Commodity Digest: January 2026

Commodity market – month in review

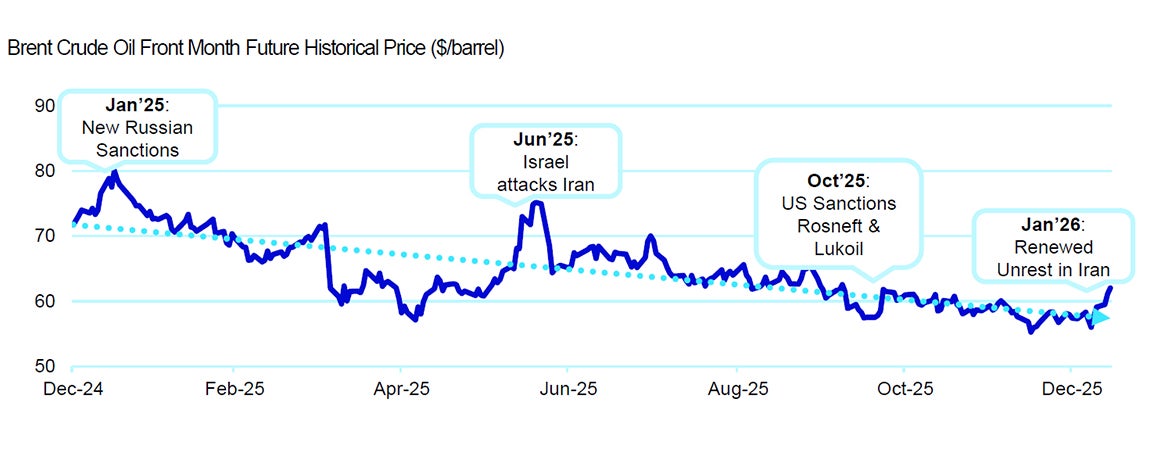

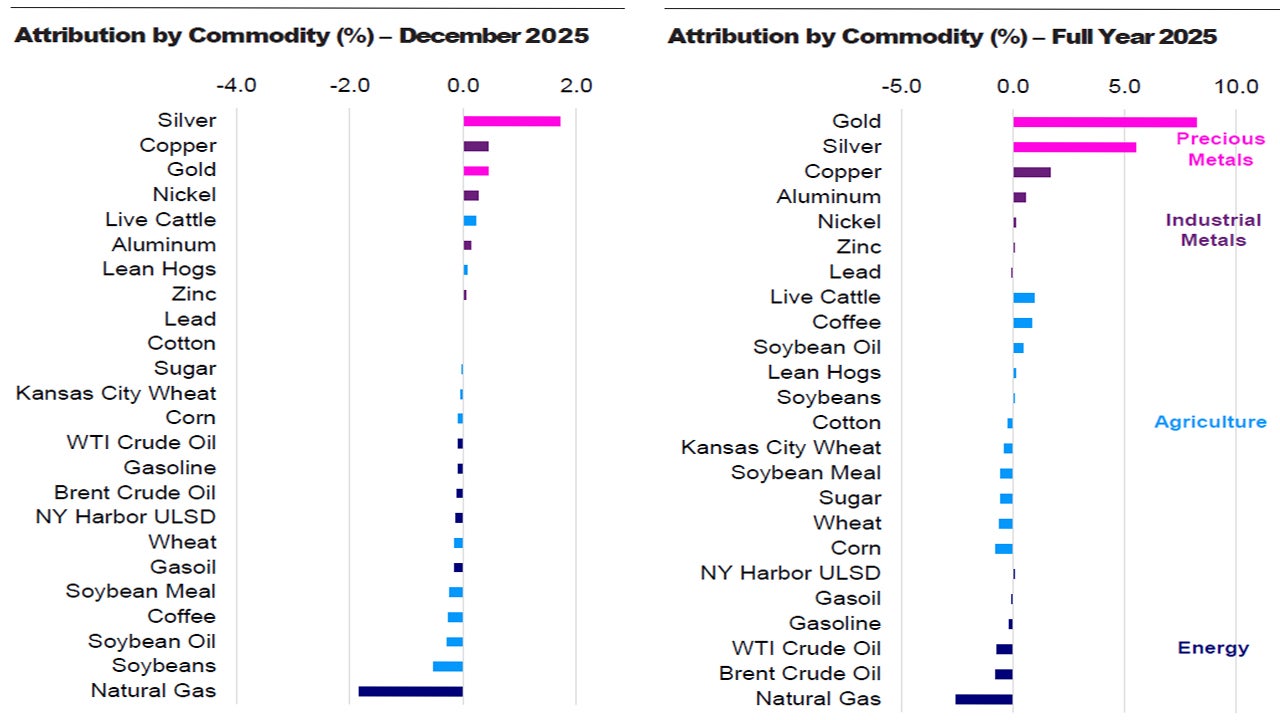

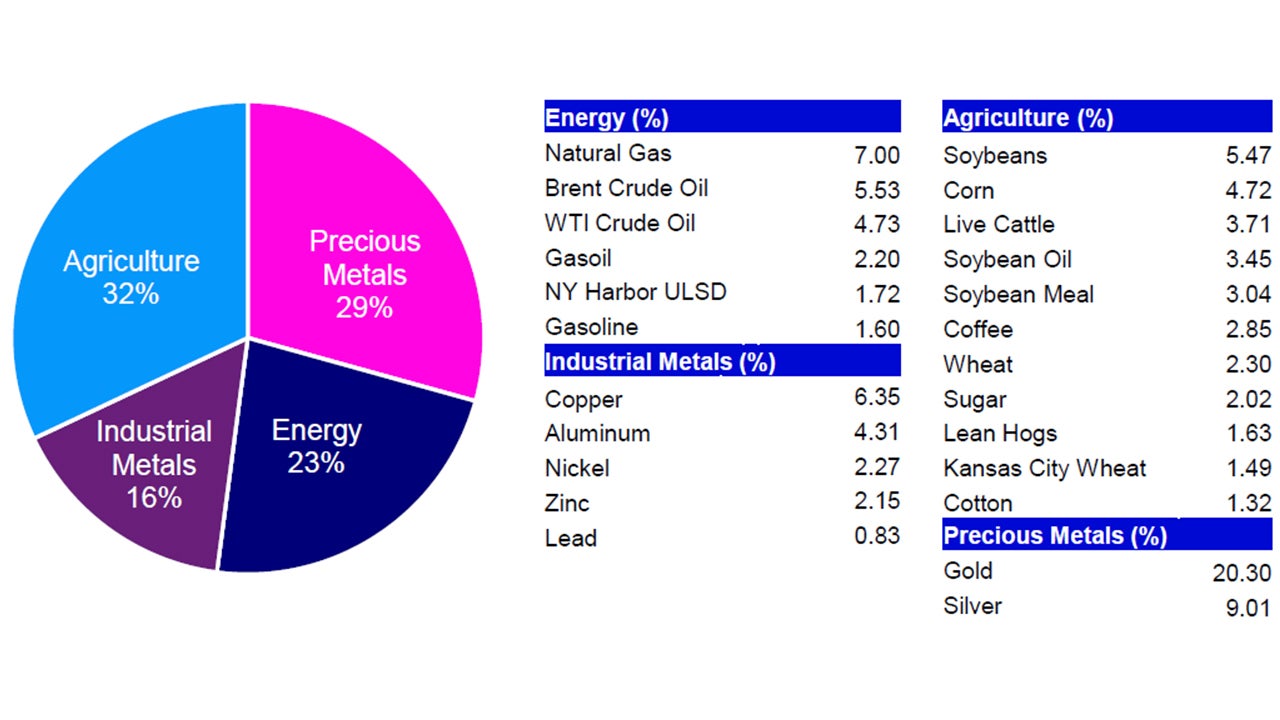

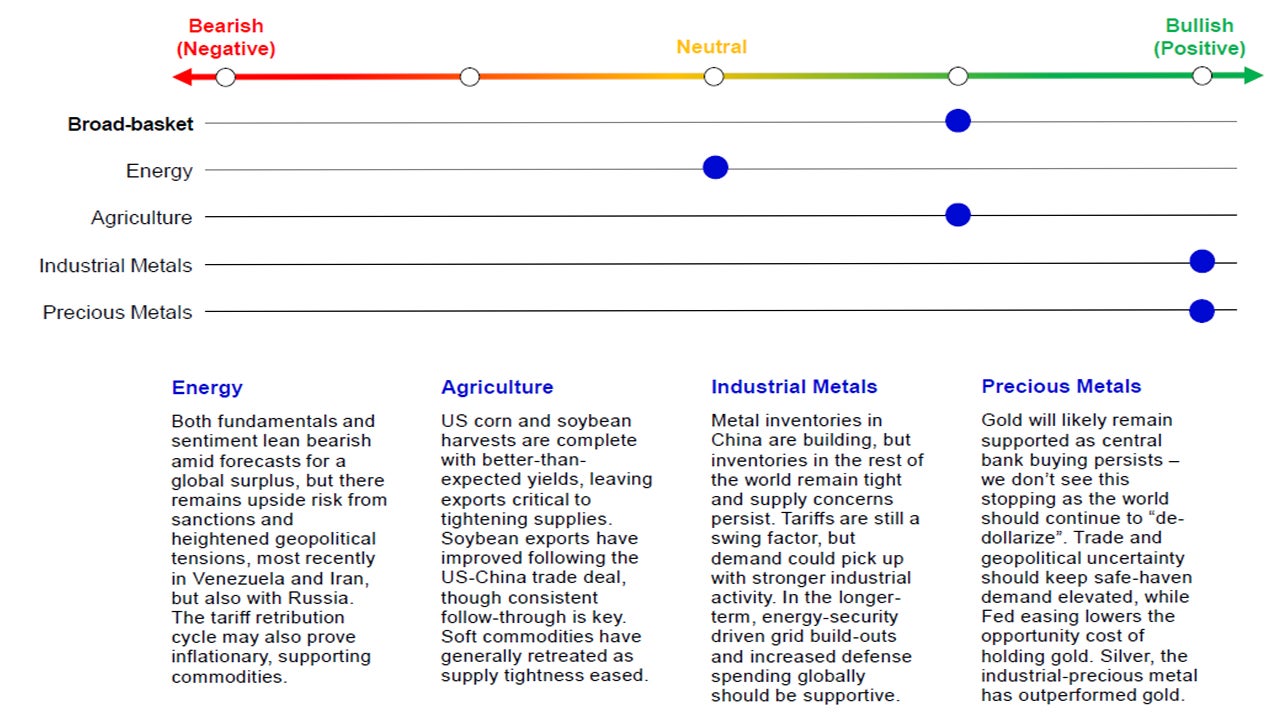

Commodities posted a modest loss in December, with the Bloomberg Commodity Index (“BCOM Index”) down 0.65%, but finished the year +11.07%. Precious metals led performance, followed by industrial metals, though gains were largely offset by declines in energy and select agricultural markets. Silver was the standout, with front-month prices surging nearly 25% on strong investor inflows, expectations of Federal Reserve (Fed) rate cuts, and tightening supply amid global deficits and China’s export restrictions. Copper also rallied to record highs, supported by mine-supply disruptions, robust consumption tied to AI investments, and