Thinking Thematically From pandemics to wildfires: a changing world for real estate?

Overview

A summer filled with wildfires and smoke is a reminder of the society-wide challenges caused by the climate crisis

Real estate, a source of 40% of our emissions and a linchpin of human activity, is part of the needed transition

The sector is also at a turning point post COVID, and more efficient buildings could help. Already, they demand premiums ranging from 13.3% to 36.5% vs. traditional real estate12

After an already record-breaking summer, the air choking with smoke, the US experienced a devastating fire on Maui that killed more than one hundred people and destroyed Lahaina. While heart-wrenching questions remain about inequality and lack of preparation from disaster planners, this tragedy also showed just how multi-faceted climate change is. Drought combined with strong winds and invasive non-native grass created an out of control blaze. It’s a crisis compounded by other crises, carbon emissions and biodiversity just two facets of the massive challenges we face.

And this summer of fire stretches globally. More than 20,000 people have fled their homes in Greece, and Canada still has more than a thousand active wildfires whose smoke blanketed North America1. Tenerife is seeing its worst fires in 40 years and Asia has also seen challenging fires in Indonesia, Thailand, and Kazakhstan. Many around the world continue to remember the Australian wildfires of 2020, which were one of the worst disasters for wildlife in history2.

So why, when all of this is happening, would we talk about real estate? For one, the kinds of buildings we’re in matters. While we write frequently about the kinds of investments in clean energy we need to face the climate crisis, real estate still accounts for around 40% of global emissions4. But perhaps just as importantly, as our skies turn red and air pollution kills nearly 700,000 people each year, we’re at a stage where mitigation will matter a lot, forcing us back into the homes and buildings we’ve taken for granted3. In fact, it wasn’t so long ago – during the first global pandemic in a century – that the entire world was obsessing over indoor air quality. Some have even felt like this summer is a sort of ‘reverse COVID’ with masks being worn outside and taken off inside. But with office space in flux, real estate has become an almost unwanted asset class for many investors. So today, we talk about what kind of buildings can help, and why they’re a theme we can’t afford to ignore.

What makes a building efficient?

When people think of building efficiency, they often think of standards like LEED

(Leadership in Energy and Environmental Design) in the US, BREEAM (Building Research Establishment Environmental Assessment Method) in the UK, or BEAM (Building Environmental Assessment Method) in Hong Kong. But what are these standards trying to address? The scope can be wide-ranging from carbon emissions to using more sustainable materials, protecting ecosystems, and building community through things like transit access5. Another essential element of many standards is human health. In the wake of the pandemic, the CDC suggests exchanging air in buildings at least 5 times per hour with high quality filtration6. However, the act of pulling in air from the outside and through better filters – and having to treat it to heat, cool, or dehumidify it – often means good ventilation requires more energy7. This makes it all the more important that building owners take seriously the need for investment in new technologies and better systems engineering. But can the current outlook for real estate support the investments we need?

