Crypto Digest: December 2025

Crypto market – month in review

Cryptocurrencies saw a sharp downturn in November, with spot Bitcoin (BTC) falling ~17%, Ethereum (ETH) down ~22%, and Solana (SOL) plunging nearly 27%, erasing all year-to-date (YTD) gains. November marked Bitcoin’s worst monthly performance since June 2022 during the FTX collapse. The sell-off was fueled by a broad risk-off tone driven by hawkish Federal Reserve (Fed) signals ahead of the December rate cut (which ultimately occurred), the US government shutdown, forced liquidations of leveraged positions, and technical breakdowns as key support levels failed to provide support. US spot crypto ETPs recorded record outflows of ~$3.9B (-$3.5B from BTC, -$1.4B from ETH, +$1.0B in all other) in November as sentiment shifted to “extreme fear” on the Crypto Fear & Greed Index.1

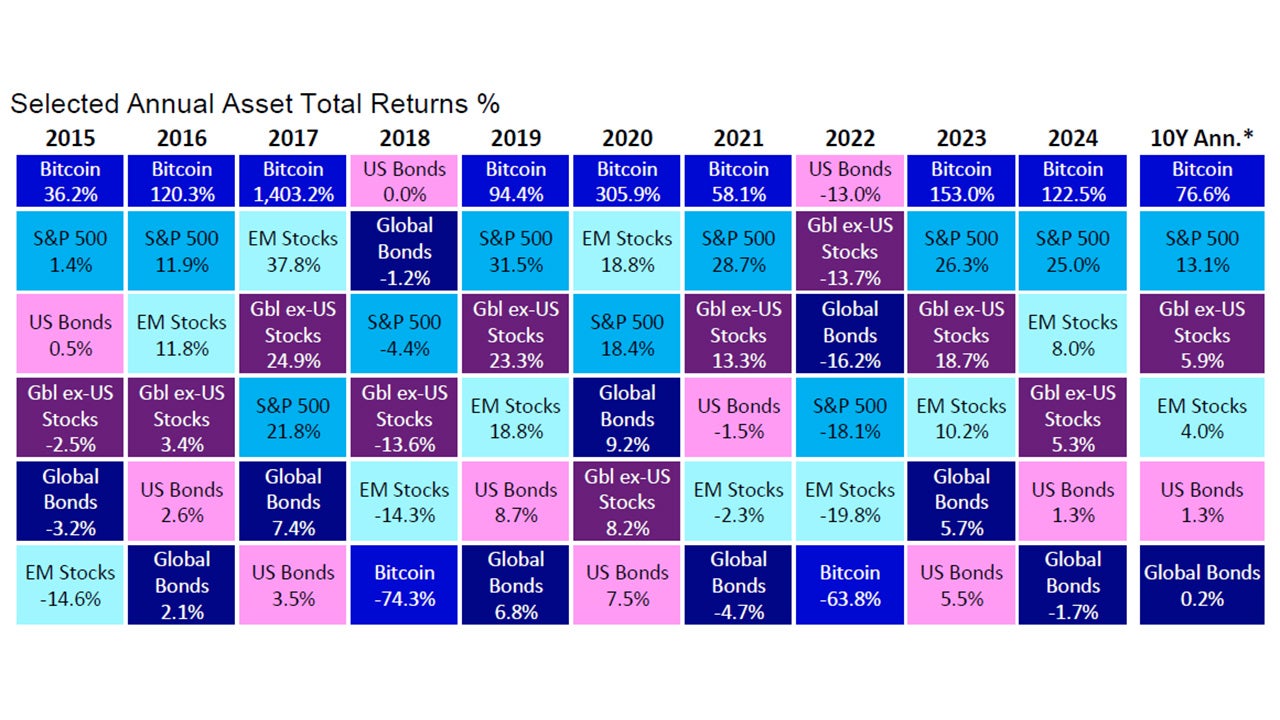

The weakness extended into December, with markets entering a range-bound consolidation phase as November’s selling pressure lingered. Seasonal tax-loss harvesting likely added to the downside, with over $5.2B in US spot BTC ETP sales since October 10. Lower liquidity typical of year-end has amplified volatility as traders adjust exposure. If BTC closes 2025 in the red, it will mark only the fourth annual loss since inception. Historically, sharp drawdowns have preceded strong rebounds, which allows for some optimism —BTC fell 74% in 2018 and 64% in 2022, followed by gains of 94% in 2019 and 153% in 2023 (see chart below).

Source: Bloomberg L.P. unless otherwise stated. BTC is represented by XBTUSD Spot Exchange Rate. ETH is represented by the XETUSD Spot Exchange Rate. SOL is represented by XSOUUSD Spot Exchange Rate.

Sources: Bloomberg and Invesco, as of December 31, 2024. All returns are unhedged total returns in USD. See page 3 for indices used. Past performance is no guarantee of future results. An investment cannot be made directly into an index. *Annualized performance shows the average yearly return of an investment. EM = Emerging Market. Gbl = Global. Please keep in mind that high, double-digit and/or triple-digit returns are highly unusual and cannot be sustained.