mounting deficits, while nickel led base metals in December after Indonesia announced plans to cut output by one-third. On the downside, natural gas plunged 20% due to milder weather and strong US production, despite sharp volatility from shifting heating demand and storage data; all energy commodities ended lower as brief geopolitical rebounds were overshadowed by surplus forecasts and a potential move toward contango in early 2026. Agriculture was mixed, with livestock and cocoa advancing on tight supply and index rebalancing expectations, while grains and soy products fell under pressure from larger crops, high stock levels, and reduced South American export tariffs.

Geopolitical risks have taken center stage for commodities to start the new year, underscoring the strategic value of holding them in portfolios. Unlike other market drivers, price swings triggered by geopolitical events are difficult to predict—and with global turmoil at unprecedented levels, commodities offer a critical hedge against uncertainty.

In energy, geopolitical uproars in Venezuela and Iran are introducing meaningful supply risks, though structural challenges limit immediate production shifts. In industrial metals, battery metals are rebounding on supply discipline, while Chinese copper demand is slowing seasonally ahead of the Lunar New Year, creating some near-term pressure. Silver continues to outperform gold, but its dual precious-and-industrial nature, alongside lingering tariff uncertainty, creates both upside potential and near-term correction risk. At the macro level, expected Fed rate cuts, tariff volatility, and prospects for US fiscal expansion ahead of midterms should provide broad support for the commodities complex.

