---|---|---|---|

NASDAQ-100 |

10.7% | 10.7% | -18.4% | 16.9% |

| S&P 500 | 6.3% | 6.3% | -8.7% | 12.0% |

Relative |

4.1% | 4.1% | -10.7% | 4.4% |

Source: Bloomberg as of 31 Jan 2023.

An investment cannot be made directly into an index.

Source: Bloomberg as of 31 Jan 2023.

An investment cannot be made directly into an index.

Past performance does not predict future returns.

Data: Invesco, FactSet, as of 31 Jan 2023 Data in USD.

Whilst the Nasdaq-100 specifically excludes Financials (incl. Real Estate), it also currently offers no exposure to Materials or Energy

Nasdaq 100 Performance Drivers

January performance attribution of the Nasdaq 100 vs the S&P 500 Index

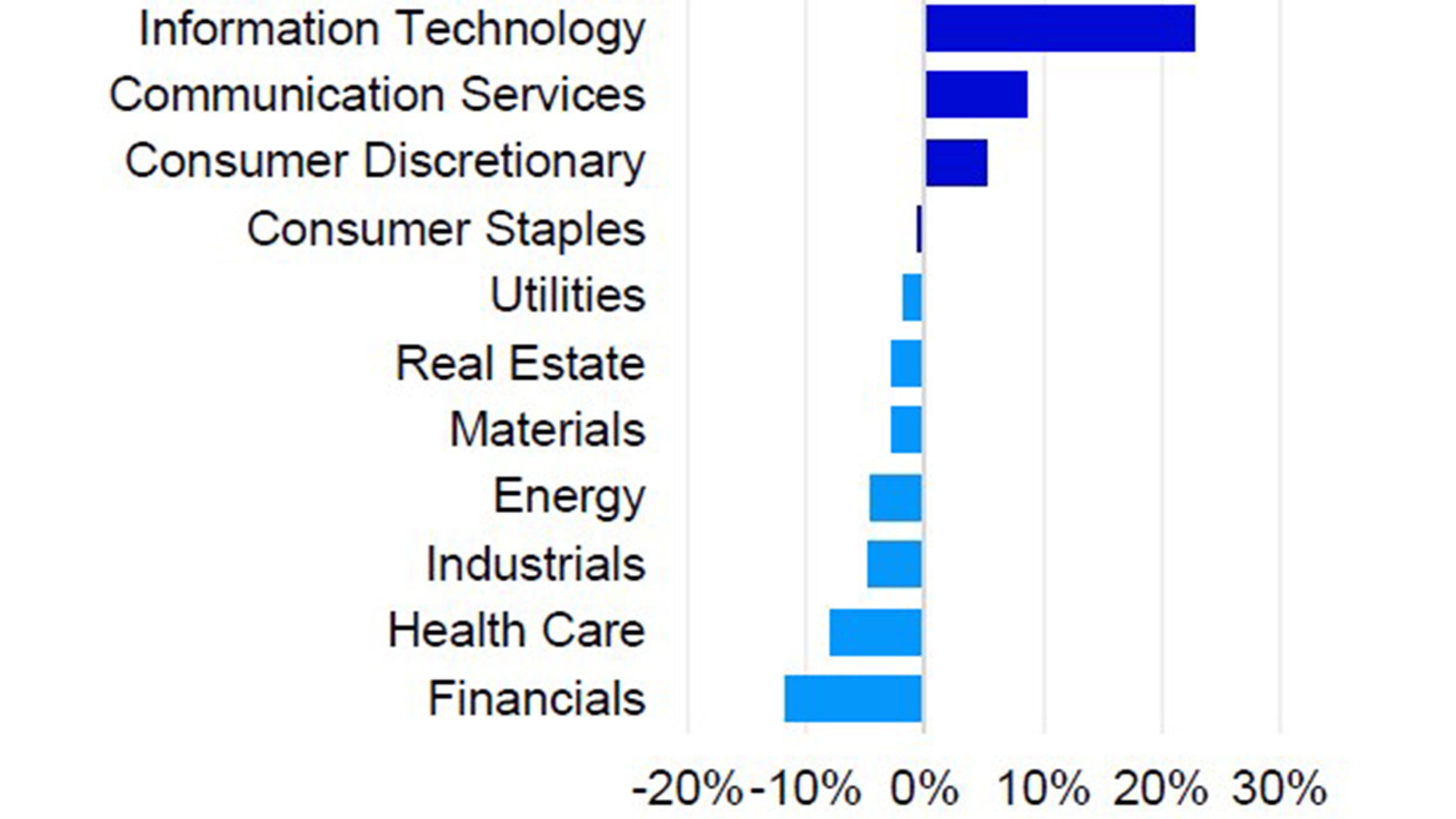

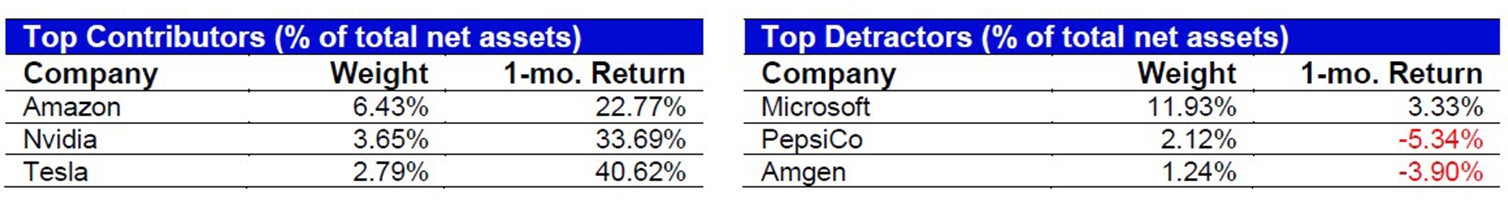

For the month of January, the Nasdaq 100 Index returned 10.7%, outperforming the S&P 500 Index, which returned 6.3%. Consumer discretionary, Communication services, and Information Technology were NDX’s best performing sectors and returned 22.9%, 14.1% and 9.8%, respectively. The Utilities sector was the only negative contributor to performance with a return of -1.6%.

NDX’s outperformance vs. the S&P 500 was largely driven by its overweight exposure and differentiated holdings in the Consumer Discretionary, Information Technology, and Healthcare sectors. Lack of exposure to Materials, Real Estate, and Financials detracted slightly from the index’s relative performance vs. the S&P 500.

Data: Invesco, FactSet, as of 31 Jan 2023 Data in USD.

Source: Bloomberg, as of 31 Jan 2023. Past performance does not predict future returns. Top and bottom performers for the month by relative performance.

Past performance does not predict future returns

Data: Invesco, Bloomberg, as of 31 Jan 2023. Data in USD. An investment cannot be made into an index.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.