The challenges facing real estate

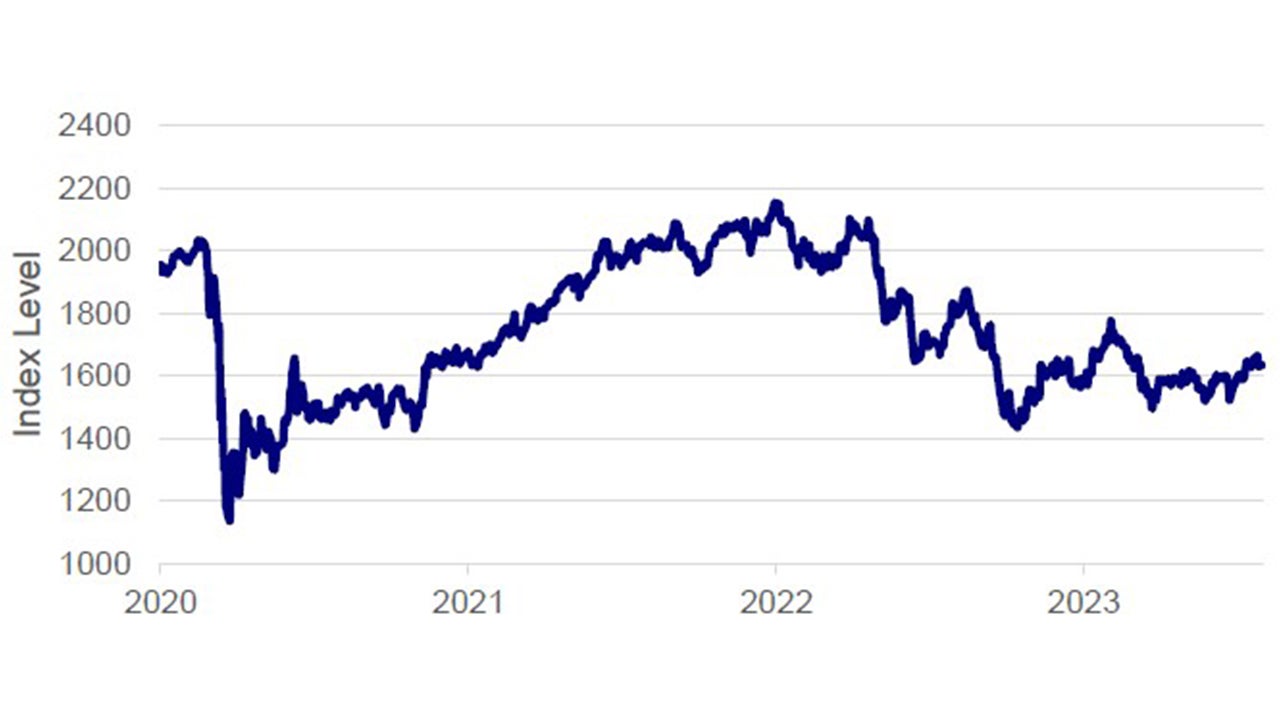

Starting in March of 2020, real estate was an initial candidate for quick selling in the markets, especially amidst widespread stay-at-home orders that aimed to curb the spread of COVID. While real estate initially rebounded with much of the market, 2022 began to see renewed selling in the space that’s turned into mostly sideways performance in 2023. One of the largest drivers of this trend is concern about office space, where vacancy rates are 5% higher than they were before the pandemic8. Meanwhile, even as companies push through return-to-work policies and hybrid working structures, experts still see office space in flux with the potential to see vacancy rates rise as much as 55% by the end of the decade9. While this is hardly the whole story on real estate (96% of public real-estate investment trust (REIT) value is in the US, for example, is outside of office space10), higher quality, more efficient buildings could also help.

Source: Bloomberg L.P. as of 7/31/2023

Not just vents – dollars and cents

Given the global scope of the climate crisis, it’s no surprise that 88% of large companies have assets at risk of extreme weather11. With smoke in the air and a hotter environment less conducive to work, cooling costs will rise and the value of better ventilation should remain apparent even if we don’t see more viral pandemics (which we well could). And it seems renters could be viewing those benefits beyond the abstract. Buildings with LEED certification in the US collect 3.7% higher rent and maintain 4% higher occupancy rates11. When those buildings are sold, they also demand a premium that ranges from 13.3% to 36.5% on transaction prices vs. traditional real estate12.

What happens next?

As we’ve seen this summer, we’re already seeing widespread destruction and harm from climate change, and we’re just at the beginning of the climate crisis. This presents a society-wide challenge, and one that will need to be both solved and mitigated across a wide variety of sectors. Real estate, with its massive footprint and place in society, is at a unique crossroads of past and future with the potential to deliver on essential technologies for the challenges we face. A bunch of buildings might not seem like an opportunity for innovation, but we’re thinking thematically, and that means looking ahead.