See index definitions below. Past performance is not a guarantee of future results. Please keep in mind that high, double-digit and/or triple-digit returns are highly unusual and cannot be sustained.

What’s Top of Mind?

Geopolitics Take Center Stage

- What Now for Venezuela? The surprise capture of Venezuelan President Maduro on January 3 has reignited regime change discussions, presenting one of the most significant upside risks to global oil supply for 2026–27 and beyond. Venezuela, home to the world’s largest oil reserves—nearly 20% of global supply—currently produces about 750k barrels per day (b/d), but with institutional reforms and renewed investment, output could surge to 2.5 mb/d over the next decade.1 US officials have been tasked with encouraging American energy firms to reinvest in Venezuela’s aging infrastructure, and combined with Guyana’s rapid discoveries and US reserves, this could give Washington influence over roughly 30% of global oil.1 Such a shift would strengthen US energy security and likely stabilize prices lower, while reshaping the global energy power balance. However, Venezuela faces deep structural challenges, and the current US administration’s bandwidth is constrained by competing priorities.2

- Beyond oil, Venezuela holds extensive mineral reserves, including bauxite (aluminum), gold, nickel, and iron ore, but unlocking this potential will require major improvements in governance, security, and infrastructure (especially power and transportation), with bauxite offering the most immediate opportunity, given an existing but underutilized aluminum smelter, though reliable power remains a critical challenge.3

- Iranian Unrest Grows – Iran is facing its most significant unrest since 2009, as protests fueled by economic collapse, soaring inflation, and a plunging currency leave the regime with no clear path forward. Public confidence has eroded further amid military setbacks preceding the 12-day war with Israel and the US in June, while the risk of renewed conflict grows as Washington weighs intervention following Tehran’s violent crackdown on demonstrators.

- Oil prices have fluctuated amid ongoing developments, yet markets appear to underestimate the risk of significant supply disruptions—despite historical patterns where regime changes in major oil-producing nations drove sustained price spikes averaging 76% from onset to peak.4 Iranian unrest could pose a threat to oil markets if workers join protests and initiate strikes, though recent episodes of unrest have not resulted in strike-induced supply cuts. Additionally, the Islamic Revolutionary Guard Corps (IRGC) and allied militias may target regional energy infrastructure to deter US intervention, even if their Axis of Resistance has weakened.2

Source: Bloomberg L.P. as of January 14, 2026. Morgan Stanley Research.

Commodity Index Rebalance Impact

- The annual Bloomberg Commodity Index (BCOM) and S&P Goldman Sachs Commodity Index (GSCI) rebalance took place on January 8-14. Some of the key changes and implications for commodities markets included a heavy slash to precious metals, with gold’s BCOM weight going from ~20% to 15% and silver from ~10% to 4%, leading to heavy selling. In contrast, energy commodities gained prominence: Brent crude reached a record weight of 8.36%in BCOM, attracting inflows. Copper also benefited from a higher allocation while agriculture saw mixed effects—cocoa rejoined the index for the first time since 2005, sparking heavy inflows, while grains and some softs faced reductions.5,6 While the rebalance drove short-term volatility and large technical flows given BCOM and S&P GSCI are the two main commodity benchmarks, fundamentals are expected to regain control once adjustments settle.

Past performance is not a guarantee of future results. See index definition below.

Industrial Metals On Fire!

- Battery Metals Stage A Comeback – The battery metals market, which had been oversupplied for much of the past year, continues to show signs of a turnaround. Nickel, lithium, and cobalt are experiencing production cuts as producers respond to prolonged price weakness and inventory overhang. Notably, Nickel soared in late-December after headlines anticipating a one-third cut to Indonesia’s nickel ore quota, with the move amplified by both investor positioning and strong Chinese buying. Although the full impact remains uncertain and quota cuts don’t necessarily translate into production losses, these supply-side shifts are already tightening the market and fueling rallies across the sector. The shift underscores a critical inflection point for battery metals, as demand fundamentals remain strong amid accelerating energy transition initiatives, while supply discipline is starting to restore balance and supporting renewed investor optimism.