Top of Mind Into 2026

Technical Levels To Watch

- Bitcoin’s downtrend has investors watching key technical levels. Galaxy analysts highlight the importance of BTC holding above its 50-week moving average (~$102K) to signal a potential breakout from the correction. Failure to do so could see prices slide toward the 200-week moving average near $65K before finding meaningful support.2

Solana Takes Center Stage

- Invesco’s Global Head of Digital Assets, Kathleen Wrynn, recently attended Solana’s Breakpoint conference in Abu Dhabi where Solana was featured.

- Galaxy noted that Solana’s ecosystem is entering a more mature phase—shifting from being defined by its raw technical capability (where it remains a leader) to tackling structural challenges that will determine whether it can truly serve as the execution layer for Internet Capital Markets (ICM). If Solana sustains the discipline and momentum of the past year, it could become a driving force in bringing global finance on-chain. Two key narratives to watch in the year ahead are the race to modernize Solana’s market microstructure and the transition from meme-driven activity to ICM-driven adoption—benchmarks that will define Solana’s success by the next Breakpoint.3

“The Great Convergence”

- The “Great Convergence” — the merging of decentralized finance (DeFi) and traditional finance (TradFi) — is no longer theoretical; it’s happening now. Stablecoin adoption is accelerating, with total supply surpassing $300B and more than 1% of all US dollars now tokenized. Meanwhile, tokenized versions of Treasuries, money market funds, credit, and real estate are increasingly accessible. The integration of these worlds is not just likely — it’s inevitable.4

“DAT” Is Not So Good

- The ongoing collapse in cryptocurrencies has severely impacted Digital Asset Companies (DATs)—firms whose core business model revolves around acquiring and holding crypto assets. One of the most prominent examples is Strategy (formerly MicroStrategy), which has seen its share price plunge nearly 65% from its July 2025 peak. Despite this sharp decline, the company remains committed to its Bitcoin-centric strategy, continuing to accumulate BTC during the downturn. As of now, Strategy holds an astonishing 671,268 BTC, reinforcing its position as one of the largest corporate holders of Bitcoin globally. This aggressive accumulation underscores the company’s conviction in bitcoin’s long-term value, even as short-term volatility weighs heavily on valuations.5

- Many DATs are revealing structural weaknesses, including excessive leverage, poor governance, and unsustainable business models. These vulnerabilities have led to significant investor losses and triggered forced liquidations, creating a vicious cycle of selling pressure and bankruptcies across the sector. Investors are increasingly recognizing the inherent risk of using these equities as proxies for direct cryptocurrency exposure—a strategy that has proven far more volatile and fragile than anticipated.

Crypto Regulation in the US Midterm Year

- 2025 marked a breakthrough year for digital asset regulation as the Trump administration advanced its procrypto agenda. Looking ahead, further regulatory clarity in 2026 is expected to accelerate institutional adoption. The midterm elections will be a key focus for the administration as it seeks to maintain control of Congress and the Senate. Meanwhile, regulators are working to establish a coherent framework for banks to operate on-chain. For example, the Office of the Comptroller of the Currency (OCC) recently authorized banks to act as “riskless” principal intermediaries in crypto transactions—allowing same-day buy-and-sell activity without holding assets on balance sheets.6

- In 2026, Congress and US regulators are expected to clarify crypto rules, reducing enforcement risk for platforms like Coinbase and Robinhood and paving the way for institutional adoption. A comprehensive market structure bill is likely in the first half of the year. Meanwhile, “Project Crypto” aims to modernize securities regulation through tokenization and on-chain infrastructure. A mix of rulemakings, guidance, exemptions, and safe harbors should enable both traditional and decentralized finance to innovate without fear of regulatory overreach—marking a pivotal step toward integrating blockchain into mainstream financial markets.6

Past performance is not a guarantee of future results.

Index Definitions

An investment cannot be made into an index.

- S&P 500 Index is a market capitalization weighted index of the 500 largest domestic U.S. stocks.

- Bitcoin –Bloomberg Galaxy Bitcoin Index seeks to track the spot value of bitcoin in USD.

- Global ex-US Stocks –MSCI World Index is designed to measure large and mid market capitalization stocks in developed markets.

- Emerging Market Stocks –MSCI Emerging Markets Indexis designed to measure large and mid market capitalization stocks in emerging markets.

- US Bonds –Bloomberg US Aggregate Bond Indexis an index designed to capture the performance of US government and corporate bonds.

- Global Bonds –Bloomberg Global Aggregate Bond Indexis an index designed to capture the performance of global developed market government and corporate bonds across 27 local currency markets.

The opinions expressed are those of Kathy Kriskey and Lucy Lin, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals. This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations), and investors may not get back the full amount invested.

Cryptocurrencies are subject to fluctuations in the value of the cryptocurrency, which have been and may in the future be highly volatile. The price of a digital currency could drop precipitously (including to zero) for a variety of reasons, including, but not limited to, regulatory changes, a crisis of confidence, flaw or operational issue in a digital currency network or a change in user preference to competing cryptocurrencies. Cryptocurrencies trade on exchanges, which are largely unregulated and, therefore, are more exposed to fraud and failure than established, regulated exchanges for securities, derivatives, and other currencies. Currently, there is relatively limited use of cryptocurrency in the retail and commercial marketplace, which contributes to price volatility.

There are risks involved with investing in exchange traded products (ETPs), including possible loss of money. Shares are not actively managed and are subject to risks similar to those of stocks, including those regarding short selling and margin maintenance requirements.