- Slowing Chinese Demand – Chinese copper demand has shown signs of slowing as industrial activity moderates and buyers step back ahead of the Lunar New Year holiday. Inventories are beginning to build, reflecting weaker near-term consumption and seasonal patterns. This pre-holiday stock accumulation is typical, as manufacturers reduce purchases and draw down existing supplies before shutting operations for the extended break. While this trend is not unusual, it underscores softer short-term fundamentals even as the longer-term outlook remains supported by structural demand drivers.

- The long-term outlook for industrial metals—especially copper and aluminum—remains strong, driven by electrification, renewable energy, and advanced technologies like AI. Copper’s role as the backbone of electrical infrastructure positions it as a key beneficiary of global decarbonization and grid modernization. In 2026, stagnant mine supply and surging demand from green tech and data centers—expected to add ~740k tons of copper demand—are set to create a 600k ton supply shortfall.6 Meanwhile, China’s aluminum output caps and tariff uncertainty are tightening global availability and spurring stockpiling. These dynamics, coupled with rising investment in critical minerals and supply chain resilience, reinforce a compelling long-term case for metals.

Silver Soars: The Best of Both Worlds?

- While gold captured most of the market’s attention, silver was the standout performer in 2025, ending the year up over 140% versus gold’s ~65%.7 Beyond shared macro tailwinds for precious metals like heightened geopolitical and macro uncertainty, silver’s rally reflects a persistent supply deficit fueled by green tech demand (solar, EVs, AI data centers) and strong investor flows. Its sharp rise, however, raises concerns about demand destruction, particularly in solar, where silver now accounts for ~20% of module costs vs. less than 5% pre-2024.8

- Uncertainty around Section 2329 tariffs on critical minerals, combined with silver’s dual precious-and-industrial role, continues to skew risks to the upside and position the metal as a more growth-driven alternative to gold. Although the January 14 Critical Minerals proclamation highlighted US concerns over reliance on foreign suppliers, the administration signaled it would not impose immediate tariffs, opting instead to pursue bilateral agreements and consider a potential import price floor, with officials expected to report back within 180 days. While tariffs remain a future possibility, the softer near-term stance reduces immediate disruption risk and could slow silver’s recent momentum, leaving future trade policy shifts, macro conditions, or supply disruptions as the key catalysts ahead.

Macro Trends Provide Support

- Anticipated Fed rate cuts in 2026 should boost investor risk appetite, further pressure the US dollar, and incentivize economic activity and business investments, skewing US and global growth risks to the upside. This should be supportive of commodities, especially energy and metals. Lower rates reduce the opportunity cost of holding non-yielding assets like gold, while also stimulating industrial demand tied to infrastructure buildouts and green tech.

- Tariff uncertainty will likely continue to inject volatility and upside risk into metals and broader commodities by challenging supply chains and driving strategic stockpiling—as seen in copper last year. Front-running and precautionary buying distort prices, creating artificial short-term demand and volatility spikes. Without concrete tariff guidelines, businesses are hesitant to reroute their supply chains, ultimately passing higher costs to consumers.

- The Midterm election is critical for President Trump as it determines control of Congress, directly affecting his ability to pass legislation and shape economic policy going forward. Winning both the House and Senate would give him maximum leverage to push through fiscal stimulus, tax cuts, and deregulation without gridlock. To strengthen his position, he would likely aim to stimulate the economy—or at least create the perception of prosperity—through aggressive fiscal measures (i.e., tax cuts, infrastructure spending), pressure for deeper Fed rate cuts, and policies that boost asset prices. A strong stock market and lower borrowing costs foster a “wealth effect,” making households feel richer and reinforcing consumer confidence, even if structural risks persist.

Past performance is not a guarantee of future results.

Source: FactSet as of December 31, 2025. The Bloomberg Commodity Index (BCOM) is made up of 24 of the most traded commodities futures across energy, industrial metals, precious metals and agricultural commodities., and is often used as a financial benchmark for commodity performance. An investment cannot be made into an index.

Source: Bloomberg L.P. as of December 31, 2025.

The opinions expressed are those of Kathy Kriskey and Lucy Lin and are based on current market conditions, subject to change without notice. These opinions may differ from those of other Invesco investment professionals. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions, there can be no assurance that actual results will not differ materially from expectations.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Commodities may subject an investor to greater volatility than traditional securities such as stocks and bonds and can fluctuate significantly based on weather, political, tax, and other regulatory and market developments.